Private investors have contributed $2 million to Jelly Labs AG and Fintonomy LTD, the companies developing the foundational protocols underpinning Jellyverse. Based on DeFiMetaChain, Jellyverse is a platform providing advanced decentralized financial services. The money raised will be used by Jelly Labs AG and Fintonomy LTD to further accelerate the growth of the decentralized platform.

The founding team of DeFiChain Accelerator, which has been instrumental in pushing the adoption of DeFiChain via the development of innovative software, the implementation of international marketing campaigns, and calculated business development endeavors, launched Jellyverse.

The DeFi sector has advanced digital token interaction to an astonishing degree, but it hasn’t been able to include real-world assets into its offerings. Combining cutting-edge decentralized financial apps with real-world price feeds is essential to propelling DeFi to new heights. In order to close this market gap and create DeFi 3.0, the next version of DeFi, Jellyverse steps in. Jellyverse provides products like as bonds, lending, decentralized portfolios, and more advanced options for staking.

DeFiMetaChain (DMC) is an EVM-compatible Layer-2 that serves as an extension to the underlying non-Turing complete DeFiChain, upon which the platform is based. DeFiMetaChain functions as a parasitic chain that can easily connect with several blockchains and collect data, taking a novel way to interoperability. The development of cross-chain protocols that surpass the current industry norms depends on this data. Because there are less gas fees on DeFiMetaChain than on Ethereum, building on the platform is therefore more cost-effective.

Santiago Sabater, the Co-Initiator of Jellyverse stated:

“Jellyverse merges the pinnacle of past DeFi achievements with a fresh perspective. We present decentralized assets that pioneer a novel way to diversify your crypto portfolio, complemented by self-balancing multi-token pools.”

The jAssets developed through a community team will be one contribution to the Jellyverse protocols. Users may acquire completely decentralized price exposure to real-world assets like as equities and commodities using the jAssets. These assets follow the price development almost depending on processes included into the protocol, rather than being exactly linked to the price of the stock or commodity.

Jellyverse offers self-balancing portfolio pools with tokens that track real-time price feeds, therefore delivering state-of-the-art portfolio management in a truly decentralized manner. With yield on top, investors will be able to build intricate portfolios with a wide range of assets.

