Your gateway to successful crypto investing guided by data and research

Key Takeaways

- Market Momentum: Bitcoin’s profitability metrics, including Realized Profit and Loss Ratio and SOPR, indicate a shift in market momentum; while previously showcasing confidence with a majority of profitable transactions, recent trends lean towards a market in uncertainty, suggesting traders exercise caution and consider protective strategies.

- Risk Vectors: Amid macroeconomic uncertainties, changes in the crypto derivatives and stablecoin markets suggest capital is flowing out of the crypto space, exacerbating concerns related to liquidity and market depth; such conditions are conducive to sudden and highly unpredictable market moves, calling for heightened risk management in the cryptocurrency space.

- On-Chain Basics: Realized Cap, a metric that values each cryptocurrency coin at the time of its last on-chain movement, offers a nuanced alternative to the traditional market cap by reflecting the asset’s perceived value over time; Glassnode provides a dedicated dashboard for deeper insights into this and related metrics.

Month in Review: August

In August, Bitcoin transitioned from a period of extreme volatility compression to one of a sudden volatility expansion, marked by a sharp drop that nudged BTC prices beneath the $25k mark. This downturn, largely propelled by a pronounced deleveraging in the futures markets, resulted in over $2.5 billion worth of perpetual futures contracts being liquidated in a span of mere hours.

While such leverage flush-outs typically signify considerable derisking and frequently align with local market bottoms, the on-chain landscape suggests a persisting risk. The share of short-term holder supply sitting at an unrealised loss, which at around 88% part is at its YTD highs, is of particular concern here.

Coupled with the fact that a large portion of spot supply is near or above the current price, we are looking at a market that is particularly sensitive to price changes, regardless of direction. Downward price movements could lead to increased selling to lock in losses, while upward movements might see selling to break even. This dynamic makes the short-term holder cost basis a potential resistance.

Therefore, the key question for market participants, could be formulated as follows: Is this a temporary setback in the recovery narrative, or is a deeper downturn on the horizon?

In this edition of the Finance Bridge, we’ll revisit previously discussed indicators, assessing their current implications for traders and asset managers. We’ll also consider the broader macroeconomic factors impacting Bitcoin and the cryptocurrency market.

One of the primary measures of the current market trend and the flow of capital into cryptocurrency markets is Bitcoin’s profitability metrics. As we’ve touched upon in past editions of the Finance Bridge, a market showing signs of recovery typically leans towards realizing more profits than losses.

Such a market indicates investor confidence and translates into a positive market sentiment, often reinforcing the market’s momentum. On the other hand, a market leaning towards losses hints at negative sentiment, potentially leading to hesitancy in new investments and exacerbating future sell-offs.

The key metrics we are going to use to check on the current market’s pulse are Realized Profit and Loss Ratio, Spent Output Profit Ratio, and UTXO Realized Price Distribution. For more information on these metrics, please refer to the second and the third edition of Finance Bridge.

Understanding Market Shifts Through Profit and Loss

Realized Profit and Loss Ratio is one of the basic metrics to use to pinpoint potential shifts in this behaviour. In sustained uptrends, this ratio consistently reads above 1.0, showing that the number of sellers locking in losses is dwindling and that a solid demand can offset those looking to cash in on profits.

While Realized P/L Ratio stayed above 1 for the majority of the year, it has trended downwards since mid-July, now nearing an equilibrium. For traders, this signals a market in a state of uncertainty, with no clear direction which warrants caution.

Narrowing It Down with Spent Output Profit Ratio (SOPR)

Spent Output Profit Ratio, or SOPR, can offer additional insights into market participants’ current profitability. SOPR can enhance our perspective because, unlike other profit and loss metrics, it doesn’t discriminate between transaction sizes.

