The digital banking landscape in Asia is a vibrant and diverse ecosystem, contrasting significantly with its Western counterparts.

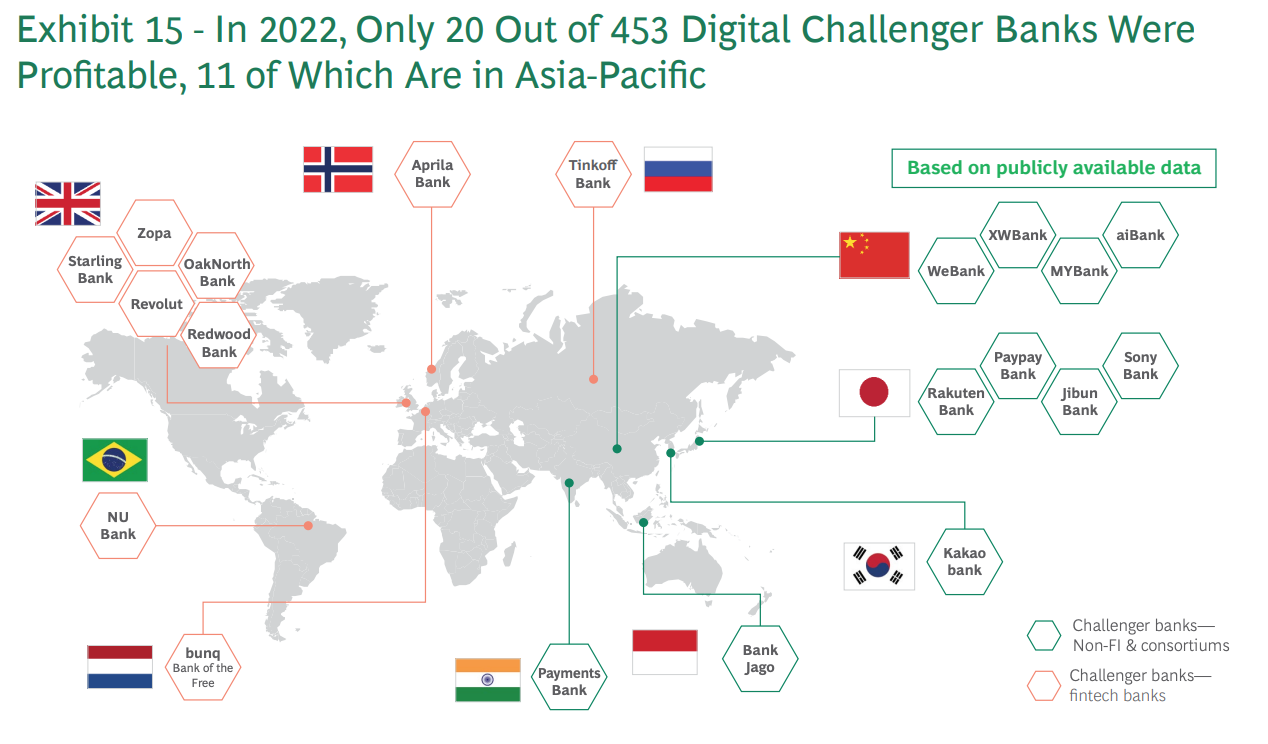

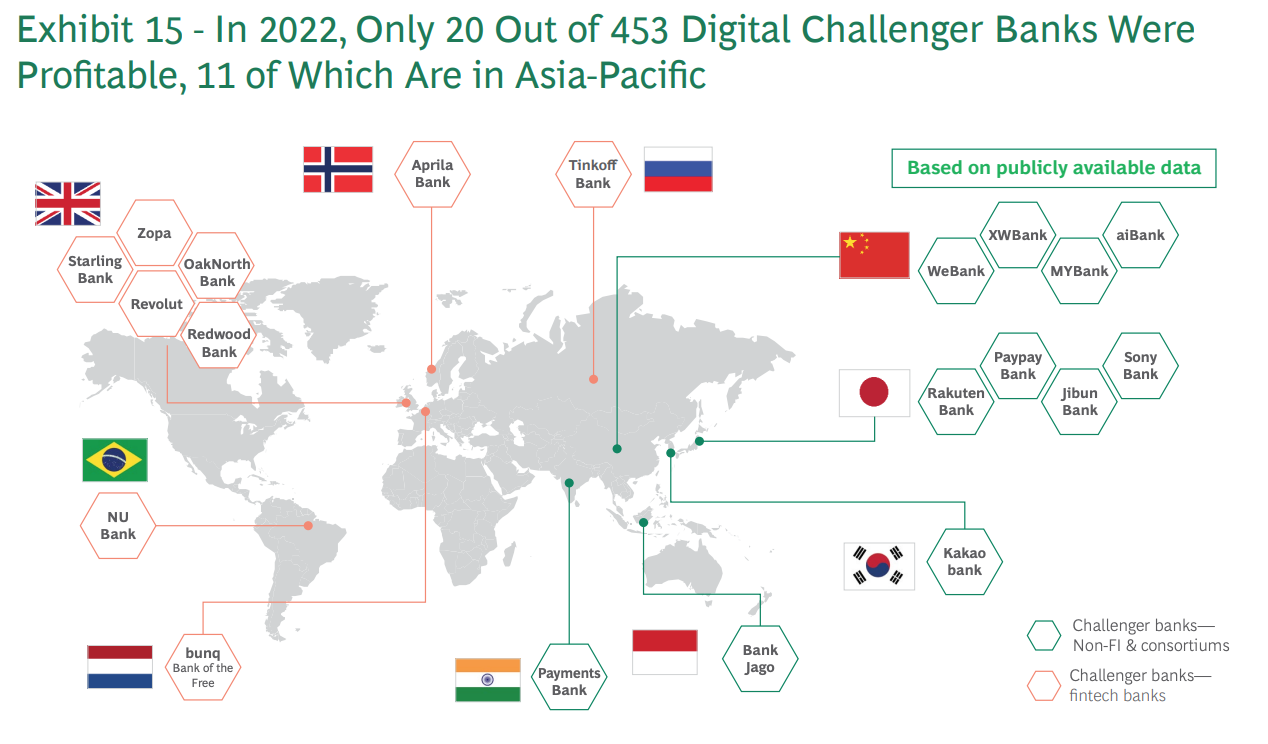

In the Asia-Pacific (APAC) region, 11 out of the 13 profitable digital banks, including South Korea’s Kakao Bank, India’s Paytm Bank, and China’s AIBank, WeBank, XW Bank, and MyBank, are redefining banking paradigms.

These banks are flourishing amidst existing ecosystems, a customer base inclined towards digital adoption, and business models tailored to the unique demands of their markets.

Ecosystem-driven digital banks

Unlike many Western digital banks that operate as standalone apps focusing primarily on user experience, APAC’s digital banks often leverage existing, comprehensive ecosystems.

These ecosystems range from e-commerce platforms to social media apps, providing a built-in customer base with a high propensity for digital adoption.

For instance, entities like Jibun Bank, Sony Bank, PayPay Bank, and Rakuten Bank have successfully capitalised on their associated ecosystems in Japan.

Many digital banks in Southeast Asia, such as Singapore, Hong Kong, and Malaysia, adopt a consortium model rather than operating as single entities. This collaborative approach leverages the strengths and resources of multiple partners, providing a more robust foundation for growth and innovation.

Business models and value propositions of Asian digital banks

To gain deeper insights into the intriguing business models and value propositions of Asian digital banks, let’s explore a range of compelling cases and key players in the region.

Kakao Bank: A South Korean phenomenon South Korea Kakao Bank is one of the most successful examples in the Asia-Pacific region. Founded in 2019, Kakao Bank quickly gained traction and achieved profitability within two years. It boasts 13.35 million users and assets worth US$25 billion (SG$33 billion), making it the largest digital bank in South Korea by users and assets.

South Korea Kakao Bank is one of the most successful examples in the Asia-Pacific region. Founded in 2019, Kakao Bank quickly gained traction and achieved profitability within two years. It boasts 13.35 million users and assets worth US$25 billion (SG$33 billion), making it the largest digital bank in South Korea by users and assets.

Kakao Bank’s primary strength lies in its ability to leverage an ultra-sticky ecosystem. The bank’s free messaging app, Kakao Talk, is used by nearly 90 percent of South Korea’s population, making it a ubiquitous platform. South Korea’s fast and reliable internet connection speeds further contributed to Kakao Bank’s success.

