The world of business is no stranger to change. In recent years, the upheaval has been profound, sweeping across industries and borders. With the assistance of Mambu cloud-native SaaS platform and remarkable benchmarking data, financial businesses have found a way to weather uncertainty and disruption, and emerge stronger and more resilient.

The years following 2020 have been marked by significant disruption, making resilience and adaptability essential for thriving in the current landscape. In the wake of the COVID-19 pandemic, inflation soared to 8.8% by the end of 2022 and 6.5% for the end of 2023, the highest numbers since 1982.

Emerging data shows that the traditional response of focusing on short- and medium-term earnings has been rendered ineffective. What’s needed is the ability to adapt and absorb changes with agility.

Embracing Innovation with Mambu

The Turning turbulence into triumph report explores how personal lenders, SME lenders, and neobanks have navigated the unpredictable outlook of recent times. From this analysis, we can derive valuable lessons that are particularly relevant in today’s climate.

The benchmarking report illustrates how agility in embracing innovation is key to thriving amid disruption. This is where Mambu excels, offering the core agility needed to weather turbulent times. Mambu’s global reach and adaptability have been proven across various sectors, demonstrating consistent success in navigating uncertainty.

Mambu has proven to be a critical ally for financial institutions (FIs) striving to weather disruptive storms. With Mambu at the core, banks can pivot quickly and embrace innovation.

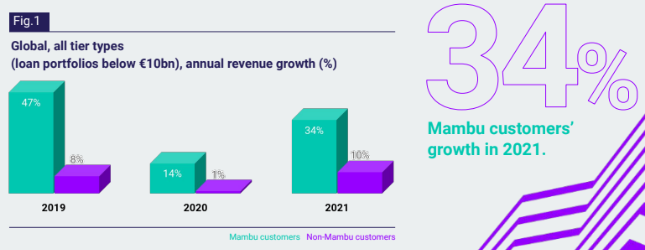

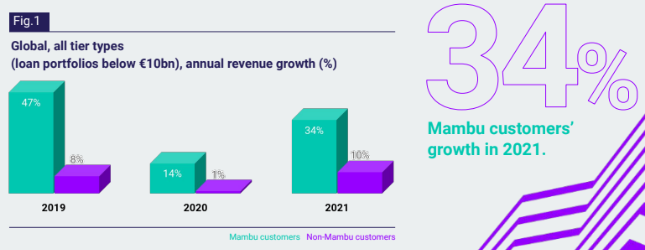

According to the benchmarking report in 2019, Mambu customers averaged 47% revenue growth, dropping to 14% when the pandemic hit in 2020. But the data interestingly reflects the resurgence of FIs on Mambu’s platform in 2021, in comparison with the rest of the market.

Mambu Benchmarking Showcases Differentiation and Speed in the Market

With Mambu, differentiation and speed are central. The core SaaS platform empowers customers to building a differentiated and personalised experience, creating a rich customer experience without relying on stretched DevOps teams, by enabling the selection of best components across the tech stack.

By utilising configurable fields instead of lines of code, Mambu offers unparalleled speed to market. The API-first architecture further enables the rapid adoption of new technologies. The platform’s configuration fields allow products to be built quickly, without reliance on a DevOps team.

This has translated into a remarkable performance, as the benchmarking study illustrates: Mambu customers achieved a remarkable 47% revenue growth in 2019, showcasing resilience even during the pandemic, with growth rates bouncing back to 34% in 2021.

In 2020, despite the pandemic, Mambu’s customers averaged 14% growth, compared to just 1% in the market. In 2021, the 34% revenue growth achieved by Mambu customers dwarfed the 10% gained by the rest of the market.

With Mambu’s core banking platform, businesses have found a way to navigate the storm, demonstrating success across global regions, segments, and sizes.

