The Bitcoin market can be a very stressful and competitive environment even for experienced and skilled traders. This is because unlike the stock markets, the Bitcoin market never closes or sleeps. It’s not unusual to wake up one morning and see immense gains or losses in your portfolio.

Because of this, traders sometimes have to rely on tricks and tools that allow them to execute trades more efficiently. That said, here are some great tips to ensure that your Bitcoin trading goes smoothly:

Use a Reliable Trading Software

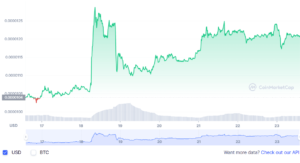

The Bitcoin market can be very volatile. As a result, more and more traders are relying on trading bots and software. These tools allow them to remain in control of their trading, even when they are sleeping.

Trading software interacts directly with exchanges, placing buy or sell orders on the trader’s behalf. Bitcoin Code, for instance, is a trading software that you can use to automate certain processes. It can predict and detect trends in the market and changes in prices. The software can also manage hundreds of trades and complete transactions faster.

With a good Bitcoin trading software, you can execute trades more efficiently than you’d be able to do manually. Some trading strategies that you can do with the use of trading software are the following:

- Arbitrage – This is the process of purchasing assets in one market and selling in another at a higher price. While the spread between different Bitcoin exchanges is smaller nowadays, they still materialize every now and then. Trading software can help you take advantage of these differentials.

- Market Making

This strategy involves buying and selling Bitcoins to capture the spread between the buy and sell price. Your trading software will automatically place orders when there are fluctuations in the price of Bitcoin. - Set Profit Targets and Use Stop Losses

Setting profit targets means getting out of the market after you hit a minimum profit for a given period. This is an exit strategy that helps you avoid getting too complacent or greedy. Additionally, if you have a profit target before you start trading, you can assess whether the profit potential outweighs the risk of taking the trade.

A stop loss, on the other hand, is a tool that helps you minimize your losses. With a stop loss, you don’t have to monitor your assets daily since it would allow you to walk away when the trade is not going as you had expected. - Use Both Fundamental and Technical Analysis

Below are the two crucial tools that you need while trading.– Fundamental analysis focuses on the big picture instead of short-term price movements. It considers projects and developments, mainstream integration, and significant world events. As a trader, you should always keep up-to-date with current events that can have an impact on the value of Bitcoin.– Technical analysis involves predicting future price movements. It is based on the principle that price movements speak for themselves, no matter what else is happening around the world. By looking at price charts, you’ll be able to figure out what is likely to happen next.

Conclusion

The Bitcoin market, with its history of bubbles and extreme price volatility, can be risky for traders, but also potentially very profitable. When trading, make sure that you use tools that will help you trade more effectively, prevent burnout, and maximize your profits.

Source: https://coingape.com/make-bitcoin-trading-smooth-one/

- 2019

- ADvantage

- analysis

- around

- Assets

- Big Picture

- Bitcoin

- bitcoin trading

- bots

- buy

- Buying

- Charts

- considers

- content

- cryptocurrencies

- Current

- Environment

- events

- Exchanges

- Exit

- Exit Strategy

- Figure

- financial

- future

- good

- great

- Guest

- here

- history

- hold

- How

- How To

- HTTPS

- Hundreds

- Impact

- integration

- investing

- IT

- July

- Mainstream

- Market

- market research

- Markets

- Opinion

- orders

- Other

- picture

- portfolio

- price

- Profit

- profitable

- projects

- research

- Risk

- sell

- Share

- Software

- spread

- start

- stock

- Stock markets

- Strategy

- Target

- Technical

- Technical Analysis

- the world

- tips

- trade

- trader

- Traders

- trades

- Trading

- Trading Strategies

- Transactions

- Trends

- value

- Volatility

- What is

- Wikipedia

- world