Classifying Uniswap’s Liquidity Providers and Their Strategies

Introduction

This report is the third part of an ongoing research piece aiming at assisting Uniswap market makers in understanding these new dynamics. The goal is to provide a comprehensive overview of the competitive market-making landscape on Uniswap. The introduction of concentrated liquidity in Uniswap V3 has granted market makers greater flexibility and opportunity to manage their positions. However, it has also increased competition among Liquidity Providers, who can now compete via using different market-making strategies. Additionally, it has created opportunities for algorithmic traders or bots to derive value from Market Makers.

In this report, we will introduce various metrics and methodologies that can provide a deeper understanding of the different strategies applied in Uniswap’s liquidity markets. Additionally, we will shed light on bot activities and their impact on Market Makers.

Part I – A Breakdown of Uniswap Protocol Activities

In the first part of our report, we provide a comprehensive overview of the protocol performance. We present various metrics and methodologies we believe can help market makers better understand Uniswap as well as help assess the preferences by Market Makers as well as Traders.Part II – Understanding Liquidity Supply and Demand Dynamics on Uniswap

In this part we examine the various exogenous and endogenous variables that influence Market Makers on Uniswap and their decision-making process. We cover frameworks or selecting a token pair, the right fee-tier for a market-making position.Part III (this report) – Classifying Uniswap’s Liquidity Providers and Their Strategies

In this section, we deliver an extensive analysis of Uniswap’s liquidity providers, and classify them into bots and organic Market Makers. We then shed some light on the different strategies by each cohort group.(Please be aware that the metrics featured in these reports cover activities on Ethereum’s mainnet)