Sector-Specific Insights

Personal Lending

While the pandemic hit personal lending hard, Mambu’s customers were better insulated. During 2020, growth in balances for them slowed only marginally from 52% to 44%, while the market experienced a 22% contraction. Mambu’s agility enabled lenders to adapt in real-time, maintaining or even growing their portfolios.

SME Lending

The Mambu platform also demonstrated its value in the SME lending sector, enabling customers to return to 28% growth in 2021. Those who can address short- and long-term SME concerns with innovative features will continue to grow despite ongoing disruption.

Neobanks

Digital banking, fostered by the pandemic, has been a boon for neobanks as demand for digital banking soared during this period. Mambu benchmarking shows its flexibility helped neobanks using Mambu to maintain above-market growth rates throughout the pandemic, with a revenue growth of 55% in 2021 compared to 10% of the market.. This illustrates how Mambu can help capture the rising demand for digital banking.

Regional focus: EMEA and Latin America

The benchmarking report also analysed regional deposit and revenue growth for all financial institutions operating on the Mambu platform in regions like EMEA and in Latin America (LATAM) — the region hardest hit by COVID-19.

In LATAM, Mambu has helped financial institutions avoid negative growth. Unlike their peers, financial institutions working with Mambu in LATAM saw continued growth, achieving 32% and 31% revenue growth for middle and upper tier FIs in 2021, standing out positively against their peers even during the pandemic.

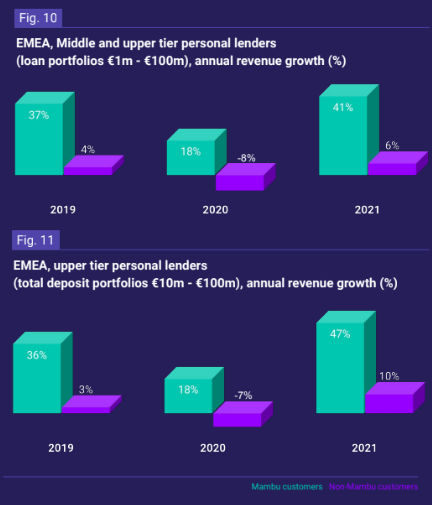

Meanwhile in the area broadly known as Europe, the Middle East, and Africa region (EMEA), while all sectors experienced slowdowns in 2020, benchmarking shows that Mambu customers across personal lending, SME lending, and neobank segments all experienced less pervasive effects.

They also rebounded much more strongly than their counterparts when the economy began to recover the following year. For instance in the personal lending segment, middle- and lower-tier FIs that were Mambu customers saw their revenues slashed by half in 2020, from 37% to 18%. But following market recovery in 2021, Mambu customers in this segment shot up to 41% in revenue growth, ahead of even pre-pandemic numbers.

In contrast, the rest of the EMEA personal lending market witnessed a contraction of 8% in 2020, and the 2021 recovery experienced only a modest 6% growth.

A New Era of Resilience

This may indeed be an age of disruption, but it also marks a new era of resilience. With Mambu’s agile technology, financial institutions around the world have not only weathered the storms but positioned themselves for growth in a future rife with uncertainty.

The Mambu benchmarking results unequivocally indicate that cloud-based SaaS banking systems like Mambu provide the core agility and responsiveness needed to navigate the events of the future. The consistency of these results across global regions is a compelling argument for all financial institutions, wherever they may be based.

In a world where change is the only constant, embracing innovation and swiftly adapting is key. The Mambu benchmarking report highlights the capabilities and provide the tools, insights, and resilience that will help usher the financial sector into an exciting new phase. With the right technology and a forward-thinking approach, FIs can pivot disruption into opportunities, and turn turbulence into triumph.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://fintechnews.sg/77108/sponsoredpost/mambu-benchmarking-marks-new-era-of-resilience-and-growth-for-lending-neobanks/

