USD/JPY has started the week quietly as it continues to trade at the 134 line. It was a rough week for the yen, which declined by 2% and dropped as low as 135.11, its lowest level this year. The US dollar has received a tailwind from a host of strong economic releases. Retail sales surprised with a 3% gain, manufacturing data beat the forecast and consumer inflation ticked lower to 6.4% but was higher than expected.

The data points to a surprisingly resilient economy despite significant tightening by the Federal Reserve. Inflation remains public enemy number one and the Fed will be able to continue raising rates, confident in the knowledge that the economy can withstand further rate increases. The Fed is widely expected to raise rates by 25 basis points at the March meeting, with an outside chance of a 50-bp increase. Last week, Fed members Mester and Bullard said that they saw a case for raising rates by 50 basis points at the February meeting, rather than the 25-bp hike that the Fed delivered. It appears a given that the benchmark rate of 4.5% will jump above 5% in the next few months, with the terminal rate likely to be higher than previously expected.

Will Kuroda surprise at his final meeting?

In Japan, there is speculation that BoJ Governor Haruhiko Kuroda could surprise the markets with one last hurrah in March, prior to his departure in April. Kuroda’s final meeting is on Mar. 10, and there is a risk that Kuroda could widen the BoJ’s target yield band in order to reduce the pressure on the new Governor, Kazuo Ueda. There has been constant pressure on the BoJ to tighten policy, and if Kuroda doesn’t take off some of the heat, there could be massive bond selling before Ueda even holds his first meeting. A move next month by Kuroda would give Ueda some breathing room and allow him to carefully evaluate matters before making any changes.

.

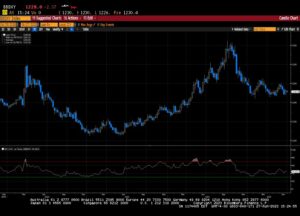

USD/JPY Technical

- USD/JPY tested resistance at 134.18 earlier in the day. Above, there is resistance at 135.75

- There is support at 1.3350 and 1.3190

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://www.marketpulse.com/20230220/japanese-yen-steady-at-134/

- 1

- 10

- 11

- 2%

- 2012

- a

- Able

- above

- advice

- affiliates

- All

- Alpha

- analysis

- analyst

- and

- April

- article

- author

- authors

- BAND

- based

- basis

- before

- below

- Benchmark

- Benchmark Rate

- boj

- BOJ Governor Haruhiko Kuroda

- bond

- Box

- breathing

- broad

- buy

- carefully

- case

- Chance

- Changes

- COM

- Commodities

- confident

- constant

- consumer

- continue

- continues

- contributor

- CORPORATION

- could

- Covers

- daily

- data

- data points

- day

- delivered

- deposited

- Despite

- Directors

- Doesn’t

- Dollar

- dropped

- Earlier

- Economic

- economy

- Equities

- evaluate

- Even

- expected

- experienced

- February

- Fed

- Federal

- federal reserve

- few

- final

- financial

- Financial Market

- First

- Focus

- Forecast

- forex

- from

- fundamental

- funds

- further

- Gain

- General

- Give

- given

- Governor

- High

- higher

- highly

- Hike

- holds

- host

- HTTPS

- in

- Including

- Increase

- Increases

- inflation

- information

- investing

- investment

- Israel

- IT

- Japan

- Japanese

- Japanese Yen

- jump

- knowledge

- Last

- Level

- likely

- Line

- lose

- Low

- lowest level

- major

- Making

- manufacturing

- March

- Market

- MarketPulse

- Markets

- massive

- Matters

- max-width

- meeting

- Members

- Month

- months

- move

- necessarily

- New

- next

- number

- officers

- ONE

- online

- Opinions

- order

- outside

- plato

- Plato Data Intelligence

- PlatoData

- points

- policy

- Posts

- pressure

- previously

- Prior

- public

- publications

- published

- purposes

- quietly

- raise

- raising

- range

- Rate

- Rates

- received

- reduce

- Releases

- remains

- Reserve

- resilient

- Resistance

- retail

- Retail Sales

- Risk

- Room

- Said

- sales

- Securities

- seeking

- Seeking Alpha

- sell

- Selling

- several

- sharing

- significant

- since

- solution

- some

- speculation

- started

- steady

- strong

- suitable

- support

- surprise

- surprised

- Tailwind

- Take

- Target

- Terminal

- The

- the Fed

- this year

- tightening

- to

- trade

- Trading

- us

- US Dollar

- week

- which

- widely

- will

- Work

- would

- would give

- year

- Yen

- Yield

- You

- Your

- zephyrnet