Despite being an attractive segment for financial services providers due to their loyalty and lower default risk, women are still widely underrepresented in the portfolio of the fintech firms, presenting a tremendous opportunities for digital financial services providers alike, a new report by the International Finance Corporation (IFC) says, signalling and need for industry to drive financial inclusion for women.

The report, titled “Her Fintech Edge: Market Insights for Inclusive Growth”, explores the representation of women within fintech portfolios and the factors influencing, and examines the performance of women customers compared to overall portfolios, considering loyalty, customer lifetime value (CLV), and default rates. It draws on a survey of 114 fintech firms across 17 countries, as well as interviews with leaders from 25 fintech firms, conducted between November 2022 and February 2023.

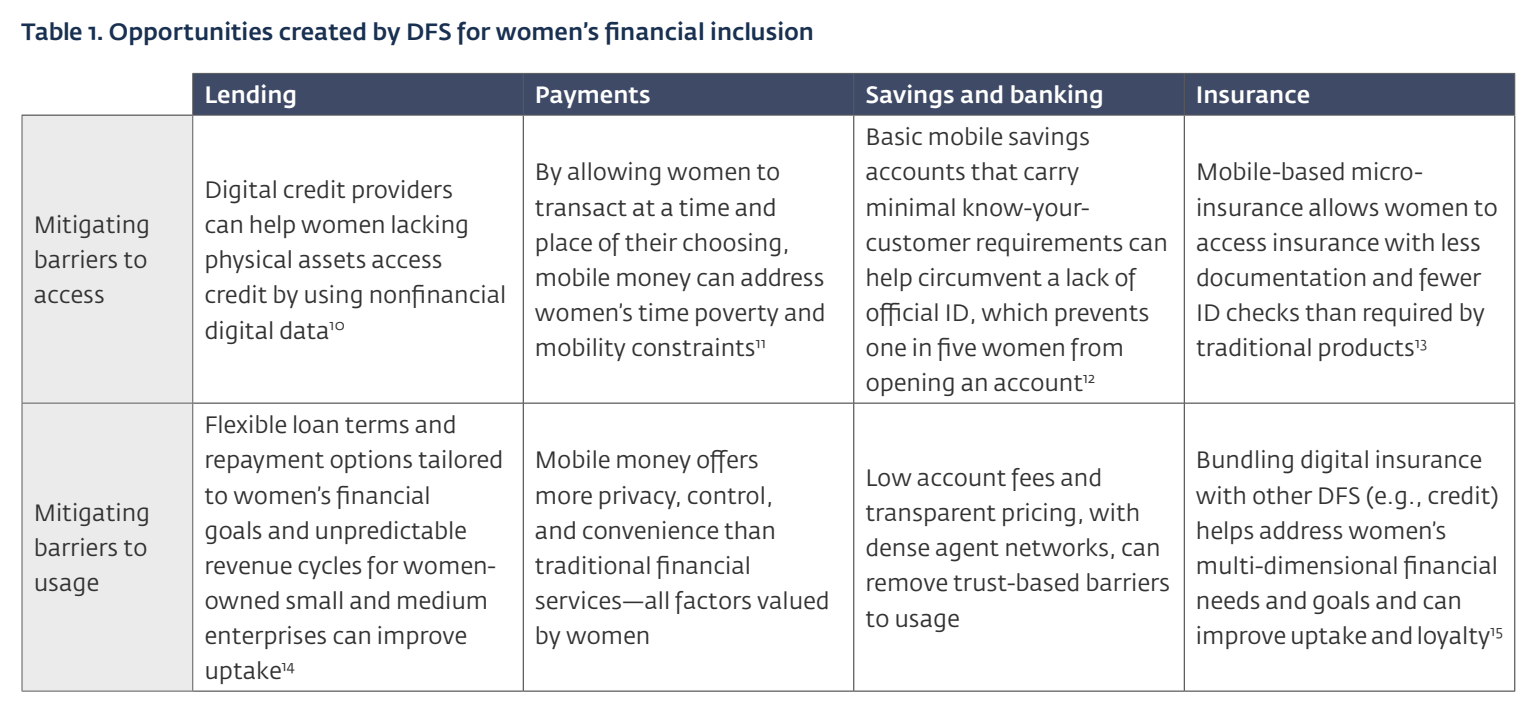

According to the report, digital financial services carry significant potential to advance women’s financial inclusion. When designed appropriately, fintech solutions can directly address access and usage barriers for women, supporting their financial goals and needs.

Opportunities for Financial Inclusion for Women

