In Southeast Asia and the broader Asia-Pacific (APAC) region, green fintech is picking up steam and growing on the back of increasing climate-related regulations, growing adoption of sustainable practices among Asian businesses, and rising investors’ interest, a new report by UOB, PwC Singapore and the Singapore Fintech Association, says.

The 2023 Fintech in ASEAN report, released on November 16, provides an overview of the Southeast Asian fintech landscape, highlighting emerging trends and the different developments observed across the region over the past year.

According to this year’s edition, sustainability and green fintech are two sectors that are gaining traction across Southeast Asia.

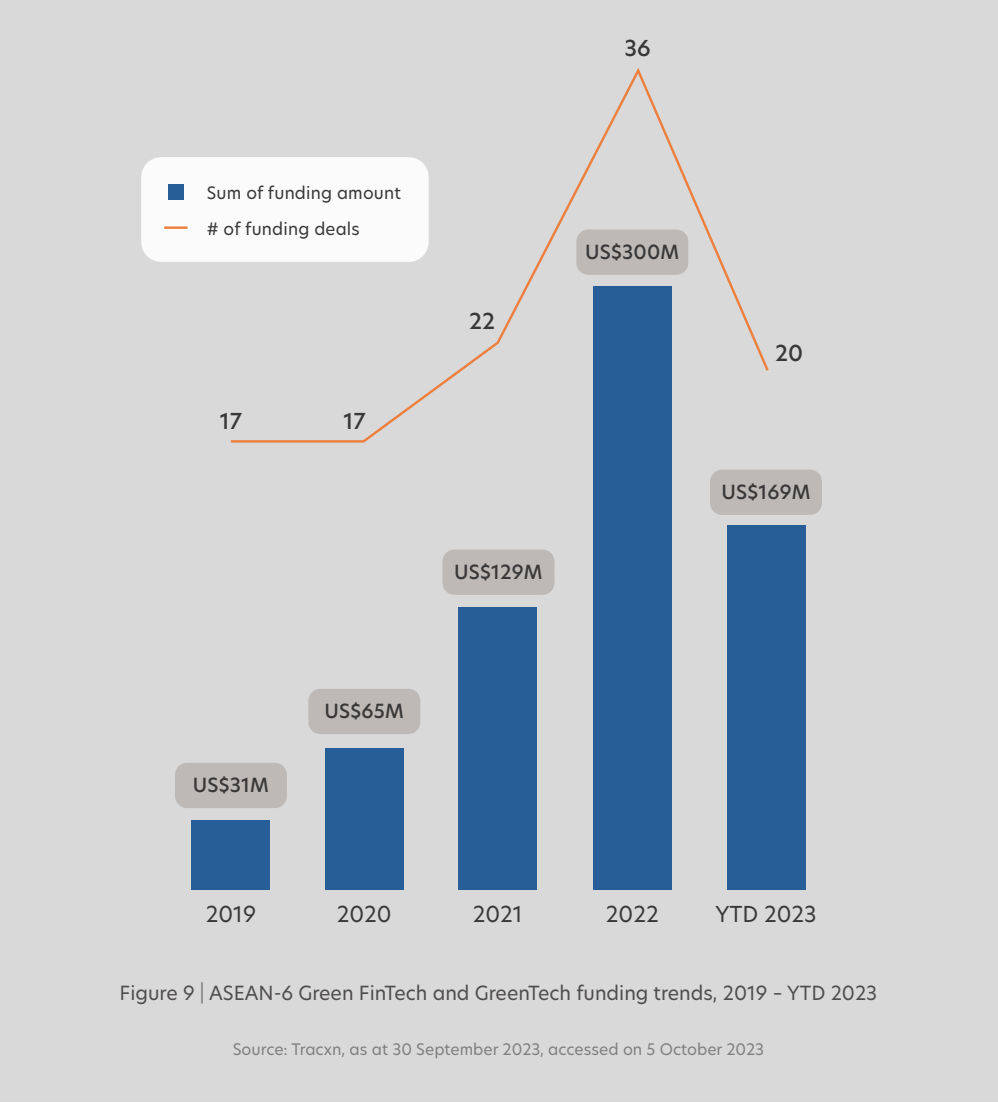

In the first nine months of 2023, greentech and green fintech companies in the region’s six largest economies, also referred to as “ASEAN-6”, secured a total of US$169 million. Although that figure represents a decline from 2022’s US$300 million total, the number is already higher than 2021’s US$129 million.

