- Index Coop introduced cdETI an ERC20 token representing CoinDesk Indices’ Ether Trend Indicator.

- The token will provide an automated solution for users to navigate and leverage ETH’s volatility.

- The collaboration between Index Coop and CoinDesk Indices aims to offer an on-chain ETI-driven product without requiring constant market monitoring.

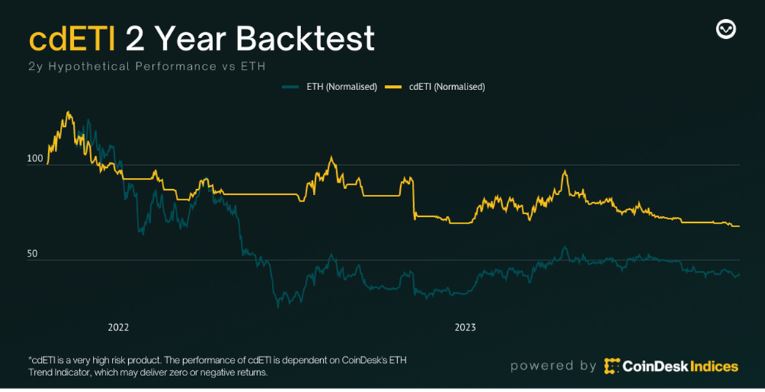

Index Coop recently introduced cdETI, an ERC20 token representing CoinDesk Indices’ Ether Trend Indicator. This automated offering enables users to leverage ETH’s volatility, seizing profits in bullish markets and safeguarding capital in bearish trends.

Index Coop x CoinDesk Indices

According to the media release, cdETI will provide users with an automated approach to navigate ETH’s volatility, aiming to capture profits during bullish phases and safeguard capital during bearish periods without requiring constant market monitoring.

Andy Baehr, CFA, Managing Director at CoinDesk Indices, stated that the Ether Trend Indicator is crafted to identify the presence, direction, and strength of trends in the price of ether. He noted that the product intends to facilitate client-developed outcome-oriented ETH strategies for a smoother experience.

“We are excited to collaborate with Index Coop for cdETI, the first on-chain ETI-driven product,” Baehr stated.

Moreover, Jordan Tonani, Head of Institutions at Index Coop, noted that ETH’s enduring volatility makes it an ideal candidate for a trend product.

“We’re optimistic that this strategy will make gaining exposure to ETH a more attractive proposition for users who may have been concerned about volatility or the need to actively manage an ETH position. cdETI could also be an interesting product for sophisticated users looking to try and outperform ETH,” he added.

How does cdETI work?

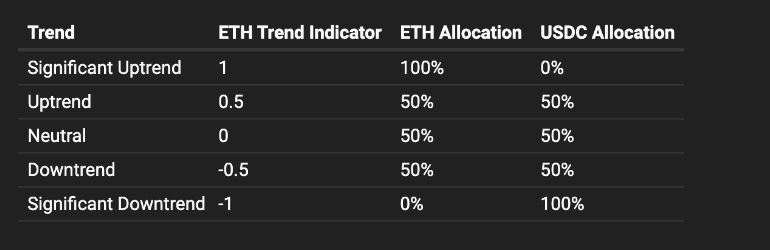

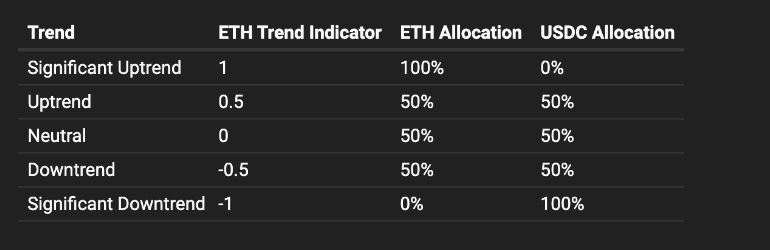

The statement noted that the CoinDesk Indices Ether Trend Indicator (ETI) identifies trends in ETH’s price movement by comparing recent prices to older prices over a historical period.

