If one looks inside the fintech regulatory landscape, they will see a complex web of shifting laws, regulations, and frameworks.

However, many jurisdictions have an insular approach, and companies are slow to collaborate on fraud prevention. This is why the knowledge gap opens, causing the anticipated US$48 billion loss due to fraud in 2023.

Full-cycle verification platform Sumsub’s data shows that over 70% of fraudulent behavior occurs after onboarding, and many companies use outdated transaction monitoring processes.

Sophisticated Know Your Customer (KYC) and anti-money laundering (AML) solutions are often used, but the next compliance steps are unfit for purpose. Clients may be verified correctly at the beginning, but fraud happens at later stages.

The fintech guide that fraudsters hate

Flawed processes in the fintech world can be solved by using regulations as innovative guides. The first step is to understand the AML requirements in the organisation’s customer regions, and the second is to study regulatory success stories.

Sumsub has created The Ultimate KYC/AML and Fraud Prevention Guide For Fintechs to provide all the information needed in one place. All core global regions are covered, including the APAC region and its regulatory requirements.

Capitalise on global patterns

Understanding patterns within the fintech regulatory landscape is crucial if fintechs want to capitalise on them. So, the Sumsub guide highlights how different fintech services, consumer bases, and related regulations are transforming the landscape.

For example, a recent study by BCG predicts that the APAC region will be the largest fintech market by 2030, accounting for 25% of global banking valuations.

The largest fintechs, highest underbanked populations, and tech-savvy demographics in APAC explain this prediction.

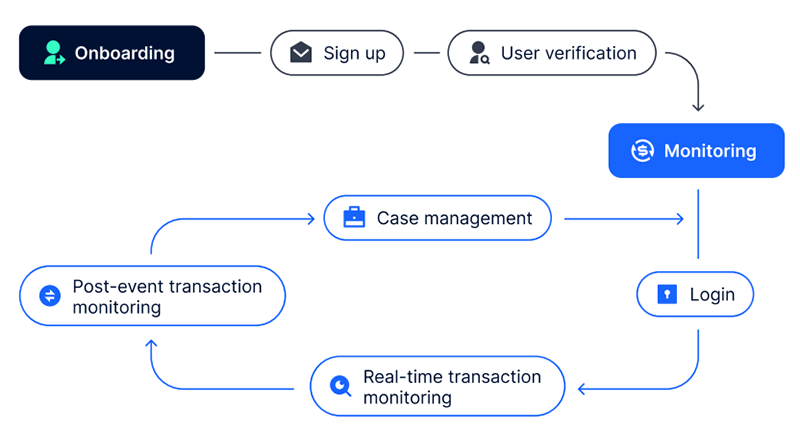

Apply fraud-resilient verification flows

Fraudsters love generic systems that lack customisation. Sumsub’s guide explains why a generic or ‘tick-box’ approach weakens fintech risk management strategies, and how to fix them with a dynamic KYC/AML and transaction monitoring process.

This includes high compliance standards, jurisdiction-specific verification, quick automation and orchestration, full customer lifecycle management as well as code-free ease of use.

Here is a summary of the stages used to deliver world-class verification flows:

1. Sign-up and pre-screening

Users identify themselves at registration by providing their name and country of residence (or nationality) without submitting any documents. This is a simple setting that speeds up registration.

2. ID verification

Sumsub validates ID documents through reliable sources, and external databases are used to double-check document authenticity. This option is not available everywhere, but many countries are covered, and the list keeps growing.

3. AML and sanctions screening

High-risk clients are easily detected with AML screening and continually checked against global watchlists, sanctions, PEPs, and adverse media.

Use fintech-customised transaction monitoring

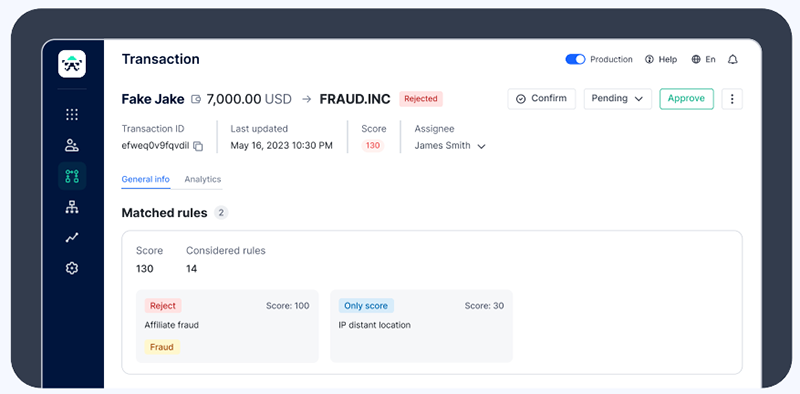

Fintech transaction monitoring is integral to the entire verification flow, meaning that user, business, and transaction verification are connected. Every single available data point is used to assess users, risks, and suspicious patterns.

The Sumsub Transaction Monitoring solution enables fintechs see detailed information for each transaction, report the transaction if necessary, and prevent fraud-related losses by detecting suspicious activities.

Fintech transaction monitoring solutions cover the following stages:

- Transaction data transfer: Data on transactions, payment methods, and customers is gathered via secure API.

- Ongoing transaction monitoring: Every transaction is screened in real-time and suspicious activities are detected based on set rules.

- Case management: Alerts are set to discover and dive deep into suspicious transactions and related customer details.