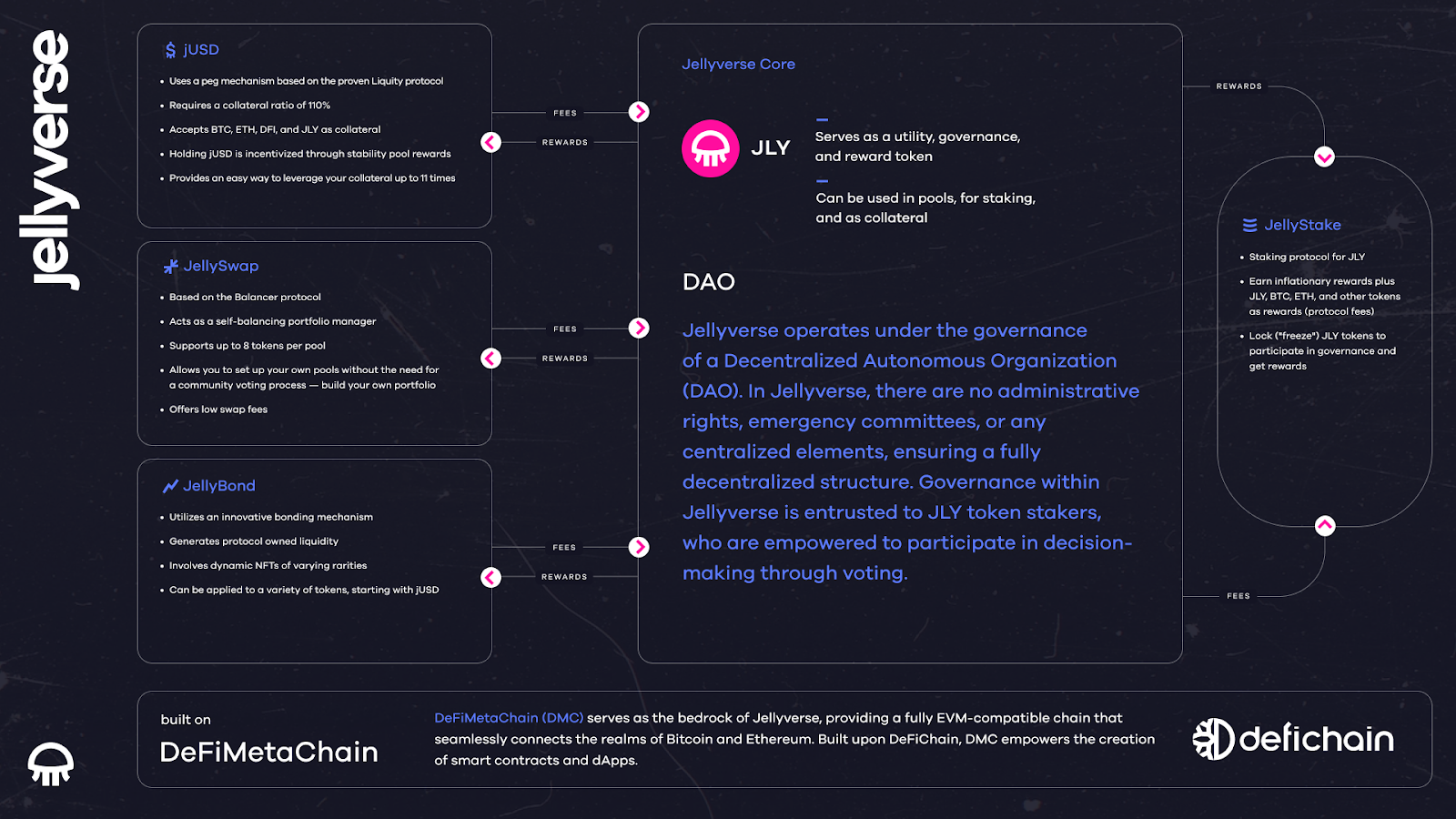

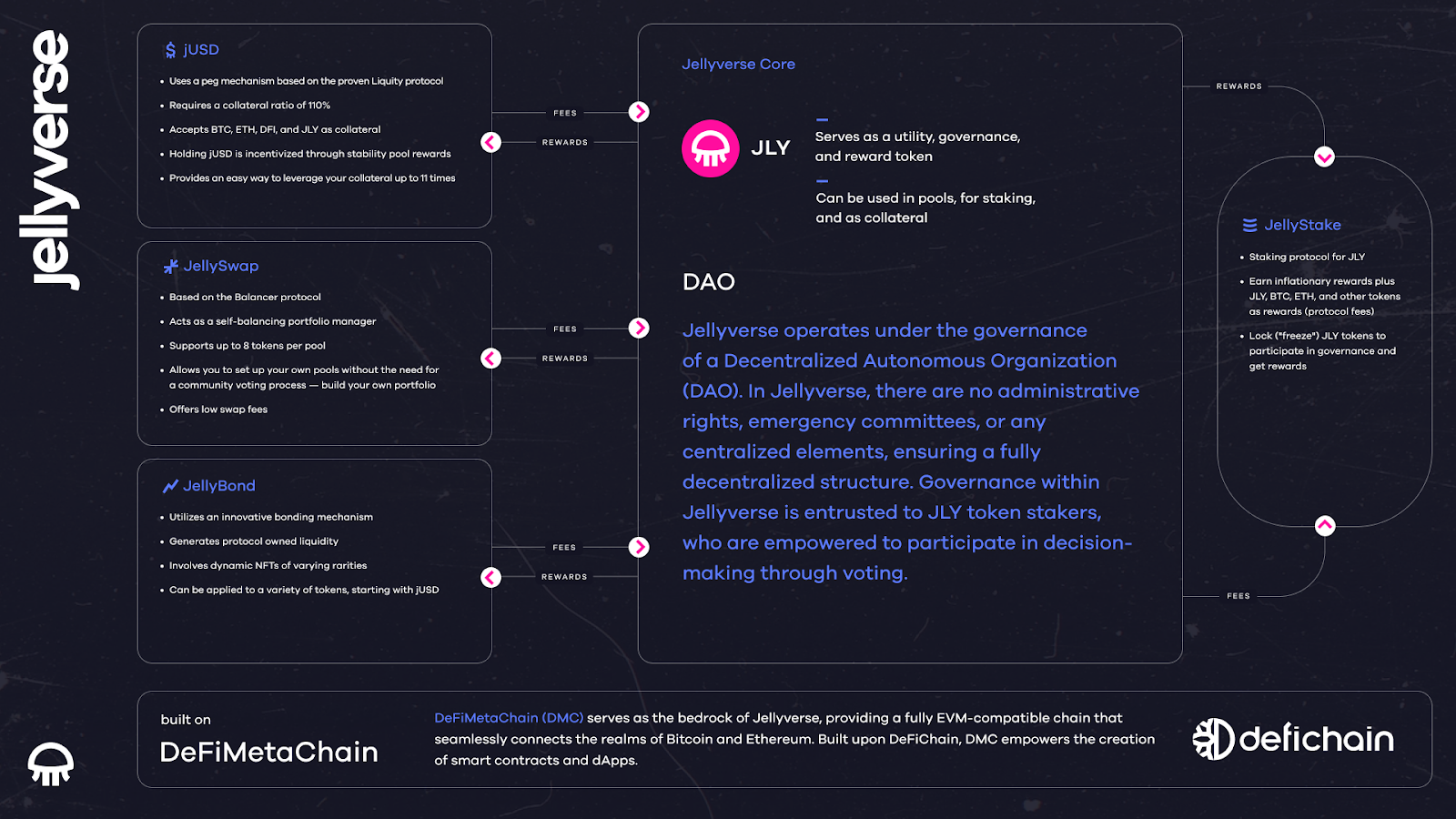

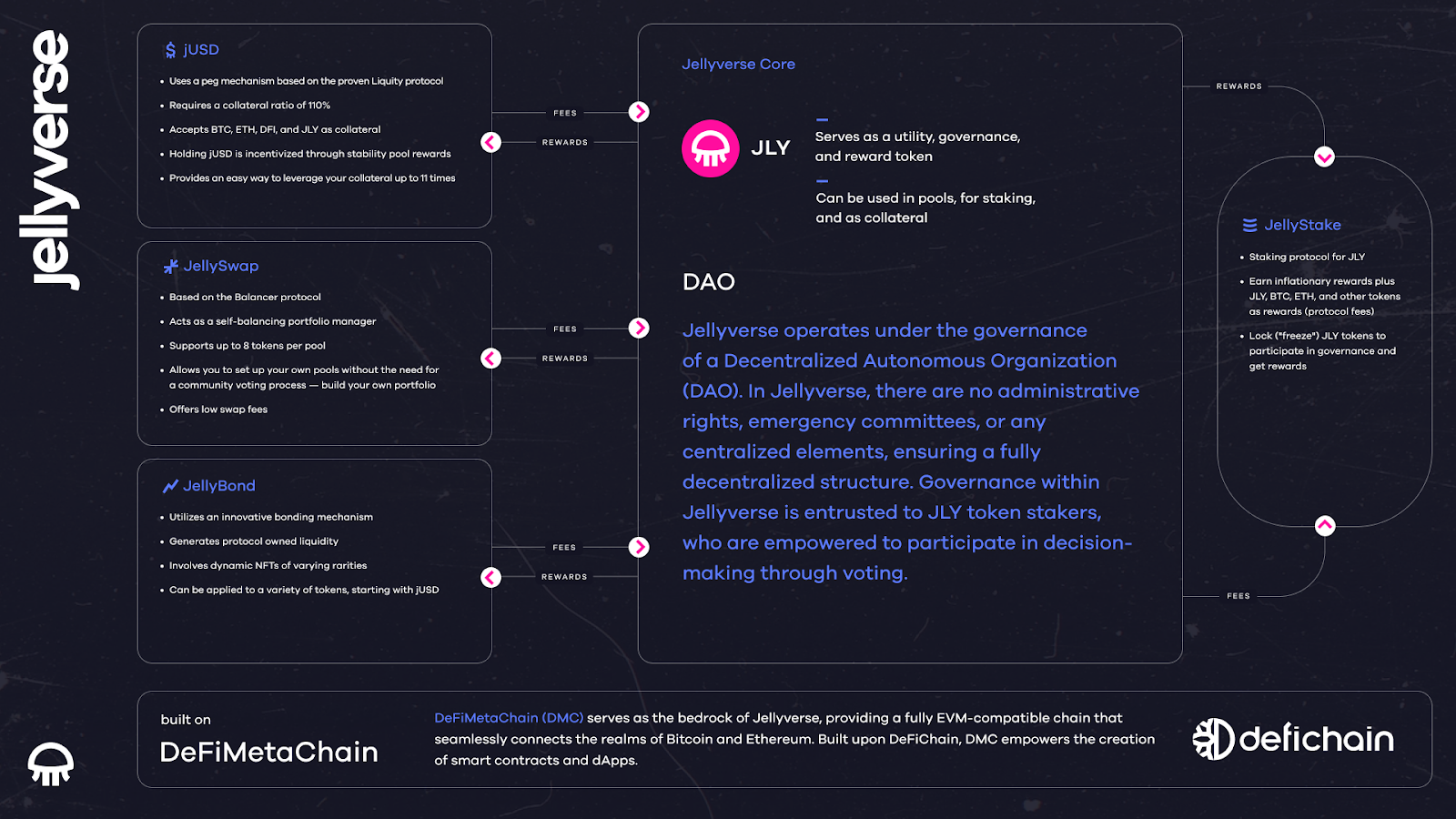

Among the first products available on Jellyverse are:

JellySwap:

A state-of-the-art DEX built on Balancer with expanded features. It is where the Jelly Token resides. Fully decentralized JellySwap acts as a liquidity provider and non-custodial portfolio manager.

JellyStake:

Using the decentralized staking system JellyStake, you may boost rewards and voting power by staking your JLY tokens. In addition to being driven by inflation, JellyStake is also fueled by fees earned by protocols throughout the whole ecosystem.

jUSD:

Based on the extensively examined and validated stability features from the LUSD by Liquity protocol, jUSD is a stablecoin. In exchange for DFI, dETH, JLY, and other cryptocurrencies, users may borrow jUSD.

jAssets:

Tokens created by users and backed by cryptocurrencies that use real-time price feeds to replicate the values of stocks, commodities, and exchange-traded funds (ETFs). Hence, assets enable oblique involvement in conventional financial markets, thereby broadening the cryptocurrency portfolio. The jAsset protocol is being developed by a community team rather than Jelly Labs AG or Fintonomy LTD, with the goal of linking it to Jellyverse via a future governance decision.

JellyBond:

A protocol to bind jUSD and jAssets. JellyBond creates protocol-owned liquidity while introducing the first bonding mechanism to DeFiChain and providing token holders with increased yield.

Complete platform development and governance will be handled by an on-chain decentralized autonomous organization (DAO). With decentralized governance, the community contributes legal frameworks, direction, marketing, user assistance, funding, and visionary notions, but developers have the authority to take action.

