- The GBP is the second weakest currency among the major US dollar pairs in the past five days.

- A potential bearish reversal set-up has emerged for GBP/JPY while the JPY bears seem to be cautious about Japan’s MoF intervention at around the 150.30 risk level on USD/JPY.

- Watch the key short-term resistance at 182.95 on the GBP/JPY.

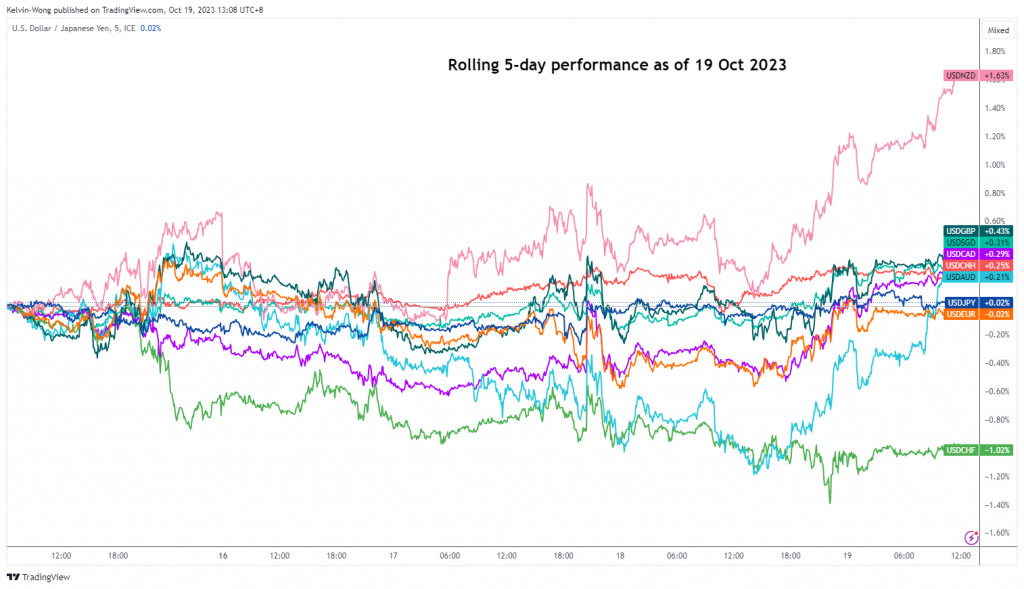

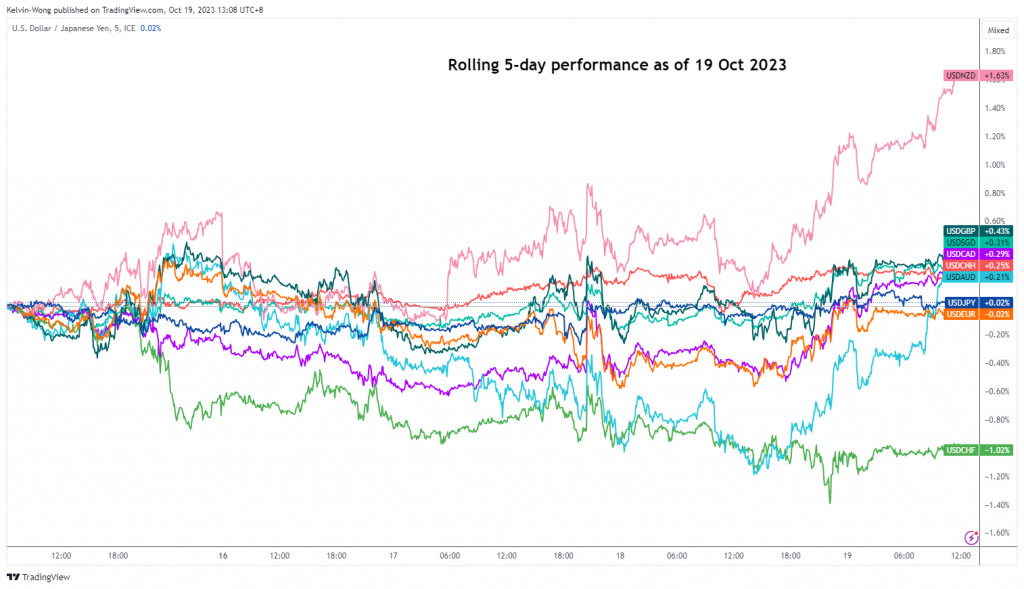

The UK pound sterling (GBP) is the second weakest currency among the major US dollar pairs based on a five-day rolling performance calculation at this time of the writing. The USD/GBP has recorded a gain of +0.43% ex-post UK inflation data (September) that was released yesterday, 18 October.

Fig 1: USD major pairs rolling 5-day performance as of 19 Oct 2023 (Source: TradingView, click to enlarge chart)

Both the headline and core inflation rates in the UK have come in slightly above expectations; (6.7% y/y vs. 6.6% y/y consensus) and (6.1% y/y vs. 6% y/y consensus) respectively.

Interestingly, the USD/JPY has continued to trade in a sideways range as the JPY bears may be getting cautious and likely on the lookout for potential intervention by Japan’s Ministry of Finance at around the 150.30 risk level on USD/JPY.

