Natural gas has fallen another 4% this Tuesday, down from a peak of $10 to now $8.42 as the commodity seems to have double topped.

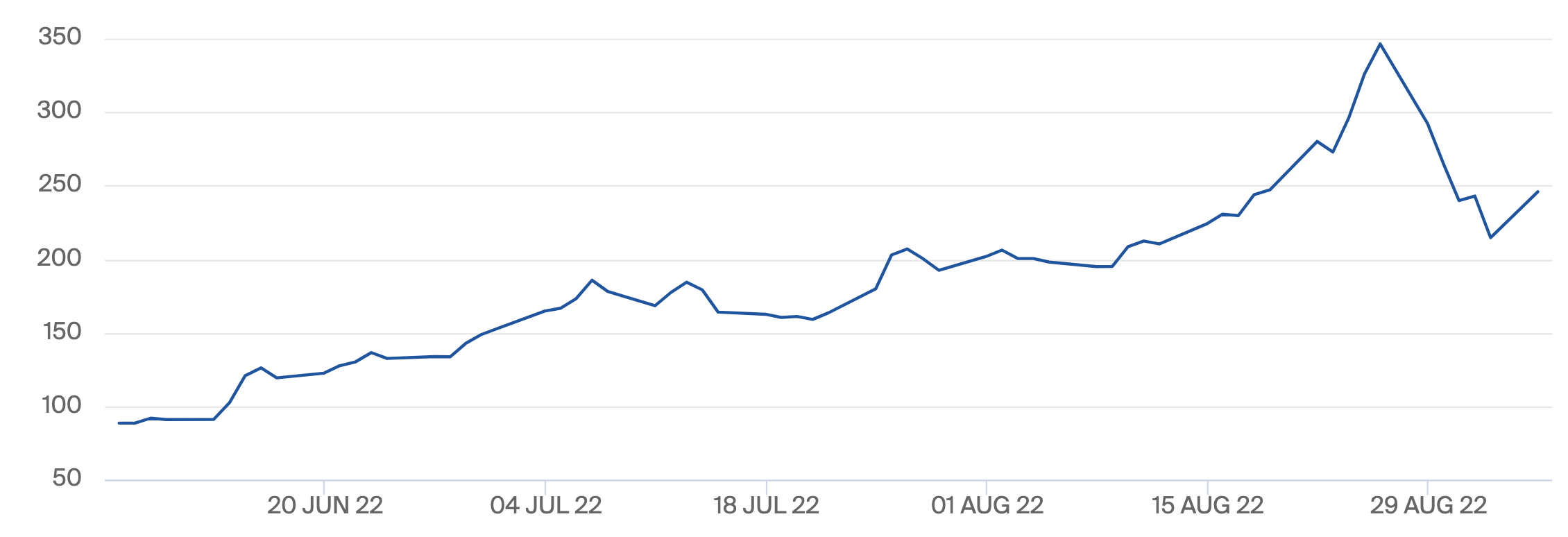

European gas has fallen as well with the Dutch TTF Gas Futures down to €245 from €346 last week.

This comes amid movements in Europe. The fastest and biggest one is from Liz Truss, the newly elected Prime Minister of Great Britain and Northern Ireland.

She is set to impose a price cap for energy bills that effectively translates to £2,000 per year, the rest will be covered by the government at an estimated cost of circa £80 billion a year, though very much dependent on just how gas prices move.

The scheme is understood to cover both households and businesses, with this singular move potentially sufficient to bring inflation significantly down, maybe even within the target of 2% as the vast majority of inflation has been due to energy costs.

The European Union is moving too. Emmanuel Macron, the French President, has now backed proposals for a cap on Russian natural gas prices following a phone call with German Chancellor Olaf Scholz.

The European Commission is set to propose a price cap on Russian gas this Friday when energy Ministers meet, in addition to new benchmarks for EU-wide gas price setting and a command-and-control allocation of gas to needy countries in an emergency, according to documents seen by Politico.

This is somewhat similar to the price cap on Russian oil proposed by the G7, with it unclear whether Russia’s response will be the same whereby they claim they just won’t sell gas to those that price cap.

Yet Russia is in some economic trouble. In announcing some nowadays rare data, the Russian central bank revealed their biggest banks had lost 1.5 trillion rubbles, $25 billion, just in the first half of this year.

Only three months of that first half included Swift level sanctions, and it may be those three months alone that account for the vast majority of these losses, though the central bank provided no breakdown.

This compares to gains in all of 2021 of 2.4 trillion rubbles, making this potentially a very serious issue as these losses are at about 25% of their total reserves.

The commercial banks in Russia have $116 billion in such reserves, the central bank said, which at this rate might not be enough for even a couple of more halves.

It may well be probable therefore that economic reality will force Russia to keep this energy ‘diplomacy’ to a temporary matter, and so an EU price cap may succeed.

On the ground too Ukraine seems to be making some gains. The blue and yellow flag probably won’t fly on Kherson City anytime soon however as they’re going slowly, but it seems to be flying on more and more villages.

To keep spirits somewhat up, and antagonism from some western views, Russia is now bragging that China will start using rubles and yuan to pay for Russian gas, instead of dollars.

The yuan itself however is soft-pegged to the dollar, and global gas prices are still denominated in USD, so yuan or the ruble won’t quite be acting as a unit of account, and therefore won’t ‘set’ the price of gas.

On the other hand China’s UnionPay has stopped accepting cards issued by sanctioned Russian banks which turned to this payment system following the exit of Visa and Mastercard, as they’re worried about secondary sanctions.

This is just one example as some debate continues regarding who is hurting more from sanctions.

Arguably, if it was possible for the Russian people – who keep falling from windows – to not hurt at all, maybe that would be better.

Because the aim, arguably, is not to hurt the people as such or even to incite them to revolt, but to simply degrade Russia’s capabilities so that it can not keep up in Ukraine.

That’s what the elected said anyway when all this began, that the aim was to degrade Russia’s capabilities so that they can’t produce, at least to the same extent or quality, the many tools they need on the ground. Anything else can well be considered collateral damage, or a bonus, depending on your perspective.

Making the debate on who is hurting more mute because it doesn’t matter, technocratically speaking, on the ground with there being no debate that the sanctions do of course degrade Russia’s capabilities.

In addition the solution seems to be quite easy: Liz will pay for it all. She also plans to unleash fracking so that UK too can become energy independent, and even an exporter, like USA did after its fracking boom.

Leading one to wonder whether this is potentially the beginning of the end of the energy crisis as the government – society as whole – covering the cost in the short term while the infrastructure is set up, both fracking and renewables on school roofs in UK, may well be a solution.

That would mean an easing of pressure on bitcoin and stocks, and a slowdown in interest rate hikes, while the economy hopefully continues to grow, and maybe even with proper growth as it has for the first half of this year.

- Bitcoin

- blockchain

- blockchain compliance

- blockchain conference

- coinbase

- coingenius

- Commodities

- Consensus

- crypto conference

- crypto mining

- cryptocurrency

- decentralized

- DeFi

- Digital Assets

- ethereum

- Europe

- machine learning

- news

- non fungible token

- plato

- plato ai

- Plato Data Intelligence

- Platoblockchain

- PlatoData

- platogaming

- Polygon

- proof of stake

- Second

- Trustnodes

- W3

- zephyrnet