Our free Bank reconciliation template provides a simple way to reconcile your cashbook with your bank statement. Hit the download button and follow our guide to learn more.

<Not final link>

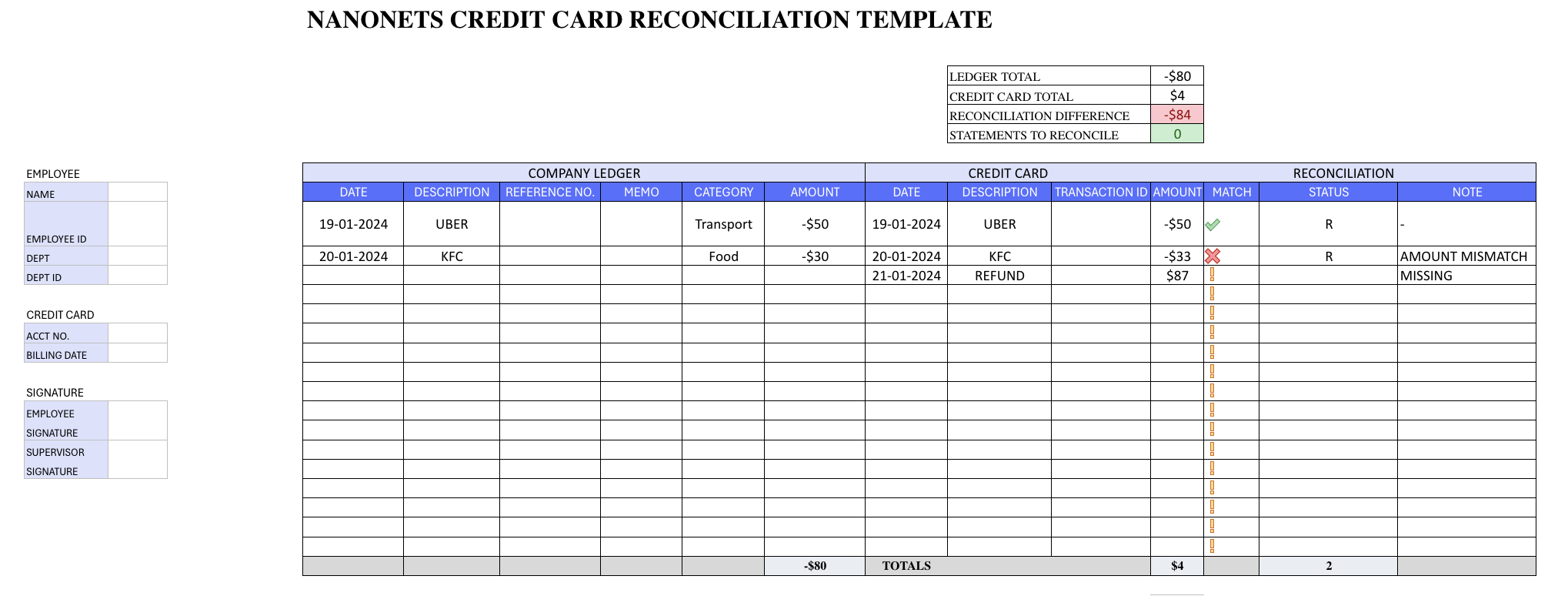

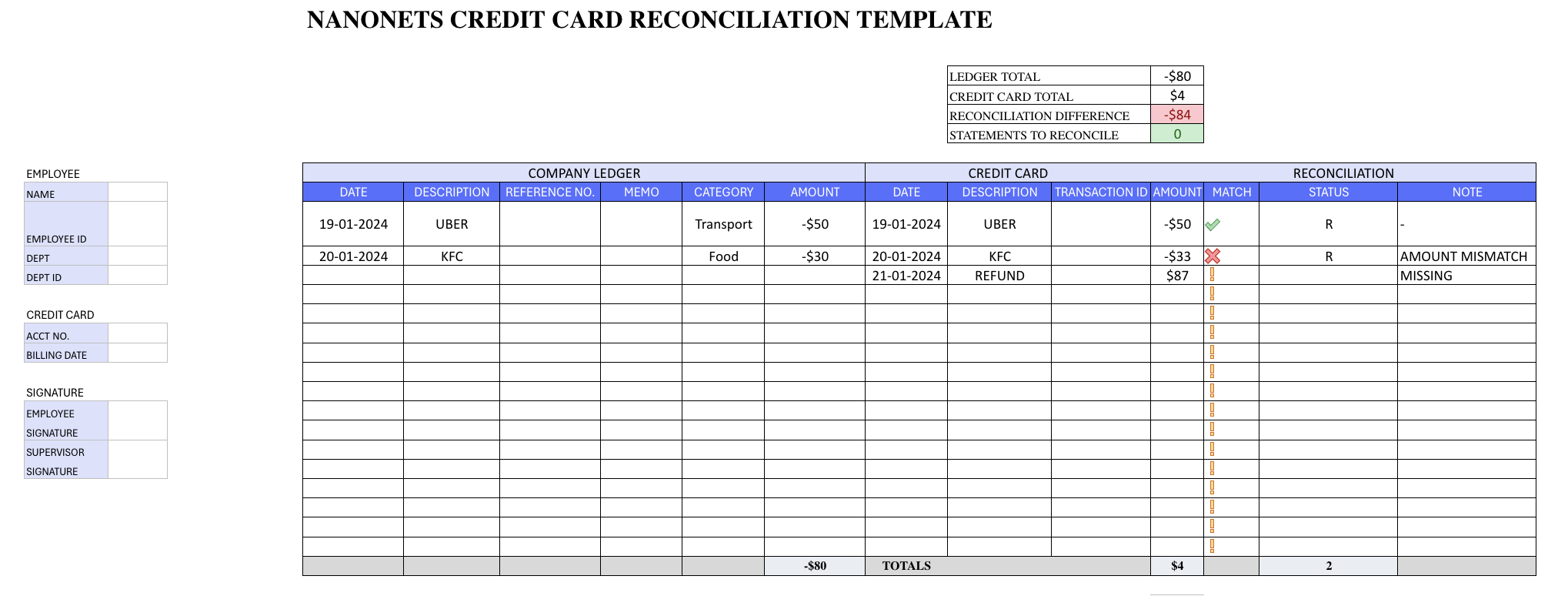

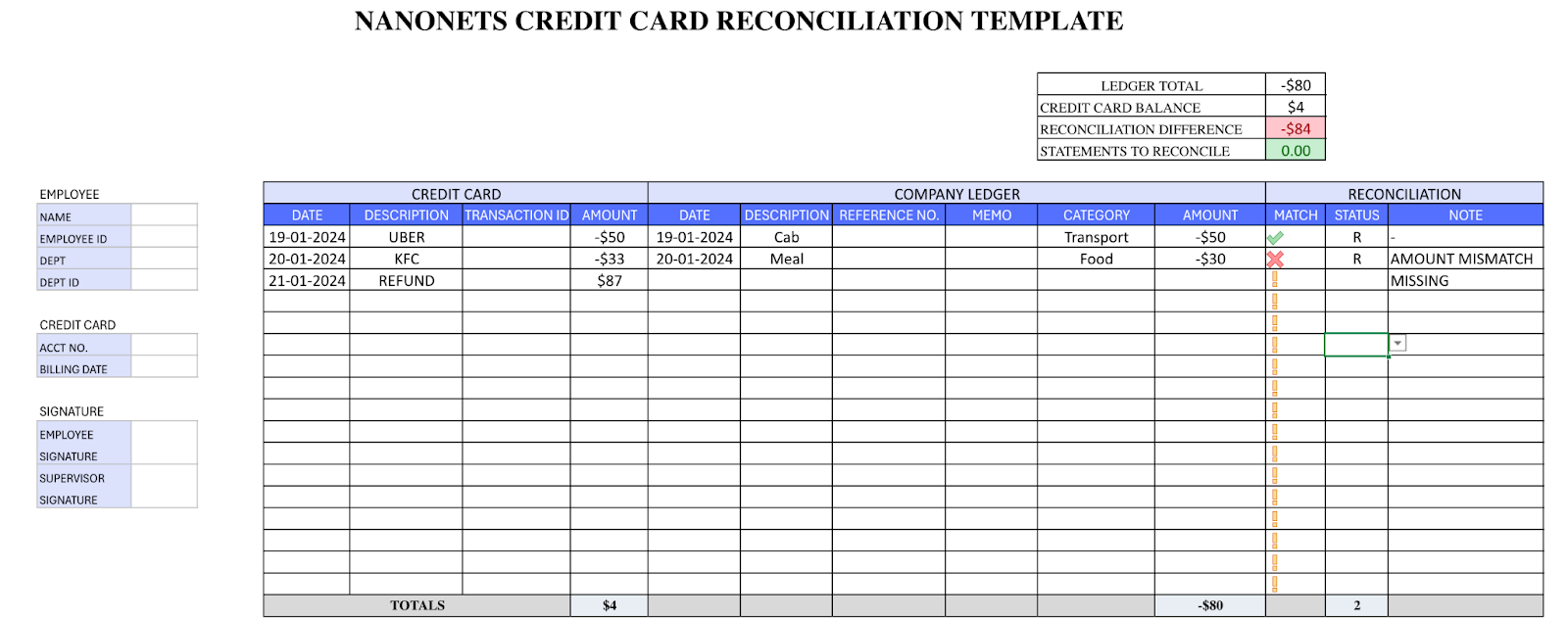

Example of our Excel credit card reconciliation template:

How to do credit card reconciliation?

