Microsoft share price hit an all-time high after the tech giant announced new updates for its AI products, pushing the company to a $2.67 trillion market capitalization.

On Tuesday, July 18, the company announced a subscription service for Microsoft 365 Copilot, which should cost 50% more for enterprise users.

Although the tech firm has not yet set timelines for its rollout, the tool is in its early testing stages with about 600 business customers, among them Goodyear and General Motors.

A golden Tuesday

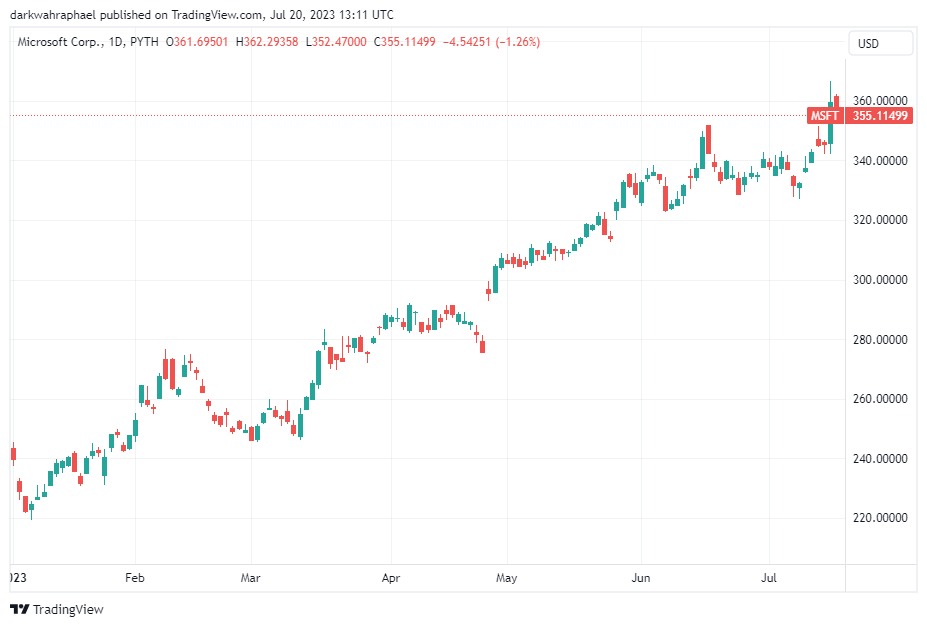

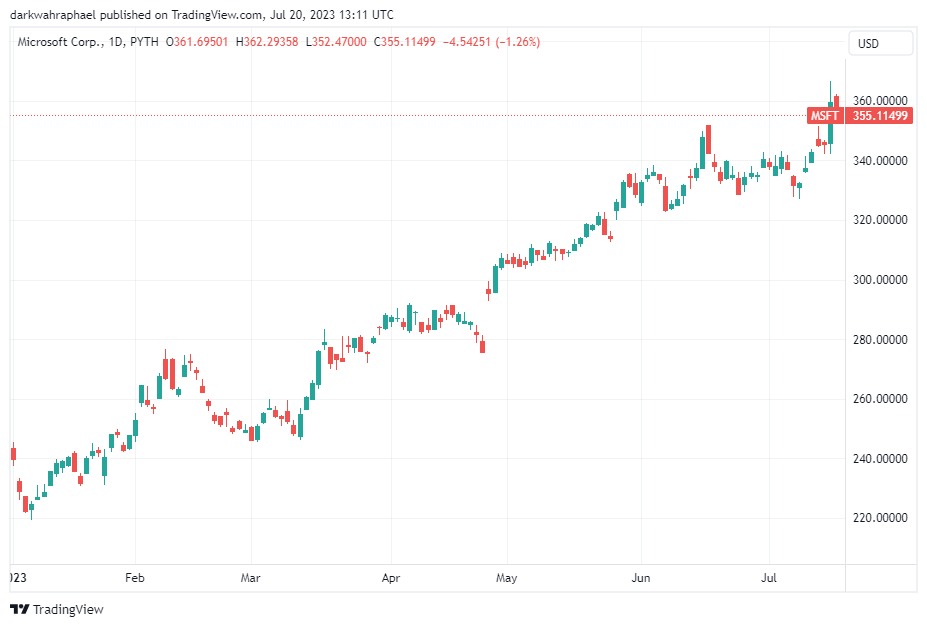

Following the announcement, MSFT, the stock of Microsoft Corporation reached a 52-week high price of $366.78 on July 18. The stock was exchanging hands for $355.08, as of writing, data from Yahoo Finance showed.

The stock has jumped by over 8% in the first three weeks of July thanks to the company’s foray into the artificial intelligence (AI) sector which has seen Microsoft join competitors like Google, NVIDIA, and International Business Machine Corporation (IBM) as technology companies churning out customer-driven AI products and services.

On a year-to-date (YTD) basis, the stock has soared by 50% adding more than $120 in seven months after opening the year at $243.08 on January 3.

