- According to Chainalysis, in 2022, illicit addresses from suspicious and legitimate organizations sent nearly $23.8 billion worth of digital currency.

- A Know-Your-Business(KYB) system generally obtains comprehensive information about business partners or clients.

- A KYW system is specifically designed to assess the risks and assets of the crypto wallet.

The crypto industry’s success, redundancy, and evolutionary concept led to the significant rise of the web3 community. Bitcoin redefined our views on financial systems. It broke the barriers and limitations of centralization, showcasing a better, more efficient, and safer way of securing money. Soon, its fame and revolutionary technology inspired many altcoins, each striving to deliver something new to the industry. From Ether, which aimed to build an ecosystem where Bitcoin would thrive, to DogeCoin, which proved to be a valuable digital asset beyond its initial sectors.

These altcoins are among the thousands, each supporting the entire crypto industry. Its success was overwhelming. Unfortunately, the same glory and fame would lead others to use digital currency for nefarious reasons. Terrorist groups, thieves, and scammers soon utilized the anonymity of digital assets to launder millions of dollars in crypto. This would eventually also lead to a significant rate of crypto fraud, causing the industry to lose billions.

Crypto fraud is a common act today, and as digital assets become more mainstream, scammers have moved from targeting few individuals to building entire organizations to launder money and scam millions.

Due to this strife, anti-laundering tools have significantly improved over the years. Today, Know-your-Client systems have held together many financial institutes from preying scammers. Its success has led to the development of Know-your-Business(KYB), Know-your-Transaction(KTY), and Know-Your-Wallet(KYW) systems.

This article will highlight the evolution of these Anti-laundering systems in the crypto industry.

The Rise of Crypto Frauds

Crypto scams and hacks have evolved over the years. From MT Gox to the most recent FTX crash, showcase how to die the situation truly is.

Generally, blockchain security systems have an innate security feature that preserves data integrity. This is among the few reasons decentralized applications have grown in usage. Unfortunately, because the very concept of blockchain is merely two decades old, we still have yet to explore its full potential. As a result, the rise of crypto fraud and money laundering activities has cost billions of dollars, significantly reducing the industry’s value and credibility.

Crypto frauds have evolved from small-time startups and platforms to involving large organizations. For instance, crypto fraud in South Africa is at an all-time high. Its government’s positive take on crypto has allowed South Africa to become one of the best countries in the world. The variety of crypto infrastructure and the plethora of crypto payment gateway has enabled crypto traders to thrive significantly.

Also, Read Digital KYC system’s ability to revolutionize the African Fintech Industry.

Its progress in adopting and implementing digital currency even outweighs Africa’s top crypto trading volume, Nigeria. Unfortunately, because of this positive take, many scammers and hackers thrive in its environment. According to authorities and analysts within SA, crypto fraud cases have shot up by 25% during the last quarter of 2023. Its government is in the process of developing a new legal framework aimed at curbing such activities. It has also cautioned all crypto-based organizations to tread carefully; any sign of fraudulent activity will lead to an immediate shutdown.

Aside from crypto frauds, money laundering activities in the industry have become a rising concern. According to Chainalysis, in 2022, illicit addresses from suspicious and legitimate organizations sent nearly $23.8 billion worth of digital currency. Money laundering activities are among the main reasons many governments fear digital currency. Its anonymous nature, speed, and decentralized nature make it impossible to pinpoint the exact source and destination of the transfer. Furthermore, organizations like Tornado Mixer have worsened their state. Their tools and systems have significantly empowered money laundering activities over the years.

Unfortunately, standard blockchain security tools cannot mitigate this issue. As a result, security experts and developers have collaborated to design several systems to address this issue specifically. This led to the development of the KYC systems, which evolved, providing a wide range of security measures amid the ecosystem.

What are KYC systems?

A Know Your Customer (KYC) system is a security feature specifically designed to counteract money laundering activity. In 2002, during the peak of web2 systems, many banks, governments, and organizations quickly identified a rising trend: money laundering. For those unaware, money laundering can destabilize a nation’s economy.

Through these illicit activities, criminals can “clean” currency acquired through illegal activities like drug trafficking and tax evasion, among other financial crimes. If unaddressed, a substantial inflow of money earned through money laundering erodes the trust of the financial system. In addition, economies generally stagnate by avoiding tax, eventually leading to a collapse. The Reserve Bank of India introduced the first KYC guideline for banks, but later on, developers would implement these rules into fully functioning systems.

The basic components of a KYC system.[Photo/Medium]

The general functions of a KYC system revolve around gathering credible information about the customer to legitimize their identity. It requires confirmation of end-user information and develops a pattern for daily transactions. This system generally is the first stage of anti-money laundering(AML) systems.

Also, Read KuCoin exchange introduces a new KYC system.

Recently, KYC systems have significantly grown in popularity to avoid any issues. After the FTX crash, many centralized exchanges had to double down on their blockchain security. Integrating the KYC system with their blockchain security tools provides additional reassurance for regulators and crypto traders.

Custodial/Centralized exchanges generally secure users’ private keys to safeguard their hot wallets. Despite numerous skeptics over their functionality, they generally hold the entire crypto industry together. For instance, Binance calculates at least $9 billion worth of crypto assets and holds most of the Bitcoin. If such an organization were to crash, it would doom for the entire industry.

A KYC system can vary depending on its manufacturer. With AI growing in popularity, many blockchain security systems have integrated AI with the KYC system to provide a self-learning system that detects anomalies within a customer’s transaction.

The evolution of the KYC systems

KYC systems’ success led to more AML systems to bolster blockchain security. Unfortunately, security in the digital world is a never-ending battle between security experts and hackers. The constant tug of war has forced many developers to improve security policies and tools, and the KYC system is no different. Below are the various evolutions of the KYC systems:

Know-Your-Business(KYB) system

The crypto industry is an expansive franchise that gradually grows as time moves. Today, many startups and organizations have sought glory and wealth, and the systems further expand the attack surface of hackers. The KYB system soon followed after establishing the KYC system in the crypto industry. A Know-Your-Business(KYB) system generally obtains comprehensive information about business partners or clients.

Today, many organizations send and receive millions in cryptocurrency; thus, developing an AML system was close. KYB systems and policies are mandatory for most regulatory bodies, building trust between clients, government, and organizations. However, a KYB system has a lengthy check system that is often energy-consuming and requires high-end processing.

A KYB system enclaves multiple parts in dealing with organizations, and its functionalities can extend beyond an organization’s bodies. Crypto companies must analyze and verify their client’s business and financial information. This protects them from many AML activities, and document fraud guarantees the organization’s legitimacy.

A KYB system provides the means to keep a company, assets, and reputation intact. After the FTX crash, KYBs have become a criterion within the crypto company. The loss incurred by an organization dealing with money laundering often reads in millions and billions.

Know-Your-Transaction(KYT) system

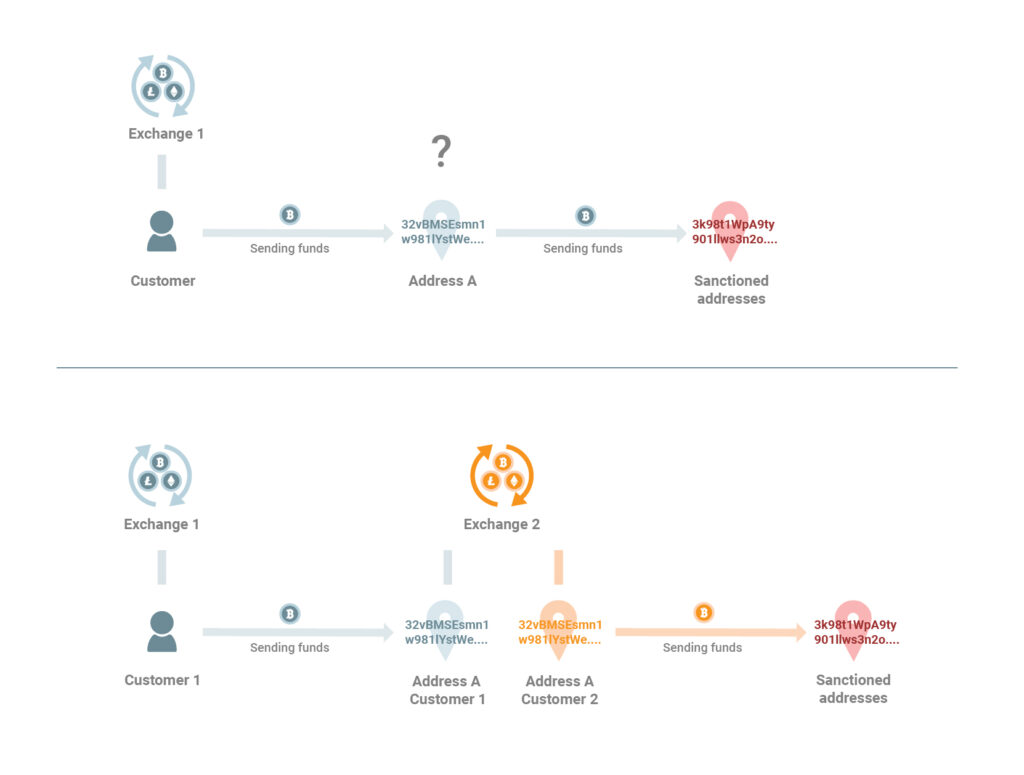

KYC and KYB systems existed long before digital currency gained entire ecosystems. Its functionalities and purpose were widely used in traditional banks but would later transition into the digital age. Know-Your-Transaction(KYT) system is an offshoot of both AML systems and significantly picked up after Bitcoin became more mainstream.

A KYT system generally monitors transactions financial institutions hold. It’s generally the eagle’s eye watching out for any money laundering activities. Its standard functionality involves monitoring, evaluating, and determining whether the transaction is legal.

The basic parameters of KYT systems.[Photo/Chainalysis]

The KYT system was designed after the dangers of digital assets became all too clear. It can collect information and process the risk of a customer’s transactions. Generally, crypto-based organizations can utilize this blockchain security tool to identify information and conduct risk-level analysis.

Also, Read Blockchain applications Africans should be excited about.

Initially, the launch of a KYT system presented numerous challenges. For instance, many experts claimed it infringed on the basic blockchain concept. By adding monitoring systems, it represented a centralized entity. Unfortunately, this claim would sink amid the rising crypto frauds and AML activities. Custodial exchanges have already presented a centralized entity amid the crypto industry, providing the perfect testing growth for a KYT system.

Depending on the developer, A KYT system can provide details on all crypto transactions within a custodial exchange. In addition, it can highlight possible suspicious patterns, raising a flag and altering the administration.

The need for a KYT system is still a heated debate, but it has become necessary in various regions after the crash.

Know-Your-Wallet(KYW) system

The KYC system’s most recent and last evolution is the Know-Your-Wallet(KYW) system. Over the years, it became apparent that crypto wallets are often the primary target point for hackers. Most hacks and scams occur via an individual giving the details of their crypto wallet. This has raised a negative reputation in the crypto industry. Many newbie Crypto traders are cautioned to be very careful about which kind of crypto walt they use.

A KYW system is specifically designed to assess the risks and assets of the crypto wallet. It collects data on the owners and their organizations to confirm the legitimacy of the crypto wallets. In some organizations, a KYW system identifies the legitimacy of the crypto asset.

Companies like CryptoPass have designed a KYW system that calculated the risk core to identify potentially compromised crypto wallets. Experts will also identify wallets that undergo unusual transactions through these blockchain security tools. Other organizations offer KYW systems to individual traders to identify and verify the eligibility of an exchange’s hot wallet.

