Insurtech plays a significant role as Thailand turns to technology to boost its insurance industry and make it inclusive. It is embedded in the country’s Fourth Insurance Development Plan (IDP 4) for 2021 to 2025 to ensure that the industry can adapt to the new environment.

Even the latest five-year investment promotion strategy framework approved by its Board of Investment (BOI) this month puts creativity, innovation, and technology as part of its core concepts leading to the new economy for 2023 to 2027.

Those three factors are synonymous with insurtech, and meet what the market is looking for as it demands greater accessibility, flexibility, and personalization in the products and services it seeks.

Thailand to be a leader in Insurtech

In IDP 4, the Organization of Insurance Commission (OIC) outlined its plan to make the nation a leader in insurance technology by expanding the role of Center of InsurTech (CIT) as the Insurance One Stop Service Center, amending regulations to support insurtech and make more funding sources accessible and enabling startups to enter the insurance market more quickly

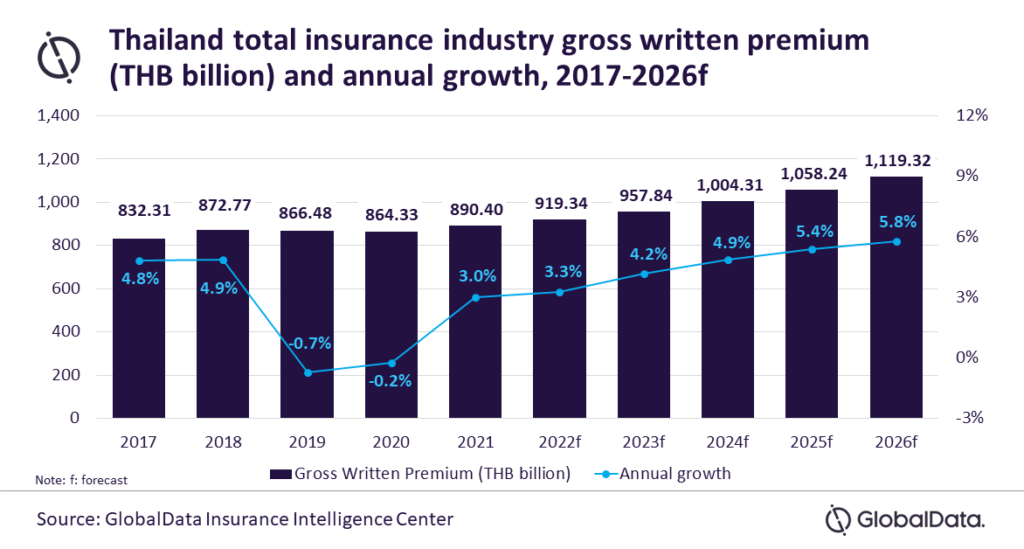

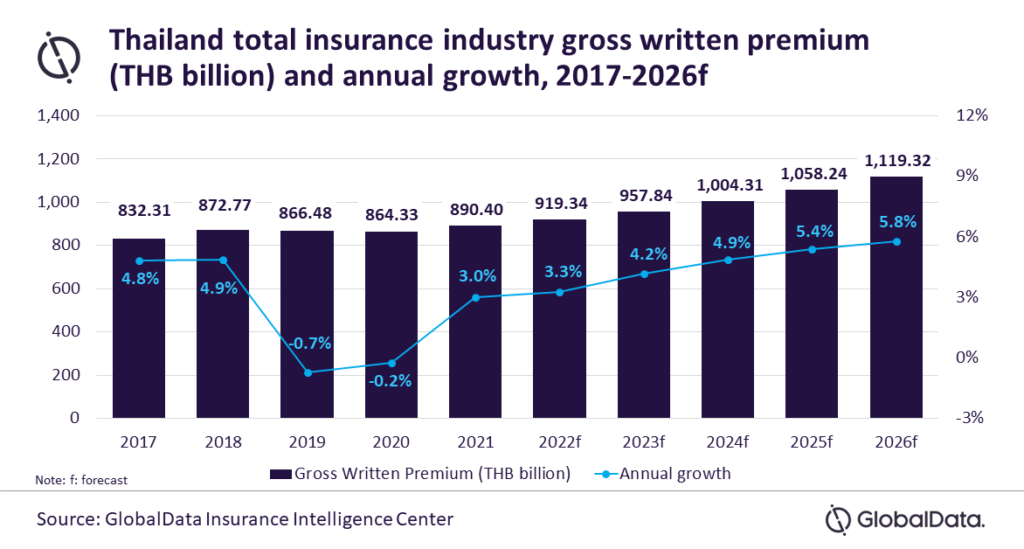

Thailand’s insurance industry is forecasted to reach THB 1373.03 billion (US$36.1 billion) by 2026, according to a GlobalData estimate.

source: GlobalData

It also noted that the country has a total insurance penetration of 5.5 percent in 2021, higher than in emerging markets like China (4.4 percent), Vietnam (3.3 percent), the Philippines (1.7 percent), and Malaysia (1.5 percent).

The pandemic paved the way for customers to have greater access to learning and purchasing insurance products thanks to accelerated digital transformation and the power of social media.

For example, there were nine million covid-19 insurance policies as of 30 December 2020. Three months later, the number jumped to 11 million by 31 March 2021, the IDP 4 report mentioned.

Familiarity with purchasing insurance online increased due to the pandemic

“The COVID-19 pandemic has made more people more familiar with purchasing insurance products online. Online channels allow them to compare the coverage and premium of each policy on their own and easily decide to buy the policy if they consider that the premium is affordable,” the OIC observed.

Insurtech can provide full-stack end-to-end solutions or focus on one or several stages in the insurance value chain. These include Marketing, Sales, and Distribution; Product Development and Actuary; Claim Management; Reinsurance; Asset Management; Data and Analytics; Risk Analysis, Pricing and Underwriting; Onboarding, Administration, and Customer Engagement; and more.

