LUNA surges 20% amid the rise of staking on Terra and the popularity of DEFI and now the crypto network attracts more DEFI users than ever so let’s read more today in our latest altcoin news today.

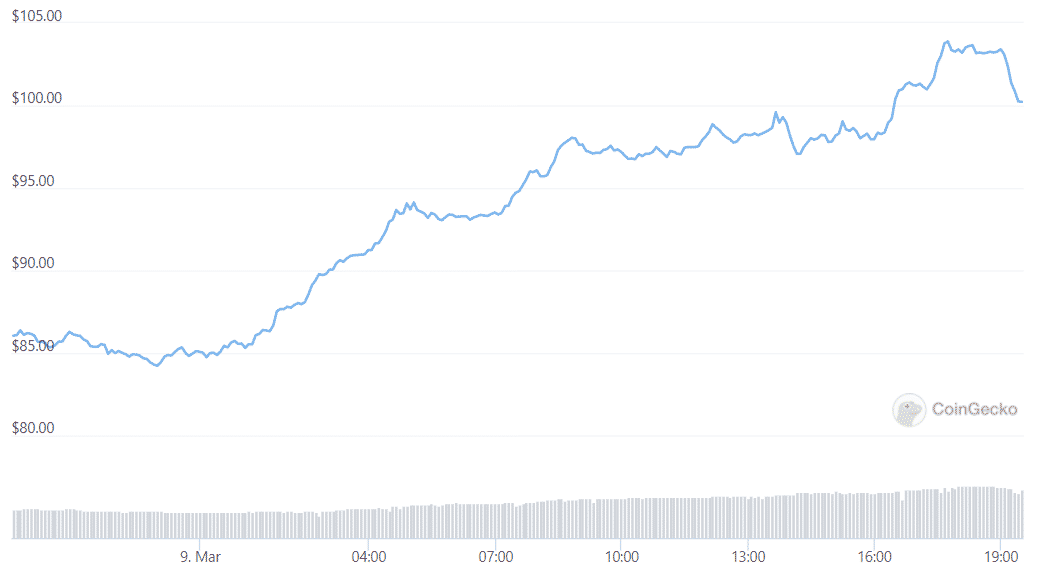

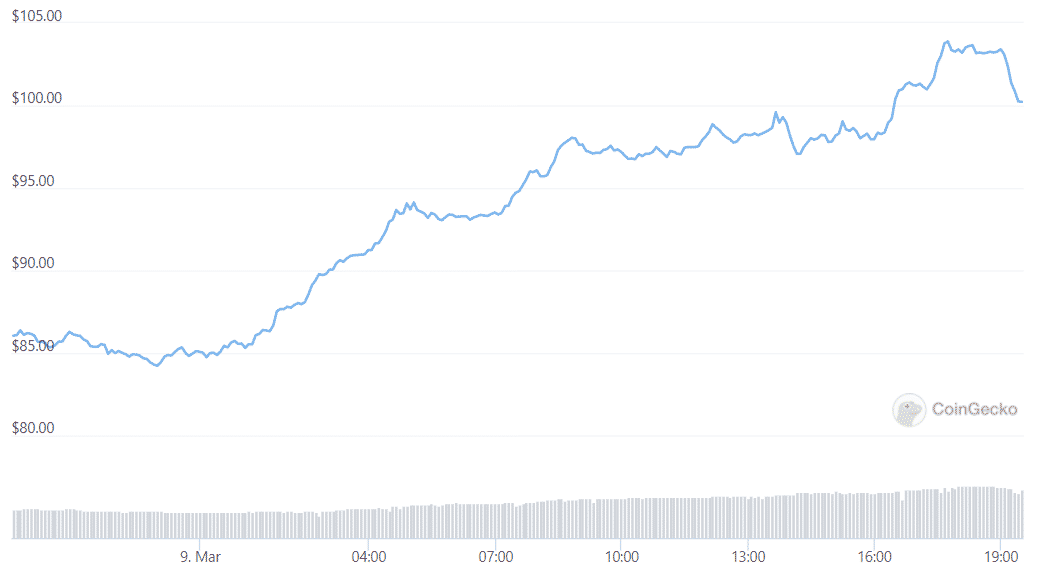

LUNA surges 20% over the past 24-hours with the crypto network attracting more DEFI users than ever. The cryptocurrency is now trading hands at $98 which is a major rise given that it was trading at about $77 on Monday. The current price puts LUNA within 5% of the ATH of $103.43 seen past December. Terra is the crypto network built using the Cosmos development kit SDK. The project attracted a lot of attention as of late because of the steady rise of the US-based stablecoins UST. LUNA on the other hand serves as a staking and governance token which allows users to vote and make proposals about how the protocol can be improved.