Opportunities for Financial Inclusion for Women, Source: Her Fintech Edge: Market Insights for Inclusive Growth, International Finance Corporation, Mar 2024

But despite the potential of fintech solutions, barriers to access and adopt these services persist. Data from the World Bank’s Global Findex Database reveal that, in 2021, men were 6% points more likely than women to use digital payments, a gender gap that had remained consistent across developing economies since 2014 in part because of the broader gender gap in access to digital services.

Findings of a 2021 research by the Bank for International Settlements show that this disparity is not limited to payments, pointing to a similar gender gap of 8% points in the adoption of a broader set of services, such as lending, insurance and investment.

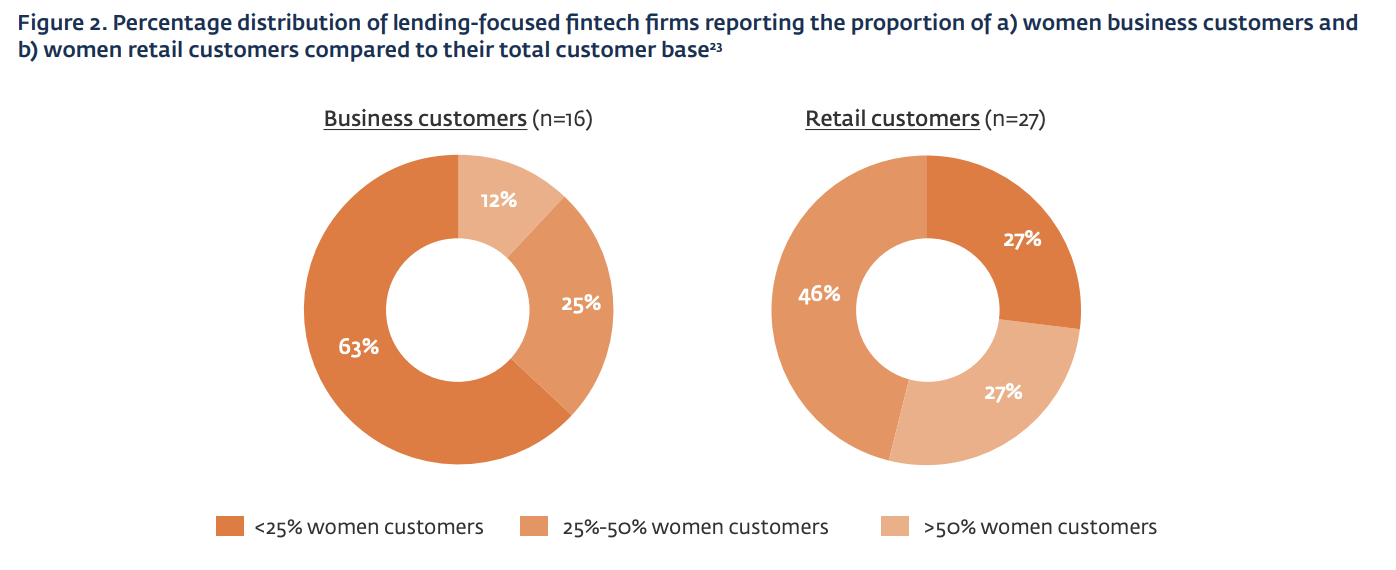

Low representation of women

Results of the IFC study corroborate with these data, revealing that the representation of women in the portfolios of the fintech firms remains suboptimal,

According to the study, 63% of the lending-focused fintech firms surveyed reported that women comprised less than a quarter of their business customer base, while 27% reported that women comprised less than a quarter of their total number of retail customers.