The concept of a KYW system is still new, but its outlook and approach to blockchain security will quickly catch up.

Blockchain security has constantly evolved through the numerous trials and losses it has experienced. A KYC system is a rising trend among many exchanges as it represents a symbol of trust and security. KYB, KYT, and KYW systems are variants of the original. They offer different services to different groups but ultimately strive to prevent money laundering in the crypto industry.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://web3africa.news/2023/11/01/news/kyc-systems-evolving-to-bolster-cryptocurrency/

- :has

- :is

- :where

- $9 Billion

- $UP

- 2022

- 2023

- 32

- 8

- a

- ability

- About

- According

- acquired

- Act

- activities

- activity

- adding

- addition

- Additional

- address

- addresses

- administration

- Adopting

- africa

- African

- After

- age

- AI

- aimed

- All

- allowed

- already

- also

- Altcoins

- Amid

- AML

- among

- an

- analysis

- Analysts

- analyze

- and

- anomalies

- Anonymity

- Anonymous

- any

- apparent

- applications

- approach

- ARE

- around

- article

- AS

- assess

- asset

- Assets

- At

- attack

- Authorities

- avoid

- avoiding

- Bank

- Bank of India

- Banks

- barriers

- basic

- Battle

- BE

- became

- because

- become

- before

- below

- BEST

- Better

- between

- Beyond

- Billion

- billions

- binance

- Bitcoin

- blockchain

- Blockchain security

- bodies

- bolster

- both

- Broke

- build

- Building

- business

- but

- by

- calculated

- calculates

- CAN

- cannot

- careful

- carefully

- cases

- Catch

- causing

- Centralization

- centralized

- Centralized Exchanges

- chainalysis

- challenges

- check

- claim

- claimed

- clear

- clients

- Close

- CNN

- CO

- collaborated

- Collapse

- collect

- Common

- community

- Companies

- company

- components

- comprehensive

- Compromised

- concept

- Concern

- Conduct

- Confirm

- confirmation

- constant

- constantly

- Core

- Cost

- counteract

- countries

- Crash

- Credibility

- credible

- Crimes

- Criminals

- crypto

- crypto asset

- crypto companies

- crypto company

- Crypto ecosystem

- crypto fraud

- Crypto frauds

- Crypto Industry

- Crypto infrastructure

- crypto payment

- crypto traders

- crypto trading

- crypto trading volume

- crypto transactions

- Crypto wallet

- crypto wallets

- crypto-assets

- crypto-based

- cryptocurrency

- curbing

- Currency

- custodial

- custodial exchanges

- customer

- daily

- daily transactions

- dangers

- data

- dealing

- debate

- decades

- decentralized

- Decentralized Applications

- deliver

- Depending

- Design

- designed

- Despite

- destination

- details

- determining

- Developer

- developers

- developing

- Development

- develops

- Die

- different

- digital

- digital age

- Digital Asset

- Digital Assets

- digital currency

- digital world

- Dogecoin

- dollars

- doom

- double

- down

- drug

- due

- during

- each

- earned

- economies

- economy

- ecosystem

- Ecosystems

- efficient

- eligibility

- empowered

- enabled

- Entire

- entity

- Environment

- establishing

- Ether

- evaluating

- evasion

- Even

- eventually

- evolution

- evolutions

- evolved

- exchange

- Exchanges

- excited

- Expand

- expansive

- experienced

- experts

- explore

- extend

- eye

- FAME

- fear

- Feature

- few

- financial

- financial crimes

- financial information

- Financial institutions

- financial system

- financial systems

- fintech

- First

- followed

- For

- Framework

- franchise

- fraud

- fraudulent

- fraudulent activity

- from

- FTX

- ftx crash

- full

- fully

- functionalities

- functionality

- functioning

- functions

- further

- Furthermore

- gained

- gateway

- gathering

- General

