- Three factors plague the crypto industry, hindering its global adoption; high volatility, scalability, and security.

- The US Federal Reserve has launched a new supervision program to clarify the relationship and regulations between banks and crypto.

- The US Federal Reserve will integrate the new program into the existing supervisory process.

The crypto industry as a whole is a consistently expanding ecosystem. The age of digital currency is upon us, organizations and governments all over must change with the tides. As technology evolves, new markets emerge, offering new platforms for innovations.

Currently, several regions worldwide are thriving within the web3 ecosystems. Decentralized applications are steadily becoming the primary trend as industries like Africa’s fintech and E-Commerce sector embrace the new technology to improve their efficiency.

Despite the rapid growth, the 2022 crypto crash significantly regressed the industry’s progress. Numerous regions halted any association with the crypto industry, causing a massive decline in adoption. Unfortunately, the US crypto industry is among the few that face a complete decline. Recently, the US federal Reverse launched several novel activities and supervision programs. This new initiative will oversee bank-crypto activity and bring the market to more centralized control.

At this rate, the crypto regulators have crossed the line, shifting more to control rather than regulate. Unfortunately, the tides are changing. The illegal use of crypto is growing, and undefined crypto laws are worsening the situation.

The US Crypto Industry crumbling at its feat

Throughout the industry’s history, digital currency has always posed significant issues in its implementation. Initially, the digital currency was nothing more than a hoax with few success stories. After the crypto industry gained a substantial audience, its value increased, beating prior expectations.

Soon, what started as a practical system became a trillion-dollar franchise, later expanding into a revolutionary technology. Blockchain technology soon grasped the hearts of many investors, while also boosting other sectors.

This led to the growth of a new financial system that could earn millions for any investor or visionary willing to dive in. Unfortunately, it’s also through its potential did it attract potential risks.

The risk behind cryptocurrency

Three factors plague the crypto industry, hindering its global adoption. High volatility, scalability, and security are the three main plot holes within the Web3 roadmap. Unfortunately, experts have only addressed the scalability issue due to its direct problem. Unfortunately, security has been a complex matter within the industry that developers have struggled to address.

Over the years, the entire crypto industry has succumbed to numerous crypto hacks. The new nature of blockchain technology has presented several loopholes that hackers and scammers have exploited throughout the years. From the OneCoin scam to the Mt Gox hack, the franchise has lost billions and maintained its high valuation.

Also, Read: The Federal Reserve Bitcoin report and what it means for the African crypto market.

Unfortunately, addressing security is much more complex than people think. Normally, individuals often think that security encompasses the security measures and systems within the crypto industry. This is only but a small fraction of the problem. One of the main issues of crypto security is the lack of undefined crypto laws.

The establishment of unclear crypto laws has hindered regulators and crypto-based systems. Due to this negligence for years, crypto regulators have struggled to act against crypto-based firms with suspicious activities. Through this, plenty of crypt scams have swindled millions from unsuspecting users.

With high stakes in illegal crypto use, regulating cryptocurrency has become a heated topic among the community and government. It’s due to this reason that Africa, despite its rapid crypto adoption, only has a few countries actively participating in the industry.

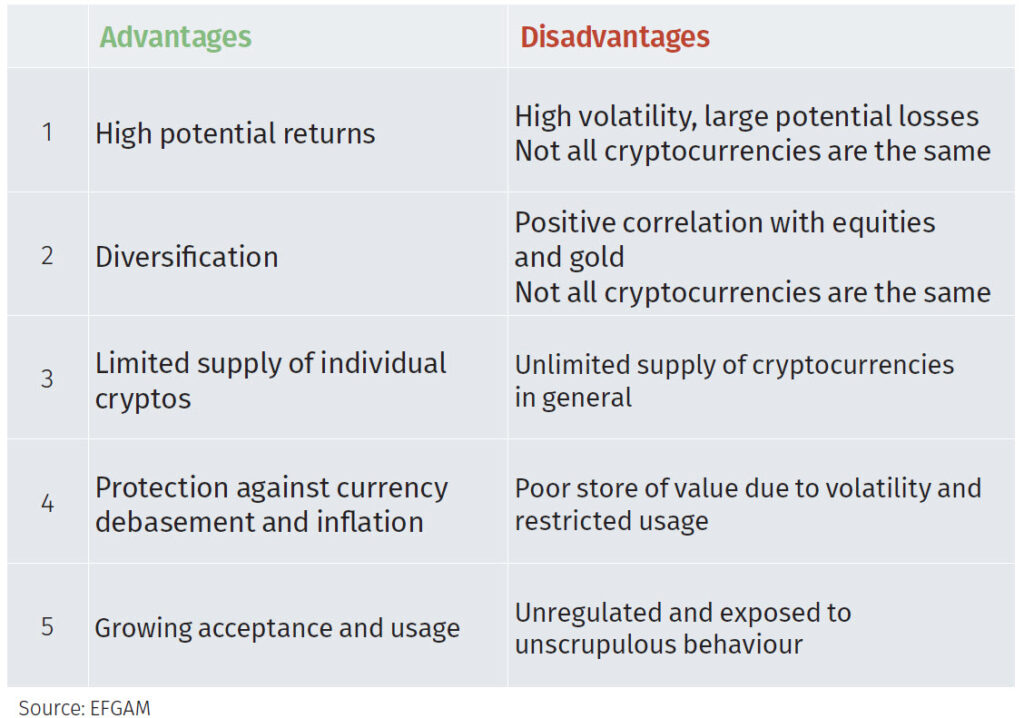

Standard Pros and Cons of the entire crypto ecosystem.[Photo/Medium]

