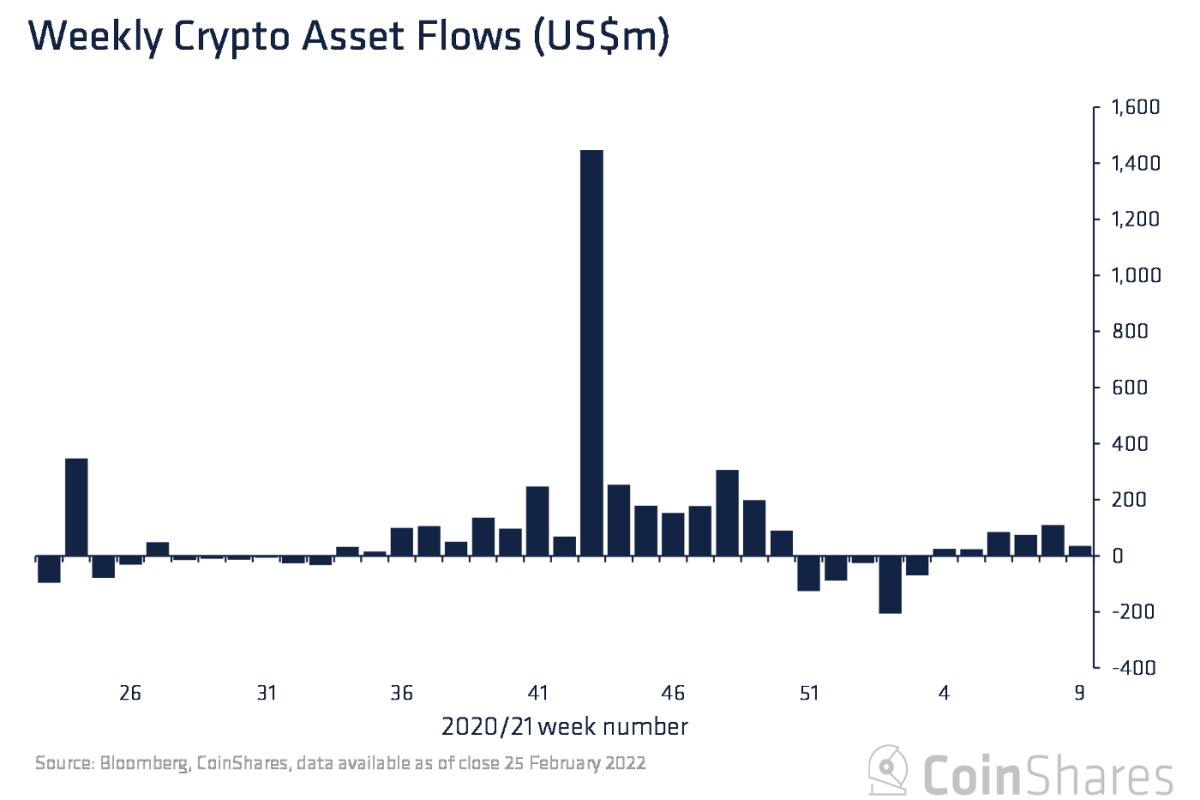

Digital asset manager CoinShares says institutional investment in crypto assets hit $36 million last week as Russia’s invasion of Ukraine rocked global markets.

In the latest Digital Asset Fund Flows Weekly report, Coinshares says institutional inflows from the Americas canceled out last week’s European outflows.

“Digital asset investment products saw inflows totaling US$36m last week despite the ongoing turmoil in Eastern Europe and the anticipated negative sentiment. Interestingly, volumes in Bitcoin crypto exchanges that trade the RUB/USD pair have seen volumes rise by 121% week-on-week.

Regionally, flows have been, one-sided, with the Americas seeing inflows (notably Canada & Brazil) totaling US$95m while European investment products saw outflows totaling US$59m last week.”

According to CoinShares, this marks the sixth week of investment inflows into digital asset products.

As usual, the leading crypto by market cap Bitcoin (BTC) enjoyed the lion’s share of inflows, followed in turn by the second-leading crypto by market cap, Ethereum (ETH).

“Bitcoin saw inflows totaling US$17m last week, entering its 5th consecutive week of inflows totaling US$239m. Ethereum saw minor inflows totaling US$4.2m.”

Breaking recent inflow trends, Solana (SOL) and Litecoin (LTC) suffered outflows this week, along with most of the altcoin market. According to CoinShares, up-and-coming smart contract platform Tezos (XTZ) was the only digital investment product to defy the outflowing altcoin markets.

“Unusually, most altcoins saw minor outflows last week. Solana and Litecoin were the primary focus of negative investor sentiment with outflows totaling US$2.6m and US$0.5m respectively.

Tezos was the only altcoin investment product to see inflows which totaled US$4.4m…”

The full CoinShares report can be read here.

Check Price Action

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/CHIARI VFX/Mia Stendal

The post Institutions Pour $36,000,000 Into Bitcoin, Ethereum and One Additional Altcoin As Market Volatility Skyrockets: CoinShares appeared first on The Daily Hodl.

- Coinsmart. Europe’s Best Bitcoin and Crypto Exchange.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. FREE ACCESS.

- CryptoHawk. Altcoin Radar. Free Trial.

- Source: https://dailyhodl.com/2022/02/28/institutions-pour-36000000-into-bitcoin-ethereum-and-one-additional-altcoin-as-market-volatility-skyrockets-coinshares/

- "

- &

- 000

- 2019

- 28

- 3d

- According

- Additional

- advice

- advisor

- Affiliate

- affiliate marketing

- Altcoin

- Altcoins

- Americas

- asset

- Assets

- Bitcoin

- Block

- Brazil

- BTC

- Buying

- Canada

- capital

- CoinShares

- consecutive

- contract

- copyright

- crypto

- Crypto Exchanges

- cryptocurrencies

- cryptocurrency

- Despite

- digital

- Digital Asset

- Digital Assets

- diligence

- Display

- eastern

- eastern europe

- ETH

- ethereum

- Europe

- European

- Exchanges

- featured

- First

- Focus

- full

- fund

- Global

- high-risk

- HODL

- HTTPS

- image

- Institutional

- institutions

- investment

- Investments

- investor

- Investors

- latest

- Latest News

- leading

- light

- Litecoin

- LTC

- Making

- manager

- Market

- Market Cap

- Marketing

- Markets

- medium

- million

- most

- Natural

- Neon

- news

- Opinions

- platform

- primary

- Product

- Products

- recommend

- report

- Risk

- sentiment

- Share

- shine

- smart

- smart contract

- Solana

- trade

- trades

- transfers

- Trends

- Ukraine

- us

- use

- Volatility

- Water

- week

- weekly

- without

- XTZ