Once users are within the Kakao ecosystem, it becomes challenging to leave. Besides Kakao Talk and Kakao Bank, users can access many services, including Kakao Pay, Kakao Games, Kakao Page for monetised content, and Kakao Mobility for ride-hailing. Kakao’s strategic partnerships with tech giants like Ant Group (Kakao Pay) and Tencent (Kakao Games and Kakao Bank) have played a pivotal role in its growth.

MYBank: Revolutionising SME financing in China

China’s MYBank, associated with Ant Group, serves small and micro enterprises (SMEs). It has pioneered the “310 lending model,” which enables SME owners to obtain collateral-free business loans within minutes through a mobile app.

The application process is completed within three minutes, approved within one second, and requires zero human interaction.

The success of MYBank is rooted in its approach to SME financing. It has harnessed advanced technologies such as graph computing, multimodal recognition, blockchain, and privacy-preserving computation to offer supply chain financing solutions. These solutions support blue-chip brands by providing more financing options for SMEs in their supply chains.

In 2021, over 500 major brands, including China Mobile, Haier, and Mengniu Dairy, implemented MYBank’s supply chain financing solutions. This not only boosted the accessibility of SME loans but also contributed to the bank’s growth.

MYBank’s focus on rural areas is another notable aspect of its business model. Using remote sensing technologies on farmland, the bank assesses credit risk based on crop growth and various factors. This approach ensures that even farmers in remote areas can access credit.

Trust Bank: Rapid customer acquisition and unique products

Trust Bank, backed by Standard Chartered Bank and FairPrice Group, launched in Singapore in 2022. Within a short period, it quickly gained over 500,000 customers, with a focus on helping customers save on everyday spending.

Trust Bank’s success can be attributed to its customer-centric approach, products, and strategic partnerships. The bank’s customer referral programme, offering everyday vouchers as rewards, played a significant role in its rapid customer acquisition.

Additionally, Trust Bank’s integration into the FairPrice Group ecosystem showcases the potential for synergy between digital banks and established businesses.

By aligning with a well-established retailer, Trust Bank was able to tap into a vast customer base and provide added value to its users.

Paytm Bank: India’s pioneer in digital payments

Paytm Bank, a household name in India, started as a digital wallet offering easy digital payments. It quickly became synonymous with digital payments in India, even before introducing the Unified Payments Interface (UPI). Many small businesses benefited from its technology, software, and financial services.

Paytm Bank’s financial services, payment services, and commerce and cloud services contribute significantly to its revenue, with the financial and payments sectors alone accounting for 75 per cent of its revenues.

By 2015, PayTM expanded its services to include mobile recharges, gas, electricity, and water bill payments. It also ventured into travel ticket facilities, with 20 lakh monthly ticket bookings.

Strategic investments from companies like Alibaba and Berkshire Hathaway propelled PayTM’s growth and solidified its position as a leader in the Indian digital banking space.

Paytm Bank is India’s largest digital ecosystem for merchants and consumers. As of March 2021, it had one of the largest India-based payments platforms in terms of the number of transactions, consumers, merchants, and revenue, according to RedSeer.

ZA Bank: High interest rates and comprehensive products Hong Kong’s ZA Bank, backed by ZhongAn Insurance, has carved a niche in the digital banking sector. By the end of 2020, the bank had amassed over HK$6 billion in deposits and attracted 300,000 customers, surpassing other virtual banks in Hong Kong.

Hong Kong’s ZA Bank, backed by ZhongAn Insurance, has carved a niche in the digital banking sector. By the end of 2020, the bank had amassed over HK$6 billion in deposits and attracted 300,000 customers, surpassing other virtual banks in Hong Kong.

It is also the first virtual bank in Hong Kong to receive a Type 1 license from the Securities and Futures Commission for dealing in securities in January 2022.

One of the strategies contributing to ZA Bank’s success is its competitive deposit rates. The bank offered an attractive two per cent interest rate for three-month Hong Kong dollar deposits capped at HK$200,000. Some clients were even offered up to four percent more interest, totalling six percent, setting it apart from its competitors.

