TL;DR Breakdown

- Litecoin price analysis shows a bearish market trend

- LTC prices have seen support at the $97.8 level

- Litecoin prices are down by 3.08 percent

The most recent Litecoin price analysis reaffirms a strong bearish trend in the market, with the price plummeting to its lowest point after 17 December 2020. The cryptocurrency is finding support against the trend, and this provides buyers a glimmer of hope. The price has been trading below the $100.0 mark, establishing a lower low today. The bears were able to flee the bullish surge this week, despite the fact that the market was in their favor last week. The value of the coin is currently $100.88, and it could drop even lower if selling pressure grows.

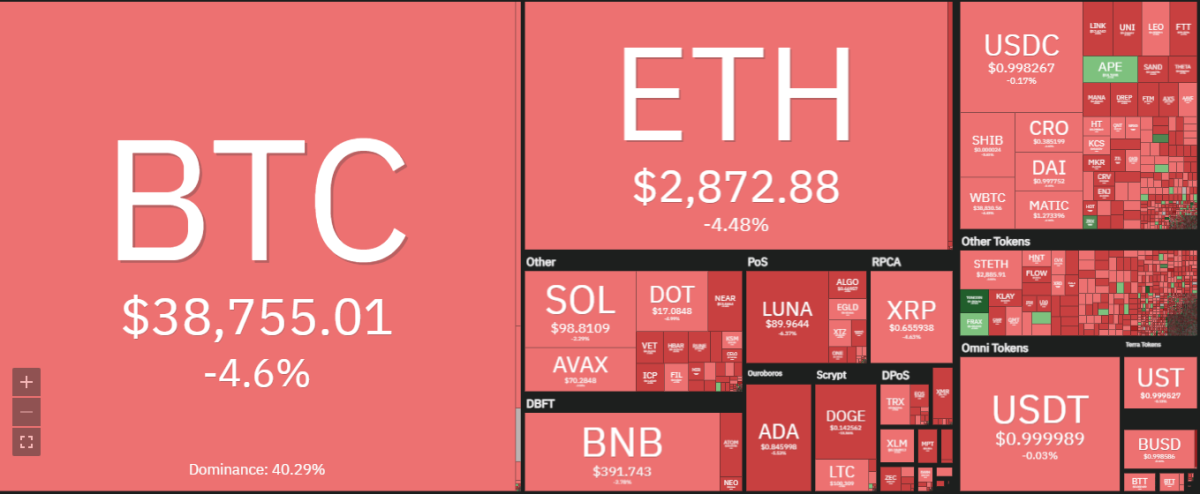

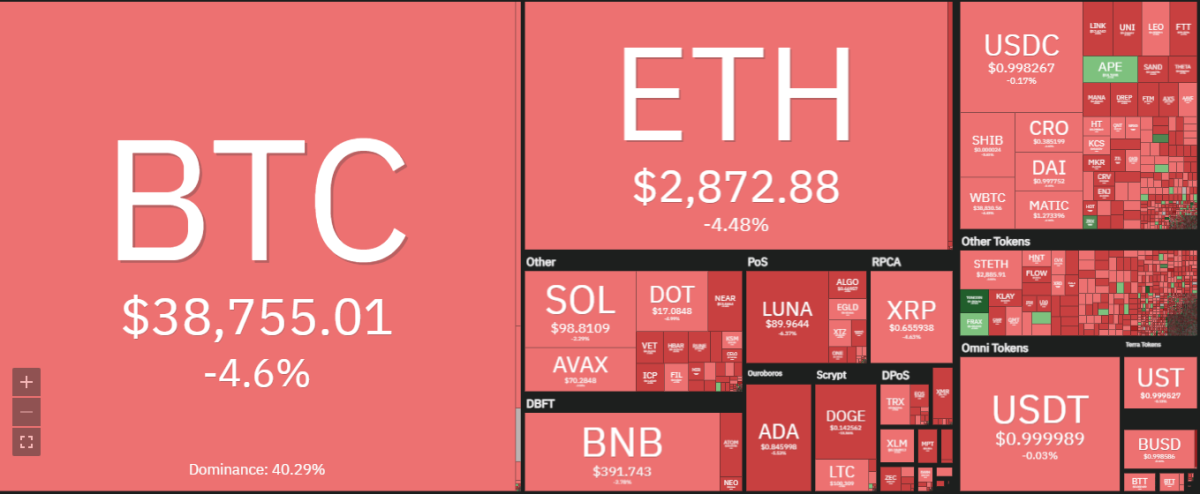

Litecoin’s price movement over the last 24 hours reveals the cryptocurrency has been trading in a range of $97.59 and $104.76 while the total market dominance remains at 0.39%. The 24-hour trading volume is $731,815,704.53 and the circulating supply is 7 billion LTC. The bulls are however seen to be trying to maintain the $100 level in the last few hours of trading.

Litecoin price action on a 1-day timeframe: LTC prices trade along with the 21-day exponential moving average in the $97.7 level

Over the last 24 hours, Litecoin’s price has been trading along with a range which is found between the 21-day EMA and 38.2% Fib retracement level from its recent high of $104.76 to the low of $96.08 which is currently at $97.7 level. The price is around the middle of its range, indicating a neutral market condition, and could change depending on the relative strength between buyers and sellers. The MACD histogram shows a bull trend after it moved above zero, with both lines starting to move up as well.

The LTC price is bearish on the 1-day price chart as the moving averages are sloping downwards, with the 50 SMA (Simple Moving Average) crossing below the 100 SMA on the 4-hour chart. This is a confirmation of bearish momentum in the market as the 200 SMA has not been breached. The RSI is at 37.99, indicating that prices have further to fall as the market is oversold. Prices could reach the $97.8 level of support before a possible bounce back up.

Litecoin price action on a 4-hour price chart: Recent developments and further technical indications

