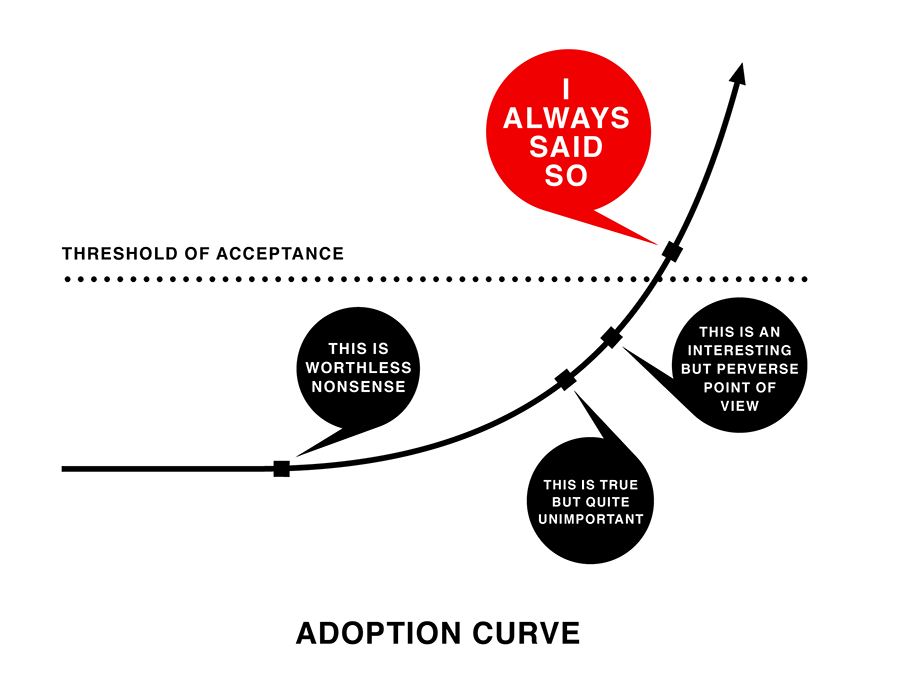

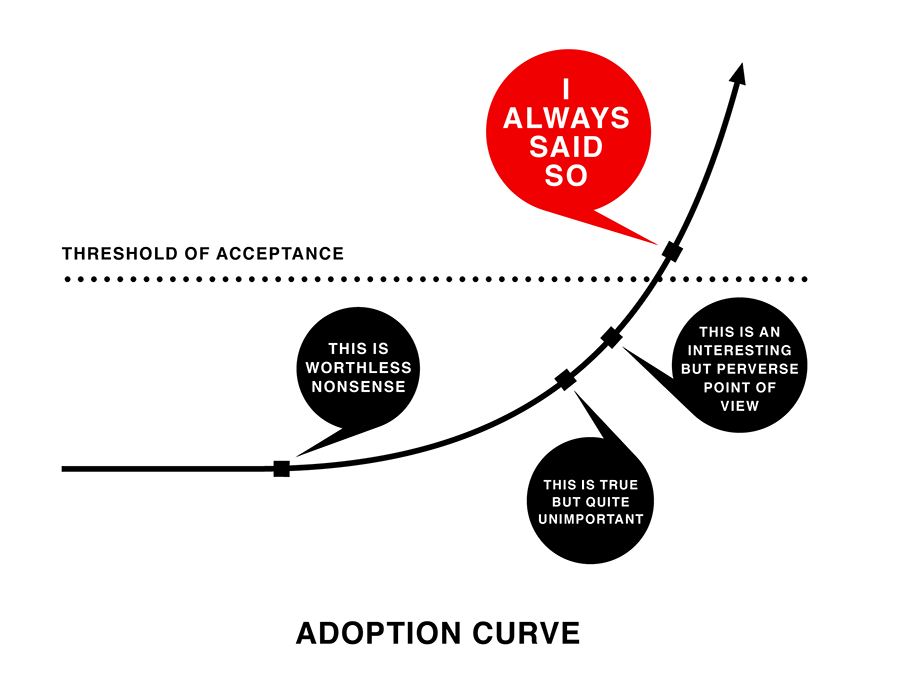

Last year I interviewed John Ahlberg, co-founder of Swedish 100% nuclear electricity utility, Kärnfull. I wrote that new ideas, no matter how good, are only adopted slowly at first. Over time, popularity builds, until suddenly it seems like everyone is in favour of it and always has been [1].

I concluded — somewhat hopefully — that nuclear energy would soon burst through the threshold of acceptance and enter the mainstream.

The crazy thing is, it might already be happening. Crazier still, in large part, it’s thanks to bitcoin.

