- Mark Cuban has called for DeFi and stablecoin regulation after losing money.

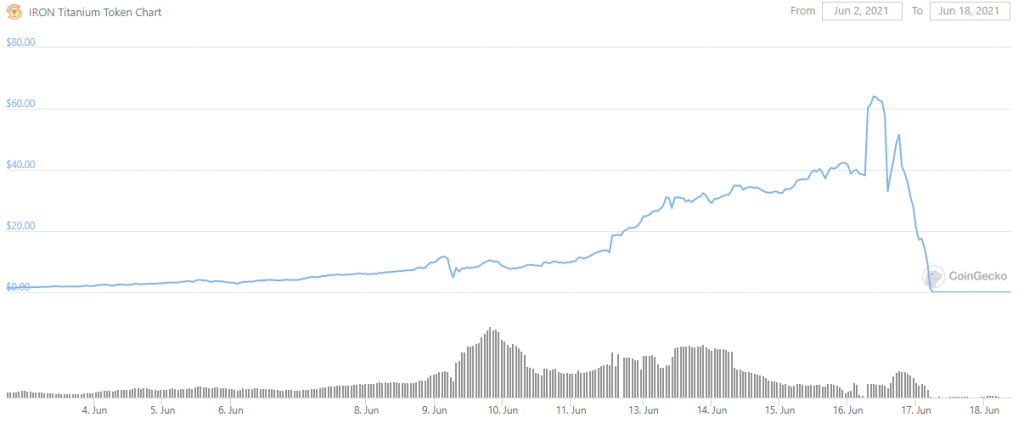

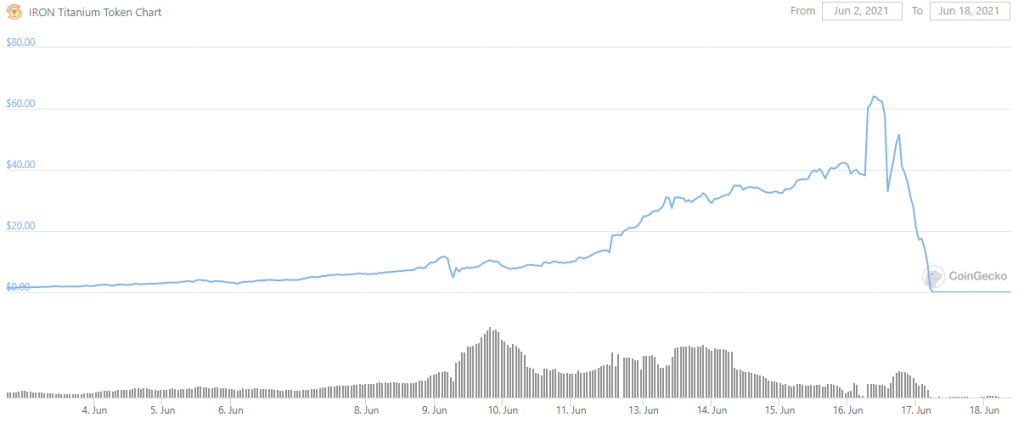

- As the Iron Finance token which Cuban invested collapsed from $64 to zero.

- Currently, the stablecoin sector is under the spotlight from US lawmakers.

Shark Tank star, DeFi proponent, and Billionaire investor Mark Cuban has called for decentralized finance (DeFi) and stablecoin regulation after losing money, as the token he invested collapsed from $64 to zero.

Cuban invested in the partially collateralized stablecoin project Iron Finance. However, the token is subject to a historical bank run, which resulted in the price of the IRON stablecoin moving off peg. More so, Iron’s native token TITAN dropped by almost 100% over two days from it’s all-time high of $64.

On June 17, speaking with Bloomberg, Cuban blamed himself for “being lazy” and also for not doing enough research. In addition, he also raised questions about the regulation of stablecoins. He adds that there should be regulation to define stablecoin and what collateralization is acceptable. Added to this, he said we require $1 in US currency for every dollar.

Why is it that everytime we win an influencer, they turn around and go full wack

Cuban went Degen to “Let’s have the US regulate smart contracts from anon devs”

Elon went from BTC is money to environment nightmare

All we have left is @tobi and he just verified his bitclout :'( https://t.co/Mn6rVqFOcB

— DCF GOD (@dcfgod) June 17, 2021

Iron Finance Features Fractional Reserve Problems

According to the Iron Finance blog post, the project mentioned that it plans to hire a third party to make an in-depth analysis of the protocol. In order to understand all the circumstances that led to this outcome.

Notably, IRON is a partially collateralized stablecoin that intends to be pegged at $1. More so, the stablecoin is collateralized by both of its native token TITAN and the USDC stablecoin. Moreover, the ratio of USDC to total IRON supply is dubbed the Collateral Ratio (CR).

After a huge sell-off from whales which led the price of TITAN to drop to $30. Along with this, IRON stablecoin also dropped below $1 peg. Evenmore, as the protocol relies on a Time Weighted Average Price (TWAP) to evaluate CR, the market activity overcomed the CR as it does not maintain its volatility.

Furthermore, the Whales were able to buy IRON at $0.90 and redeem them for $0.25 TITAN and $0.75 USDC. This temporarily forced the price of TITAN to around $50. They then followed to cash out their gains which sent the price crashing. This led to bank runs from other investors who also began to cash out sending the price of TITAN down to near zero.

Stablecoin Regulation

Currently, the stablecoin sector is under the spotlight from US lawmakers as they consider the way to regulate the spontaneously evolving sector. More so, in December 2020, a bill dubbed the ‘STABLE ACT’ is introduced which requires stablecoin issuers to get a banking charting and observe with traditional banking regulations.

After the digital currency downturn last month, Federal Reserve Chair Jerome Powell explained on May 20, that “as stablecoins’ use increases, so must our attention to the appropriate regulatory and oversight framework.”

Follow us on Twitter, Telegram and Google News

Source: https://coinquora.com/mark-cuban-wants-defi-regulation-after-his-invested-token-collapsed/

- 2020

- 9

- All

- analysis

- around

- Bank

- Banking

- Bill

- Blog

- Bloomberg

- BTC

- buy

- Cash

- CoinGecko

- contracts

- Currency

- DeFi

- digital

- digital currency

- Dollar

- Drop

- dropped

- Environment

- Features

- Federal

- federal reserve

- finance

- Framework

- full

- High

- hire

- House

- HTTPS

- huge

- influencer

- investor

- Investors

- IT

- lawmakers

- Led

- mark

- Mark Cuban

- Market

- medium

- money

- Near

- order

- Other

- price

- project

- Regulation

- regulations

- research

- Run

- smart

- Smart Contracts

- So

- Spotlight

- stablecoin

- Stablecoins

- supply

- time

- token

- traditional banking

- us

- USDC

- Volatility

- WHO

- win

- zero