- generally

- Giving

- glory

- Government

- Governments

- Gox

- gradually

- Group’s

- Growing

- grown

- Grows

- Growth

- guarantees

- hackers

- hacks

- had

- Have

- Held

- High

- High-End

- Highlight

- hold

- holds

- HOT

- Hot wallet

- How

- How To

- However

- HTTPS

- identified

- identifies

- identify

- Identity

- if

- Illegal

- illicit

- immediate

- implement

- implementing

- impossible

- improve

- improved

- in

- incurred

- india

- individual

- individuals

- industry

- industry’s

- information

- Infrastructure

- initial

- innate

- inspired

- instance

- institutions

- integrated

- Integrating

- integrity

- INTERPOL

- into

- introduced

- Introduces

- involving

- issue

- issues

- IT

- ITS

- jpg

- Keep

- keys

- Kind

- Know

- Know Your Customer

- kyb

- KYC

- kyt

- large

- Last

- later

- launch

- Laundering

- lead

- leading

- least

- Led

- Legal

- legal framework

- legitimacy

- legitimate

- like

- limitations

- Long

- lose

- loss

- losses

- Main

- Mainstream

- make

- mandatory

- Manufacturer

- many

- max-width

- means

- measures

- merely

- millions

- Mitigate

- mixer

- money

- Money Laundering

- monitoring

- monitors

- more

- more efficient

- most

- moved

- moves

- MT

- multiple

- must

- Nations

- Nature

- nearly

- necessary

- Need

- negative

- New

- Nigeria

- no

- numerous

- obtains

- of

- offer

- often

- Old

- on

- ONE

- or

- organization

- organizations

- original

- Other

- Others

- our

- out

- Outlook

- over

- overwhelming

- owners

- parameters

- partners

- parts

- Pattern

- patterns

- payment

- Peak

- perfect

- picked

- Platforms

- plato

- Plato Data Intelligence

- PlatoData

- plethora

- Point

- policies

- popularity

- positive

- possible

- potential

- potentially

- presented

- prevent

- primary

- private

- Private Keys

- process

- processing

- Progress

- proved

- provide

- provides

- providing

- purpose

- Quarter

- quickly

- raised

- raising

- range

- Rate

- Read

- reasons

- reassurance

- receive

- recent

- reducing

- regions

- Regulators

- regulatory

- represented

- represents

- reputation

- requires

- Reserve

- reserve bank

- Reserve Bank of India

- result

- revolutionary

- revolutionize

- Rise

- rising

- Risk

- risks

- rules

- SA

- safer

- same

- Scam

- Scammers

- scams

- Sectors

- secure

- securing

- security

- Security Measures

- security policies

- send

- sent

- Services

- several

- shot

- should

- showcase

- showcasing

- shutdown

- sign

- significant

- significantly

- situation

- Skeptics

- some

- something

- soon

- sought

- Source

- South

- South Africa

- specifically

- speed

- Stage

- stagnate

- standard

- Startups

- State

- Still

- strive

- striving

- substantial

- success

- such

- Supporting

- Surface

- suspicious

- symbol

- system

- Systems

- Take

- Target

- targeting

- tax

- Tax Evasion

- Technology

- terrorist

- Testing

- that

- The

- The Reserve Bank of India

- the world

- their

- Them

- These

- they

- this

- those

- thousands

- Thrive

- Through

- Thus

- time

- to

- today

- together

- too

- tool

- tools

- top

- tornado

- Traders

- Trading

- trading volume

- traditional

- transaction

- Transactions

- transfer

- transition

- tread

- Trend

- trials

- true

- truly

- Trust

- two

- Ultimately

- undergo

- unfortunately

- Usage

- use

- used

- utilize

- utilized

- Valuable

- value

- variety

- various

- verify

- very

- via

- views

- volume

- Wallet

- Wallets

- war

- was

- watching

- Way..

- we

- Wealth

- Web2

- Web3

- Web3 community

- were

- whether

- which

- wide

- Wide range

- widely

- will

- with

- within

- world

- worth

- would

- years

- yet

- Your

- ZenLedger

- zephyrnet