Credit card reconciliation is the process of matching credit card records with your company ledger. This is a routine process done by finance teams to ensure that company financial records are accurate and to detect any errors or fraud.

Let’s get started with the process:

- Gather documents

You will need the company’s general ledger and the latest credit card statement. Download them in CSV format and paste them into individual Excel sheets. Also, find all the invoices/receipts related to credit card payments. In case of any discrepancy, this will help you confirm the transaction details, the authorization of the transaction, and expense categorization.

- Match documents

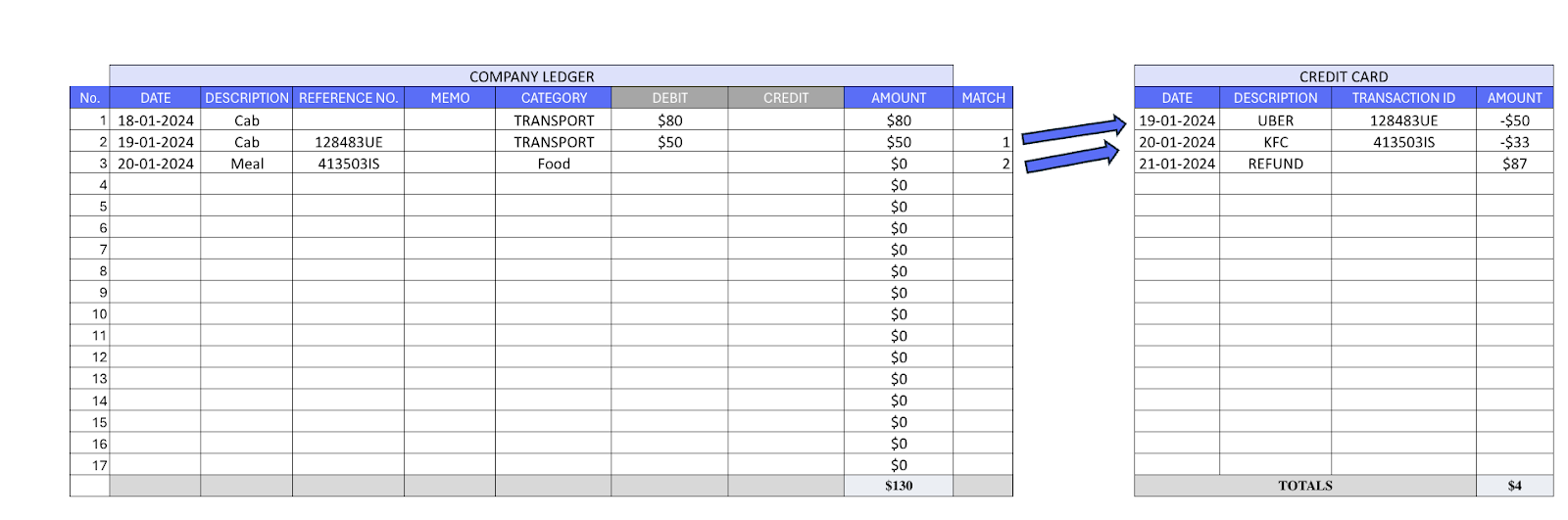

We need to find out the matching transactions in the credit card statement and the general ledger. You can do an exact match if your GL records the transaction ID.