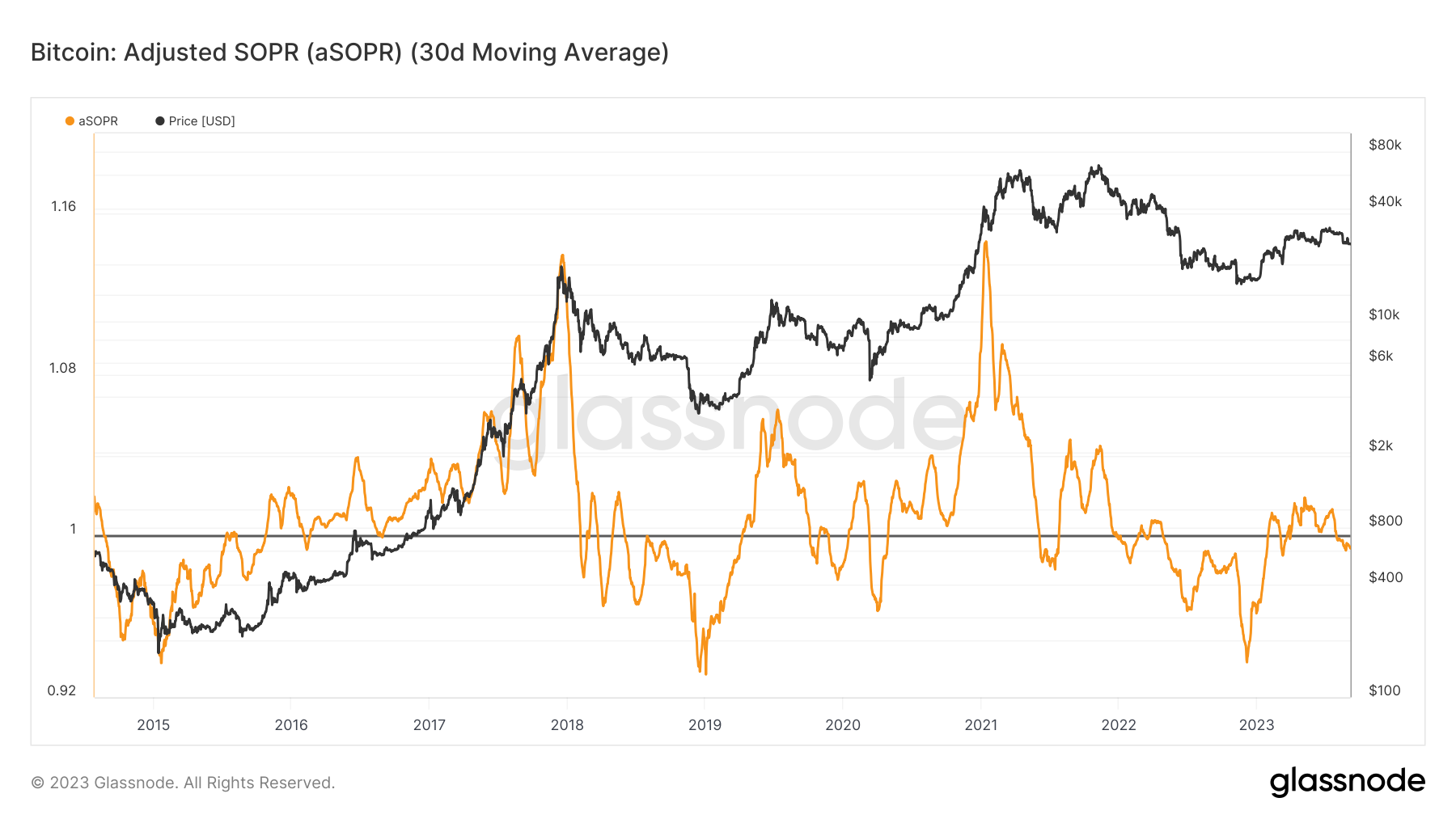

As we explained in our second edition of Finance Bridge, SOPR evaluates the profit or loss of each transaction against the price at the time of the coins’ last movement. Similarly to the Realized P/L Ratio, SOPR also takes values north or south of 1, indicating profit or loss dominance in recent transactions. Notably, the chart below presents the metric with a longer-term moving average applied which helps differentiate between brief drops below the baseline and sustained trends.

Currently, SOPR also points to a departure from prior periods of modest profit-taking that has prevailed this year. While the rally from the lows has not reversed yet, the trend already did and we are now in a period where the majority of transactions bear a loss.

Can this change? Historically, a dip below 1 in the SOPR can be brief. However, when SOPR remains below 1 for an extended duration, especially with the longer-term MA applied, it becomes challenging for the market to revert to a profit-dominant regime.

The read on the SOPR metric echoes, therefore, the Realized Profit and Loss Ratio and suggests that the downtrend may be gaining momentum. For traders and investors, adopting a “buy the dip” approach now carries heightened risk. Those contemplating new or additional positions might want to wait for clearer bullish indicators or strategizing optimal entry points. For those already invested, it may be practical to consider protective strategies or reassess stop-loss parameters.

Price at a Precipice: UTXO Realized Price Distribution

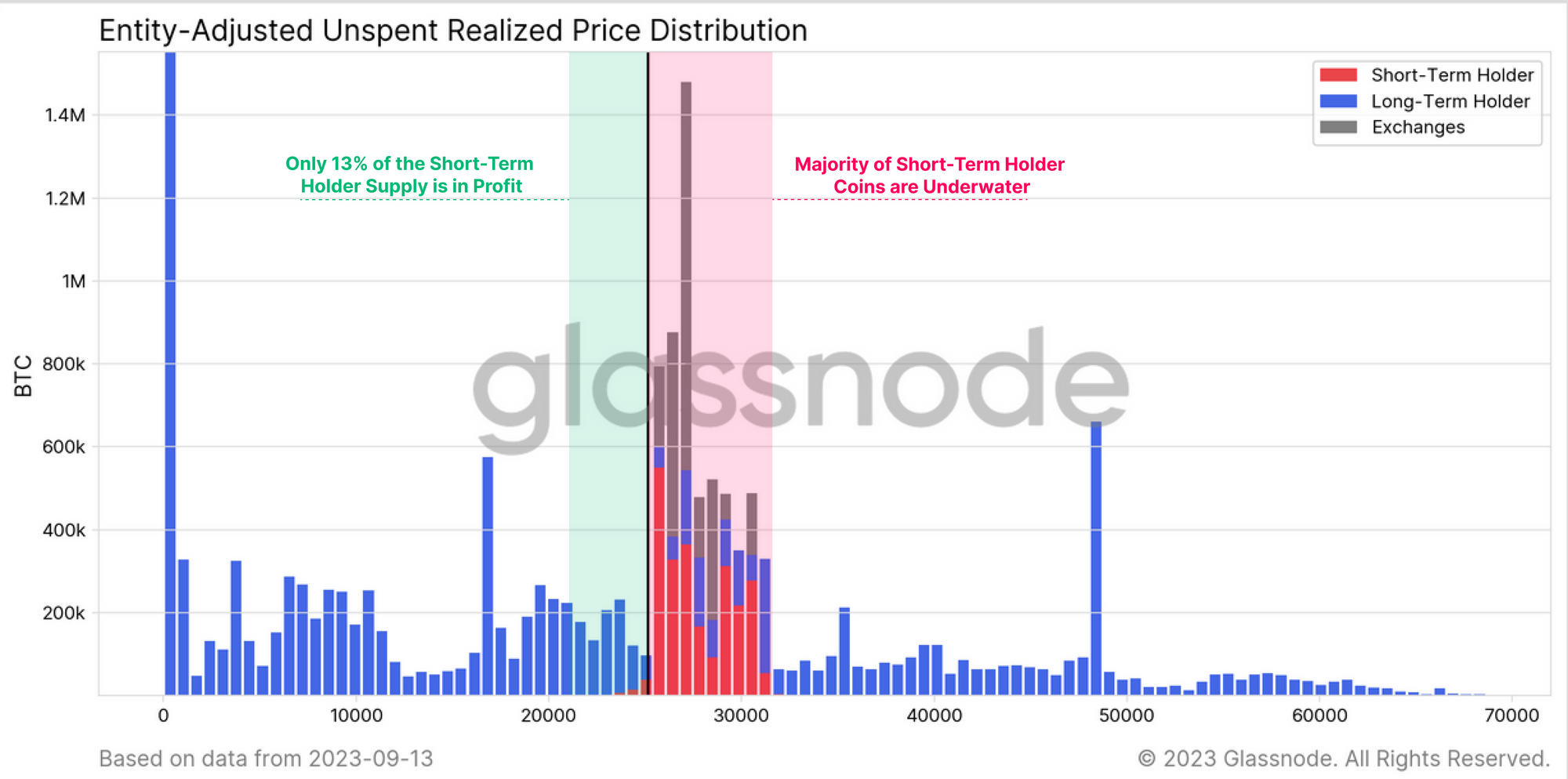

The final metric under our lens is the UTXO Realised Price Distribution (URPD), segmented by short and long-term holders. URPD provides a view of the sensitivity of investor cost basis relative to the spot price. As such, it can offer crucial insights into the market’s current state and its potential short-term direction. For a deeper dive into UTXOs, refer to the 3rd edition of Finance Bridge.