Brief Overview of Concentrated Liquidity on Uniswap

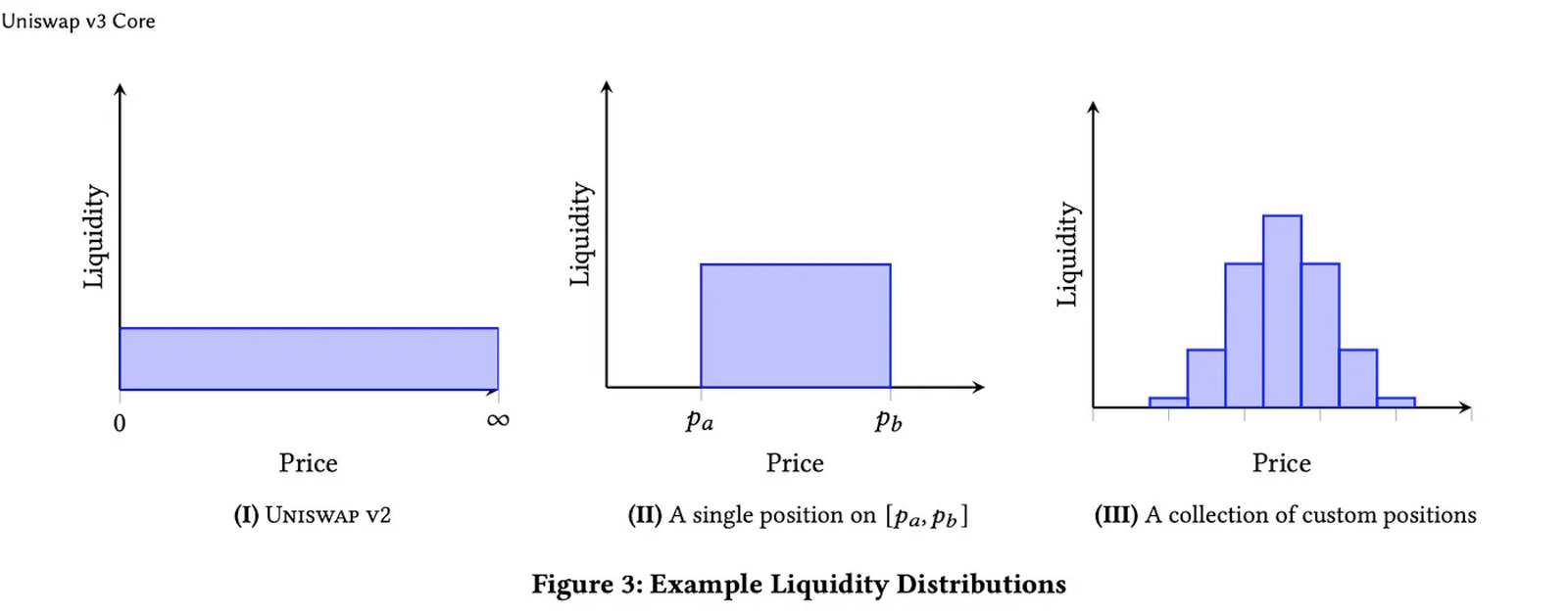

Since the incorporation of concentrated liquidity into the Uniswap protocol, Market Makers can now allocate liquidity within a specific and concentrated price range. These ranges are determined by discrete points on a set price scale, known as ticks. Market Makers select the lower and upper price ticks to define their price range.

Fees will only be earned for ticks within the market’s trading range. The narrower the range, the higher the relative share of liquidity for a particular tick, and consequently, the more fee revenue the Liquidity Provider will earn over that price range. If you are unfamiliar with Uniswap’s main design features, please refer to our Primer about Uniswap for a full overview.

Strategic Allocation of Liquidity

Market Makers now have various options when it comes to choosing their price range. They can opt to provide liquidity in a range that includes the tick where the market is currently trading, effectively entering an immediately active liquidity position. Alternatively, they can add liquidity above or below the tick where the price currently stands. In this case, the liquidity is inactive and only becomes active once the price moves into that specific tick.

💡

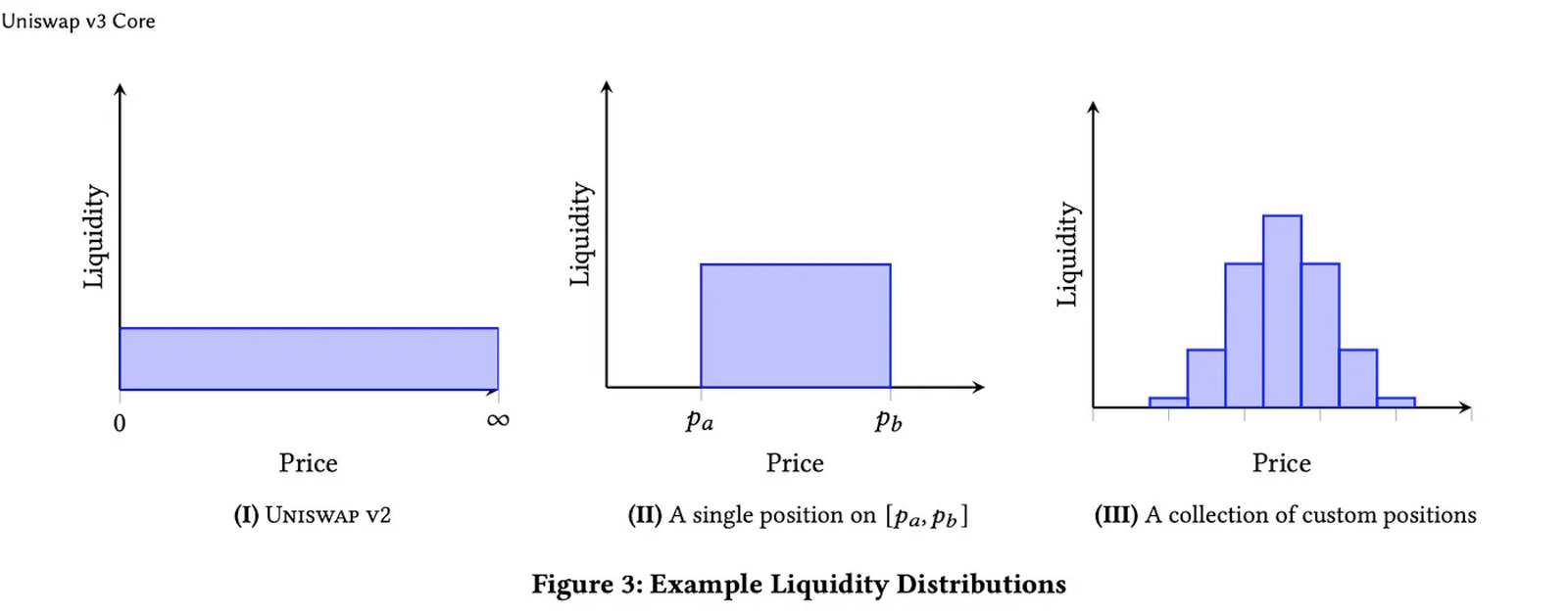

As illustrated in the chart below, approximately 60% of new liquidity positions are opened within the price range. This is where most trading activity occurs, thus making it more likely for capital to be utilized in trades and to get immediate returns. However, this comes with the trade-off of increased competition, as more liquidity concentrates in these ranges and a Market Maker’s relative share of the fees is less.