Firms with low representation of women attributed this to the prevailing sociocultural and digital barriers faced by women. Such firms also considered women’s limited economic participation in certain markets, their reliance on informal sources of credit, and low loan size requirements, as limiting demand for credit from women.

Some players also suggested that women could exhibit lower digital savviness when using financial services, mentioning that women tended to be more cautious and prefer some degree of in-person interaction rather than fully relying on digital platforms for financial matters.

Financial inclusion for women remain low among lending fintechs, Source: Her Fintech Edge: Market Insights for Inclusive Growth, International Finance Corporation, Mar 2024

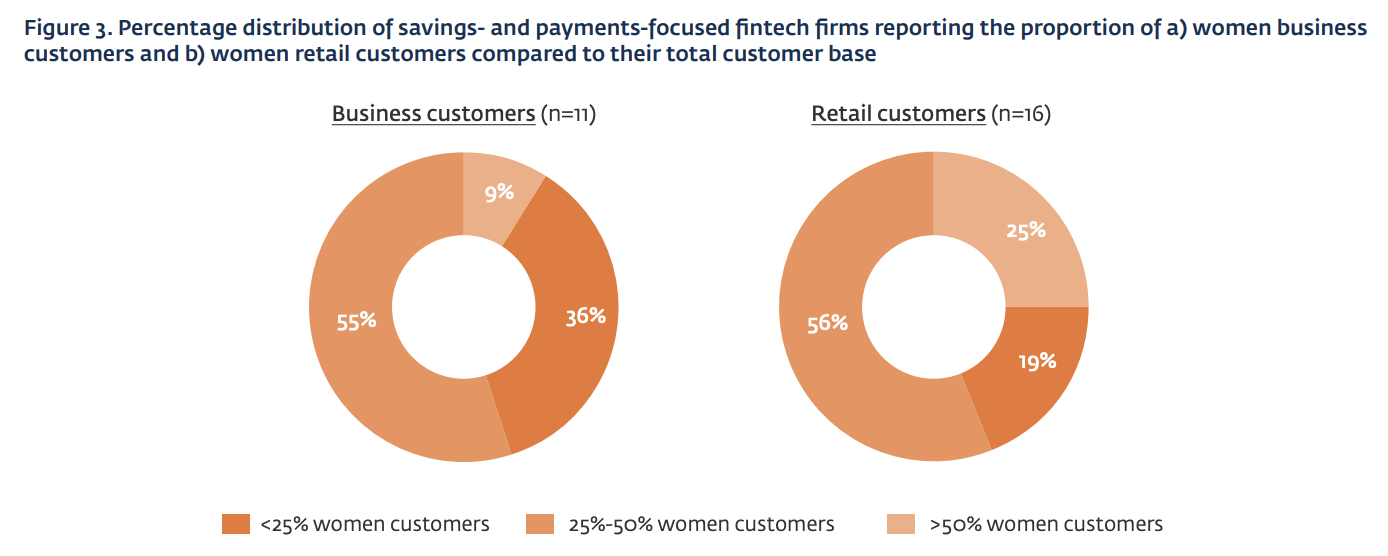

In contrast, fintech companies in the savings and payments segments, meanwhile, are reporting slightly better representation of women customers compared to their lending counterparts.

36% of the payments and savings companies polled indicated that women accounted for less than a quarter of their business customer base, while 19% reported that women comprised less than a quarter of their total number of retail customers.

