Grayscale, one of the biggest crypto asset manager specializing in stock traded products, has received the greenlight to launch an ETF which starts trading today on NYSE.

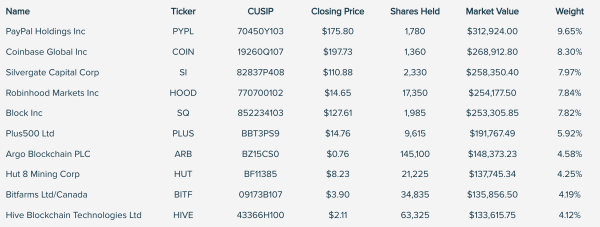

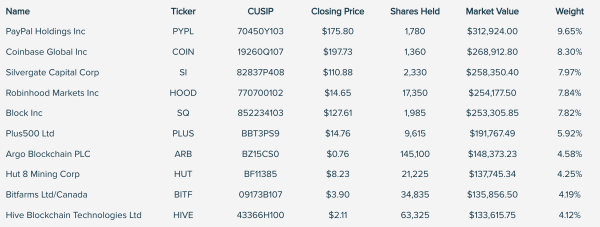

It’s not a bitcoin ETF however, instead it is more a crypto infrastructure ETF with it bundling crypto-related already publicly traded stocks.

The ETF has in it companies like PayPal, which saw its stock plunge recently after it missed estimates.

Robinhood got a beating too following a big loss last quarter. Bitfarms is doing well though, with its production up more than 50% over last year.

Coinbase is Coinbase of course, with Silvergate being more a traditional bank that recently bought Facebook’s failed Libra private blockchain project.

So the Grayscale Future of Finance ETF (GFOF) is more a traditional ETF rather than the stock traded spot bitcoin ETF that is much anticipated.

The Securities and Exchanges Commission (SEC) keeps rejecting such ETFs, but the launch of GFOF may well suggest Grayscale is getting a foot in the door so to speak, with a bitcoin ETF approval so being just a matter of time.

“A first step in what will be an ongoing strategic expansion of Grayscale’s investment offerings that leverage the ETF wrapper,” said David LaValle, Global Head of ETFs at Grayscale Investments. “Through GFOF, investors now have the opportunity to receive exposure to the companies that are pivotal to the evolution of the global financial system.”

Source: https://www.trustnodes.com/2022/02/02/grayscale-launches-etf

- 2022

- already

- asset

- Bank

- being

- Biggest

- Bitcoin

- Bitcoin ETF

- Bitfarms

- blockchain

- coinbase

- commission

- Companies

- crypto

- crypto asset

- estimates

- ETF

- ETFs

- evolution

- Exchanges

- expansion

- finance

- financial

- First

- future

- getting

- Global

- Grayscale

- Grayscale investments

- head

- HTTPS

- Infrastructure

- investment

- Investments

- Investors

- IT

- launch

- launches

- Leverage

- Libra

- Matter

- NYSE

- Offerings

- Opportunity

- PayPal

- pivotal

- private

- Production

- Products

- project

- Quarter

- Said

- SEC

- Securities

- Silvergate

- So

- Spot

- stock

- Stocks

- Strategic

- system

- time

- today

- top

- Trading

- traditional

- What

- year