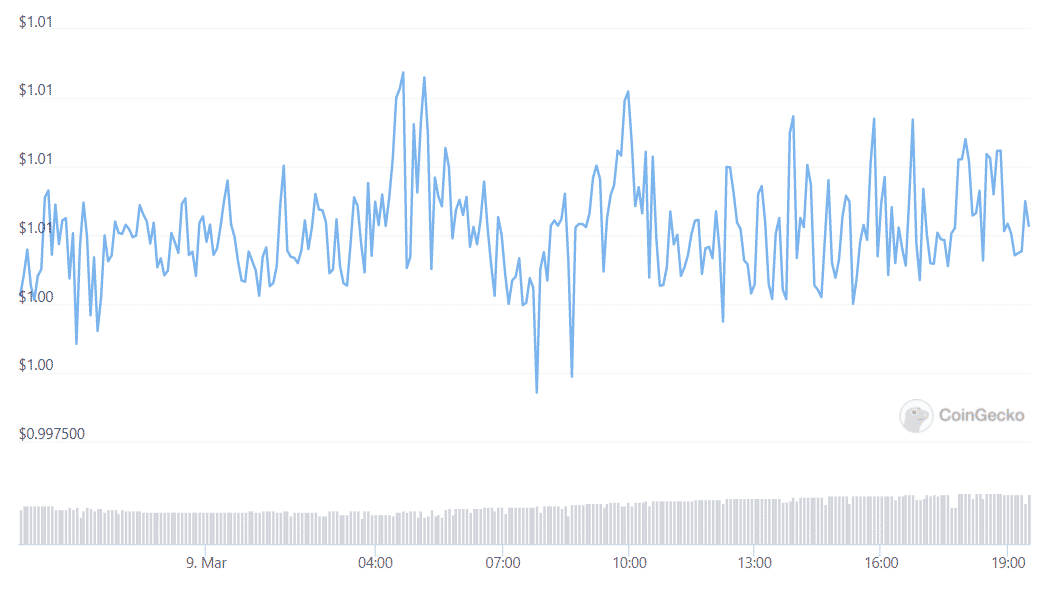

Each time $1 worth of UST is mined, an equal amount of LUNA is destroyed. The opposite is also true so to create $1 worth of LUNA users have to destroy $1 of UST. The mechanism helps keep the UST pegged to the dollar and the market participants are incentivized to swap the UST for LUNA which will destroy UST and will reduce supply to push the value of UST back to $1.

UST is the biggest decentralized stablecoin on the market and the fourth-biggest stablecoin overall. The biggest stablecoins are Tether and USD Coin with a market cap of $80 billion and $52 billion. After the price performance, LUNA became the most staked cryptocurrency overtaking ETH and Solana as per the data from Staking Rewards. Staking is the process of freezing a cryptocurrency locking it up on the inside.

The reasons are different but for many investors, the promise of earning a steady reward is most enticing. Staking on Terra now earns a little over 6.13% while the rewards on Solana and ETH also increased. The final bullish stat from tErra revolves around DEFI activity mainly because of the price of LUNA as well as a whole array of new applications so Terra is now the crypto’s second-biggest DEFI ecosystem after Ethereum.

It now commands over $28 billion and a little over 11% on the DEFI marekt share according to DeFi Llama. There are more than $143 billion around various ETH-based DEFI protocols with so other metrics on the rise, LUNA’s price surge suggests the market participants are paying close attention.

- About

- According

- activity

- Altcoin

- amount

- applications

- around

- Biggest

- Billion

- Bullish

- Coin

- CoinGecko

- Cosmos

- crypto

- cryptocurrency

- Current

- data

- decentralized

- DeFi

- destroy

- destroyed

- Development

- different

- Dollar

- ecosystem

- ETH

- ethereum

- governance

- helps

- How

- HTTPS

- increased

- Investors

- IT

- little

- major

- Market

- Market Cap

- Metrics

- Monday

- most

- network

- Other

- participants

- performance

- price

- price surge

- process

- project

- protocol

- protocols

- reasons

- reduce

- Rewards

- sdk

- Share

- So

- Solana

- stablecoin

- Stablecoins

- Staking

- supply

- surge

- Terra

- Tether

- time

- today

- token

- Trading

- USD

- USD Coin

- users

- value

- Vote

- within

- worth