Litecoin price analysis on the 4-hour price chart indicates a bearish trend as the price has been trading below the 21-day EMA with a bearish crossover of moving averages. Furthermore, the RSI indicator is also at 38.35 showing that prices could continue their downward momentum. Price action on this chart shows that the bulls have not been able to retest their previous highs despite multiple attempts found between the $102 to $103 levels.

Bulls need to maintain the $100 level and push prices up to the $103.5 level, where it will encounter resistance from the 100 SMA. A move above this level could see Litecoin prices target the $106 and $108 levels in the short term. On the other hand, if the bears continue to exert their selling pressure, we could see Litecoin prices drop to the $97 level of support. The MACD line is on the verge of a bearish crossover as the signal line is about to move below the histogram. This could see prices continue their downward momentum in the market.

Litecoin price analysis conclusion

Litecoin’s current market sentiment is bearish so far, ridden by the ongoing downward trend. With prices failing to breach the $100 level, it has shown signs of weakness which can prompt further declines with a possible drop to $97.8 support level insight. However, the possibility of Litecoin breaching its previous high is also likely given that there are multiple buyouts on the 4-hour chart.

Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

- "

- 100

- 2020

- 7

- About

- Action

- advice

- analysis

- around

- average

- bearish

- Bearish Momentum

- Bears

- Billion

- breach

- Bullish

- Bulls

- buyers

- change

- Coin

- condition

- continue

- could

- cryptocurrency

- Current

- Currently

- Depending

- Despite

- developments

- down

- Drop

- EMA

- finding

- found

- further

- High

- holds

- HTTPS

- image

- information

- investment

- Investments

- IT

- Level

- liability

- likely

- Line

- Litecoin

- Litecoin price

- LTC

- made

- maintain

- Making

- mark

- Market

- Momentum

- most

- move

- movement

- moving

- multiple

- ongoing

- Other

- Point

- possibility

- possible

- pressure

- previous

- price

- Price Analysis

- professional

- provides

- qualified

- range

- reach

- reaffirms

- recommend

- research

- Sellers

- sentiment

- Short

- Signs

- Simple

- So

- strength

- strong

- supply

- support

- support level

- surge

- Target

- Technical

- timeframe

- today

- trade

- Trading

- value

- volume

- week

- while

- zero