- Kraken is leading the way in ETH staking cancellations.

- Twitter users blame the Huobi ETH staked withdrawal surge on the handover between new and existing owners.

- The Shanghai update (Shapella) for Ethereum is already live.

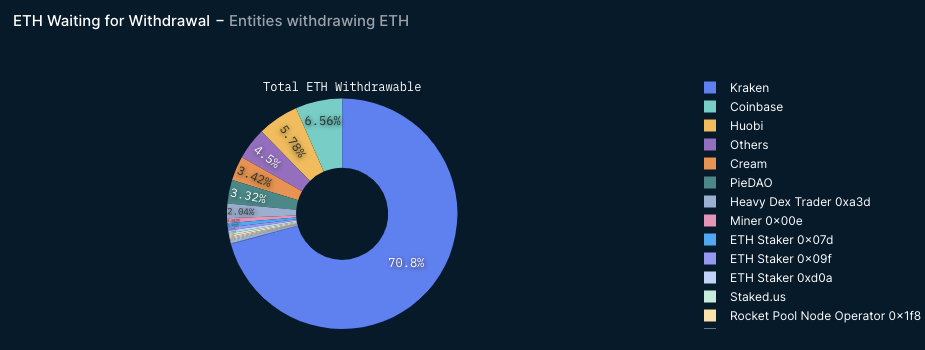

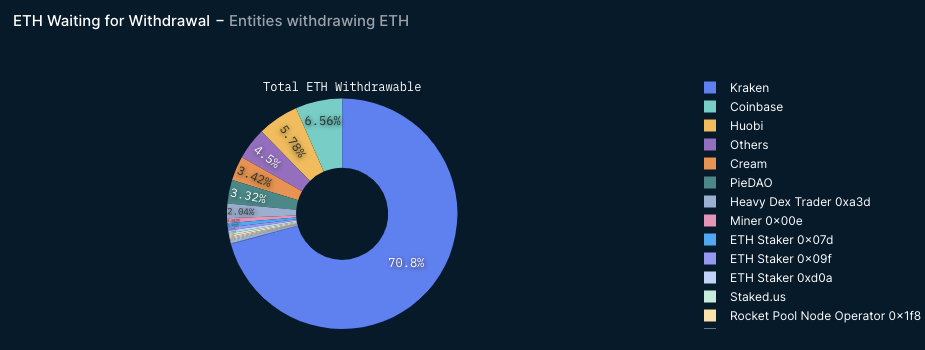

According to a recent analysis by Nansen, Kraken is leading the way in the amount of staked ETH waiting for withdrawal. As per the report, Kraken, the US-based cryptocurrency exchange, topped the list with 70.8% of the total ETH waiting for withdrawal.

The report also revealed several other popular exchange platforms waiting to cancel their ETH staking. These included Coinbase, which had 6.56% of total withdrawable ETH, and Huobi, a Seychelles-based cryptocurrency exchange with 5.78%. On the other hand, “Others” was fourth on the list with a share of 4.5% of the total withdrawable ETH, while Cream, an open source and blockchain agnostic protocol, had 3.42% at press time.

However, cryptocurrency proponents on Twitter claim that the handover of new and old shareholders is to blame for the current spike in ETH-staked withdrawals on Huobi. One user claimed that Li Lin, the creator of Huobi, was forced to perform a handover once the withdrawal was opened, which necessitated withdrawing some ETH from the exchange and depositing it back. This procedure could have produced more withdrawals and deposits than usual, which might have led to the platform’s recent spike in ETH withdrawals.

This comes amid the Shanghai (Shapella) Upgrade, which combines changes to Ethereum’s execution layer (Shanghai upgrade), consensus layer (Capella upgrade), and the Engine API. The Shanghai update for Ethereum, which is already live, will complete the transformation of Ethereum to a “proof of stake” blockchain, which uses over 99% less energy than the “proof of work” blockchain that runs the Bitcoin network.

Post Views: 22

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://coinedition.com/kraken-dominates-eth-staking-cancellations-nansen-finds/

- :is

- 70

- a

- already

- Amid

- amount

- analysis

- and

- api

- AS

- At

- back

- between

- Bitcoin

- Bitcoin Network

- blockchain

- by

- Changes

- Chart

- claim

- claimed

- coinbase

- combines

- complete

- Consensus

- consensus layer

- could

- creator

- cryptocurrency

- Cryptocurrency Exchange

- Current

- deposits

- dominates

- energy

- Engine

- ETH

- eth staking

- ethereum

- Ethereum's

- exchange

- execution

- existing

- finds

- For

- Fourth

- from

- hand

- Handover

- Have

- HTTPS

- Huobi

- in

- included

- IT

- Kraken

- layer

- leading

- Led

- Li

- List

- live

- max-width

- might

- more

- Nansen

- network

- New

- of

- Old

- on

- ONE

- open

- open source

- opened

- Other

- owners

- Perform

- Platforms

- plato

- Plato Data Intelligence

- PlatoData

- Popular

- press

- Produced

- protocol

- recent

- report

- Revealed

- several

- shanghai

- Share

- Shareholders

- some

- Source

- spike

- Staked

- Staked ETH

- Staking

- surge

- that

- The

- their

- These

- time

- to

- topped

- Total

- Transformation

- Update

- upgrade

- User

- users

- views

- Waiting

- Way..

- which

- while

- will

- with

- withdrawal

- Withdrawals

- withdrawing

- zephyrnet