The average funding amount is also trending upwards, showcasing the maturing of the sectors and booming funding activity. In 2019, the average funding amount stood at just US$1.8 million. In October 2023, that sum surged to US$8.5 million, representing a 4.7x increase.

ASEAN-6 green fintech and greentech funding trends, 2019 – YTD 2023 as of October 2023, Source: Fintech in ASEAN 2023: Seeding the Green Transition, UOB, PwC Singapore and the Singapore Fintech Association (SFA), Nov 2023

ASEAN’s green fintech sector is rising on the back of increased climate reporting requirements from regulators, and subsequently, increased adoption of sustainable practices by businesses.

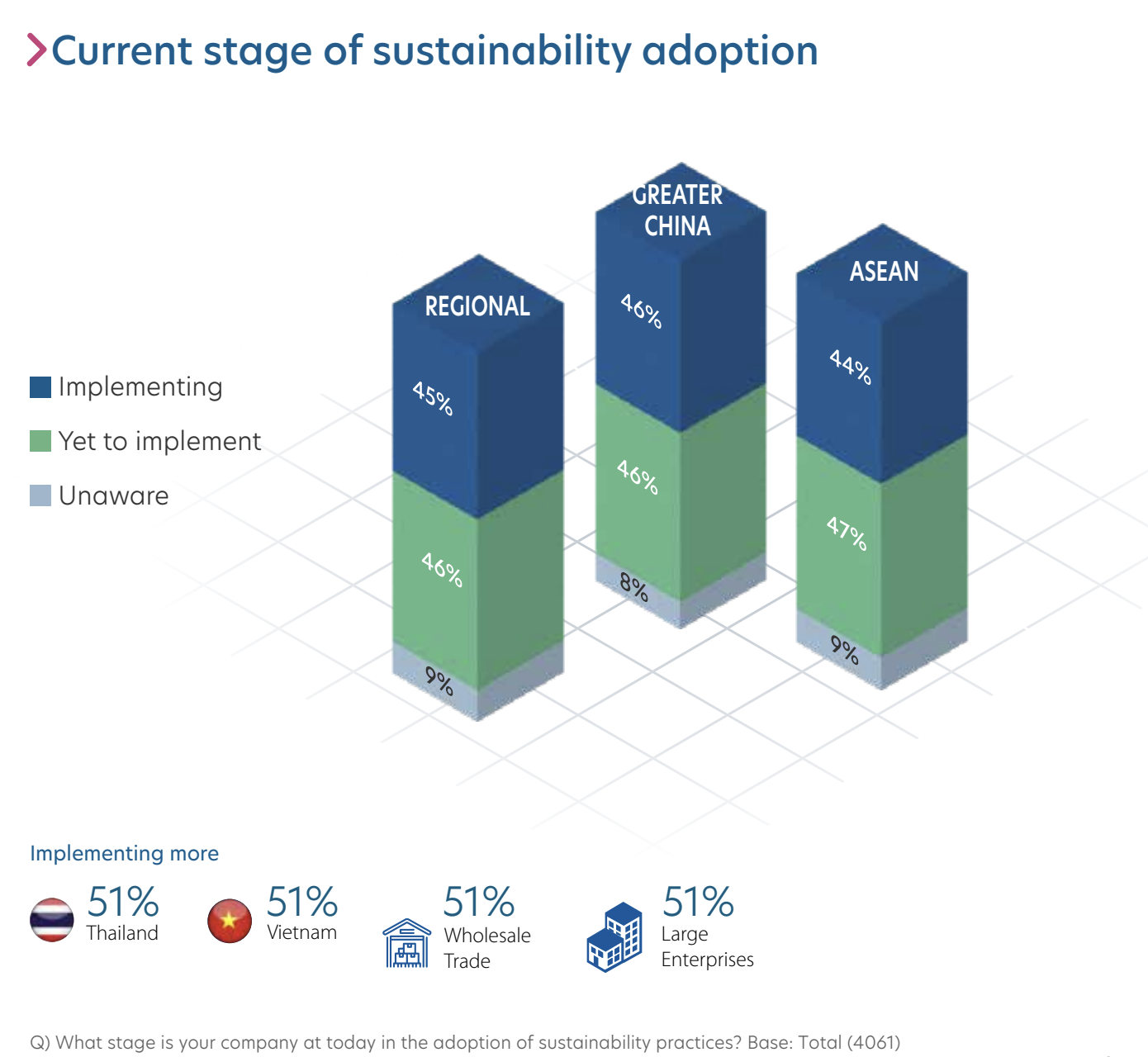

UOB’s Business Outlook Study 2023 (SME and Large Enterprises), which polled over 4,000 business owners and key executives in ASEAN and Greater China, found that nearly half of the businesses surveyed had already implemented sustainable practices. More than 50% of SMEs in Thailand and Vietnam had adopted sustainability practices, while only 38% of SMEs in Singapore had these practices in place.

Stage of sustainability adoption in Asia Pacific, Source: UOB Business Outlook Study 2023 (SME and Large Enterprises), May 2023