The concentration of UTXOs with a cost basis above the current price remains similar to how it looked a month ago. Notably, we see a significant short-term holder-dominated cluster, spanning from the current price up to $31K. Since BTC’s current price sits at the precipice of this cluster, it is likely to make short-term holders all the more reactive to price fluctuations now.

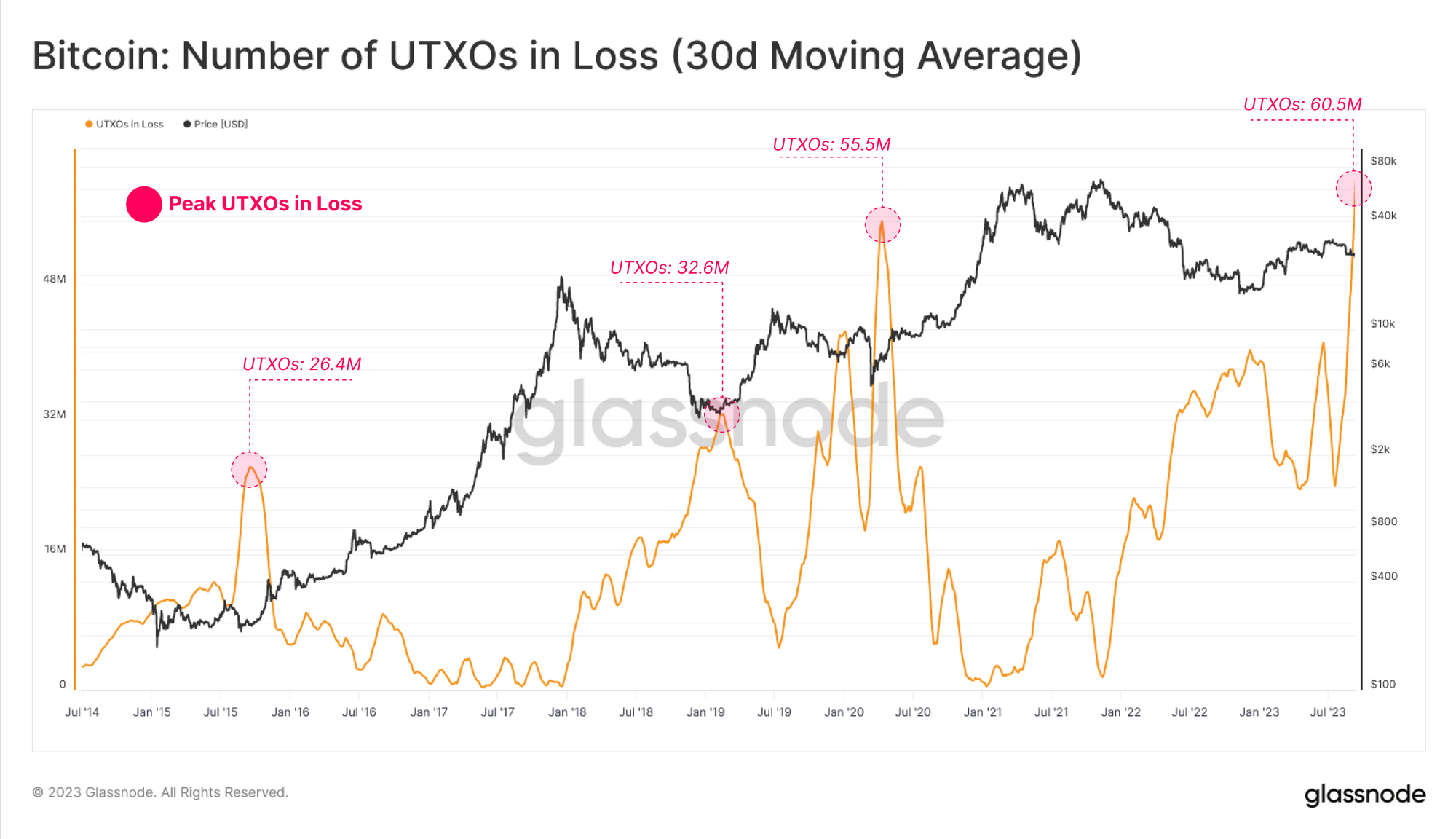

Another related metric underscores this sensitivity: the number of UTXOs currently at a loss is approaching historic highs, with the majority likely being short-term holders. Given that there’s a limit to the losses market participants can stomach, rapid sell-offs are a tangible risk. With the majority of short-term holders positioned up to $31K, any upward movement will face resistance. Each price increment might trigger selling pressures as these holders aim to break even, potentially stalling upward momentum.

The biggest risk vector for entities with exposure to cryptocurrency markets is a notable contraction of liquidity in the market. This liquidity crunch can be traced to a risk-off sentiment related to persistent uncertainty in the global markets. Hedge funds and asset managers can use crypto derivatives markets as well as stablecoin flows as an indirect measure of both market sentiment and liquidity in the cryptocurrency space.

Broader Context: Persisting Macroeconomic Uncertainty

The persistent narrative around the Federal Reserve’s aggressive rate hike since March 2022 continues to shape global financial sentiments. Even though inflation is now much closer to the Fed’s target of 2%, there are currently no clear signs of an imminent shift in monetary policy. For example, the CME FedWatch Tool prices in a 40% probability of another rate hike in November.