A new subculture is born

The last two years have seen the coming together of a curious new subculture. Firstly, nuclear advocacy finally found its way out of the nerdspace that is Reddit and onto mainstream platforms like Instagram and TikTok. We saw the advent of nuclear influencers. Some, like Operador Nuclear and Javier Santaloalla, came from the science and engineering world, but others, like fashion model Isabelle Boemeke (Isabelleboemeke), were complete outsiders.

Secondly, the tech community started showing nuclear some love. Being techno-progressive, forward-looking people, I’ve always thought of the tech world as natural allies for a nuclear revival — they just needed an awakening. 2021 hasn’t disappointed.

The tech community have finally woken up to the climate impacts of cryptocurrencies. Although many of the concerns are general to all data centres, mining bitcoins and other cryptocurrencies is seen as a particularly frivolous use of energy by many.

Even digital culture meta-God Elon Musk was getting down on bitcoin’s “insane” energy consumption (only after pumpin’ and dumpin’ several billion dollars worth, though).

2021 saw these two groups (nuclear advocates and tech-hawks) overlapping more than ever. This techno-utopian movement was spearheaded by the likes of Meltem Demir◎rs (Meltem Demirors) and Josh Wolfe. The founder of Twitter, Jack Dorsey (Jack Dorsey), seemed interested in advanced nuclear. Jason Crawford, among many others, were asking “why has nuclear been such a flop” when it ticks so many boxes? News outlets like Wired and Grist couldn’t get enough of nuclear.

We saw nuclear advocacy leaders like Madi Czerwinski (Madison Czerwinski) defending bitcoin’s energy consumption as part of a vision of an abundant future. We also had in 2020 a pro-nuclear, techno-utopian US democratic candidate in Andrew Yang, who, despite losing, left behind tens of thousands of pro-nuclear “Yang Gang” supporters.

As much as there being a new constituency that is pro-nuke and pro-crypto, it’s also that both these technologies are attractive to people who enjoy disrupting the status quo. It’s a case of, “If you liked that…you’ll love this!” If you liked Tesla, you’ll love Space-X. If you liked disrupting banking with bitcoin, you’ll love disrupting energy with microreactors.

Many of these serial disruptors have made a lot of money from cryptocurrencies in the last five years and now have the financial firepower to bring that disruption to the nuclear sector.

Don’t let Greta Thunberg fool you; there is a very online generation right now that is positive about the future. They care about the planet and humanity, but they aren’t the chronic worriers of the new environmental left. They focus on fixing problems and shun the current fashion for fatalism. In Jason Crawford’s words, they are the “solutionists”.

In short: sci fi is cool again.

From subculture to market frontier

That a pro-nuke, pro-crypto subculture exists is interesting but not necessarily important. To understand what happened next, you have to understand how the interests of the nuclear industry (not nuclear advocates, who tend to be disinterested activists) overlap with those of cryptominers (not crypto advocates, although many advocates are industry insiders). As recent developments have mostly been in the US, let’s keep our focus there.

The US nuclear industry is struggling. It faces the triple challenge of an ageing nuclear fleet (most plants were built in the 70s), anti-nuclear politics in high-profile states such as New York and California and economic pressures due to cheap, fracked gas and the chaos that intermittent solar and wind have brought to wholesale electricity markets. Cryptomining is energy-intensive, and nuclear utilities are more than happy to meet this new demand.

As well as today’s existing plants, there are tens of advanced nuclear startups in the US alone. Each claims their design is best but all face the same challenge: how to get their plant off the drawing board and built in real-life. A handful of designs have received government support to commercialise. So there is a “push” from the industry and government, but where is the “pull” from the market? Who wants to buy advanced reactors?

TLDR; nuclear is looking for new markets.

Meanwhile, profitable bitcoin mining is the solving of algorithms more quickly and using less energy than your competitors. This means miners are always searching for cheap, reliable power.

Of course, fossil fuels provide cheap, reliable power. But there is a third element at play here: public concern about carbon emissions arising from the mining of cryptocurrencies.

Feeding off the new pro-nuke, pro-crypto subculture, these three overlapping interests have created a new market frontier: nuclear bitcoin mining.

While solar, wind and hydro provide low-carbon power, all these technologies have much lower “capacity factors”, which means they’re not always available when needed. Nuclear’s high availability makes it ideal to support non-stop cryptomining operations.

This combination of nuclear power and bitcoin mining is an incredibly attractive offering. Most crudely worded:

nuclear power + bitcoin mining = low-carbon, money printing machine

The crypto-community is most excited about the potential for nuclear “microreactors”, which will be a hundred to a thousand times smaller than today’s large nuclear plants. Microreactors fit well with the decentralisation narrative that runs through the crypto world.

Nuclear comms expert (and friend) Jeremy Gordon suggested another reason this might be happening right now: China’s crack down on bitcoin mining (where over half of all mining occurs) is forcing miners to look elsewhere.