An uptrend may be indicated if recent prices are higher, while a downtrend may be in place if recent prices are lower. The ETI utilizes four distinct lookback windows, considering the 24/7 trading cycle of crypto assets.

In addition, cdETI employs the ETI to distribute capital among assets depending on the prevailing trend. If the trend indicator signals a stall or downward momentum in ETH’s price, the token allocates more to USDC. Conversely, when the trend indicator indicates an increase in ETH’s price appreciation, the token allocates more to wETH.

Its website stated that Index Coop CoinDesk ETH Trend Index will incur an annual fee of 1.50%, along with a 0.10% fee for issuance and redemption.

ETH to PHP

cdETI to PHP

This article is published on BitPinas: Index Coop, CoinDesk Data Launches ETH Trend Index

Disclaimer:

- Before investing in any cryptocurrency, it is essential that you carry out your own due diligence and seek appropriate professional advice about your specific position before making any financial decisions.

- BitPinas provides content for informational purposes only and does not constitute investment advice. Your actions are solely your own responsibility. This website is not responsible for any losses you may incur, nor will it claim attribution for your gains.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://bitpinas.com/business/index-coop-coindesk-cdeti/

- :is

- :not

- 1

- 250

- 8

- 9

- a

- About

- actions

- actively

- added

- addition

- advice

- Aiming

- aims

- allocates

- along

- also

- among

- an

- and

- annual

- any

- appreciation

- approach

- appropriate

- ARE

- article

- Assets

- At

- attractive

- Automated

- BE

- bearish

- been

- before

- between

- BitPinas

- Bullish

- by

- candidate

- capital

- capture

- carry

- cfa

- claim

- Coindesk

- collaborate

- collaboration

- comparing

- concerned

- considering

- constant

- constitute

- content

- conversely

- could

- crafted

- crypto

- crypto-assets

- cryptocurrency

- cycle

- data

- decisions

- Depending

- diligence

- direction

- Director

- distinct

- distribute

- does

- downtrend

- downward

- due

- during

- employs

- enables

- enduring

- ERC20

- ERC20 token

- essential

- ETH

- Ether

- ethereum

- excited

- experience

- Exposure

- facilitate

- fee

- financial

- First

- For

- four

- gaining

- Gains

- Have

- he

- head

- higher

- historical

- HTTPS

- ideal

- identifies

- identify

- if

- in

- Increase

- index

- indicated

- indicates

- Indicator

- Indices

- Informational

- institutions

- intends

- interesting

- introduced

- investing

- investment

- issuance

- IT

- Jordan

- jpg

- launches

- Leverage

- looking

- losses

- lower

- make

- MAKES

- Making

- manage

- managing

- Managing Director

- Market

- Markets

- max-width

- May..

- Media

- Momentum

- monitoring

- more

- movement

- Navigate

- Need

- noted

- of

- offer

- offering

- older

- on

- On-Chain

- only

- Optimistic

- or

- out

- Outperform

- over

- own

- period

- periods

- phases

- photo

- PHP

- Place

- plato

- Plato Data Intelligence

- PlatoData

- position

- presence

- price

- Prices

- Product

- professional

- profits

- proposition

- provide

- provides

- published

- purposes

- recent

- recently

- redemption

- release

- representing

- responsibility

- responsible

- safeguard

- safeguarding

- Seek

- seizing

- signals

- smoother

- solely

- solution

- sophisticated

- specific

- stated

- Statement

- strategies

- Strategy

- strength

- that

- The

- this

- to

- token

- Trading

- Trend

- Trends

- try

- uptrend

- USDC

- users

- utilizes

- Volatility

- Website

- wETH

- when

- while

- WHO

- will

- windows

- with

- without

- Work

- X

- You

- Your

- zephyrnet

![[Event Recap] Leaders in Blockchain: Female Trailblazers Discuss the Future of Web3 and Crypto [Event Recap] Leaders in Blockchain: Female Trailblazers Discuss the Future of Web3 and Crypto](http://platoblockchain.com/wp-content/uploads/2023/04/event-recap-leaders-in-blockchain-female-trailblazers-discuss-the-future-of-web3-and-crypto-300x225.png)