TradingView

Many financial analysts consider this a positive for shareholders after MSFT shed a quarter of its value in 2022 when it opened and closed the year at $325.63 and $239.53 respectively.

TradingView

With the latest announcement, Microsoft 365 customers on different plans are expected to pay a subscription of $30 for Microsoft 365 Copilot.

According to a report by Forbes, the Microsoft Copilot subscription will be an addition to already existing plans that range between $12.50 and $36 monthly.

“It’s grounded in your business data in the Microsoft Graph – that’s all your emails, calendar, chats, documents and more,” the company said in a release that assured customers that their preset security, privacy and compliance are in line with Microsoft 365 policies.

CEO Satya Nadella also said in a statement that the AI’s addition to the tool would “fundamentally change the way we work and unlock a new wave of productivity and growth.”

Also read: Apple Develops ‘Apple GPT’ AI Chatbot to Rival Bard and ChatGPT

AI powered “crazy” tech rally

Microsoft joins other tech firms that have enjoyed a bull run in 2023 spurred by AI services and investments.

NVDA, the stock of technology firm Nvidia is among the best-performing assets in the centralized financial markets in 2023 due to their products, primarily, chips seen as a major catalyst for driving AI systems development. NDVA has spiked by more than 200% YTD reaching a peak price of $480.88 on Friday, July 14 after opening 2023 at $148.51. The stock was up by 13% in the first 20 days of July, as of writing, TradingView data showed.

TradingView

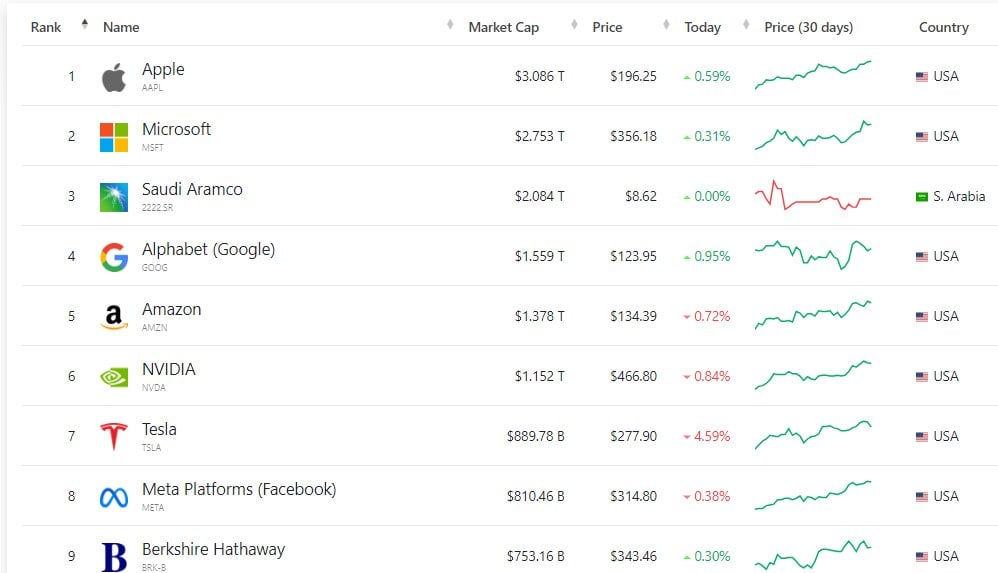

With this, NVIDIA has joined Apple (APPL), Microsoft, Saudi Aramco, Google (GOOG), and Amazon (AMZN) as the only trillion-dollar companies, data from Companies Market Cap showed.

CompaniesMarketCap

Another tech company, Oracle’s stock ORCL price has also experienced a significant rise in value over the past seven months. ORCL reached a peak price of $121.36 on Wednesday, July 19 after opening the year on January 3 with a relatively smaller price of $82.47, a 47% increase YTD. With this Oracle has climbed above Coca-Cola (KO), PepsiCo (PEP), Alibaba (BABA), and Bank of America (BAC) thanks to its more than $320 billion company market cap.

TradingView

Commenting on the recent tech rally, Tesla boss and Twitter owner Elon Musk described recent happenings in the tech industry with an eye on the $127 billion injection into the market values of Microsoft and Nvidia as “crazy times”.

The two companies currently have a combined $3.9 trillion in market cap – much of this comes from the optimism investors attached to ChatGPT, an AI chatbot by OpenAI, a company backed by Microsoft.

While Musk’s comments were about Microsoft and Nvidia’s recent rally, TSLA, the stock of Tesla has been ascending too spurred by the electric vehicle car maker’s incorporation of AI.

One of the significant moves into AI is its humanoid robot which is expected to complete “unsafe, repetitive or boring tasks.” The company has increased by more than 150% in value YTD.

Crazy times

— Elon Musk (@elonmusk) July 18, 2023

The chatbots race

In addition to the subscription prices, Microsoft also announced other AI developments such as updates to its chatbot Bing, in its quest to stay up to date with competition.