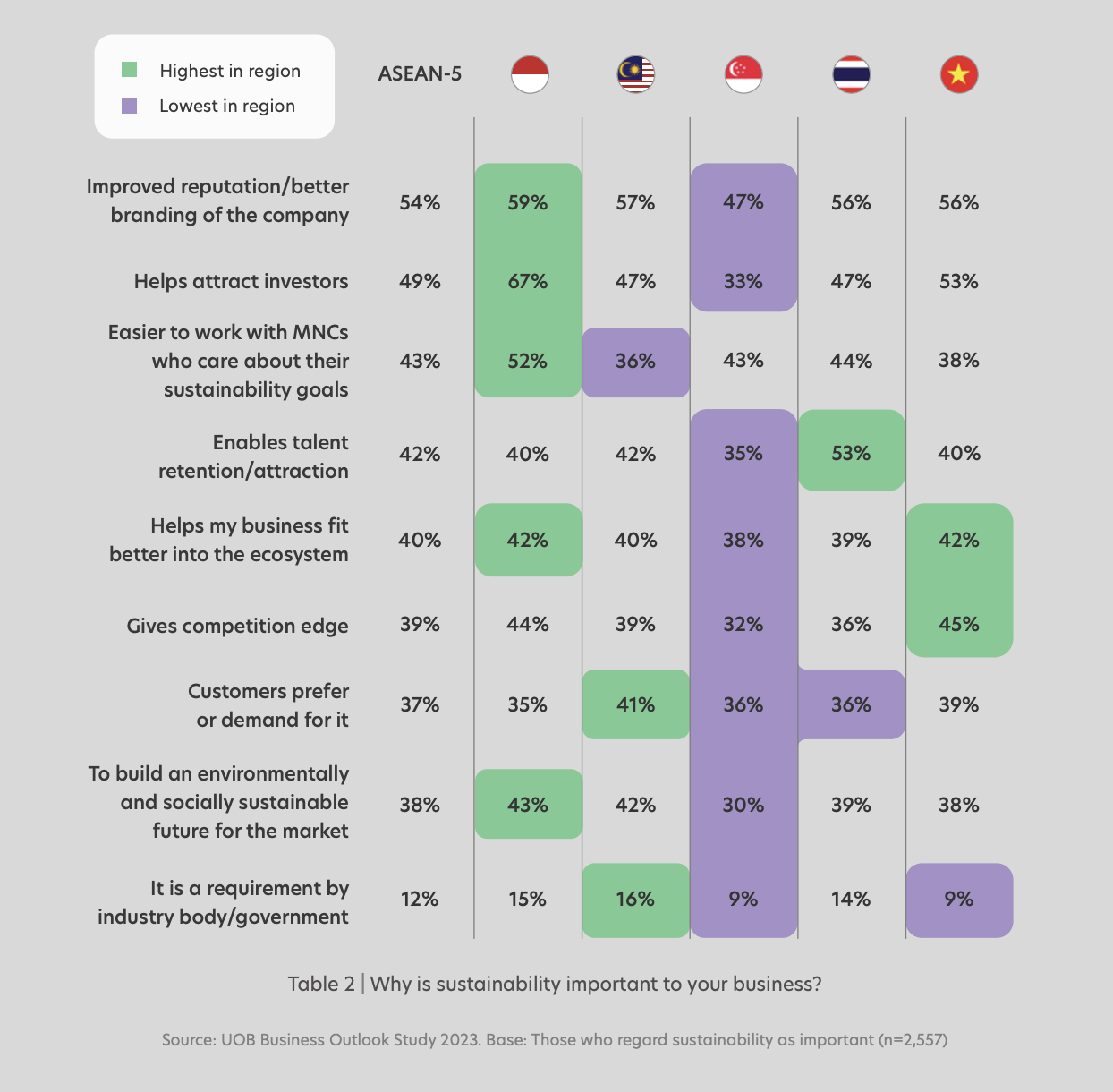

The study also found that around 90% of businesses believed that sustainability is important, citing improved reputation, being able to attract investors and making it easier to work with multinational corporations, as the top three motivating factors for going green.

Drivers of sustainability adoption, Source: UOB Business Outlook Study 2023 (SME and Large Enterprises), May 2023

The sustainability imperative

Pressure is mounting on industries to cut back on carbon emissions that cause global warming, leading to the elevation of sustainability as a prominent priority in the business community.

This is particularly relevant for East Asia and Pacific, which is one of the most vulnerable regions in the world to climate-related impact. The region includes 13 of the 30 countries most vulnerable to the impacts of climate change, and without concerted action, it could see an additional 7.5 million people fall into poverty due to climate impacts by 2030, according to the World Bank.

Against this backdrop, many governments in ASEAN have begun exploring green financing initiatives and regulations to support the region’s energy transition efforts. This trend, paired with the transition to a low-carbon economy, have made way for green fintech companies to enter the equation.

