After breaching the psychological price of $2,000, Ethereum (ETH) seems to be going full throttle for the $2,500 price level.

ETH had been trying to hit the $2,000 price for a couple of months in vain, but the second largest cryptocurrency based on market cap saw light at the end of the tunnel recently.

According to IntoTheBlock’s “In/Out of the Money” parameter, Ethereum does not face any significant resistance until the $2,500 area, with 75% of ETH holders already smiling to the bank.

The leading on-chain metrics provider disclosed that even though profit-taking is expected at these levels, which could trigger pullbacks, this is currently unlikely because Ethereum is looking at the long-term picture.

Therefore, based on IntoTheBlock’s data, stakes are high that ETH will soar to the $2,500 zone based on the positive outlook being showcased.

Notably, the number of Ethereum addresses in profit sits at 77.72 million, whereas those in losses are 21.91, according to IntoTheBlock’s statistics.

An Interesting Tale is Happening Despite Ethereum Hitting $2,000

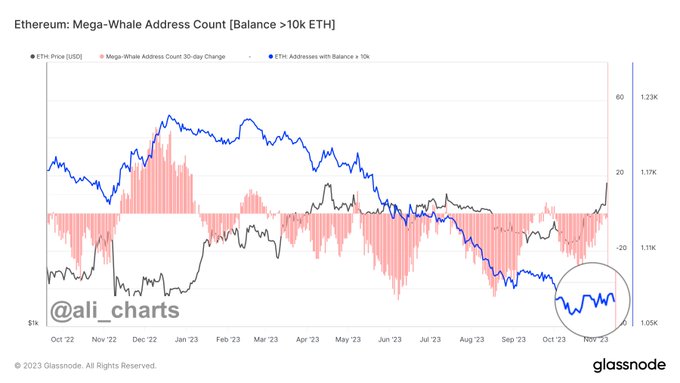

Ali Martinez, a leading market analyst, recently took to X, formerly Twitter, to highlight that despite Ethereum reclaiming the $2,000 threshold, whales were not in the mix because they had not even started buying.

Therefore, this paints a bullish picture on the Ethereum network because if whales buy, the ETH price is destined for greater heights.

The $2,000 price level illustrates that Ethereum is enjoying a 4-month high because the second largest crypto was in this trajectory in July this year.

ZyCrypto recently stipulated that ETH was currently in the $2,000 zone thanks to the world’s largest asset manager, BlackRock, filing for an iShares Ethereum Trust in Delaware, which is similar to the popular spot Bitcoin exchange-traded fund (ETF).

Furthermore, a holding culture was showcased in the Ethereum ecosystem, given that ETH supply on exchanges recently hit historic lows.

ETH was up by 12% to hit $2,079 at press time, according to CoinGecko. Therefore, time will tell whether Ethereum will scale to the new high of $2,500.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://zycrypto.com/ethereum-eyeing-2500-price-amid-75-of-holders-being-in-profit/

- :is

- :not

- $UP

- 000

- 2023

- 500

- 700

- 72

- 77

- 91

- a

- According

- addresses

- already

- Amid

- an

- analyst

- any

- ARE

- AREA

- asset

- At

- Bank

- based

- BE

- because

- been

- being

- Big

- Bitcoin

- BlackRock

- Bullish

- but

- buy

- Buying

- by

- cap

- coinbase

- CoinGecko

- content

- could

- Couple

- crypto

- cryptocurrency

- Culture

- Currently

- data

- Delaware

- Despite

- destined

- does

- ecosystem

- end

- ETF

- ETH

- eth price

- ethereum

- ethereum (ETH)

- ethereum addresses

- Ethereum ecosystem

- ethereum network

- Ethereum's

- Even

- exchange-traded

- exchange-traded fund (ETF)

- Exchanges

- expected

- eyeing

- Face

- Filing

- For

- formerly

- full

- fund

- given

- going

- greater

- had

- Happening

- heights

- High

- historic

- Hit

- hitting

- holders

- holding

- HTTPS

- if

- illustrates

- image

- in

- interesting

- iShares

- jpg

- July

- largest

- Largest Crypto

- leading

- Level

- levels

- light

- long-term

- looking

- losses

- Lows

- manager

- Market

- Market Cap

- max-width

- Metrics

- million

- mix

- months

- network

- New

- next

- number

- of

- on

- On-Chain

- Outlook

- picture

- plato

- Plato Data Intelligence

- PlatoData

- Popular

- positive

- press

- price

- Profit

- provider

- psychological

- recently

- Resistance

- saw

- Scale

- Second

- seems

- showcased

- significant

- similar

- sits

- soar

- Spot

- stakes

- started

- statistics

- Super

- supply

- tale

- tell

- Thanks

- that

- The

- therefore

- These

- they

- this

- this year

- those

- though?

- threshold

- time

- to

- took

- trajectory

- trigger

- Trust

- trying

- tunnel

- unlikely

- until

- upgrade

- vain

- was

- were

- whales

- whereas

- whether

- which

- why

- will

- with

- world’s

- X

- year

- zephyrnet