- Reporting: Suspicious Activity Reports (SARs) are formed on demand to be sent to the regulator.

Key takeaways

Access to the fintech ecosystem is vital for success because collections of organisations work together to overcome common challenges. However, the same challenges in identity verification, fraud, and transaction monitoring are still causing global roadblocks.

Sumsub’s new guide covers fintech’s best verification solutions and how to use them:

Forget the tick-box approach: Apply in-depth KYC/AML and Transaction Monitoring solutions so their company can go beyond generic compliance and offer advanced protection from fraudulent behavior.

Focus on full-cycle client journeys: The majority of fraudulent activity occurs after the KYC stage, so fintech companies must check a client’s activities throughout the entire user journey with a continuous transaction monitoring process.

Consolidate KYC/AML, KYB, and Transaction Monitoring platforms: Rely on one platform that covers the entire user journey, so time and resources are not wasted on multiple providers.

100% of fintechs want consistent client trust while improving compliance, verification pass rates, and market growth. But how can they balance all three goals?

Read The Ultimate KYC/AML and Fraud Prevention Guide For Fintechs for practical answers in an ever-changing landscape.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://fintechnews.sg/78134/sponsoredpost/fintech-regulations-new-solutions-in-a-complex-landscape/

- :has

- :is

- :not

- $UP

- 180

- 2023

- 2030

- 361

- 400

- 7

- a

- Accounting

- activities

- activity

- advanced

- adverse

- adverse media

- After

- against

- Alerts

- All

- AML

- AML screening

- an

- and

- answers

- anti-money laundering

- Anticipated

- any

- APAC

- api

- Apply

- approach

- ARE

- AS

- assess

- At

- authenticity

- Automation

- available

- Balance

- Banking

- based

- BCG

- BE

- because

- Beginning

- behavior

- BEST

- Beyond

- Billion

- business

- but

- by

- CAN

- caps

- causing

- challenges

- check

- checked

- client

- clients

- code-free

- collaborate

- collections

- Common

- Companies

- company

- complex

- compliance

- connected

- consistent

- consumer

- continually

- continuous

- Core

- countries

- country

- cover

- covered

- Covers

- created

- crucial

- customer

- customer details

- Customers

- data

- databases

- deep

- deliver

- Demand

- Demographics

- detailed

- details

- detected

- different

- discover

- dive

- document

- documents

- due

- dynamic

- each

- ease

- ease of use

- easily

- ecosystem

- enables

- Entire

- ever-changing

- Every

- everywhere

- example

- Explain

- Explains

- external

- false

- fintech

- Fintech Companies

- fintechs

- First

- Fix

- flow

- Flows

- following

- For

- formed

- frameworks

- fraud

- FRAUD PREVENTION

- fraudsters

- fraudulent

- fraudulent activity

- friendly

- from

- full

- gap

- gathered

- Global

- Global Banking

- Go

- Goals

- Growing

- Growth

- guide

- Guides

- happens

- Have

- High

- highest

- highlights

- How

- How To

- However

- HTTPS

- ID

- identify

- Identity

- Identity Verification

- if

- improving

- in

- in-depth

- includes

- Including

- information

- innovative

- inside

- integral

- into

- ITS

- journey

- Journeys

- jurisdictions

- Know

- Know Your Customer

- knowledge

- kyb

- KYC

- KYC/AML

- Lack

- landscape

- largest

- later

- Laundering

- Laws

- lifecycle

- List

- LOOKS

- loss

- losses

- love

- Majority

- management

- many

- Market

- max-width

- May..

- meaning

- Media

- methods

- monitoring

- multiple

- must

- name

- necessary

- needed

- New

- next

- of

- offer

- often

- on

- Onboarding

- ONE

- opens

- Option

- or

- orchestration

- Organisations

- over

- Overcome

- pass

- patterns

- payment

- payment methods

- Place

- platform

- Platforms

- plato

- Plato Data Intelligence

- PlatoData

- Point

- populations

- Practical

- prediction

- Predicts

- prevent

- Prevention

- process

- processes

- protection

- provide

- providers

- providing

- purpose

- Quick

- Rates

- real-time

- recent

- region

- regions

- Registration

- regulations

- regulator

- regulatory

- regulatory landscape

- related

- reliable

- reliable sources

- rely

- report

- Reports

- Requirements

- Residence

- Resources

- return

- Risk

- risk management

- risks

- roadblocks

- rules

- same

- Sanctions

- screening

- Second

- secure

- see

- sent

- Services

- set

- setting

- SHIFTING

- Shows

- Simple

- Singapore

- single

- slow

- So

- solution

- Solutions

- Sources

- speeds

- Stage

- stages

- standards

- Step

- Steps

- Still

- Stories

- strategies

- Study

- success

- Success Stories

- SUMMARY

- Sumsub

- suspicious

- Systems

- that

- The

- the information

- The Landscape

- their

- Them

- themselves

- they

- this

- three

- Through

- throughout

- time

- to

- together

- transaction

- Transactions

- transfer

- transforming

- Trust

- ultimate

- underbanked

- understand

- use

- used

- User

- user journey

- users

- using

- Valuations

- Verification

- verified

- via

- vital

- want

- Watchlists

- web

- WELL

- while

- why

- will

- window

- with

- within

- without

- Work

- work together

- world

- world-class

- Your

- zephyrnet