Bitcoin is still tethering around the $40,000 angle as the market goes through the motions of social and political crises. It has adversely affected the crypto market as it has other financial markets but the market has held strong in the face of adversity. Despite declining prices, bitcoin investors are still holding on to their digital assets as evidenced by exchange inflows/outflows.

Bitcoin Exchange Deposits Drop

Bitcoin exchange deposits are in a decline. The number of investors that are depositing their coins to exchanges, presumably to sell, has been dropping in recent times. This number has gone down by almost 50% since its all-time high in November. Exchange deposits had reached as high as 74,000 BTC flowing into exchanges per day. However, this number is down to 41% per day as of Monday the 28th of February.

Related Reading | How Analysts Expect Crypto Sports Sponsorship Spend To Reach $5B In Less Than Five Years

As exchange deposits have declined, exchange withdrawals have gone the opposite way. This number is still holding high at 40,000 to 48,000 BTC leaving exchanges per day in the month of February. This shows that bitcoin investors are still accumulating coins off of exchanges. It is also reducing the supply of BTC on exchanges each day causing more scarcity on exchanges.

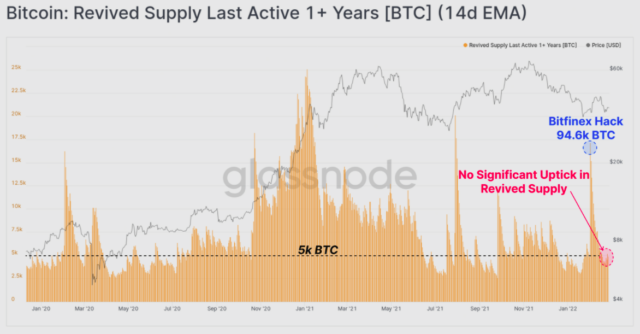

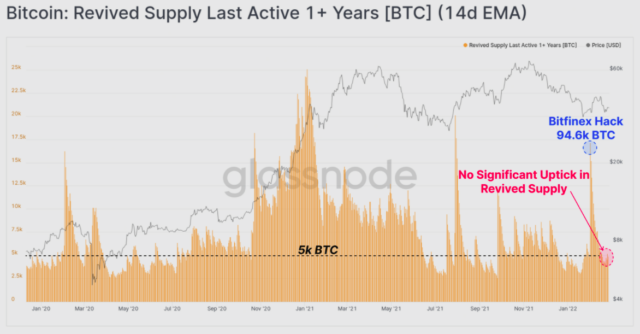

BTC revived supply remains low | Source: Glassnode

Data from Glassnode shows that this trend did not just begin. Since July, the 30-day EMA of exchange net flows has shown that more investors have preferred to withdraw their coins instead of moving them to exchanges. Even though the number of withdrawals has dropped, it is still higher than the number of bitcoin being moved into exchanges, showing that demand is still higher than supply.

Inflows Stay Down Despite Recovery

Bitcoin had touched some month-lows in February but even that has not seen exchange inflows go up. These inflow numbers have remained on a steady downtrend with only minor inflows recorded in the midst of major headwinds.

Back in May to June 2021, bitcoin inflows had shot up which had represented a loss of confidence from investors. However, the digital asset had since fallen and not gotten back up to this level. This points to a return of confidence in a major way for investors. Not only that, but it also shows that bitcoin investors are back on an accumulation trend, choosing instead to hold for the long-term rather than realize short-term gains.

Related Reading | BitConnect Founder Charged With Masterminding $2.4 Billion Fraud

BTC on verge of another bull | Source: BTCUSD on TradingView.com

The BTC revived supply metric also points to a renewed faith in the digital asset on the part of investors. Usually, when the conviction is down, this metric would record a very high uptick. However, the volume recorded has shown barely any difference from previous days.

BTC exchange deposits down | Source: Glassnode

The normal long-term capitulation that is typical of the start of bear markets has not been recorded yet. This points to investors not being ready to sell their coins. Although this could mean that there are more dips to come before the market officially welcomes another bear stretch.

Featured image from MARCA, charts from Glassnode and TradingView.com

- 000

- 2021

- Although

- Another

- around

- asset

- Assets

- being

- Billion

- Bitcoin

- Bitcoin Price

- BTC

- charged

- Charts

- Coins

- confidence

- could

- crypto

- Crypto Market

- day

- Demand

- Despite

- DID

- digital

- Digital Asset

- Digital Assets

- down

- dropped

- EMA

- exchange

- Exchanges

- expect

- Face

- financial

- For Investors

- founder

- Glassnode

- High

- hold

- HTTPS

- image

- Investors

- IT

- July

- Level

- major

- Market

- Markets

- Monday

- moving

- net

- numbers

- Other

- political

- price

- Reading

- record

- reducing

- remained

- sell

- Social

- spend

- sponsorship

- Sports

- start

- stay

- strong

- supply

- Through

- usually

- volume