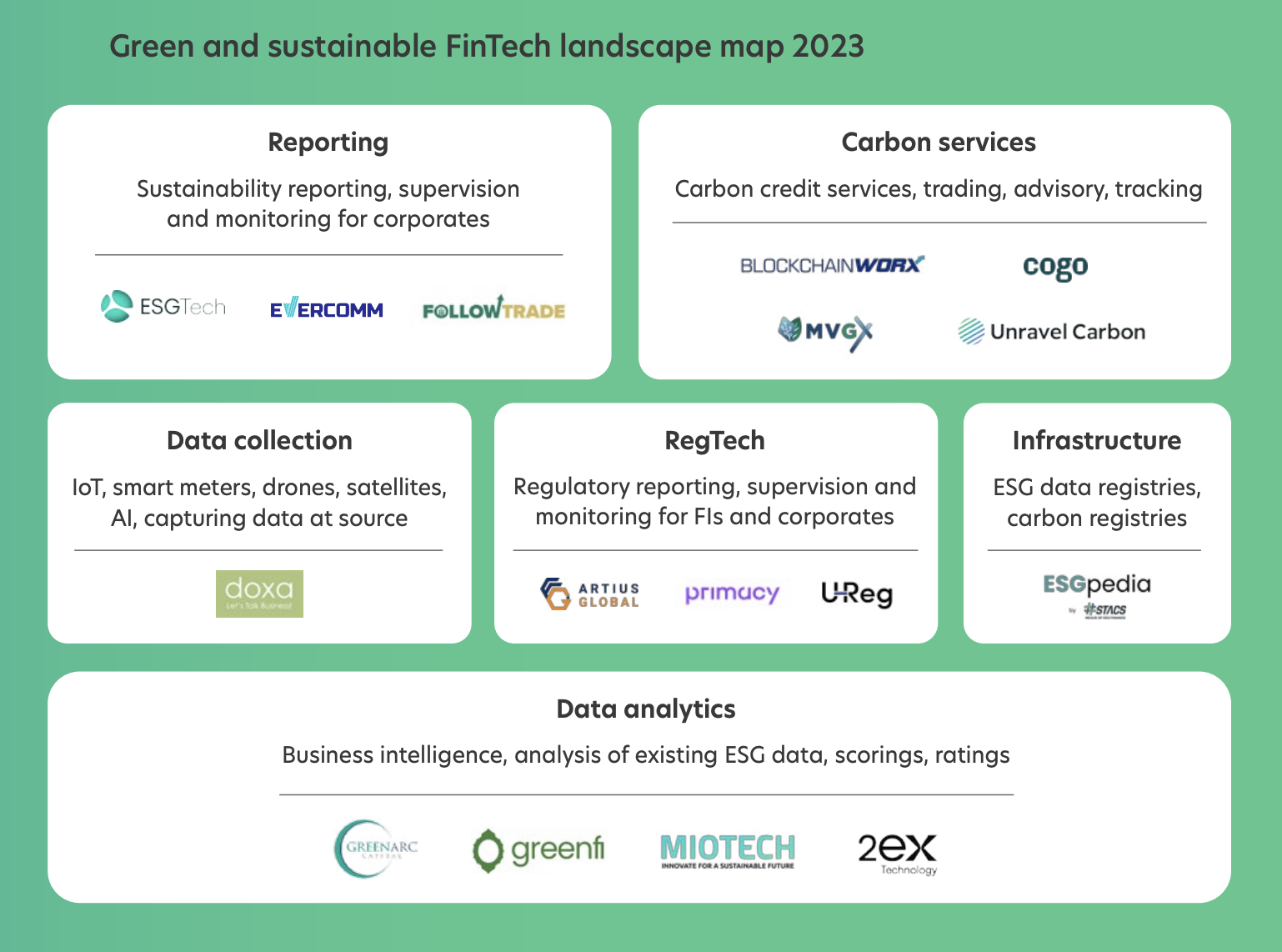

As part of the Fintech in ASEAN 2023 report, the SFA surveyed the green fintech ecosystem and developed the Green and Sustainable Fintech Landscape Map. The analysis identified six key categories for green fintech companies located in Singapore. These startups operate across data analytics, data collection, carbon services, reporting, infrastructure and regtech.

Green and sustainable fintech landscape map 2023, Source: Fintech in ASEAN 2023: Seeding the Green Transition, UOB, PwC Singapore and the Singapore Fintech Association (SFA), Nov 2023

One Singaporean startup featured in the report is STACS, an environmental, social and governance (ESG) data and technology company. The startup provides ESGpedia, a blockchain-powered platform that aggregates, records, and maintains the provenance of holistic and forward-looking ESG certifications and data of companies across various sectors and global verified sources.

Another startup highlighted in the report is Doxa, a fintech startup that brings together buyers, suppliers, and financiers on an enterprise-grade platform called Doxa Connex to help digitalize the end-to-end procurement-to-payment workflow. Leveraging cloud computing and micro-services, Doxa focuses on the construction sector.

Finally, Unravel Carbon, a carbon services company, utilizes artificial intelligence (AI) and data science to simplify and streamline the carbon accounting and decarbonization process.

The state of fintech in ASEAN

Besides its focus on the rise of green fintech, the Fintech in ASEAN 2023 report looks at the region’s fintech sector, delving into how the landscape evolved in 2022 and 2023.