Oklo has signed 20-year, 150MW deal to power bitcoin mining

A few weeks back, Oklo announced it will partner with Compass, a bitcoin mining services company, to provide 150MW of nuclear power capacity over the next 20 years. Considering their Aurora design is currently rated at 1.5MW, this means constructing up to 100 microreactors.

Oklo is the first advanced fission company to have its license to construct and operate a power plant be accepted for review by the U.S. Nuclear Regulatory Commission.

What other nuclear mining operations have already been announced?

I never thought I’d say this, but there are too many nuclear bitcoin mining projects for me to cover in detail here. Here are the ones I’m aware of, ranked chronologically from when they were first announced:

Note: Please let me know in the comments or on Twitter of any other nuclear bitcoin mining projects, and I will add them here.

How would nuclear-powered bitcoin mining work?

There are three options (and a tenuous fourth) to those miners looking to use nuclear to reduce their carbon footprint:

- Build a new data centre and new nuclear reactor(s) to power it — e.g. Oklo/Compass[2].

- Co-locate a data centre with an existing nuclear plant — e.g. Belarus, Energy Harbor/Standard Power.

- A data centre arranges a power purchase agreement (or similar) with a utility willing to sell nuclear origin electricity — e.g. Talen Energy.

- (tenuous) A data centre buys nuclear electricity certificates of origin on the re-sale market to cover its energy usage. It is arguable whether this could really be classed as “nuclear bitcoin mining” as it is simply an accounting exercise.

Why you should care about nuclear bitcoin mining

While the idea of nuclear-fuelled bitcoin mining may be cool in itself, it’s also evidence that the world is a) waking up to the severity of the climate crisis, and b) understanding that nuclear provides scalable, reliable, clean power that is not limited by local geography or the weather.

In the last few days, Elon Musk went on record saying he would buy back into bitcoin once mining carbon emissions were under control. In fact, Elon said he was “pro nuclear” and that we should use “extremely safe” nuclear power to reduce emissions.

The leaders of the tech world have exactly the mindset and capabilities needed to catapult nuclear into a new era: an appetite for disruption, a willingness to take on regulators and very deep pockets. Maybe the next Space X or Tesla will be a nuclear startup?

Although a small part of the global economy, cryptocurrencies have an outsize cultural influence. If the crypto industry were to get behind nuclear, this would have a huge knock-on effect within other sectors.

Who knows? We might even reach our UN climate goals, which rely on an expansion of nuclear power in all the main IPCC scenarios.

It’s still early days

The signs are good, but we’ve still yet to see whether the nuclear industry can reinvent some of its reactors as clean, green, money-printing machines, and help the crypto world to shake its climate-trashing reputation.

If it happens, it will help change minds about nuclear energy, and hopefully unlock this powerful tool in the fight against climate change.

- 100

- 2020

- Accounting

- advocacy

- Agreement

- algorithms

- All

- among

- announced

- appetite

- availability

- Banking

- Belarus

- BEST

- Billion

- Bitcoin

- Bitcoin mining

- board

- buy

- california

- Capacity

- carbon

- carbon emissions

- care

- challenge

- change

- claims

- Climate change

- climate crisis

- CNBC

- Co-founder

- Coindesk

- coming

- comments

- commission

- community

- company

- Compass

- competitors

- crisis

- crypto

- Crypto Industry

- cryptocurrencies

- Culture

- Current

- data

- deal

- decentralisation

- Demand

- Design

- detail

- digital

- Disruption

- dollars

- Early

- Economic

- economy

- electricity

- Elon Musk

- Emissions

- energy

- Engineering

- environmental

- EV

- expansion

- Face

- faces

- Fashion

- Finally

- financial

- First

- fit

- FLEET

- Focus

- Forbes

- founder

- future

- GAS

- General

- Global

- Global economy

- good

- Government

- Green

- GV

- here

- High

- How

- How To

- HTTPS

- huge

- Humanity

- idea

- industry

- influence

- influencers

- IP

- IT

- large

- License

- Limited

- local

- love

- Machines

- Mainstream

- Market

- Markets

- medium

- Miners

- Mining

- model

- money

- New Market

- New York

- news

- offering

- online

- Operations

- Options

- Other

- partner

- People

- planet

- Platforms

- politics

- power

- projects

- purchase

- reduce

- Regulators

- Reuters

- review

- Science

- Sectors

- sell

- Services

- Short

- Signs

- small

- So

- solar

- Space

- Stage

- started

- startup

- Startups

- States

- Status

- support

- tech

- Technologies

- Tesla

- tiktok

- time

- u.s.

- UN

- us

- utility

- vision

- WHO

- wholesale

- wind

- within

- words

- Work

- world

- X

- year

- years

- youtube