SNEAK PEEK

- The SEC lawsuit classifies 12 tokens, including Solana, Cardano, and Polygon, as securities.

- Ethereum (ETH) is notably excluded from the SEC’s list of securities.

- Allegations against Binance involve misleading customers and misappropriation of funds.

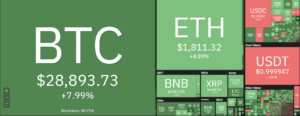

The U.S. Securities and Exchange Commission (SEC) recently filed a lawsuit against Binance, its CEO Changpeng Zhao, and Binance U.S., explicitly categorizing 12 tokens as securities. This development has caused a decline in the prices of popular cryptocurrencies such as Bitcoin (BTC), Binance Coin (BNB), and others.

Among the 12 tokens categorized as securities are BNB, Binance USD stablecoin (BUSD), Solana (SOL), Cardano (ADA), Polygon (MATIC), Filecoin (FIL), Cosmos Hub (ATOM), The Sandbox (SAND), Decentraland (MANA), Algorand (ALGO), Axie Infinity (AXS), and Coti (COTI).

SEC Takes Aim at Binance’s Token Offerings

According to SEC arguments, these tokens were offered and sold as investment contracts, therefore falling under the definition of securities. Interestingly, the SEC did not include Ethereum’s native cryptocurrency, Ether (ETH), as a security in the lawsuit.

This omission follows SEC Chair Gary Gensler’s refusal to clarify whether ETH was considered a security in April. Gensler previously stated that “everything other than Bitcoin” could be classified as a security. Being the first and most established cryptocurrency, Bitcoin has generally been regarded as a commodity rather than a security.

SEC Targets Binance and FTX for Customer Deception

On the other hand, the SEC alleges that Binance and affiliated companies misled customers and misappropriated funds, echoing similar accusations against FTX and its founder, Sam Bankman-Fried. The enforcement action follows a lawsuit filed by the Commodity Futures Trading Commission earlier this year.

In addition, the news of the SEC lawsuit has led to a decline in the prices of Bitcoin, BNB, and other affected tokens. Declaring that specific tokens are securities introduces regulatory uncertainty and potential legal ramifications for exchanges and investors. The market’s reaction further reflects concerns about increased scrutiny from regulatory bodies and the potential for more stringent cryptocurrency trading and investment regulations.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoAiStream. Web3 Data Intelligence. Knowledge Amplified. Access Here.

- Minting the Future w Adryenn Ashley. Access Here.

- Buy and Sell Shares in PRE-IPO Companies with PREIPO®. Access Here.

- Source: https://investorbites.com/market-dips-as-sec-lawsuit-against-binance-labels-12-tokens-as-securities/

- :has

- :is

- :not

- 1

- 10

- 12

- 14

- 15%

- 22

- 24

- 7

- a

- About

- Accusations

- Action

- addition

- Affiliated

- against

- aim

- ALGO

- Algorand

- Algorand (ALGO)

- an

- analyzing

- and

- April

- ARE

- arguments

- AS

- At

- atom

- Axie

- Axie Infinity

- AXS

- Bankman-Fried

- BE

- been

- being

- binance

- Binance Coin

- binance news

- Binance USD

- Bitcoin

- Bitcoin News

- blockchain

- bnb

- bodies

- BUSD

- by

- Cardano

- Cardano News

- categorizing

- caused

- ceo

- Chair

- Changpeng

- Changpeng Zhao

- classified

- Coin

- commission

- commodity

- Companies

- Concerns

- considered

- contracts

- Cosmos

- Cosmos Hub

- coti

- could

- crypto

- crypto exchange

- cryptocurrencies

- cryptocurrency

- cryptocurrency trading

- customer

- Customers

- Decentraland

- Decline

- detailed

- Development

- DID

- discussion

- Earlier

- enforcement

- established

- ETH

- Ether

- Ether (ETH)

- ethereum

- Ethereum News

- Ethereum's

- EVER

- exchange

- Exchanges

- excluded

- extensive

- external

- facts

- Falling

- Filecoin

- First

- follows

- For

- founder

- from

- FTX

- funds

- further

- Futures

- Futures Trading

- game

- Gary

- generally

- Gensler

- hand

- HTTPS

- Hub

- important

- in

- include

- Including

- increased

- Infinity

- internal

- Introduces

- investigation

- investment

- investor

- Investors

- involve

- ITS

- Labels

- largest

- lawsuit

- Led

- Legal

- List

- MANA

- Market

- Market News

- Matic

- misleading

- more

- most

- native

- network

- news

- notably

- of

- offered

- Other

- Others

- P2E

- plato

- Plato Data Intelligence

- PlatoData

- Polygon

- Polygon (MATIC)

- Popular

- potential

- Prices

- rather

- reaction

- recently

- reflects

- refusal

- regulations

- regulatory

- Revealed

- s

- Sam

- Sam Bankman-Fried

- SAND

- sandbox

- Sandbox (SAND)

- SEC

- sec chair

- sec lawsuit

- Securities

- security

- similar

- Solana

- Solana News

- sold

- specific

- stablecoin

- such

- takes

- targets

- than

- that

- The

- The Sandbox

- The Sandbox (SAND)

- therefore

- These

- this

- this year

- to

- token

- Tokens

- Trading

- u.s.

- U.S. Securities

- Uncertainty

- under

- understanding

- USD

- was

- were

- What

- What is

- What is bitcoin

- whether

- year

- zephyrnet

- Zhao