Frax will distribute nearly $400,000 to veFXS stakers this week.

Frax stakers are set to share around $400,000 worth of fee revenue after Frax became one of a few web3 projects to activate a highly sought-after yet elusive “fee switch.”

On April 3, Frax tweeted that around $400,000 worth of protocol fees will go to veFXS stakers this week, suggesting that stakers are on track to collectively earn around $20.8 million in fees annually. The Frax team added it will also buy back $400,000 worth of FXS and divert the tokens to the project’s protocol-owned liquidity.

On March 31, the Frax community voted in favor of activating the fee switch with near unanimous support as part of its “Frax Singularity Roadmap Part 1” proposal following a week-long vote. Frax will divert 50% of fees to stakers and 50% of fees to its FXS buyback program.

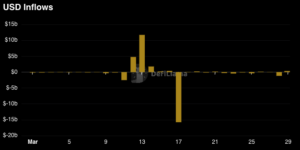

Data from DeFi Llama indicates that Frax generated $47.4 million in revenue over the past 365 days.

Frax’s introduction of a revenue-sharing program follows Uniswap governance passing a proposal paving the way for the activation of its long-requested fee switch in early March.

The move was well received by traders, with the price of Uniswap’s UNI token rallying by more than 120% in two weeks to a March 6 high of $16, according to CoinGecko. However, UNI has since pulled back to $10.71.

However, Frax’s FXS token has struggled to retain its recent gains. FXS rallied to $8 from $6.70 in the lead-up to the proposal passing, but has since slumped back to $6.82.

Singularity Roadmap

Frax’s Singularity roadmap seeks to establish a new path forward for the protocol following the launch of its Fraxtal Layer 2 network in February and the project’s stablecoin, FRAX, becoming 100% collateralized.

The Singularity Part 1 proposal also set the stage for revamping its sfrxETH liquid staking token (LST) to support restaking, plus allocating 250M FRAX to Morpho Labs’ lending pools for Ethena’s yield-bearing sUSDe stablecoin to bolster protocol revenue.

However, USDe has garnered controversy since its explosive launch due to its high yields derived from Lido’s stETH LST and funding rates from shorting Ether. Andre Cronje, the serial DeFi developer, warned that the so-called synthetic dollar could become “very high risk” should the markets turn bearish.

Frax’s LST is currently the seventh-largest liquid staking token with a total value locked of $856 million. Yet the broader LST sector is suffering from diminished growth amid the rise of liquid restaking tokens (LRTs), which offer holders Ethereum staking rewards in addition to the points earned from restaking via EigenLayer, the pioneering Ethereum staking protocol.

LRTs will also provide restaking yields once EigenLayer’s AVS ecosystem is live.

Looking ahead, Singularity also aims to attract a $100 billion total value locked (TVL) to Fraxtal by the end of 2026. Fraxtal currently hosts a $15.5 million TVL.

The roadmap also sets the stage for the launch of 23 Layer 3 networks, in addition to the launch of new LSTs, including staking derivatives for NEAR, TIA, and METIS.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://thedefiant.io/frax-stakers-on-track-to-earn-usd20-8m-annually-after-fee-switch-activation

- :has

- :is

- 000

- 1

- 2026

- 23

- 250m

- 31

- 7

- 70

- 8

- 98

- a

- Absolute

- According

- activate

- activating

- Activation

- added

- addition

- After

- ahead

- aims

- Alpha

- also

- Amid

- and

- Annually

- April

- ARE

- around

- AS

- attract

- back

- bearish

- became

- become

- Billion

- Block

- bolster

- broader

- but

- buy

- Buyback

- by

- CoinGecko

- collectively

- community

- could

- Currently

- daily

- Days

- DeFi

- DeFi llama

- Derivatives

- Derived

- Developer

- disabled

- distribute

- divert

- Dollar

- due

- dump

- Early

- earn

- earned

- end

- establish

- Ether

- ethereum

- ethereum staking

- favor

- February

- fee

- Fees

- few

- following

- follows

- For

- Forward

- Frax

- from

- funding

- funding rates

- FXS

- Gains

- generated

- Go

- Group

- Growth

- Hidden

- High

- highly

- holders

- hosts

- hover

- However

- HTTPS

- in

- Including

- indicates

- Introduction

- IT

- ITS

- join

- launch

- layer

- Layer 3

- lending

- letter

- LG

- Liquid

- liquid staking

- Liquidity

- live

- Llama

- locked

- March

- Markets

- markets turn

- member

- METIS

- million

- more

- move

- Near

- nearly

- network

- networks

- New

- of

- offer

- on

- ONE

- our

- over

- part

- Passing

- past

- path

- Paving

- Pioneering

- plato

- Plato Data Intelligence

- PlatoData

- plus

- podcast

- points

- Pools

- Premium

- price

- Program

- projects

- proposal

- protocol

- provide

- Rates

- recap

- received

- recent

- relative

- retain

- revenue

- Rewards

- Rise

- roadmap

- s

- sector

- Seeks

- serial

- set

- Sets

- Share

- Shorting

- should

- since

- singularity

- stablecoin

- Stage

- stakers

- Staking

- Staking Rewards

- stETH

- suffering

- support

- Switch

- synthetic

- team

- than

- that

- The

- The Defiant

- this

- this week

- tia

- to

- token

- Tokens

- Total

- total value locked

- track

- Traders

- Transcript

- TURN

- TVL

- two

- UNI

- Uniswap

- value

- via

- visible

- Vote

- warned

- was

- Way..

- Web3

- webp

- week

- Weeks

- WELL

- which

- will

- with

- worth

- yet

- yield-bearing

- yields

- youtube

- zephyrnet