Percentage distribution of savings- and payments-focused fintech firms reporting the proportion of women business and retail customers compared to their total customer base, Source: Her Fintech Edge: Market Insights for Inclusive Growth, International Finance Corporation, Mar 2024

An attractive segment for financial services providers

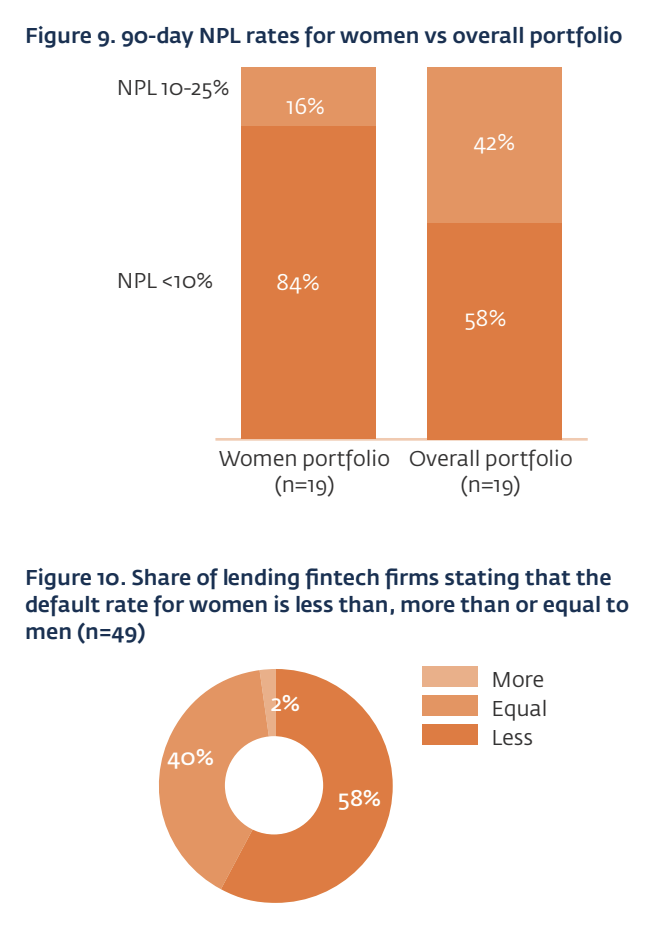

Despite the low representation of women in fintech company portfolios, women are considered an attractive segment for financial services providers. This is due to their higher loyalty, higher CLV, and lower default risk compared to men.

According to the survey’s results, women default less in the portfolios of lending fintech companies, with more fintech firms reporting non-performing loan (NPL) rates of less than 10% for their women’s portfolio. Fintech firms attributed these lower default rates to women’s more financially risk-averse behavior and a greater social pressure to repay loans compared to men.

Women were also found to be more loyal borrowers than men. Industry stakeholders noted how women took longer to build trust with digital platforms, but once they did, they proved to be “stickier” customers than men.

Non-performing loan rates for women versus other segments, Source:

Similarly, fintech companies in the savings, payments and insurance verticals described women as more loyal customers compared to men, noting that men had a significantly higher churn rate and a greater willingness to try multiple financial services applications. Additionally, close to half of these companies stated that women generate greater CLV, noting their higher tendency to maintain insurance premium payments or transact more often on payment or savings platforms.

According to Oliver Wyman, women constitute the single largest underserved group of customers in the financial services industry.

This demographic faces several barriers that impede their access to financial services. Factors such as limited financial literacy, the lack of formal identification documents, society norms, and cultural constraints often discourage women from utilizing, while unequal access to technology exacerbates demand-side barriers for them to access financial services.

On the supply-side, obstacles such as the lack of gender-disaggregated data, limited agent networks and inappropriate products and services design are further reinforcing these barriers.

Oliver Wyman estimates that financial services firms are overlooking a staggering annual revenue potential of US$700 billion by failing to adequately address women’s needs.