It’s these same undefined crypto laws that led to the FTX crash in 2022. The mismanagement of funds left millions broken and affected the entire ecosystem. As a result, the US crypto industry has become an undesirable ecosystem for cryptocurrency.

The FTX crash proved to the US crypto regulators that digital currency implemented through centralized systems poses a significant risk if mismanaged. If not for the interventions of Binance and the dedication of veteran crypto traders, the entire industry would have collapsed.

US crypto regulators started a crypto crackdown to streamline the industry, preventing a repeat of 2022. The crash enlightened the entire community, showcasing that illegal crypto use is possible through the most well-established organizations. Thus, the crypto crackdown started on suspicious crypto activities within the US.

Soon, multiple crypto exchanges closed the shop due to the numerous crypto lawsuits. Unfortunately, what started as a means of protection soon became a means of control. US crypto regulators targeted large and small crypto-based organizations and shut down operations if the company did not adhere to the unclear crypto laws.

Today, all top crypto exchanges have begun a legal battle with the US crypto industry. Unfortunately, despite the victories won through several proceedings, this latest news signifies a tremendous loss.

The US Federal Reserve starts a program to control the US crypto industry

After numerous court proceedings between crypto regulators and exchanges, the US Federal Reserve has stepped forward to intervene. The US Federal Reserve has launched a new supervision program to clarify the relationship and regulations between banks and crypto. The months of legal proceedings between crypto regulators and exchanges have only widened the gap in adoption.

The central Bank has stated the program will provide the necessary procedures and requirements to ensure the regulation between banks and the US crypto industry. The US Federal Reserve will integrate the new program into the existing supervisory process.

Also, Read African crypto industry players continue to crumble as The Bundle shuts down.

In addition, it will provide program experts to work alongside the teams supervising banks engaged in novel activities. According to them, “novel activities” encompass complex technology-driven partnerships with non-banks to provide banking services to customers. This category will heavily supervise the fintech and the US crypto industry, including all activities involving blockchain systems.

The US Federal Reserve steps in amid the crypto crackdown to introduce a new monitoring system for all blockchain-based bank partnerships.[Photo/Medium]

The US Federal Bank stated, “The goal of the novel activities’ supervision program is to foster the benefits of financial innovation while recognizing and appropriately addressing risks to ensure the safety and soundness of the banking system.”

This new novel system will be risk-based, with the US Federal Reserve notifying certain banks of the ruined monitoring. The new program will also lay out the criteria by which state banks can meet certain requirements before venturing into the US crypto industry. The banks will receive written notification of supervisory non-objection from the Federal Reserve before engaging in any crypto-based activity.

Losing the war

The entire concept of the crypto industry is to develop a decentralized system. Unfortunately, this fact has hindered many crypto regulators from developing definitive crypto laws. To overcome this challenge, many investors set to deploy digital assets via a centralized system.

Despite forming the structure of the crypto industry today, this approach has presented numerous problems. For starters, the high rate of illegal crypto use is attributed to centralized systems. They generally have added control over the blockchain network, forgoing its fundamental nature.

This gives a centralized system added control over the network. This same approach is what crypto regulators have advocated for. Furthermore, by attacking the ecosystem, regulators can steadily control the actions of centralized cryptosystems. This new novel program is no different.

Also, Read How the Federal Reserve affects the entire cryptocurrency market.

Monitoring systems only bring the ecosystems closer to more centralized control. With undefined crypto laws, the industry might fall under new administration before going global. The US crypto industry’s current state is no different. Through the numerous crypto lawsuits, the industry has become unfavorable to most crypto exchanges.

As a result, it reduces the industry’s volume to a small and controllable size while lowering the adoption rate. Through this new initiative, the US Federal Reserve may control the entire industry in a few years.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- ChartPrime. Elevate your Trading Game with ChartPrime. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://web3africa.news/2023/08/16/featured/the-us-crypto-industry-struggling-to-survive/