AI-powered chatbots became a hit following the launch of OpenAI’s ChatGPT to immediate success. Google also followed suit and launched its own – Bard, while in Asia, Baidu also came up with a Chinese version known as Ernie Bot.

With many other chatbots released on the market this year, Microsoft has added visual search to its Bing Chat, after Google recently introduced an image search feature for Bard.

According to Microsoft’s announcement on Tuesday, July 18, users can now upload images to Bing chatbot and ask for more information about it.

“Bing can understand the context of an image, interpret it, and answer questions about it,” said Microsoft.

“Whether you’re travelling to a new city on vacation and asking about the architecture of a particular building or at home trying to come up with lunch ideas based on the contents of your fridge, upload the image into Bing Chat and use it to harness the web’s knowledge to get you answers.”

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://metanews.com/kuwait-implements-total-ban-on-cryptocurrency-activities/

- :has

- :is

- :not

- $3

- $UP

- 14

- 19

- 20

- 2022

- 2023

- 50

- 51

- 67

- 9

- a

- About

- about IT

- above

- activities

- added

- adding

- addition

- After

- AI

- AI chatbot

- AI services

- Alibaba

- All

- already

- also

- Amazon

- america

- among

- an

- Analysts

- and

- announced

- Announcement

- answer

- answers

- Apple

- architecture

- ARE

- artificial

- artificial intelligence

- Artificial intelligence (AI)

- AS

- asia

- Assets

- assured

- At

- backed

- Baidu

- Ban

- Bank

- Bank of America

- based

- basis

- BE

- became

- been

- between

- Billion

- Bing

- Boring

- BOSS

- Building

- bull

- Bull Run

- business

- by

- Calendar

- came

- CAN

- cap

- capitalization

- car

- Catalyst

- centralized

- change

- chatbot

- chatbots

- ChatGPT

- chinese

- Chips

- City

- Climbed

- closed

- CNBC

- coca-cola

- combined

- come

- comes

- comments

- Companies

- company

- Company’s

- competition

- competitors

- complete

- compliance

- Consider

- contents

- context

- CORPORATION

- Cost

- cryptocurrency

- Currently

- Customers

- data

- Date

- Days

- Development

- developments

- develops

- different

- documents

- due

- Early

- Electric

- electric vehicle

- Elon

- Elon Musk

- emails

- Enterprise

- exchanging

- existing

- expected

- experienced

- eye

- Feature

- financial

- Firm

- firms

- First

- followed

- following

- For

- Foray

- Forbes

- Friday

- from

- General

- General Motors

- get

- giant

- Golden

- graph

- Growth

- Hands

- harness

- Have

- High

- Hit

- Home

- HTML

- HTTPS

- IBM

- ideas

- image

- Image Search

- images

- immediate

- implements

- in

- Increase

- increased

- industry

- information

- Intelligence

- International

- international business

- into

- introduced

- Investments

- Investors

- IT

- ITS

- January

- join

- joined

- Joins

- jpg

- July

- Jumped

- knowledge

- known

- kuwait

- latest

- launch

- launched

- like

- Line

- lunch

- machine

- major

- many

- Market

- Market Cap

- Market Capitalization

- Market Values

- Markets

- max-width

- Microsoft

- monthly

- months

- more

- Motors

- moves

- much

- Musk

- New

- now

- Nvidia

- of

- on

- only

- OpenAI

- opened

- opening

- Optimism

- or

- oracle

- ORCL

- Other

- out

- over

- own

- owner

- particular

- past

- Pay

- Peak

- pepsico

- plans

- plato

- Plato Data Intelligence

- PlatoData

- policies

- positive

- powered

- price

- Prices

- primarily

- privacy

- productivity

- Products

- Pushing

- Quarter

- quest

- Questions

- rally

- range

- reached

- reaching

- Read

- recent

- recently

- relatively

- release

- released

- repetitive

- report

- respectively

- Rise

- Rival

- robot

- rollout

- Run

- Said

- Saudi

- Saudi Aramco

- Search

- sector

- security

- seen

- service

- Services

- set

- seven

- Share

- Shareholders

- shed

- should

- showed

- significant

- smaller

- soared

- stages

- Statement

- stay

- stock

- subscription

- success

- such

- Suit

- tasks

- tech

- Tech Company

- tech giant

- tech industry

- Technology

- technology companies

- Tesla

- Testing

- than

- Thanks

- that

- The

- their

- Them

- this

- this year

- three

- timelines

- to

- too

- tool

- Total

- TradingView

- Trillion

- true

- TSLA

- Tuesday

- two

- understand

- unlock

- Updates

- use

- users

- vacation

- value

- Values

- vehicle

- version

- was

- Wave

- Way..

- we

- Wednesday

- Weeks

- were

- when

- which

- while

- will

- with

- Work

- would

- writing

- Yahoo

- year

- yet

- You

- Your

- zephyrnet