Through the lens of technical analysis, an interesting potential bearish reversal set-up has emerged for the GBP/JPY cross-pair.

Major bullish upside momentum has started to dissipate

Fig 2: GBP/JPY major trend as of 19 Oct 2023 (Source: TradingView, click to enlarge chart)

The major uptrend phase of the GBP/JPY cross-pair that has been in place since the 19 March 2020 low of 124.04 has almost reached a key major resistance/inflection level of 187.30 (printed a recent intraday high of 186.77 on 22 August 2023.

In addition, the weekly RSI momentum indicator flashed a bearish divergence condition on 22 August 2023 at its overbought region which suggests that the major upside momentum has started to ease and in turn increases the odds of potential multi-week corrective decline towards the 171.30/168.30 support zone (also the 200-day moving average).

Minor bearish “Head & Shoulders” in progress

Fig 3: GBP/JPY minor short-term trend as of 19 Oct 2023 (Source: TradingView, click to enlarge chart)

In the shorter term as seen on the 1-hour chart, the price actions of the GBP/JPY have traced out an impending minor bearish reversal “Head & Shoulders” configuration with its neckline support coming in at 181.25 after a rejection on the minor descending trendline resistance in place since 22 August 2023 high.

Several bearish elements have also emerged in the past five days where the GBP/JPY has broken below its 20 and 50-day moving averages. Watch the 182.95 key short-term pivotal resistance and a break below 181.25 reinforces a potential short-term impulsive decline towards the next immediate supports at 180.40 and 179.70.

On the flip side, a clearance above 182.95 negates the bearish tone for a retest on the next intermediate resistance at 183.80 (minor swing highs of 12 October/15 September 2023).

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.marketpulse.com/forex/gbp-jpy-technical-impending-bearish-reversal/kwong

- :has

- :is

- :not

- :where

- 1

- 12

- 15 years

- 15%

- 150

- 179

- 180

- 19

- 20

- 2020

- 2023

- 22

- 25

- 30

- 40

- 7

- 70

- 700

- 77

- 80

- a

- About

- above

- access

- actions

- addition

- advice

- affiliates

- After

- almost

- also

- among

- an

- Analyses

- analysis

- and

- any

- ARE

- around

- AS

- At

- AUGUST

- author

- authors

- avatar

- average

- award

- based

- BE

- bearish

- bearish divergence

- Bears

- beat

- been

- below

- Box

- Break

- Broken

- Bullish

- business

- buy

- by

- calculation

- cautious

- Chart

- clearance

- click

- COM

- combination

- come

- coming

- Commodities

- condition

- conducted

- Configuration

- Connecting

- Consensus

- contact

- content

- continued

- Core

- core inflation

- courses

- Currency

- data

- Days

- Decline

- Directors

- Divergence

- Dollar

- ease

- elements

- Elliott

- emerged

- enlarge

- exchange

- expectations

- experience

- expert

- finance

- financial

- Find

- five

- Flip

- flow

- For

- foreign

- foreign exchange

- forex

- found

- fund

- fundamental

- Gain

- GBP

- General

- getting

- Global

- global markets

- Have

- headline

- High

- Highs

- HTTPS

- if

- immediate

- impending

- impulsive

- in

- Inc.

- Increases

- Indicator

- Indices

- inflation

- Inflation Rates

- information

- interesting

- intervention

- investment

- IT

- ITS

- Japan’s

- JPY

- Kelvin

- Key

- Last

- Level

- levels

- like

- likely

- Low

- Macro

- major

- March

- march 2020

- Market

- market outlook

- market research

- MarketPulse

- Markets

- max-width

- May..

- ministry

- minor

- Momentum

- more

- moving

- moving average

- moving averages

- necessarily

- news

- next

- numerous

- Oct

- october

- Odds

- of

- officers

- on

- only

- Opinions

- or

- out

- Outlook

- over

- pairs

- passionate

- past

- performance

- perspectives

- phase

- photo

- pivotal

- Place

- plato

- Plato Data Intelligence

- PlatoData

- please

- positioning

- Posts

- potential

- pound

- pound sterling

- price

- Produced

- Progress

- providing

- purposes

- range

- Rates

- reached

- recent

- recorded

- region

- reinforces

- released

- research

- Resistance

- respectively

- retail

- Reversal

- Risk

- Rolling

- rsi

- rss

- Second

- Securities

- seem

- seen

- sell

- senior

- September

- service

- Services

- sharing

- short-term

- side

- sideways

- since

- Singapore

- site

- solution

- Source

- specializing

- started

- sterling

- stock

- Stock markets

- Strategist

- Suggests

- support

- Supports

- Swing

- Technical

- Technical Analysis

- ten

- term

- that

- The

- the UK

- The Weekly

- this

- thousands

- time

- to

- TONE

- towards

- trade

- Traders

- Trading

- TradingView

- Training

- Trend

- TURN

- Uk

- UK Inflation

- UK pound

- UK pound sterling

- unique

- Upside

- uptrend

- us

- US Dollar

- USD

- USD/JPY

- using

- v1

- Visit

- vs

- was

- Watch

- Wave

- weekly

- WELL

- which

- while

- winning

- with

- wong

- would

- writing

- years

- yesterday

- You

- zephyrnet