40% of newly opened liquidity positions adopt a more speculative approach. They place their liquidity outside the current price range, preparing to collect fees from trades when the price shifts into that range. This approach could potentially precede other liquidity providers adjusting their positions, leading to relatively higher fee income.

When positions are minted outside the range, it may indicate that market makers are expecting volatility. Whether market makers add their liquidity positions below or above the current price range reflects their anticipation of the market’s potential direction.

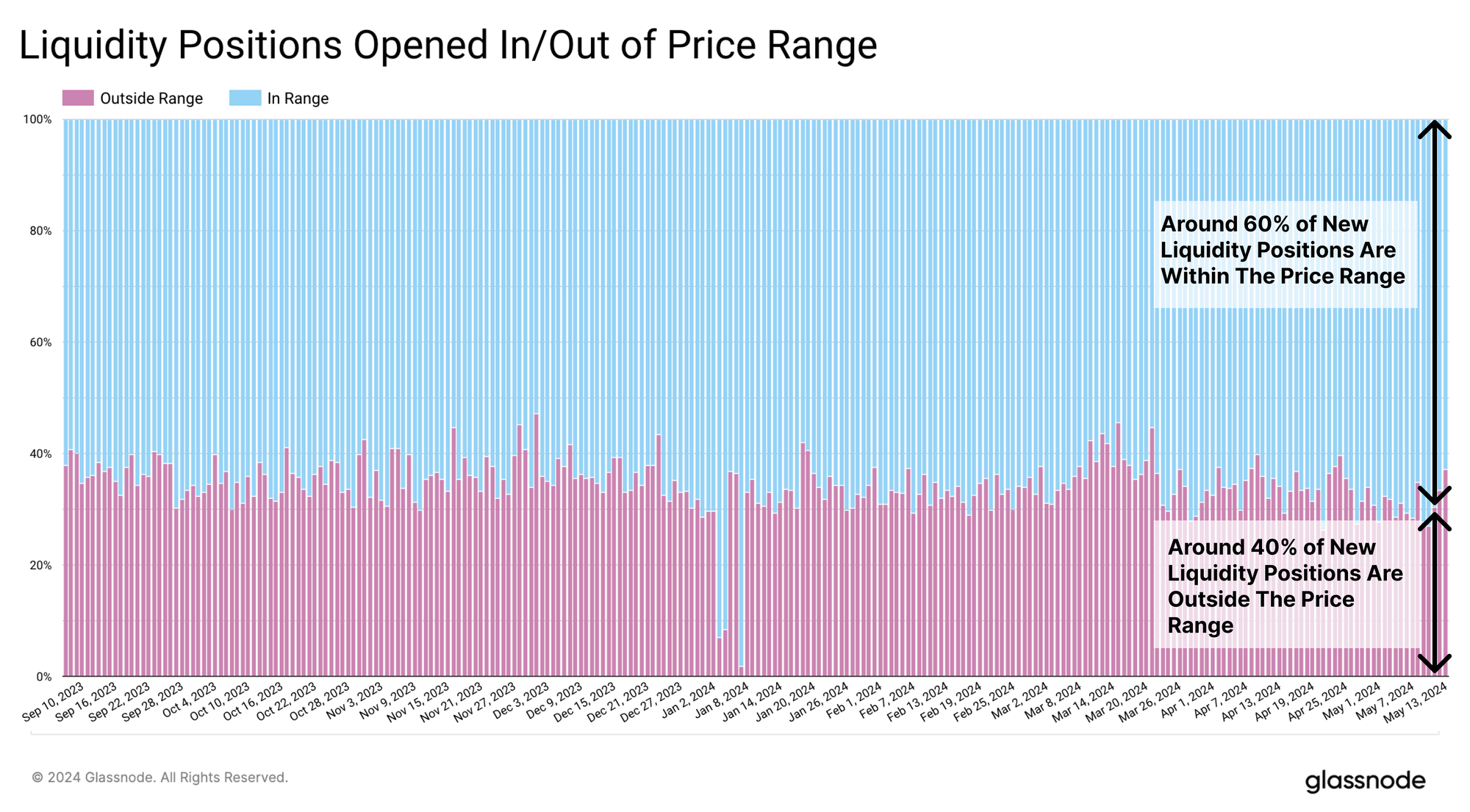

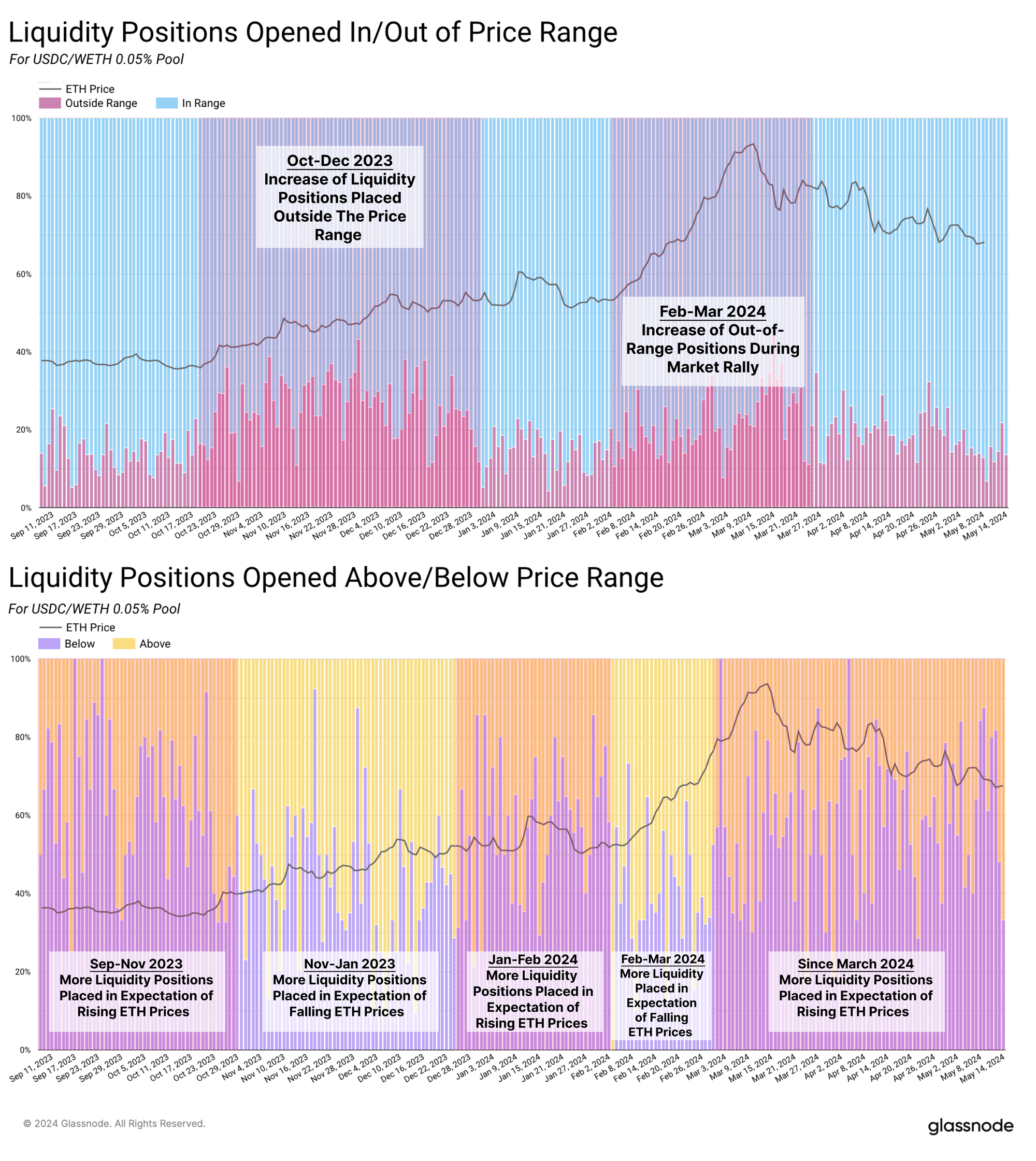

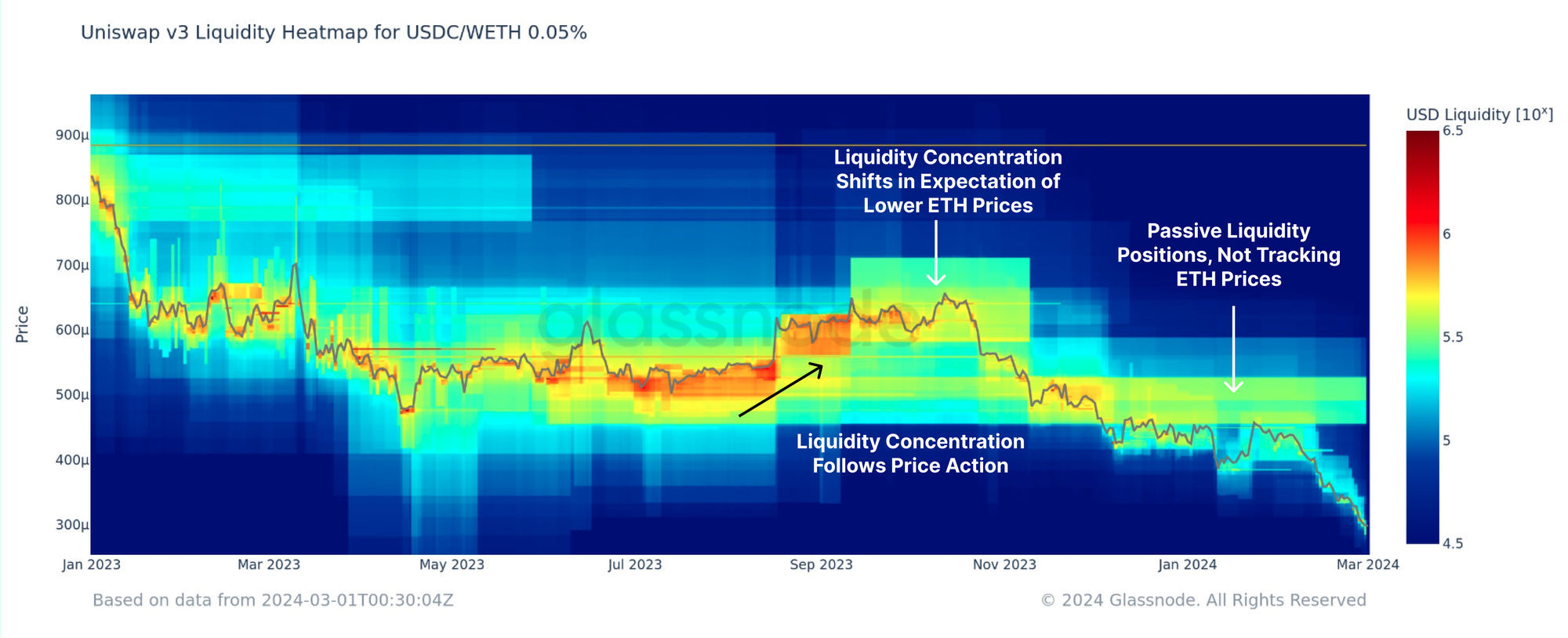

We demonstrate this with an example from one of the most active pools, the USDC/WETH 0.05% pool. We detecte market uptrends in this pool around October-November 2023 and March 2024, which coincided with an increase in out-of-range positioning.

In the second chart, we also observe increased positioning below the price range prior to market upticks. Given that this pool is denominated in USDC/WETH, this pattern suggests that Market Makers anticipated a rise in the price of ETH.

As mentioned in previous reports, the ability of market makers to concentrate liquidity in anticipation of future price moves could potentially allow liquidity pools to provide information on market sentiment.

The heatmap below shows how the concentration of liquidity, represented by the deeper orange and red zones, followed the price action. Notably, before the market rally that started in late October 2023, liquidity shifts extended beyond the price range. This indicated a transition among market makers from optimism to anticipating a decrease in ETH prices. (Please be aware that the price mentioned here is denoted in USDC/WETH).