Compounding these concerns is the contracting M2 money supply, a critical indicator of economic health, which has been shrinking for the first time since 1949. Such a contraction in liquidity can have cascading effects on various asset classes, including cryptocurrencies.

Another potential risk from the macroeconomic standpoint is China’s complicated economic trajectory. The underwhelming growth estimates for Q2 2023 and the continuous fragility in China’s real estate sector were major causes of concern for global investors.

This macroeconomic uncertainty has already translated into a risk-off mode in the cryptocurrency markets as seen by the activity in the futures market and stablecoin flows.

Derivatives Markets: Market Sentiment Indicator

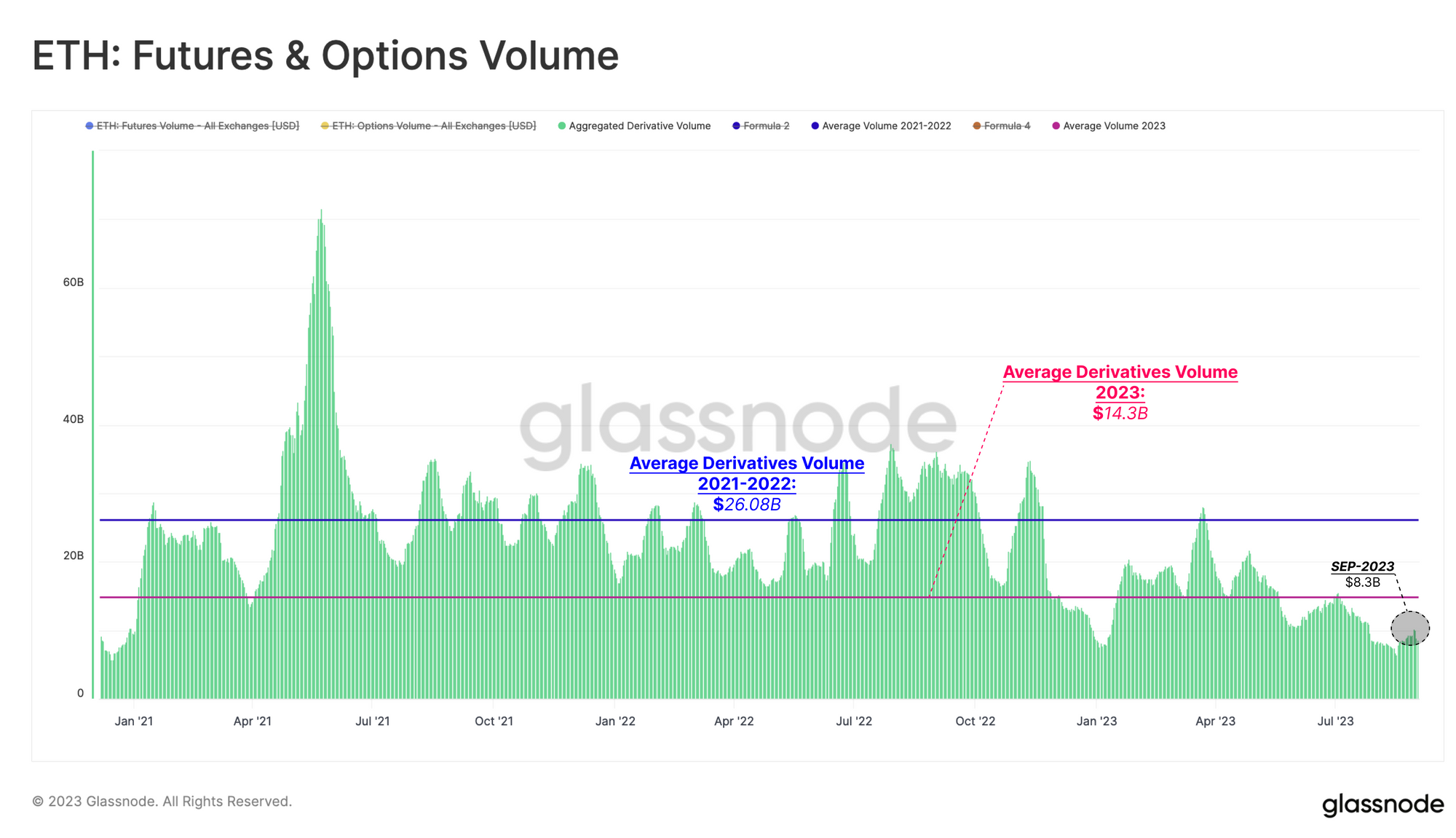

Over the 2020-2022 market cycle, we have observed substantial growth and maturation of the cryptocurrency derivatives markets, particularly those for Bitcoin (BTC) and Ethereum (ETH). It is generally accepted that these markets have been widely used by sophisticated investors and institutional participants, and as such, they can provide valuable insights into market sentiment and positioning.

On that note, it is worth mentioning that in 2023, there has been a notable decline in activity across Ethereum futures and options markets. The average daily trade volume has fallen to $14.3 billion, approximately half of the average volume observed in the preceding two years. In some weeks, the volume dropped even further to $8.3 billion.

For various reasons, Ethereum is generally speaking, higher up the risk curve than Bitcoin. Therefore, the reduced activity in the Ethereum derivatives market suggests a risk-off sentiment and reduced confidence among sophisticated and institutional investors.

Stablecoin Flows: A Liquidity Gauge

Stablecoins bridge the gap between traditional fiat and digital assets. Their flow patterns can offer valuable, albeit indirect, insights into the overall liquidity in the crypto markets.