Featured image credit: Edited from freepik

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://fintechnews.sg/93749/fintech/financial-inclusion-women-ifc/

- :is

- :not

- 1

- 114

- 17

- 2014

- 2021

- 2022

- 2023

- 2024

- 25

- 250

- 300

- 33

- 36

- 7

- a

- access

- accounted

- across

- Additionally

- address

- adequately

- adopt

- Adoption

- advance

- Agent

- alike

- also

- among

- an

- and

- annual

- ANNUAL REVENUE

- applications

- appropriately

- ARE

- AS

- At

- attractive

- author

- Bank

- barriers

- base

- BE

- because

- begin

- behavior

- being

- Better

- between

- Billion

- bis

- borrowers

- broader

- build

- build trust

- business

- but

- by

- CAN

- caps

- carry

- cautious

- certain

- Close

- Companies

- company

- compared

- Comprised

- conducted

- considered

- considering

- consistent

- constitute

- constraints

- content

- contrast

- CORPORATION

- corroborate

- could

- counterparts

- countries

- created

- credit

- cultural

- customer

- Customers

- data

- Database

- Default

- Degree

- Demand

- demographic

- described

- Design

- designed

- Despite

- developing

- DID

- digital

- Digital Payments

- digital services

- directly

- distribution

- documents

- draws

- drive

- due

- Economic

- economies

- Edge

- end

- estimates

- Examines

- exhibit

- explores

- faced

- factors

- failing

- February

- finance

- financial

- financial goals

- financial inclusion

- Financial Literacy

- financial services

- financially

- fintech

- Fintech Companies

- FINTECH COMPANY

- Fintech News

- fintechs

- firms

- For

- form

- formal

- found

- from

- fully

- further

- gap

- Gender

- generate

- Global

- Goals

- greater

- Group

- Growth

- had

- Half

- her

- High

- higher

- hottest

- How

- HTTPS

- Identification

- image

- in

- in-person

- inclusion

- Inclusive

- indicated

- industry

- influencing

- informal

- insights

- insurance

- interaction

- International

- international settlements

- Interviews

- investment

- IT

- jpg

- Lack

- largest

- leaders

- lending

- less

- lifetime

- likely

- Limited

- limiting

- literacy

- loan

- Loans

- longer

- Low

- lower

- loyal

- Loyalty

- mailchimp

- maintain

- mar

- Market

- market insights

- Markets

- Matters

- max-width

- Meanwhile

- Men

- mentioning

- Month

- more

- multiple

- Need

- needs

- networks

- New

- news

- norms

- noted

- noting

- November

- number

- obstacles

- of

- often

- oliver

- Oliver Wyman

- on

- once

- opportunities

- or

- Other

- overall

- part

- participation

- payment

- payments

- percentage

- performance

- Platforms

- plato

- Plato Data Intelligence

- PlatoData

- players

- points

- portfolio

- portfolios

- Posts

- potential

- prefer

- Premium

- presenting

- pressure

- Products

- proportion

- proved

- providers

- Quarter

- Rate

- Rates

- rather

- reliance

- relying

- remain

- remained

- remains

- repay

- report

- Reported

- Reporting

- representation

- Requirements

- research

- Results

- retail

- revealing

- revenue

- Risk

- Savings

- says

- segment

- segments

- Services

- set

- Settlements

- several

- significant

- significantly

- similar

- since

- Singapore

- single

- Size

- Social

- Society

- Solutions

- some

- Source

- Sources

- staggering

- stakeholders

- stated

- Still

- Study

- suboptimal

- such

- supply-side

- Supporting

- Survey

- surveyed

- Technology

- tendency

- than

- that

- The

- the world

- their

- Them

- These

- they

- this

- to

- took

- Total

- transact

- tremendous

- Trust

- try

- underrepresented

- underserved

- Usage

- use

- using

- Utilizing

- value

- Versus

- verticals

- WELL

- were

- when

- while

- widely

- Willingness

- with

- within

- Women

- Women in Fintech

- world

- Your

- zephyrnet