If the transaction ID isn’t recorded, you can match the transaction based on other information like date, amount, or description.

Example: We have a $50 Uber charge recorded in the company ledger; the transaction can be matched with the credit card statement using the transaction ID.

- Create a credit card reconciliation statement.

Create a reconciliation statement that marks all the transactions that match and tracks all the unmatched transactions. You can update the general ledger to reflect any valid transactions that might have been missed. In case of any unauthorized transactions or banking errors, please contact your bank.

Why credit card reconciliation?

Credit Cards offer instant global payments and a credit line, making them popular in the corporate world. Corporate credit cards are a preferred method for employees to make work-related expenses.

However, credit cards are prone to theft and fraud. It’s the most common banking-related fraud, with 100s of thousands of cases yearly and billions in value stolen. It’s essential to reconcile credit card statements to detect any errors, fraud, or unauthorized transactions.

Automate Credit Card Reconciliation

Using tools like Excel requires lots of manual intervention. If you want to scale your process, you must look into software that can automate your process end-to-end. This would require aggregating data from multiple financial sources, extracting relevant data from documents, matching data across different sources, and fraud checks.

Reconciliation software can automate 3 key items for you:

- Data collection – Automation software like Nanonets can seamlessly integrate with your ERP or Email to gather documents like credit card statements, invoices, receipts, and the company’s general ledger. The software will only pull relevant information from each document through OCR technology.

- Data matching – With no code automation, you can easily set up rules to match the two documents. You can set up new rules with time & don’t have to struggle with formulas.

- Identifying error & fraud-check – Setup flags to identify any kind of irregular transactions, duplicates, or unauthorized transactions.

Find the right reconciliation software based on your business needs and whether the tool has the features you need.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://nanonets.com/blog/free-credit-card-reconciliation-template/

- :has

- :is

- :not

- $UP

- 2000

- 7

- 9

- a

- accurate

- across

- aggregating

- All

- also

- amount

- an

- and

- any

- ARE

- authorization

- automate

- Automation

- Bank

- Banking

- based

- BE

- been

- billions

- business

- button

- by

- CAN

- card

- card payments

- Cards

- case

- cases

- charge

- Checks

- code

- Common

- company

- Confirm

- contact

- Corporate

- credit

- credit card

- Credit Cards

- CREDIT LINE

- data

- Date

- description

- details

- detect

- different

- discrepancy

- do

- document

- documents

- done

- Dont

- download

- duplicates

- each

- easily

- employees

- end-to-end

- ensure

- ERP

- error

- Errors

- essential

- Excel

- expenses

- Features

- final

- finance

- financial

- Find

- flags

- follow

- For

- format

- fraud

- Free

- from

- gather

- General

- get

- Global

- Global Payments

- guide

- Have

- help

- Hit

- HTTPS

- ID

- identify

- if

- in

- individual

- information

- instant

- integrate

- intervention

- into

- invoices

- IT

- items

- Key

- Kind

- latest

- LEARN

- Ledger

- like

- Line

- Look

- lots

- make

- Making

- manual

- Match

- matched

- matching

- method

- might

- missed

- more

- most

- multiple

- must

- Need

- needs

- New

- no

- OCR

- of

- offer

- on

- only

- or

- Other

- our

- out

- payments

- plato

- Plato Data Intelligence

- PlatoData

- please

- Popular

- preferred

- process

- provides

- receipts

- reconciliation

- recorded

- records

- reflect

- related

- relevant

- require

- requires

- routine

- rules

- s

- Scale

- seamlessly

- set

- setup

- sheets

- Simple

- Software

- Sources

- started

- Statement

- statements

- stolen

- Struggle

- teams

- Technology

- template

- that

- The

- theft

- Them

- this

- thousands

- Through

- time

- to

- tool

- tools

- tracks

- transaction

- Transaction Details

- Transactions

- two

- Uber

- unauthorized

- unmatched

- Update

- using

- valid

- value

- want

- Way..

- we

- whether

- will

- with

- world

- would

- yearly

- You

- Your

- zephyrnet