Additionally, ZA Bank holds an insurance agency license due to its affiliation with ZhongAn Insurance. This license enables the bank to offer a more comprehensive suite of products and services than its rivals.

ANEXT Bank: Empowering SMEs in Singapore

ANEXT Bank, a wholly owned subsidiary of Ant Group, has established its presence in Singapore’s digital banking landscape since its inception in 2022. The bank’s mission involves financial inclusion and empowering micro, small, and medium-sized enterprises (MSMEs).

ANEXT Bank addresses the financial challenges MSMEs face, recognising that despite Singapore’s high banking penetration, MSMEs remain underbanked.

To cater to their needs, the bank introduced the ANEXT Business Loan, offering unsecured financing solutions with a minimum loan amount starting from SG$5,000 and a streamlined application process requiring no documents for loans under SG$30,000.

Furthermore, ANEXT Bank collaborates with industry partners, including fintech companies and digital solutions providers, through its ANEXT Programme for Industry Specialists. This B2B solution empowers MSMEs by granting them access to financing solutions and support for cross-border operations.

The bank’s simple and streamlined onboarding process and user-friendly digital services have helped businesses across various industries, including those not traditionally digital. ANEXT Bank also emphasises security, incorporating features like three-factor authentication and facial recognition to ensure safe transactions.

Shaping the future of finance

Digital banks in the Asia can reshape the financial landscape through their innovative business models and customer-centric value propositions.

These banks are not just competing with their Western counterparts by effectively leveraging existing ecosystems, focusing on underserved market segments, and utilising technology-driven solutions.

Still, they are setting new standards for success in the global banking industry. As they continue to evolve and adapt to the dynamic market needs, digital banks in Asia are poised to play a pivotal role in the future of finance regionally and globally.

Featured image credit: Edited from Unsplash

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://fintechnews.sg/83865/virtual-banking/how-asias-digital-banks-are-redefining-banking-with-unique-business-models/