The ecosystem of Jellyverse uses JLY as its native governance and revenue-sharing token. Voting on important parameters and strategic choices on the various protocols and dApps on Jellyverse is available to users that stake JLY. Stakers of JLY tokens will get a portion of transaction fees collected across all protocols.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://thenewscrypto.com/jellyverse-raises-2m-seed-funding-for-boosting-defi-3-0-development/

- :has

- :is

- :where

- 26%

- 36

- 8

- a

- Able

- accelerate

- accelerator

- achievements

- acquire

- Action

- acts

- addition

- Adoption

- advanced

- AG

- All

- almost

- also

- an

- and

- apps

- ARE

- AS

- Assets

- Assistance

- authority

- autonomous

- available

- backed

- balancer

- based

- BE

- because

- been

- being

- bind

- blockchains

- Bonds

- boost

- boosting

- borrow

- build

- Building

- built

- business

- business development

- but

- by

- calculated

- Campaigns

- CAN

- chain

- choices

- Close

- collect

- combining

- Commodities

- commodity

- community

- Companies

- complete

- completely

- Connect

- contributed

- contributes

- contribution

- conventional

- cost-effective

- create

- created

- creates

- Cross-Chain

- crypto

- crypto portfolio

- cryptocurrencies

- cryptocurrency

- Current

- cutting-edge

- DAO

- DApps

- data

- decentralized

- Decentralized Autonomous organization

- decentralized governance

- decentralized platform

- decision

- DeFi

- DeFiChain

- Degree

- delivering

- Depending

- depends

- developed

- developers

- developing

- Development

- Dex

- DFI

- digital

- Digital token

- direction

- diversify

- driven

- earned

- easily

- ecosystem

- enable

- endeavors

- Equities

- essential

- ethereum

- exactly

- exchange

- exchange-traded

- exchange-traded funds

- expanded

- Exposure

- extension

- extensively

- Features

- Fees

- financial

- financial services

- First

- follow

- For

- foundational

- founding

- frameworks

- fresh

- from

- fueled

- fully

- functions

- funding

- funds

- further

- future

- gap

- GAS

- get

- goal

- governance

- Have

- heights

- hence

- holders

- HTTPS

- implementation

- important

- in

- include

- included

- increased

- industry

- inflation

- innovative

- instrumental

- interaction

- International

- Interoperability

- into

- introducing

- Investors

- involvement

- IT

- ITS

- Labs

- launched

- Legal

- lending

- less

- like

- linked

- linking

- Liquidity

- liquidity provider

- Ltd

- management

- manager

- manner

- Market

- Marketing

- Markets

- May..

- mechanism

- merges

- million

- money

- more

- native

- New

- next

- non-custodial

- norms

- novel

- of

- Offerings

- Offers

- on

- On-Chain

- ONE

- Options

- or

- order

- organization

- Organization (DAO)

- Other

- parameters

- past

- perspective

- PHP

- pinnacle

- pioneer

- platform

- plato

- Plato Data Intelligence

- PlatoData

- Pools

- portfolio

- portfolio management

- portfolio manager

- portfolios

- portion

- power

- present

- price

- processes

- Products

- propelling

- protocol

- protocols

- provider

- provides

- providing

- Pushing

- raised

- raises

- range

- rather

- real world

- real-time

- Rewards

- sector

- seed

- Seed funding

- serves

- Services

- several

- Share

- Software

- Stability

- stablecoin

- stake

- stakers

- Staking

- state-of-the-art

- stated

- Steps

- stock

- Stocks

- Strategic

- surpass

- SVG

- system

- Take

- taking

- team

- than

- that

- The

- There.

- thereby

- therefore

- These

- this

- Through

- throughout

- to

- token

- token holders

- Tokens

- top

- track

- transaction

- Transaction Fees

- truly

- underlying

- underpinning

- upon

- use

- used

- User

- users

- uses

- using

- validated

- Values

- various

- version

- via

- visionary

- Voting

- Way..

- we

- which

- while

- whole

- wide

- Wide range

- will

- with

- Yield

- You

- Your

- zephyrnet