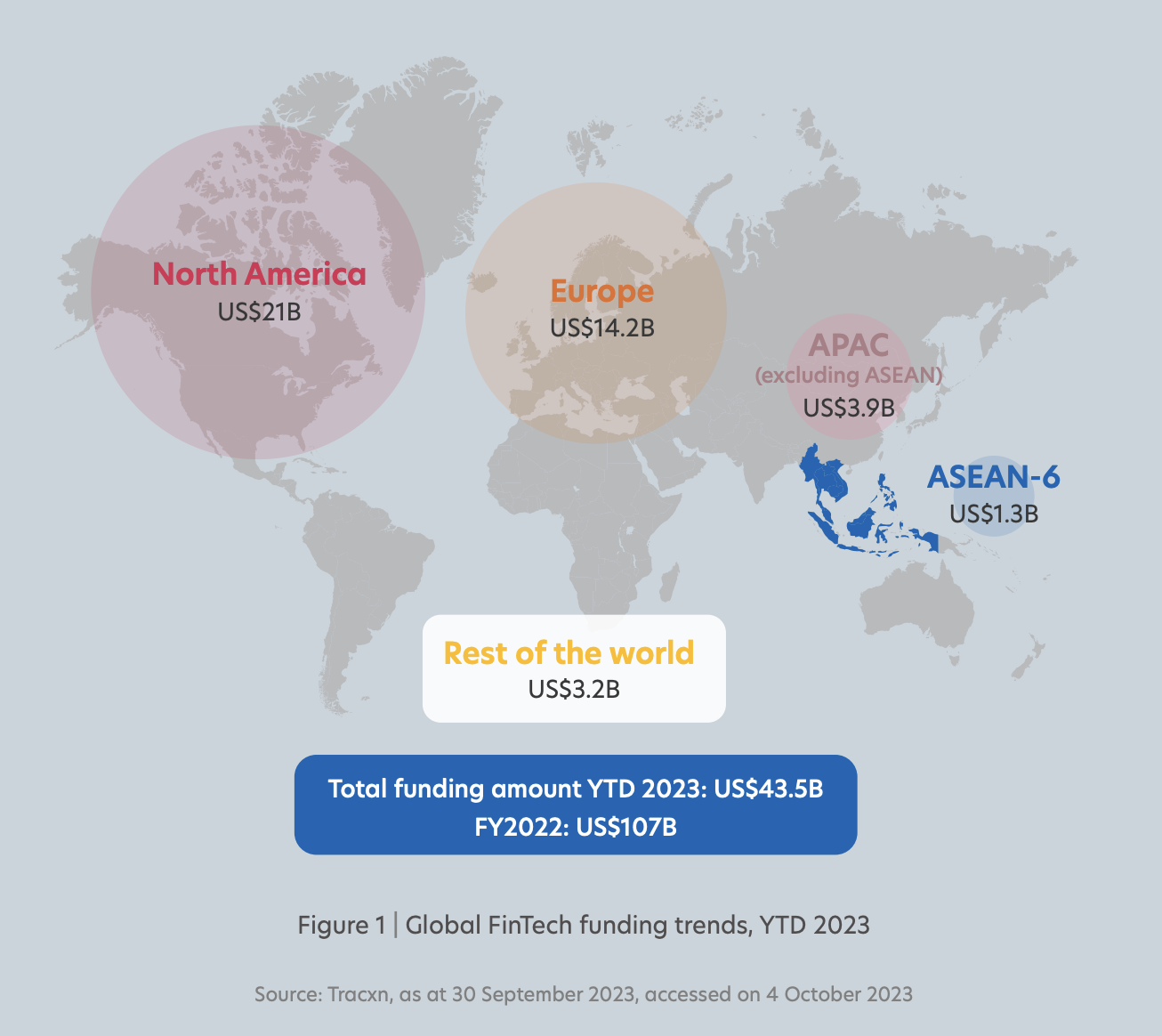

Following global trends, fintech funding in ASEAN-6 declined substantially in 2023, plunging by 75% to US$1.3 billion in the first nine months of the year. The sum is the region’s lowest since 2020. The number of deals dropped by more than 50%, with the average deal size slumping to pre-COVID levels to reach US$13.5 million.

In 2023, ASEAN-6’s share of total fintech funding dropped by two percentage points to 3%.

Global finrech funding trends, YTD 2023, Source: Fintech in ASEAN 2023: Seeding the Green Transition, UOB, PwC Singapore and the Singapore Fintech Association (SFA), Nov 2023