- :has

- :is

- :not

- 2022

- 32

- 33

- a

- According

- Act

- actions

- actively

- activities

- activity

- added

- addition

- address

- addressing

- adhere

- administration

- Adoption

- africa

- African

- African crypto market

- After

- against

- age

- All

- alongside

- also

- always

- Amid

- among

- an

- and

- any

- applications

- approach

- appropriately

- ARE

- AS

- Assets

- Association

- At

- Attacking

- attract

- audience

- Bank

- Banking

- banking system

- Banks

- Battle

- BE

- became

- become

- becoming

- been

- before

- begun

- behind

- benefits

- between

- billions

- binance

- Bitcoin

- blockchain

- Blockchain network

- blockchain technology

- blockchain-based

- boosting

- bring

- Broken

- Bundle

- but

- by

- CAN

- Category

- causing

- central

- Central Bank

- centralized

- centralized systems

- certain

- challenge

- change

- changing

- closed

- closer

- collapsed

- community

- company

- complete

- complex

- concept

- Cons

- consistently

- continue

- control

- could

- countries

- Court

- Crackdown

- Crash

- criteria

- Crossed

- crypt

- crypto

- Crypto adoption

- CRYPTO CRACKDOWN

- crypto crash

- Crypto ecosystem

- Crypto Exchanges

- crypto hacks

- Crypto Industry

- crypto laws

- Crypto Lawsuits

- Crypto Market

- crypto security

- crypto traders

- crypto use

- crypto-based

- cryptocurrency

- Currency

- Current

- Current state

- Customers

- decentralized

- Decentralized Applications

- Decline

- dedication

- definitive

- deploy

- Despite

- develop

- developers

- developing

- DID

- different

- digital

- Digital Assets

- digital currency

- direct

- down

- due

- e-commerce

- earn

- ecosystem

- Ecosystems

- efficiency

- embrace

- emerge

- encompass

- encompasses

- engaged

- engaging

- ensure

- Entire

- establishes

- establishment

- evident

- evolves

- Exchanges

- existing

- expanding

- expectations

- experts

- exploited

- Face

- fact

- factors

- Fall

- Fed

- Federal

- federal reserve

- few

- financial

- financial innovation

- financial system

- fintech

- firms

- For

- Forward

- Foster

- fraction

- franchise

- from

- FTX

- ftx crash

- fundamental

- funds

- Furthermore

- gained

- gap

- generally

- gives

- Global

- goal

- going

- Government

- Governments

- Gox

- Growing

- Growth

- hack

- hackers

- hacks

- Have

- heavily

- High

- history

- Holes

- HTTPS

- if

- Illegal

- implementation

- implemented

- improve

- in

- Including

- increased

- individuals

- industries

- industry

- industry’s

- initially

- Initiative

- Innovation

- innovations

- integrate

- intervene

- interventions

- into

- introduce

- Investopedia

- investor

- Investors

- involving

- issue

- issues

- IT

- ITS

- jpg

- Lack

- large

- later

- latest

- Latest News

- launched

- Laws

- Lawsuits

- lay

- Led

- left

- Legal

- legal proceedings

- like

- Line

- loopholes

- loss

- lost

- Lowering

- Main

- many

- Market

- Markets

- massive

- Matter

- max-width

- May..

- means

- measures

- Meet

- might

- millions

- monitoring

- months

- more

- most

- MT

- much

- multiple

- must

- Nature

- necessary

- network

- New

- news

- no

- normally

- nothing

- notification

- notifying

- novel

- numerous

- of

- offering

- often

- on

- ONE

- OneCoin

- only

- Operations

- or

- organizations

- Other

- out

- over

- Overcome

- oversee

- participating

- partnerships

- People

- Plague

- Platforms

- plato

- Plato Data Intelligence

- PlatoData

- players

- Plenty

- poses

- possible

- potential

- Practical

- presented

- preventing

- primary

- Prior

- Problem

- problems

- procedures

- Proceedings

- process

- Program

- Programs

- Progress

- PROS

- protection

- proved

- provide

- rapid

- Rate

- rather

- Read

- reason

- receive

- recently

- recognizing

- reduces

- regions

- Regulate

- regulating

- Regulation

- regulations

- Regulators

- relationship

- repeat

- report

- Requirements

- Reserve

- result

- reverse

- revolutionary

- Risk

- risks

- roadmap

- Safety

- same

- Scalability

- Scam

- Scammers

- scams

- SEC

- sector

- Sectors

- security

- Security Measures

- Services

- set

- several

- SHIFTING

- Shop

- showcasing

- Shut down

- Shuts

- significant

- significantly

- signifies

- situation

- Size

- small

- soon

- started

- starts

- State

- stated

- Steps

- Stories

- streamline

- structure

- substantial

- success

- Success Stories

- supervision

- suspicious

- system

- Systems

- teams

- Technology

- than

- that

- The

- The LINE

- The US Federal Reserve

- their

- Them

- These

- they

- think

- this

- three

- thriving

- Through

- throughout

- Thus

- tides

- to

- today

- top

- topic

- Traders

- tremendous

- Trend

- undefined

- under

- unfortunately

- upon

- us

- US Federal

- us federal reserve

- use

- users

- Valuation

- value

- veteran

- via

- victories

- visionary

- Volatility

- volume

- was

- Web3

- Web3 Ecosystems

- What

- which

- while

- whole

- will

- willing

- with

- within

- Won

- Work

- worldwide

- would

- written

- years

- zephyrnet