After flirting around $3,300 levels earlier this weak, there’s some profit-booking visible in Ethereum (ETH). As of press time, ETH is trading 5% down at a price of $3,173 and a market cap of $371 billion. This comes amid the high ETH deposits taking place at the exchanges.

As per on-chain data provider Santiment, a total of 779,880 ETH were sent to the exchanges on Monday, August 23. This was the highest ETH exchange inflow in the last two months since June 21st. Thus, the data provider attributes the ETH price slide as a direct outcome of this.

Besides, Santiment also points out to a particular address that has been sending the maximum ETH to the network. The data provider notes:

Sent 600,000 ETH to Binance. Last acquired ETH on July 2nd at ~$2k. So huge that it breaks overall ETH exchange flow charts. Based on its behavior so far, it doesn’t look like an undiscovered exchange wallet.

Santiment further notes that it could possibly be a whale willing to take some profits. Thus, it adds that the whale address has been doing significant profit-booking at the current levels.

Key On-Chain Metrics to Watch

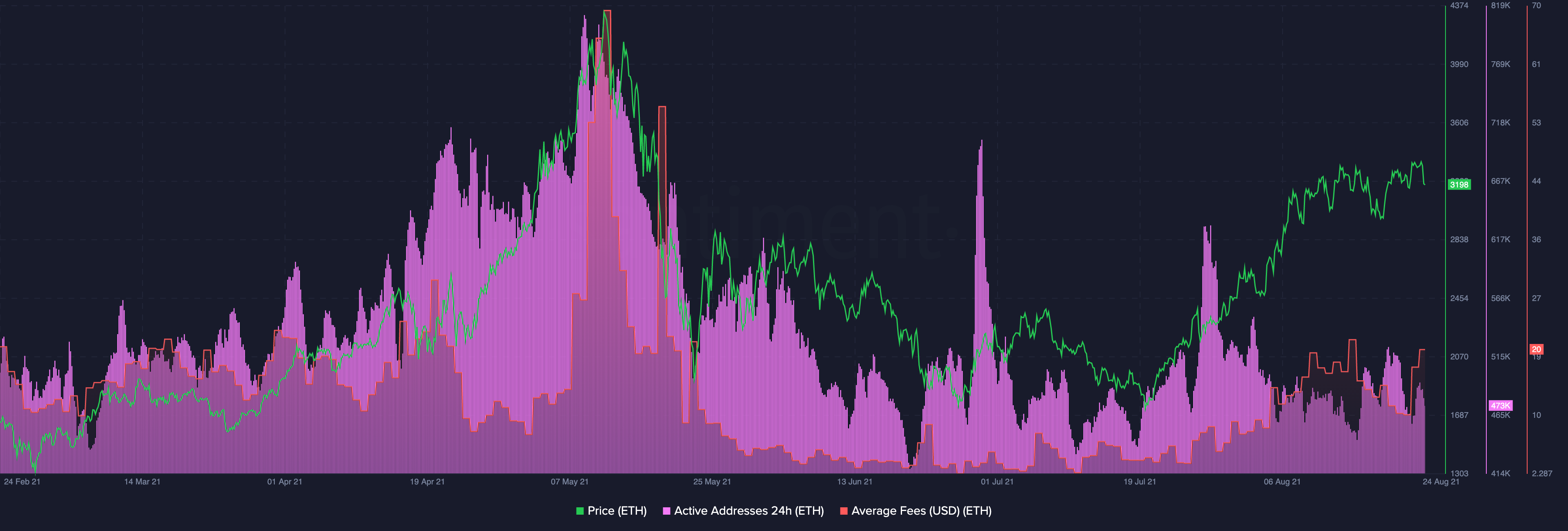

Furthermore, as Ethereum continues its rally to its all-time high, the gas fee has been increasing simultaneously. However, the active addresses for Ethereum aren’t enough to support this price rally.

With the gas fee surging fast, the number of unique addresses interacting with the Ethereum blockchain has dropped. The data provider explains:

Perhaps it’s one of the reasons why we see a divergence between fees and active addresses. Based on previous behavior we should assume that the addresses are going to decline a little bit.

Looking at the exchange inflows and low network activity, investors should be careful about making fresh entries. On the monthly chart, Ether (ETH) is already trading at 45% gains.

advertisement

Disclaimer

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Handpicked Stories

Related Posts

Loading Next Story

- "

- 000

- 7

- 77

- 9

- active

- All

- Altcoin

- amp

- around

- article

- AUGUST

- Billion

- binance

- Bit

- blockchain

- Charts

- comments

- content

- continues

- creator

- cryptocurrencies

- Current

- data

- dropped

- ETH

- eth price

- ethbtc

- Ether

- Ether (ETH)

- ethereum

- ethereum (ETH)

- ETHUSD

- exchange

- Exchanges

- FAST

- Fees

- financial

- flow

- fresh

- GAS

- High

- hold

- HTTPS

- huge

- ICON

- image

- investing

- Investors

- IT

- July

- Key

- large

- Making

- Market

- Market Cap

- market research

- Metrics

- Monday

- months

- network

- news

- Opinion

- press

- price

- price rally

- Profile

- rally

- reasons

- research

- Share

- So

- support

- time

- Trading

- W

- Wallet

- Watch

- XML

✓ Share: