The price of Ethereum (ETH) has regained the psychological $2,000 mark.

Some experts expect Ethereum to reach a high of $2,200, but it will face strong resistance at current levels.

Long-term analysis of the Ethereum price: Bullish

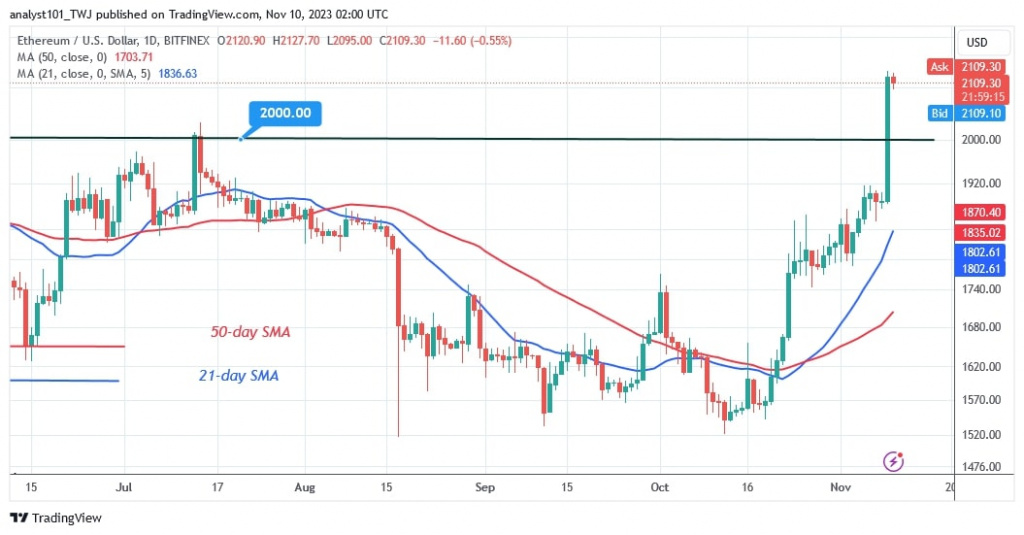

The bulls have broken through the resistance levels of $1,860 and $1,920 as the price rose to a high of $2,131 on November 9.

The largest altcoin is steadily moving towards its previous high. ETH rose to a high of $2,146 on April 16, but was unable to overcome this support level.

Analysis of the Ethereum Indicator Analysis

Following the recent price recovery, the price bars are now well above the moving average lines. Before the price recovery, the price bars on the 4-hour chart were moving diagonally below and above the moving average lines. During the previous sideways trend, the moving average lines were horizontal and pointed in opposite directions. The uptrend will continue as long as the ETH price remains above the moving average lines.

Technical indicators:

Key resistance levels – $1,800 and $2,000

Key support levels – $1,600 and $1,400

What Is the Next Direction for Ethereum?

Ethereum’s uptrend has continued with the price breaking above the psychological $2,000 mark. Judging by the price momentum, Ether is on its way to a high of $3,000. However, Ether will continue to rise if buyers break the previous barrier of $2,146.

Last week Coinidol.com reported that Ether remained above the support level of $1,880, that signalized that ETH may rise to the psychological price level of $2,000.

Disclaimer. This analysis and forecast are the personal opinions of the author and are not a recommendation to buy or sell cryptocurrency and should not be viewed as an endorsement by CoinIdol.com. Readers should do their research before investing in funds.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://coinidol.com/ethereum-recaptures-psychological-mark/

- :has

- :is

- :not

- $3

- 000

- 10

- 12

- 16

- 200

- 2023

- 400

- 9

- 900

- a

- above

- Altcoin

- an

- analysis

- and

- April

- ARE

- AS

- At

- author

- average

- barrier

- bars

- BE

- before

- below

- Break

- Breaking

- Broken

- Bulls

- but

- buy

- buyers

- by

- Chart

- COM

- continue

- continued

- continues

- cryptocurrency

- Current

- daily

- direction

- do

- during

- Endorsement..

- ETH

- eth price

- Ether

- ethereum

- ethereum (ETH)

- Ethereum Price

- expect

- experts

- Face

- following

- For

- Forecast

- funds

- Have

- High

- Horizontal

- hour

- However

- HTTPS

- if

- in

- Indicator

- Indicators

- info

- investing

- IT

- ITS

- jpg

- Key

- key resistance

- largest

- Last

- Level

- levels

- lines

- Long

- mark

- May..

- Momentum

- moving

- moving average

- next

- nov

- November

- now

- of

- on

- Opinions

- opposite

- or

- Overcome

- personal

- plato

- Plato Data Intelligence

- PlatoData

- previous

- price

- psychological

- reach

- readers

- recent

- Recommendation

- recovery

- remains

- research

- Resistance

- Rise

- ROSE

- s

- sell

- should

- sideways

- some

- steadily

- strong

- support

- support level

- support levels

- that

- The

- their

- this

- Through

- to

- towards

- Trend

- unable

- uptrend

- was

- Way..

- week

- WELL

- were

- will

- with

- zephyrnet