- :has

- :is

- :not

- :where

- $UP

- 2019

- 2020

- 2021

- 2022

- 2023

- 250

- 7

- 8

- a

- ability

- achieved

- achieving

- across

- adapt

- address

- Adoption

- africa

- against

- age

- agile

- ahead

- All

- allow

- Ally

- also

- america

- Amid

- an

- analysis

- and

- approach

- architecture

- ARE

- AREA

- argument

- around

- AS

- Assistance

- At

- avoid

- back

- balances

- Banking

- Banks

- based

- BE

- been

- began

- benchmarking

- BEST

- Better

- borders

- broadly

- Building

- built

- business

- businesses

- but

- by

- CAN

- capabilities

- caps

- capture

- central

- change

- Changes

- Climate

- code

- compared

- comparison

- compelling

- components

- Concerns

- Configuration

- consistent

- constant

- continue

- continued

- contraction

- contrast

- Core

- Core Banking

- COVID-19

- COVID-19 pandemic

- Creating

- critical

- Current

- customer

- customer experience

- Customers

- data

- Demand

- demonstrated

- demonstrating

- deposit

- Despite

- differentiated

- Differentiation

- digital

- digital banking

- Disruption

- disruptive

- Dropping

- during

- Earnings

- East

- economy

- effects

- embrace

- embracing

- EMEA

- emerge

- empowers

- enabled

- enables

- enabling

- end

- Era

- essential

- Europe

- Even

- events

- exciting

- experience

- experienced

- explores

- false

- Features

- Fields

- financial

- Financial institutions

- Financial sector

- fintech

- FIS

- Flexibility

- Focus

- focusing

- following

- For

- forward-thinking

- forward-thinking approach

- found

- friendly

- from

- further

- future

- gained

- Global

- Grow

- Growing

- Growth

- Half

- Hard

- Have

- help

- helped

- highest

- highlights

- Hit

- How

- HTTPS

- illustrates

- in

- indeed

- indicate

- industries

- inflation

- Innovation

- innovative

- insights

- instance

- instead

- institutions

- into

- IT

- ITS

- just

- Key

- known

- landscape

- LATAM

- Latin

- latin america

- lenders

- lending

- less

- Lessons

- like

- lines

- long-term

- maintain

- Maintaining

- Making

- Mambu

- marked

- Market

- max-width

- May..

- Middle

- Middle East

- modest

- more

- much

- Navigate

- navigating

- needed

- negative

- neobank

- Neobanks

- New

- New technologies

- no

- numbers

- of

- offering

- Offers

- on

- ongoing

- only

- operating

- opportunities

- or

- out

- Outlook

- pandemic

- particularly

- performance

- period

- personal

- Personalised

- phase

- Pivot

- platform

- Platforms

- plato

- Plato Data Intelligence

- PlatoData

- portfolios

- positioned

- Products

- profound

- proven

- provide

- quickly

- rapid

- Rates

- reach

- real-time

- Reality

- recent

- Recover

- recovery

- reflects

- region

- regional

- regions

- relevant

- reliance

- relying

- remarkable

- report

- resilience

- resilient

- response

- REST

- Results

- return

- revenue

- revenue growth

- revenues

- Rich

- right

- rising

- SaaS

- saw

- sector

- Sectors

- segment

- segments

- selection

- shot

- showcasing

- Shows

- significant

- since

- Singapore

- sizes

- slowdowns

- SME

- SME lending

- soared

- speed

- stack

- Storm

- storms

- stranger

- stronger

- strongly

- Study

- success

- swiftly

- Systems

- team

- teams

- tech

- Technologies

- Technology

- than

- that

- The

- The Area

- The Future

- the world

- their

- Them

- themselves

- These

- they

- this

- those

- thriving

- throughout

- tier

- times

- to

- today’s

- tools

- traditional

- turbulence

- turbulent

- TURN

- Uncertainty

- unlike

- unparalleled

- unpredictable

- upheaval

- using

- Valuable

- value

- various

- Wake

- Way..

- we

- Weather

- were

- when

- while

- WHO

- will

- window

- with

- without

- witnessed

- working

- world

- year

- years

- zephyrnet