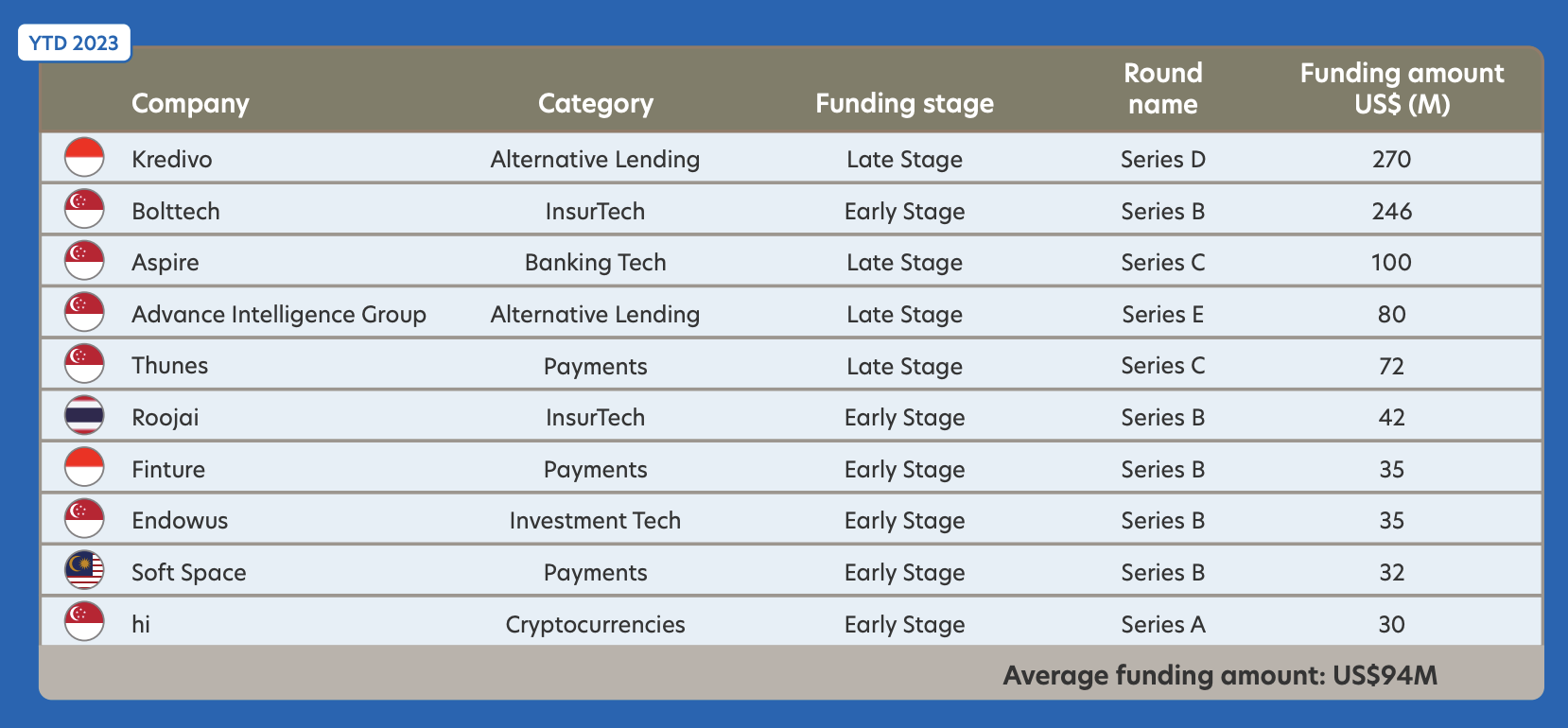

This year again, Singapore retained its leading position by raising a total of US$747 million, or 59% of total ASEAN-6 fintech funding.

The city-state also secured some of the largest rounds in the region of the period, including Bolttech’s US$246 million Series B, Aspire’s US$100 million Series C, Advance Intelligence Group’s US$80 million Series E, and Thunes’ US$72 million Series C.

Largest fintech rounds of funding in ASEAN-6 in the first nine months of 2023, Source: Fintech in ASEAN 2023: Seeding the Green Transition, UOB, PwC Singapore and the Singapore Fintech Association (SFA), Nov 2023

Despite the decline in fintech funding, the report notes that several trends are starting to pick up, signaling a potential rebound in fintech funding and possibly heralding a transformative era in financial data management and accessibility. These trends include the accelerated digitalization of traditional industries, alongside the rapid advancement in AI and the phased implementation of open banking.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://fintechnews.sg/80534/green-fintech/green-fintech-picks-up-steam-in-asean-amid-growing-investor-interest-business-adoption/

- :is

- $UP

- 000

- 1

- 13

- 16

- 2019

- 2020

- 2022

- 2023

- 2030

- 30

- 35%

- 39

- 7

- 8

- a

- Able

- accelerated

- accessibility

- Accounting

- across

- Action

- activity

- Additional

- adopted

- Adoption

- advance

- advancement

- again

- aggregates

- AI

- alongside

- already

- also

- Although

- Amid

- among

- amount

- an

- analysis

- analytics

- and

- and governance (ESG)