Bots vs. Organic Market Maker

In recent years, different participants in the Ethereum network have engaged in practices aimed at extracting profits by strategically including, excluding, or reordering transactions within blocks. This is particularly evident in the context of Decentralized Exchanges, where varying strategies of so-called Maximal Extractable Values (MEV) run by bots have been observed. (For more information on MEV, please refer to this primer.)

This report focuses on a specific type of bot, known as Just-In-Time bots, which primarily aim to extract value from Market Makers. These bots monitor the public mempool of the Ethereum network, where new transactions are queued. Once the discover a lucrative swap transaction on a DEX, they supply liquidity by depositing tokens into the liquidity pool just before that profitable trade is executed in that pool. After collecting the trading fees, the JIT provider immediately withdraws their liquidity from the pool.

Although this type of MEV attack does not harm the trader, JIT bots take away the fees and reduce the profit margin for existing Market Makers. This could potentially result in lower overall market liquidity, as passive liquidity may decrease if it becomes uncompetitive compared to the JIT bots.

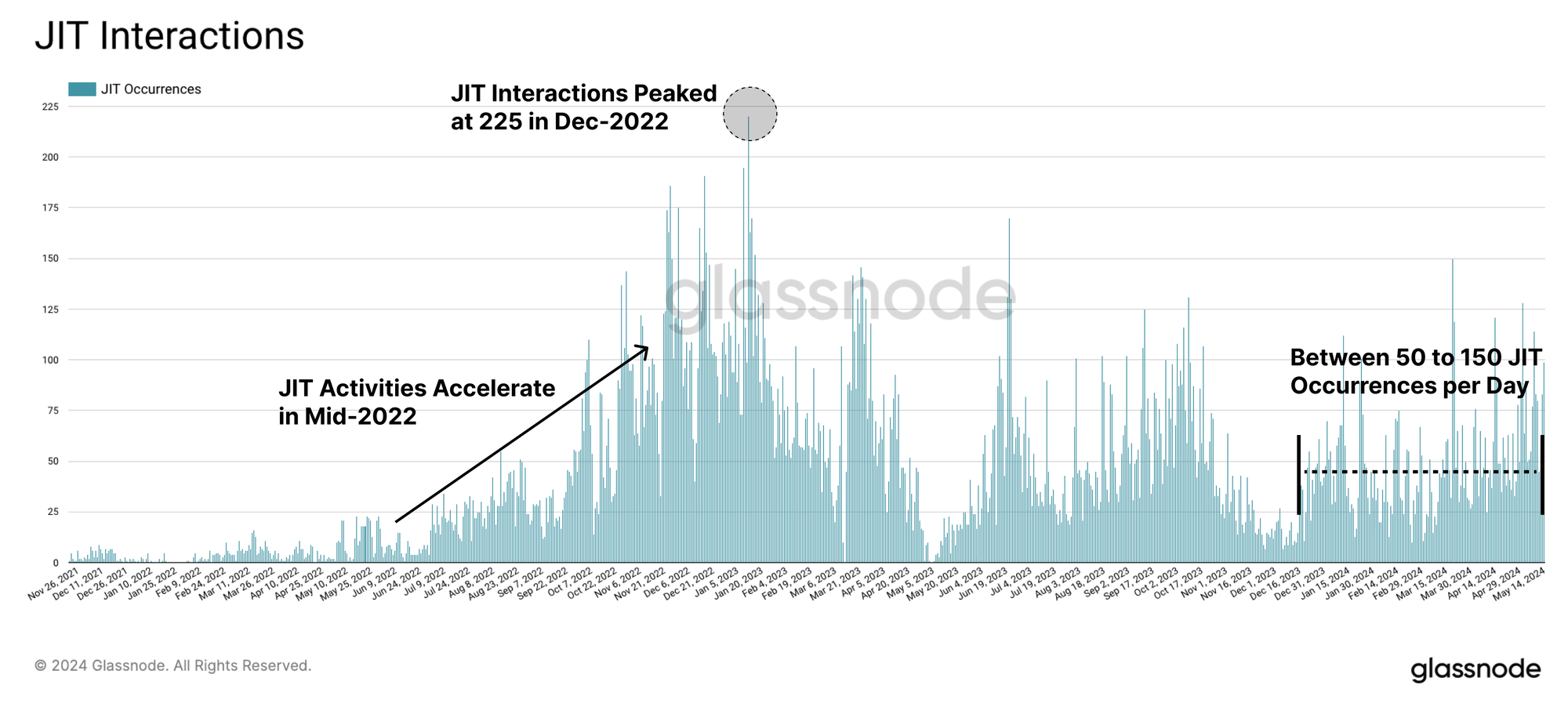

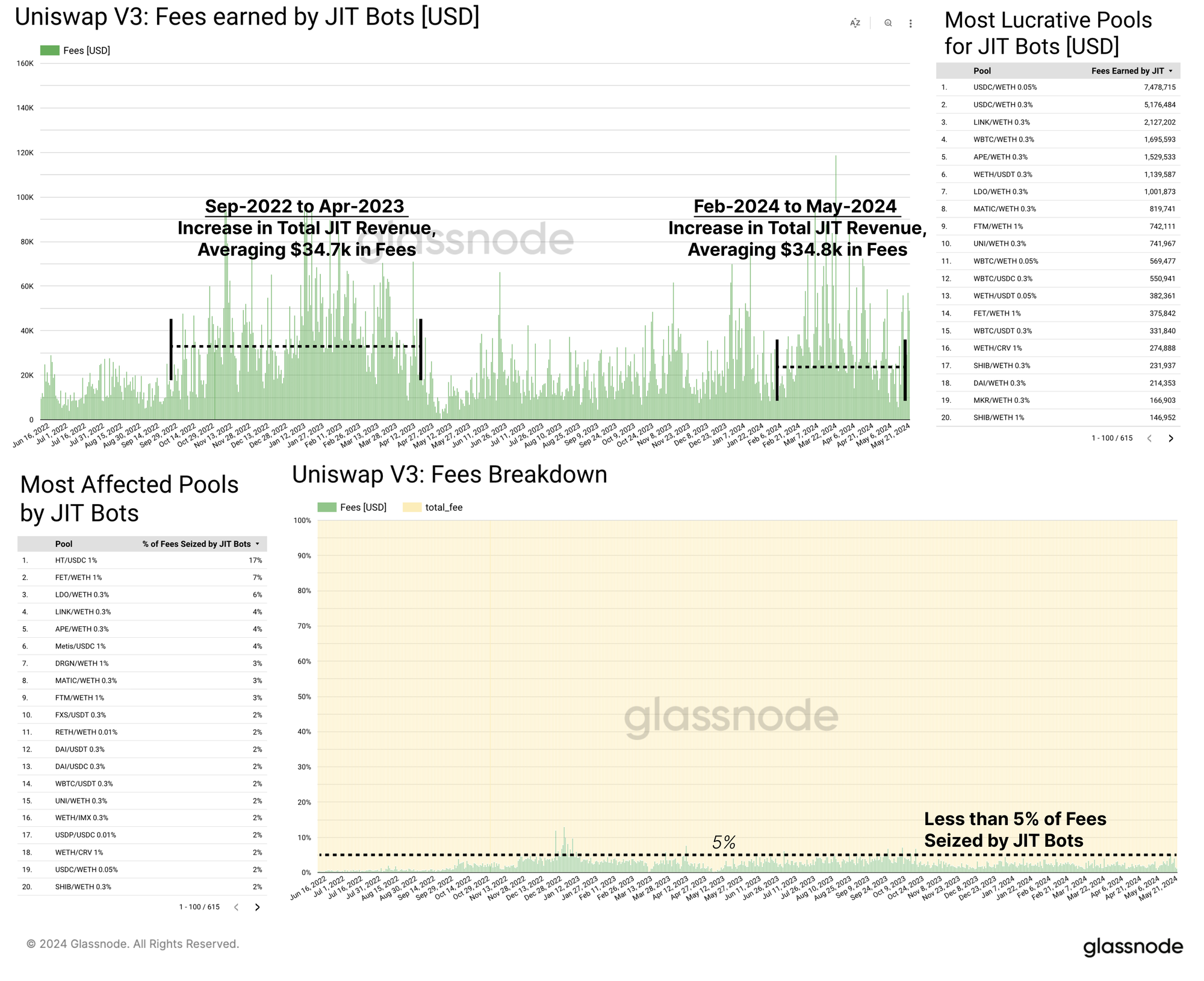

Using our heuristic approach to detect JIT bots, we are able to quantify such activities and their impact on Market Makers on Uniswap. JIT interactions began to surge in the summer of 2022, peaking in December of the same year with approximately 225 JIT interactions per day. Throughout the year, daily JIT occurrences fluctuated between 50 and 150.