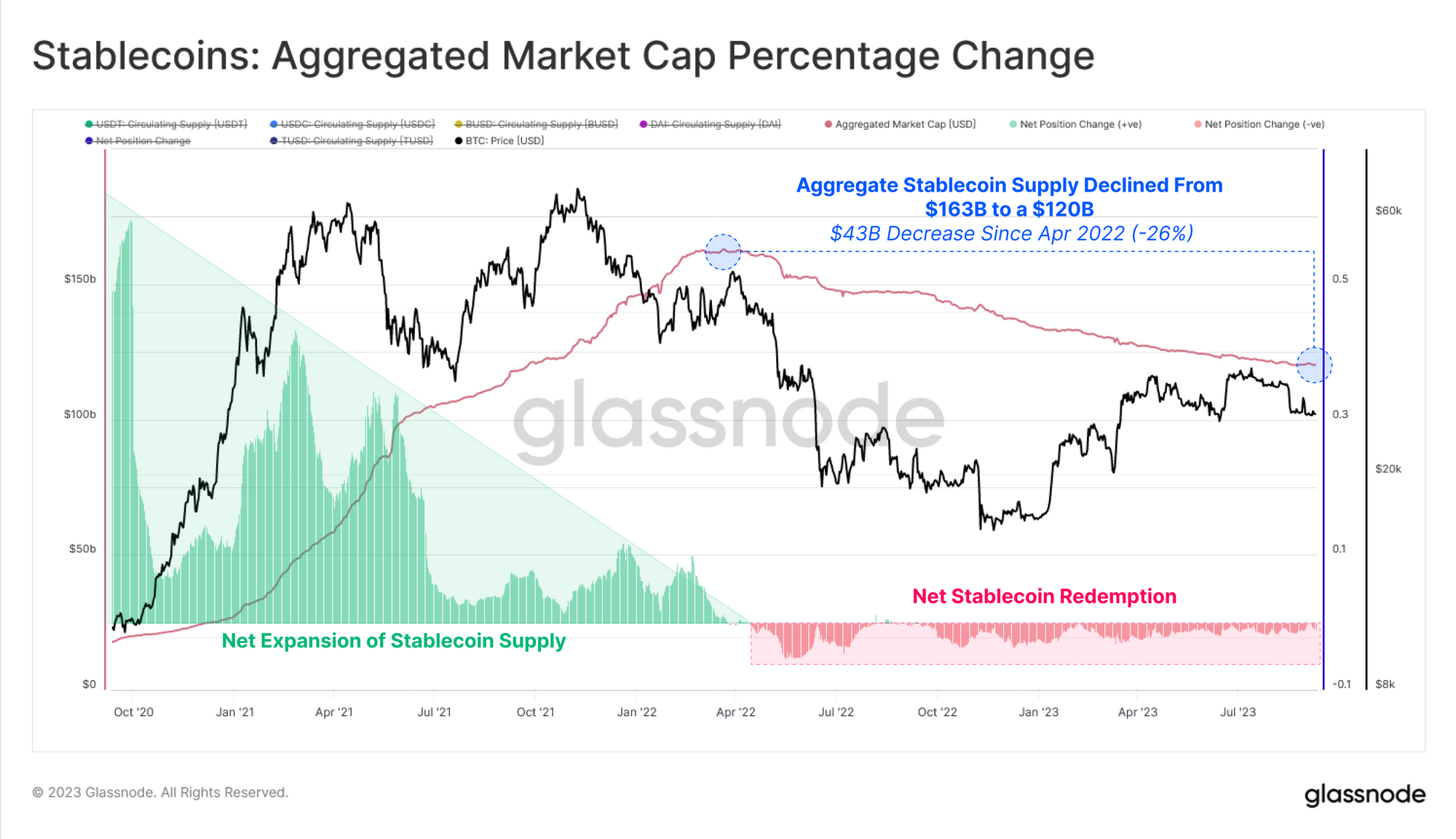

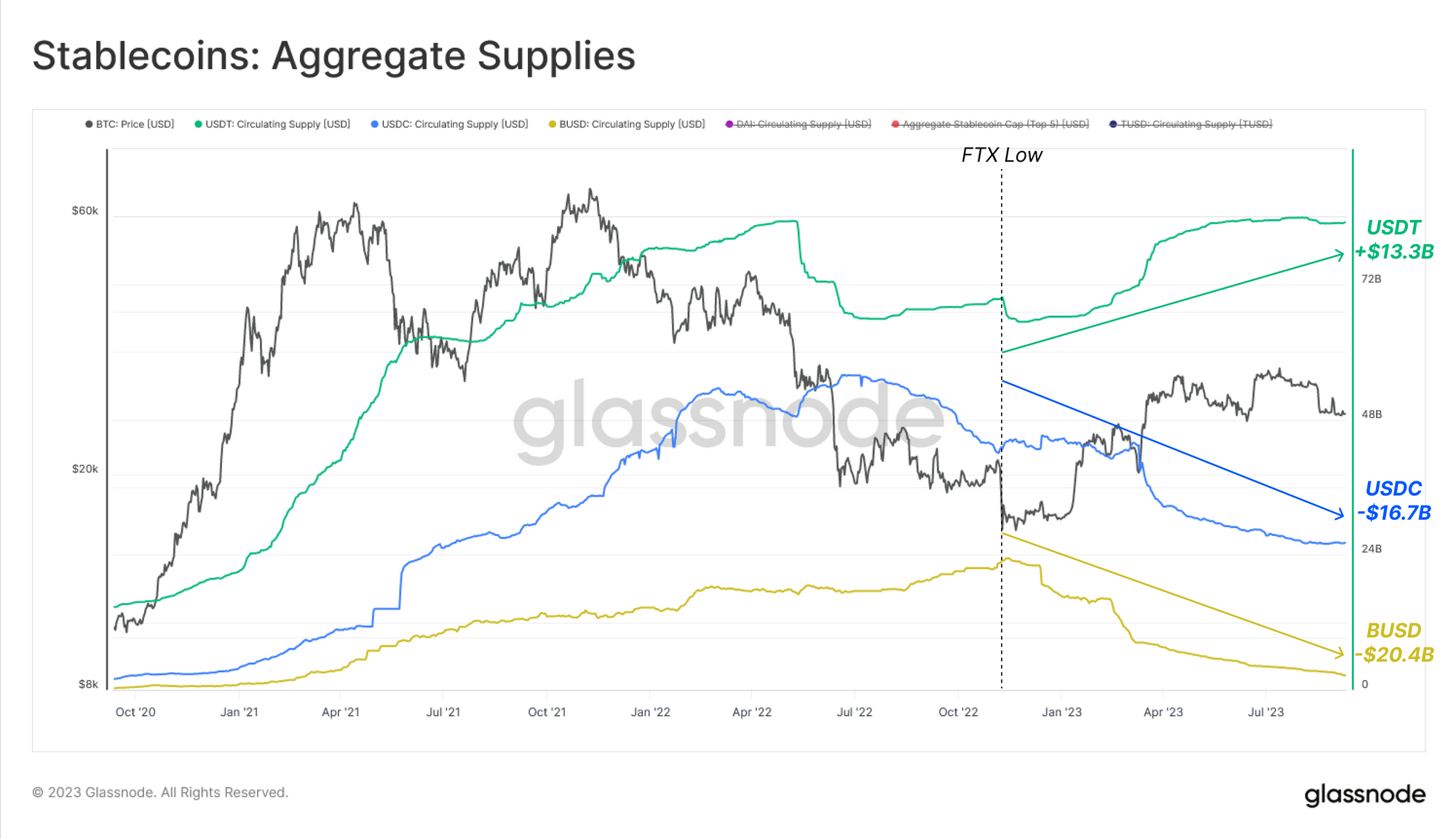

Current data indicates that the stablecoin market is experiencing a significant net outflow, with users converting stablecoins into fiat currency, which could signify reduced confidence in the crypto market, a demand for traditional market liquidity, or a shift in investment strategies.

Furthermore, there is a notable shift from USD Coin (USDC) to Tether (USDT), indicating changing geographical preferences in stablecoin usage and potentially impacting liquidity, especially if U.S. investors are heavily redeeming USDC. The appeal of U.S. treasuries and traditional capital markets is incentivizing investors to exit the crypto space, potentially exacerbating liquidity concerns.

Additionally, a consistent decrease in stablecoin supplies indicates capital outflow from the crypto market, potentially reflecting a bearish sentiment, which can be a self-reinforcing effect, adversely affecting liquidity and market depth.

Key Implications for Institutional Players

For institutional entities engaging with cryptocurrency markets, such as hedge funds and asset managers, the current market dynamics present a multifaceted challenge:

- Liquidity Concerns: Both the decline in derivatives trade volume and the consistent reduction in stablecoin supplies point to a shrinking liquidity in the market. This diminished liquidity can lead to pronounced price fluctuations, making it challenging for large investors to adjust positions without causing significant market price shifts.

- Market Sentiment Indicators: The derivatives markets, especially futures and options, serve as bellwethers of market sentiment. A downturn in activity can suggest heightened uncertainty. Concurrently, while historical data on stablecoin flows is limited, any shift in their supplies can provide early signals of broader market movements, hinting at the potential return of capital to the crypto space.

- Risk Management and Portfolio Strategy: Derivatives, particularly options, are pivotal for hedging. A dip in their activity can indicate that effective hedging is becoming more challenging, increasing exposure to market volatilities. Additionally, the consistent outflow from stablecoins might indicate a broader capital reallocation strategy, suggesting either a bearish sentiment or a strategic shift among investors.

The interplay between global macroeconomic factors, liquidity concerns, and on-chain metrics underscores the complexity of the current landscape. For hedge funds and asset managers, integrating on-chain data into their analytical toolkit can offer a more granular understanding of market dynamics.

This multi-faceted approach not only enhances risk assessment but also aids in making informed, strategic decisions in an increasingly challenging market environment.

Glassnode provides institutional entities weekly updates on the most interesting trends and events in the crypto markets, with actionable insights that can enhance your trading and risk management strategies. Subscribe to our YouTube and LinkedIn channels to keep the pulse on the major digital assets and become even more proactive in your approach.