“Online services are fully utilised throughout the insurance process, including videoconferences, virtual signature, email, e-applications for policy offering, confirmation, delivery of documents, premium payment, receiving protection and even compensation payment,” insurance regulator at the OIC Thanita Anusonadisai told The Actuary Magazine last December.

“I also have seen the use of artificial intelligence (AI) technology and robotics in the value chain, such as for product development, premium rates calculation for a specific group of customers in the pool, big data or so-called risk-based pricing and services, online application consideration, claims management, and pre-and post-sales services.”

Affordable and personalised insurance protection

Insurtech FairDee, which recently raised TBH2472.21 million (US$65 million) in funding, aims to make affordable and personalised insurance protection accessible to underinsured people across Southeast Asia.

It started in its home country, as Thailand has the most significant consumer insurance market with over 150,000 general insurance brokers. More than 70 percent of them work independently.

FairDee creates mobile platforms where brokers can connect with a more extensive selection of general insurance providers.

This allows these micro-entrepreneurs to offer their customers more options and better services. The digital tools also enable brokers to stay competitive and improve their income.

With the plan to take insurtech to new heights, FairDee’s managing director Thanasak Hoontrakul said that the company is committed to working with insurers, brokers, OIC, and the ecosystem to further invest in the growth of Thailand’s insurance market.

Insurtech in Thailand paving the way

Having insurance is vital to foster financial resiliency, from individuals to businesses, and has a multiplier effect on the economy.

Making it inclusive for all is possible by having the ability to create customized insurance products and services and making them easy to get.

Armed with passion, skills, and drive while increasingly attracting interest and funding from local and international investors with their innovations, Thai insurtech companies and startups are heeding the call and working on getting it done.

- ant financial

- blockchain

- blockchain conference fintech

- chime fintech

- coinbase

- coingenius

- crypto conference fintech

- fintech

- fintech app

- fintech innovation

- Fintechnews Singapore

- Insurtech

- OpenSea

- PayPal

- paytech

- payway

- plato

- plato ai

- Plato Data Intelligence

- PlatoData

- platogaming

- razorpay

- Revolut

- Ripple

- square fintech

- stripe

- tencent fintech

- Thailand

- xero

- zephyrnet