Germany has contracted in the first quarter of the year by 0.1% over Q1 2022, the first major economy to do so.

“The final consumption expenditure of both households and government declined at the beginning of 2023,” the German Federal Statistical Office Destatis said.

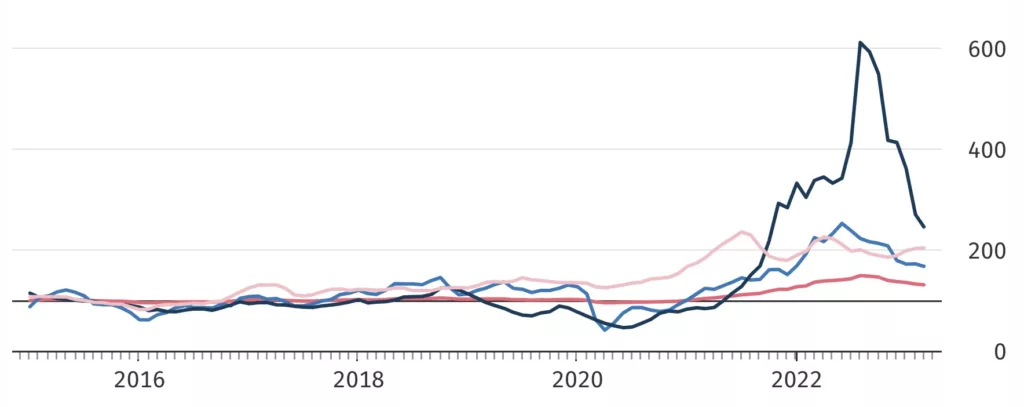

Exports are up however, while the import prices index is down from 149 in August 2022 to 130, though still considerably higher than 101 in 2019.

The euro area overall also saw 1.3% growth over last year, with Germany the only one to contract among developed economies so far.

Why? Well, the monetary supply is contracting. The chairs and presidents of central banks in developed economies are not hiding the fact they want a significant slowdown, and have moved at great speed to use the blunt tool of interest rates to achieve that aim.

European commercial banks are now lending less to businesses. As an export heavy economy, Germany might just be the first to feel the pinch.

Some might also say it could be due to the energy prices, but no contraction was shown last year when they peaked. Although there could be lagging effects, it may be more that money overall is becoming tighter.

That raises the question of whether central banks have gone too far. They have experienced no political pressure to slowdown, but a contraction for Germany in Q1 might suggest a deteriorating economic outlook.

Many expect it to get worse, and some fear a hard landing this autumn. The banking crisis in the United States might be just a prelude, and yet central bankers continue to hike in their own bubble.

Risks of miscalculations therefore are high, but all we can do for now is wait for politics to return to this extremely important matter of the economy as it has been absent so far during a year long radical shift in gear that risks a crash.

Smart money however is not waiting. The rise of gold has not gone unnoticed, while bitcoin has doubled.

That’s because in an economic recession, especially due to monetary mismanagement, banks can get wobbly, as they have already to some extent.

The monetary tightening at high speed means defaults might increase considerably, and that in turn means banks run out of money.

The rise of gold therefore is no coincidence. Nor the doubling of bitcoin this year. The market clearly thinks politicians are aloof and central bankers are in a bubble, so they’re betting the assets outside of their control are where safety is now.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoAiStream. Web3 Data Intelligence. Knowledge Amplified. Access Here.

- Minting the Future w Adryenn Ashley. Access Here.

- Buy and Sell Shares in PRE-IPO Companies with PREIPO®. Access Here.

- Source: https://www.trustnodes.com/2023/05/02/germany-on-the-brink-of-recession

- :has

- :is

- :not

- :where

- $UP

- 1

- 2019

- 2022

- 2023

- a

- absent

- Achieve

- aim

- All

- already

- also

- Although

- among

- an

- and

- ARE

- AREA

- AS

- Assets

- At

- AUGUST

- bankers

- Banking

- banking crisis

- Banks

- BE

- because

- becoming

- been

- Beginning

- Betting

- Bitcoin

- both

- brink

- bubble

- businesses

- but

- by

- CAN

- Can Get

- central

- central bankers

- Central Banks

- clearly

- coincidence

- commercial

- consumption

- continue

- contract

- contracting

- contraction

- control

- could

- Crash

- crisis

- defaults

- developed

- do

- doubled

- doubling

- down

- due

- during

- Economic

- economic recession

- economies

- economy

- effects

- energy

- energy prices

- especially

- Euro

- expect

- experienced

- export

- extremely

- far

- fear

- Federal

- Federal Statistical Office

- feel

- final

- First

- For

- from

- Gear

- German

- Germany

- get

- Gold

- Government

- great

- Growth

- Hard

- Have

- heavy

- High

- higher

- Hike

- households

- However

- HTTPS

- import

- important

- in

- Increase

- index

- interest

- Interest Rates

- IT

- just

- lagging

- landing

- Last

- Last Year

- lending

- less

- Long

- major

- Market

- Matter

- max-width

- May..

- means

- might

- Monetary

- monetary tightening

- money

- more

- no

- now

- of

- Office

- on

- ONE

- only

- out

- Outlook

- outside

- over

- overall

- own

- plato

- Plato Data Intelligence

- PlatoData

- political

- Politicians

- politics

- Presidents

- pressure

- Prices

- Q1

- Quarter

- question

- radical

- raises

- Rates

- recession

- return

- Rise

- risks

- Run

- Safety

- Said

- say

- shift

- shown

- significant

- Slowdown

- So

- so Far

- some

- speed

- States

- statistical

- Still

- suggest

- supply

- than

- that

- The

- their

- There.

- therefore

- they

- Thinks

- this

- this year

- though?

- tightening

- tighter

- to

- too

- tool

- Trustnodes

- TURN

- United

- United States

- use

- wait

- want

- was

- we

- webp

- WELL

- when

- whether

- while

- with

- worse

- year

- yet

- zephyrnet