- :has

- :is

- :not

- $UP

- 000

- 000 Customers

- 1

- 11

- 13

- 20

- 2015

- 2019

- 2020

- 2021

- 2022

- 250

- 300

- 35%

- 500

- 51

- 58

- 7

- 75

- a

- ability

- Able

- access

- accessibility

- According

- Accounting

- achieved

- acquisition

- across

- adapt

- added

- addresses

- adopt

- Adoption

- advanced

- agency

- AI

- Alibaba

- aligning

- alone

- also

- amidst

- amount

- an

- and

- ANEXT Bank

- Another

- ant

- Ant Group

- APAC

- apart

- app

- Application

- approach

- approved

- apps

- ARE

- areas

- AS

- asia

- asian

- aspect

- assesses

- Assets

- associated

- At

- attracted

- attractive

- Authentication

- B2B

- backed

- Bank

- Banking

- banking industry

- banking sector

- Banks

- base

- based

- BE

- became

- becomes

- before

- begin

- Berkshire

- Berkshire Hathaway

- besides

- between

- Bill

- Billion

- blockchain

- blue-chip

- bookings

- Boosted

- brands

- built-in

- business

- business model

- business models

- businesses

- but

- by

- CAN

- caps

- carved

- cases

- cater

- cent

- chain

- chains

- challenges

- challenging

- Chartered

- China

- Chinas

- clients

- Cloud

- cloud services

- collaborates

- collaborative

- COM

- Commerce

- commission

- Companies

- compelling

- competing

- competitive

- competitors

- Completed

- comprehensive

- computation

- computing

- connection

- consortium

- Consumers

- content

- continue

- contribute

- contributed

- contributing

- counterparts

- credit

- crop

- cross-border

- customer

- Customers

- dealing

- deeper

- demands

- deposit

- deposits

- Despite

- digital

- digital bank

- digital banking

- digital ecosystem

- Digital Payments

- digital services

- digital wallet

- diverse

- documents

- Dollar

- due

- dynamic

- e-commerce

- easy

- ecosystem

- Ecosystems

- effectively

- electricity

- empowering

- empowers

- enables

- end

- ensure

- ensures

- enterprises

- entities

- established

- Even

- everyday

- evolve

- examples

- existing

- expanded

- experience

- explore

- facial

- facial recognition

- facilities

- factors

- farmers

- farmland

- FAST

- Features

- finance

- financial

- financial inclusion

- financial services

- financing

- fintech

- Fintech Companies

- First

- flourishing

- Focus

- focusing

- For

- form

- Foundation

- Founded

- four

- Free

- from

- further

- future

- Futures

- Gain

- gained

- Games

- GAS

- giants

- Global

- Global Banking

- Globally

- granting

- graph

- Group

- Growth

- had

- harnessed

- Have

- helped

- helping

- High

- holds

- Hong

- Hong Kong

- hottest

- household

- How

- HTTPS

- human

- image

- implemented

- in

- inception

- Inclined

- include

- Including

- inclusion

- incorporating

- india

- Indian

- industries

- industry

- industry partners

- Innovation

- innovative

- insights

- instance

- insurance

- integration

- interaction

- interest

- INTEREST RATE

- Interest Rates

- Interface

- Internet

- internet connection

- into

- intriguing

- introduced

- introducing

- Investments

- IT

- ITS

- January

- Japan

- jpg

- just

- Kakao

- Kakao Pay

- Key

- Kong

- korea

- Korea’s

- Korean

- landscape

- largest

- launched

- leader

- Leave

- lending

- Leverage

- leverages

- leveraging

- License

- lies

- like

- loan

- Loans

- mailchimp

- major

- Making

- Malaysia

- many

- March

- Market

- Markets

- max-width

- Media

- Merchants

- messaging

- Messaging App

- micro

- million

- minimum

- Minutes

- Mission

- Mobile

- Mobile app

- mobility

- model

- models

- Month

- monthly

- more

- most

- multiple

- name

- nearly

- needs

- New

- news

- niche

- no

- notable

- obtain

- of

- offer

- offered

- offering

- often

- on

- Onboarding

- once

- ONE

- only

- operate

- operating

- Operations

- Options

- Other

- out

- over

- owned

- owners

- page

- paradigms

- partners

- partnerships

- Pay

- payment

- Payment Services

- payments

- Paytm

- penetration

- per

- percent

- period

- pioneer

- pioneered

- pivotal

- platform

- Platforms

- plato

- Plato Data Intelligence

- PlatoData

- Play

- played

- players

- poised

- population

- position

- potential

- presence

- primarily

- primary

- process

- Products

- profitability

- profitable

- programme

- propelled

- provide

- providers

- providing

- quickly

- range

- rapid

- Rate

- Rates

- rather

- recognising

- recognition

- Redefining

- Referral

- region

- reliable

- remain

- remote

- requires

- reshape

- Resources

- retailer

- revenue

- revenues

- revolutionising

- Rewards

- Risk

- rivals

- robust

- Role

- rooted

- Rural

- Rural Areas

- safe

- Save

- Second

- sector

- Sectors

- Securities

- Securities and Futures Commission

- security

- segments

- serves

- Services

- setting

- Short

- significant

- significantly

- Simple

- since

- Singapore

- Singapore’s

- single

- SIX

- small

- small businesses

- SME

- SMEs

- Social

- social media

- Software

- solution

- Solutions

- some

- Sony

- South

- South Korea

- south korean

- southeast

- Southeast Asia

- Space

- specialists

- speeds

- Spending

- standalone

- standard

- Standard Chartered

- Standard Chartered Bank

- standards

- started

- Starting

- Strategic

- Strategic Partnerships

- strategies

- streamlined

- strength

- strengths

- subsidiary

- success

- successful

- Successfully

- such

- suite

- supply

- supply chain

- Supply chains

- support

- surpassing

- synergy

- synonymous

- tailored

- Talk

- Tap

- tech

- tech giants

- Technologies

- Technology

- Tencent

- than

- that

- The

- The Future

- their

- Them

- These

- they

- this

- those

- three

- Through

- ticket

- to

- towards

- traditionally

- Transactions

- travel

- Trust

- Trust Bank

- two

- type

- ubiquitous

- under

- underbanked

- underserved

- unified

- unique

- unsecured

- UPI

- used

- User

- User Experience

- user-friendly

- users

- using

- value

- various

- Vast

- vibrant

- Virtual

- virtual bank

- Wallet

- was

- Water

- were

- Western

- which

- wholly

- with

- within

- worth

- years

- Your

- ZA Bank

- zephyrnet

- zero