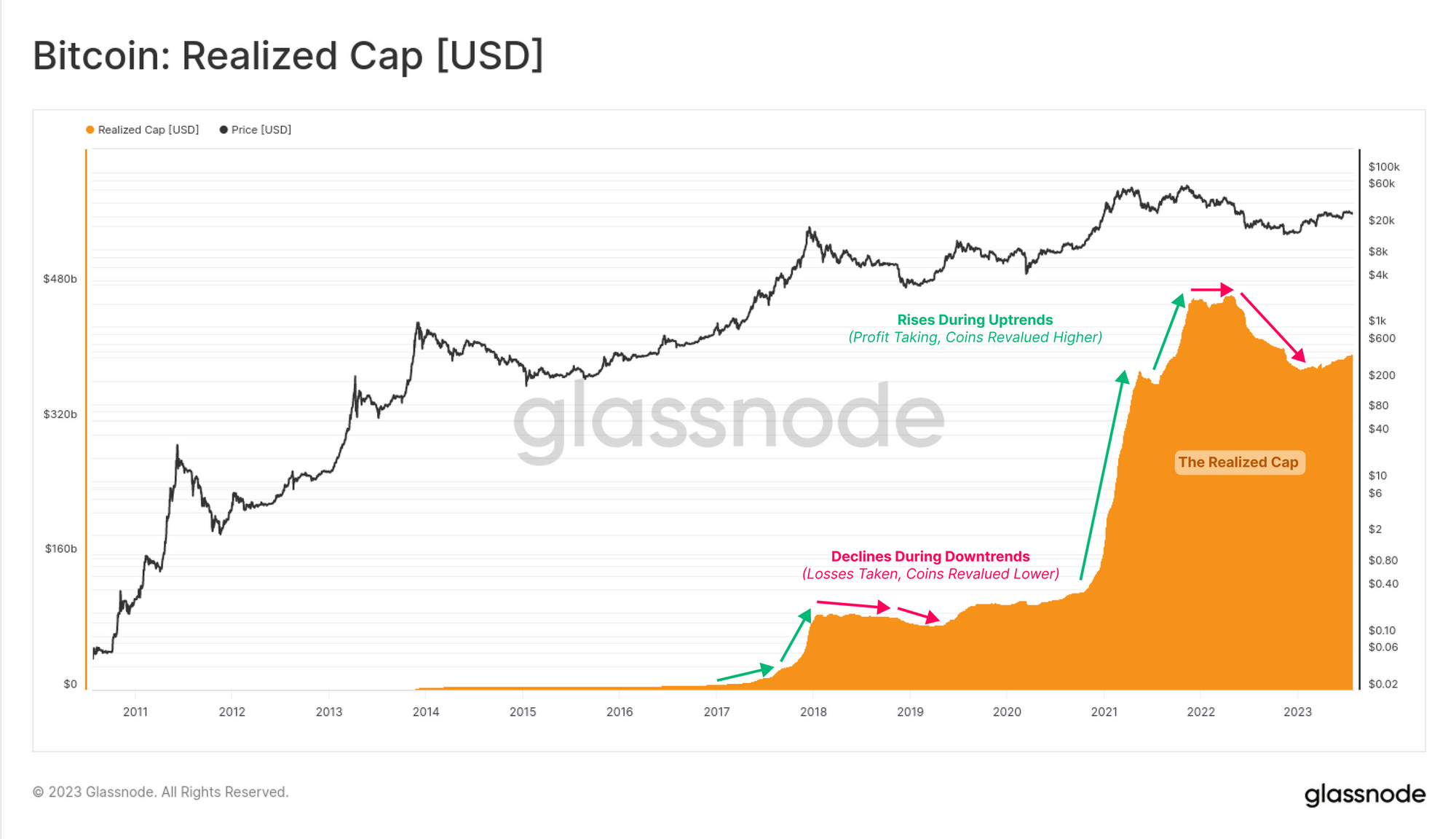

Realized Cap is a foundational on-chain metric which, at the same time, provides a high-level view of the flow of capital in and out of the major assets in the cryptocurrency space. It is also a much more precise gauge than the traditional market cap.

How exactly does Realized Cap differ from the standard way of measuring market cap? Instead of multiplying the current price of a cryptocurrency by its total supply, the Realized Cap calculates the value of each coin at the time of its last on-chain movement and sums it up. By taking into consideration the age of coins and the price at which they last transacted, it provides insights into an asset’s perceived value over time.

Realized Cap is an extremely practical metric and can be used to answer critical questions like

- What are the smart money currently doing with their coins?

- How can we pinpoint the moment when the market cycle starts to shift?

- Is the market experiencing a robust inflow of capital?

For those wanting a deeper dive into this fundamental metric, Glassnode has recently unveiled a comprehensive Dashboard focused on Realized Cap and related metrics. This resource will help you take your first steps in the world of on-chain analysis and use the insights you uncover in your day-to-day trading or risk management activities.

Get Personalised Insights

We hope that Finance Bridge continues to provide valuable insights and helps you navigate the crypto landscape more effectively.

If you have an idea about how we could improve this newsletter to make it more practical for you, we invite you to engage with us. Do you have any questions about the content of this issue or any other queries? Would you like to connect directly with our team of analysts? Or are you interested in discovering how you can leverage Glassnode’s full potential?

Don’t hesitate to reach out. Your thoughts and insights will help us continue to improve the quality of our services and this newsletter, so we’re genuinely excited to hear from you. Schedule a call with a dedicated member of our Institutional sales team to begin the conversation.

Disclaimer: This report does not provide any investment advice. All data is provided for information and educational purposes only. No investment decision shall be based on the information provided here and you are solely responsible for your own investment decisions.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- ChartPrime. Elevate your Trading Game with ChartPrime. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://insights.glassnode.com/finance-bridge-edition-4/

- :has

- :is

- :not

- :where

- $2.5 billion

- $UP

- 1

- 1800

- 1949

- 2%

- 2000

- 2022

- 2023

- 3rd

- 7

- a

- About

- above

- accepted

- across

- activities

- activity

- Additional

- Additionally

- Adjusted

- Adopting

- adversely

- advice

- affecting

- against

- age

- aggressive

- ago

- aids

- aim

- align

- All

- already

- also

- alternative

- Amid

- among

- an

- analysis

- Analysts

- Analytical

- and

- Another

- answer

- any

- appeal

- applied

- approach

- approaching

- approximately

- ARE

- around

- AS

- Assessing

- asset

- asset-managers

- Assets

- At

- AUGUST

- average

- based

- Baseline

- basic

- basis

- BE

- Bear

- bearish

- because

- become

- becomes

- becoming

- been

- begin

- being

- below

- beneath

- between

- Biggest

- Billion

- Bitcoin

- both

- Break

- BRIDGE

- broader

- BTC

- BTC Prices

- Bullish

- but

- buy

- buy the dip

- by

- calculates

- calling

- CAN

- cap

- capital

- Capital Markets

- Cash

- causes

- causing

- caution

- challenge

- challenging

- change

- Changes

- changing

- channels

- Chart

- check

- China

- Chinas

- classes

- clear

- clear signs

- clearer

- closer

- Cluster

- CME

- Coin

- Coins

- complexity

- complicated

- comprehensive

- concentration

- Concern

- Concerns

- conditions

- confidence

- Connect

- Consider

- considerable

- consideration

- consistent

- consistently

- content

- context

- continue

- continues

- continuous

- contracting

- contraction

- contracts

- Conversation

- converting

- Cost

- cost basis

- could

- critical

- crucial

- crunch

- crypto

- crypto investing

- crypto landscape

- Crypto Market

- Crypto Markets

- crypto space

- cryptocurrencies

- cryptocurrency

- cryptocurrency market

- cryptocurrency markets

- Currency

- Current

- Current state

- Currently

- curve

- cycle

- daily

- data

- day-to-day

- decision

- decisions

- Decline

- decrease

- dedicated

- deeper

- Demand

- depth

- Derivatives

- derivatives markets

- DID

- differ

- differentiate

- digital

- Digital Assets

- Dip

- direction

- directly

- discovering

- discussed

- distribution

- dive

- do

- does

- doesn

- doing

- Dominance

- down

- downtrend

- DOWNTURN

- downward

- Drop

- dropped

- Drops

- duration

- dynamic

- dynamics

- each

- Early

- echoes

- Economic

- edition

- educational

- effect

- Effective

- effectively

- effects

- either

- engage

- engaging

- enhance

- entities

- entry

- Environment

- Equilibrium

- especially

- estate

- estimates

- ETH

- ethereum

- ethereum (ETH)