- APAC

- ARE

- around

- artificial

- artificial intelligence

- Artificial intelligence (AI)

- AS

- Asean

- asia

- asia pacific

- asian

- Association

- At

- attract

- average

- back

- backdrop

- Bank

- Banking

- begin

- begun

- being

- believed

- Billion

- blockchain-powered

- Brings

- broader

- business

- business owners

- businesses

- buyers

- by

- called

- caps

- carbon

- carbon emissions

- categories

- Cause

- certifications

- change

- China

- Climate

- Climate change

- Cloud

- cloud computing

- collection

- community

- Companies

- company

- computing

- concerted

- construction

- content

- Corporations

- could

- countries

- Cut

- data

- Data Analytics

- data management

- data science

- deal

- Deals

- decarbonization

- Decline

- developed

- developments

- different

- digitalization

- drivers

- dropped

- due

- e

- easier

- East

- economies

- economy

- ecosystem

- edition

- efforts

- emerging

- Emissions

- end

- end-to-end

- energy

- Enter

- enterprise-grade

- enterprises

- environmental

- Era

- ESG

- evolved

- executives

- Exploring

- factors

- Fall

- featured

- Figure

- financial

- financial data

- financing

- fintech

- Fintech Companies

- Fintech Funding

- fintech startup

- First

- Focus

- focuses

- For

- form

- forward-looking

- found

- from

- funding

- gaining

- Global

- going

- governance

- Governments

- greater

- Green

- Green Fintech

- Group’s

- Growing

- had

- Half

- Have

- help

- heralding

- higher

- Highlighted

- highlighting

- holistic

- hottest

- How

- HTTPS

- identified

- Impact

- Impacts

- implementation

- implemented

- important

- improved

- in

- include

- includes

- Including

- Increase

- increased

- increasing

- industries

- Infrastructure

- initiatives

- Intelligence

- interest

- into

- investor

- Investors

- IT

- ITS

- jpg

- just

- Key

- landscape

- large

- Large enterprises

- largest

- leading

- levels

- leveraging

- located

- LOOKS

- lowest

- made

- mailchimp

- maintains

- Making

- management

- many

- map

- max-width

- May..

- million

- Month

- months

- more

- most

- motivating

- multinational

- nearly

- New

- news

- nine

- Notes

- nov

- November

- number

- october

- of

- on

- once

- ONE

- only

- open

- open banking

- operate

- or

- Outlook

- over

- overview

- owners

- Pacific

- page

- paired

- part

- particularly

- past

- People

- percentage

- period

- Phased

- pick

- Picks

- Place

- platform

- plato

- Plato Data Intelligence

- PlatoData

- plunging

- points

- position

- possibly

- potential

- Poverty

- practices

- pre-COVID

- priority

- process

- prominent

- provenance

- provides

- PWC

- raising

- rapid

- reach

- rebound

- records

- referred

- region

- regions

- Regtech

- regulations

- Regulators

- relevant

- report

- Reporting

- representing

- represents

- reputation

- Requirements

- Rise

- rising

- rounds

- says

- Science

- sector

- Sectors

- Secured

- see

- Series

- Series B

- Series C

- Services

- services company

- several

- Share

- showcasing

- simplify

- since

- Singapore

- Singapore Fintech Association

- Singapore FinTech Association (SFA)

- Singaporean

- SIX

- Size

- SME

- SMEs

- Social

- some

- Source

- Sources

- southeast

- Southeast Asia

- STACS

- Stage

- Starting

- startup

- Startups

- State

- Steam

- streamline

- Study

- Subsequently

- substantially

- suppliers

- support

- Surged

- surveyed

- Sustainability

- sustainable

- Technology

- Thailand

- than

- that

- The

- The Landscape

- the world

- These

- this

- three

- to

- together

- top

- Total

- traction

- traditional

- transformative

- transition

- Trend

- trending

- Trends

- two

- unravel

- UOB

- upwards

- US$100 million

- utilizes

- various

- verified

- Vietnam

- Vulnerable

- Way..

- which

- while

- with

- without

- Work

- workflow

- world

- World Bank

- year

- Your

- zephyrnet