- Even

- events

- exactly

- example

- excited

- Exercise

- Exit

- expansion

- experiencing

- explained

- Exposure

- extreme

- extremely

- Face

- fact

- factors

- Fallen

- Federal

- federal reserve

- Fiat

- Fiat currency

- final

- finance

- financial

- First

- first steps

- first time

- flow

- Flowing

- Flows

- fluctuations

- focused

- follows

- For

- fragility

- frequently

- from

- full

- fundamental

- funds

- further

- future

- Futures

- futures markets

- gaining

- gap

- gateway

- gauge

- generally

- geographical

- given

- Glassnode

- Global

- global financial

- global markets

- going

- Growth

- guided

- Half

- hand

- Have

- Health

- hear

- heavily

- hedge

- Hedge Funds

- hedging

- heightened

- help

- helps

- here

- hesitancy

- high-level

- higher

- highly

- Highs

- Hike

- hints

- historic

- historical

- historically

- holder

- holders

- hope

- horizon

- HOURS

- How

- However

- HTTPS

- idea

- if

- imminent

- impacting

- implications

- improve

- in

- incentivizing

- Including

- increased

- increasing

- increasingly

- increment

- indicate

- indicates

- Indicator

- Indicators

- inflation

- information

- informed

- insights

- instead

- Institutional

- institutional investors

- Integrating

- interested

- interesting

- into

- invested

- investing

- investment

- Investments

- investor

- investor cost basis

- Investors

- invite

- issue

- IT

- ITS

- Keep

- Key

- landscape

- large

- largely

- Last

- lead

- leading

- Leverage

- like

- likely

- LIMIT

- Limited

- LIQUIDATED

- Liquidation

- Liquidity

- liquidity crunch

- live

- ll

- local

- long-term

- long-term holders

- looked

- looking

- loss

- losses

- Lows

- M2

- Macroeconomic

- major

- Majority

- make

- MAKES

- Making

- management

- Managers

- March

- mark

- marked

- Market

- Market Cap

- Market Cycle

- market environment

- market moves

- market sentiment

- Markets

- May..

- measure

- measures

- measuring

- member

- mere

- metric

- Metrics

- might

- Mode

- modest

- moment

- Momentum

- Monetary

- Monetary Policy

- money

- money supply

- Month

- more

- most

- movement

- movements

- moves

- moving

- moving average

- much

- multifaceted

- multiplying

- NARRATIVE

- Navigate

- Near

- nearing

- negative

- net

- New

- Newsletter

- no

- North

- notable

- notably

- November

- now

- number

- of

- offer

- Offers

- offset

- often

- on

- On-Chain

- On-chain analysis

- on-chain data

- ONE

- only

- optimal

- Options

- or

- Other

- our

- out

- output

- over

- overall

- own

- parameters

- part

- participants

- particular

- particularly

- past

- patterns

- perceived

- period

- periods

- Perpetual

- Personalised

- perspective

- pivotal

- plato

- Plato Data Intelligence

- PlatoData

- please

- Point

- points

- policy

- portfolio

- portion

- positioned

- positioning

- positions

- positive

- potential

- potentially

- Practical

- precipice

- precise

- preferences

- present

- presents

- pressures

- prevailed

- previously

- price

- Price Fluctuations

- price up

- Prices

- primary

- Prior

- Proactive

- Profit

- profitability

- profitable

- profits

- pronounced

- propelled

- Protective

- provide

- provided

- provides

- pulse

- purposes

- Q2

- quality

- queries

- question

- Questions

- rally

- rapid

- Rate

- Rate Hike

- ratio

- RE

- reach

- Read

- real

- real estate

- real estate sector

- realized

- realized price

- realizing

- reasons

- recent

- recently

- recovery

- redeeming

- Reduced

- reduction

- refer

- reflecting

- Regardless

- regime

- related

- relative

- remains

- report

- Reserve

- Resistance

- resource

- responsible

- return

- revert

- review

- Risk

- risk management

- robust

- s

- sales

- same

- Second

- sector

- see

- seen

- Sellers

- Selling

- sensitive

- Sensitivity

- sentiment

- sentiments

- serve

- Services

- Shape

- Share

- sharp

- shift

- Shifts

- Short

- short-term

- Short-term holder

- showcasing

- signals

- significant

- signify

- Signs

- similar

- Similarly

- since

- sits

- Sitting

- sizes

- smart

- So

- solely

- solid

- some

- sophisticated

- SOPR

- South

- Space

- span

- spanning

- speaking

- spent

- Spot

- stablecoin

- Stablecoin Supplies

- Stablecoins

- standard

- standpoint

- starts

- State

- stayed

- Steps

- Strategic

- strategies

- Strategy

- subscribe

- substantial

- successful

- such

- sudden

- suggest

- Suggests

- sums

- supply

- Take

- takes

- taking

- tangible

- Target

- team

- temporary

- Tether

- Tether (USDT)

- than

- that

- The

- The Coins

- the information

- the world

- their

- There.

- therefore

- These

- they

- this

- this year

- those

- though?

- Through

- time

- to

- tool

- toolkit

- Total

- touched

- towards

- trade

- Traders

- Trading

- traditional

- trajectory

- transaction

- Transactions

- Treasuries

- Trend

- Trends

- trigger

- two

- typically

- u.s.

- U.S. Treasuries

- uncertainties

- Uncertainty

- uncover

- under

- underscores

- understanding

- unlike

- unpredictable

- unveiled

- Updates

- upon

- upward

- upward momentum

- us

- Usage

- USD

- USD Coin

- USD Coin (USDC)

- USDC

- USDT

- use

- used

- users

- Valuable

- value

- Values

- various

- Ve

- View

- Volatility

- volume

- wait

- want

- wanting

- Warrants

- Way..

- we

- weekly

- Weeks

- WELL

- were

- when

- which

- while

- widely

- will

- with

- without

- world

- worth

- would

- year

- years

- yet

- You

- Your

- youtube

- zephyrnet