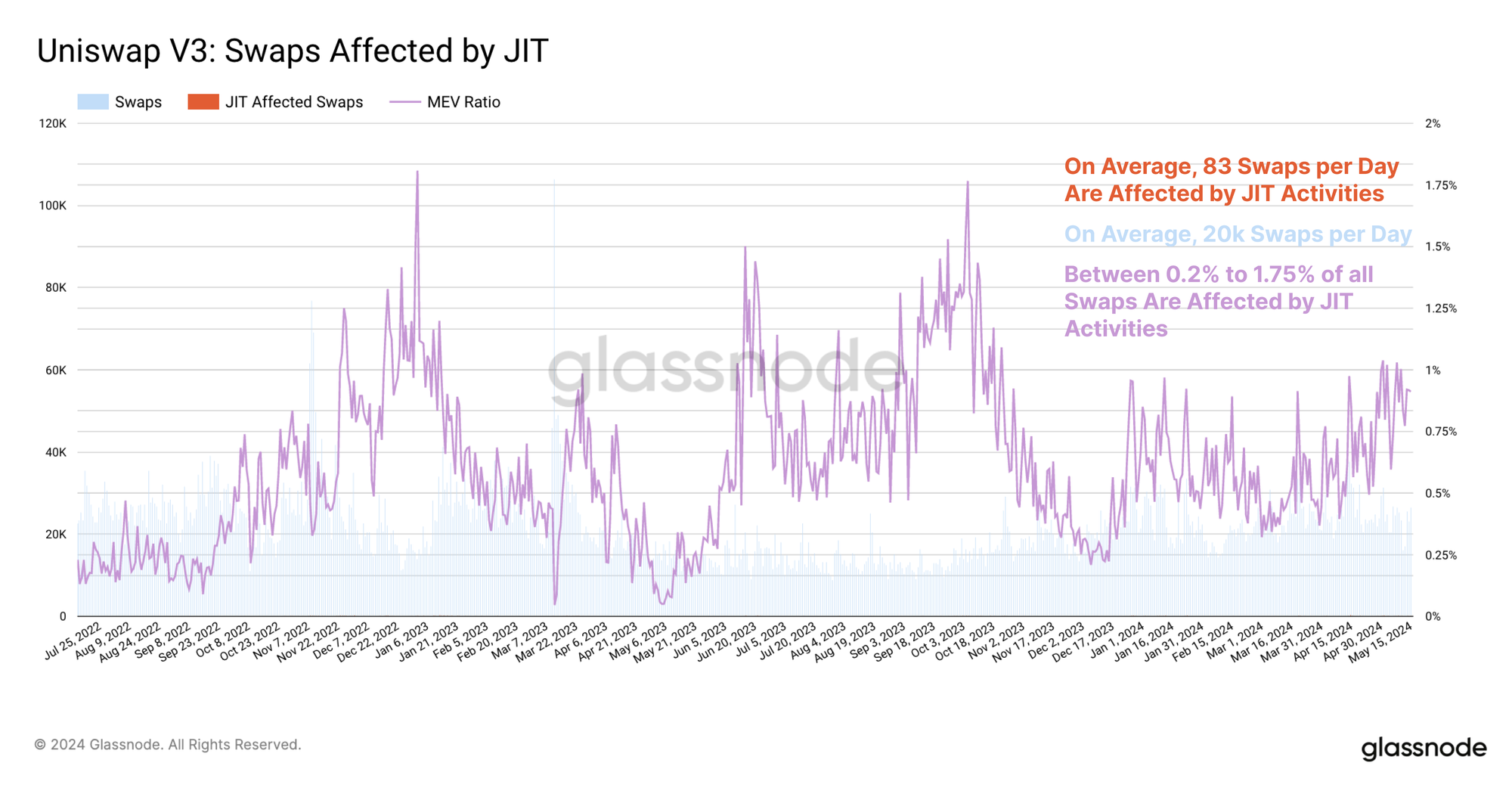

When compared to trading activities, on average 83 swaps each day are affected by swap liquidity. Over time, between 0.2% to 1.75% of all trades on Uniswap are affected by JIT activities.

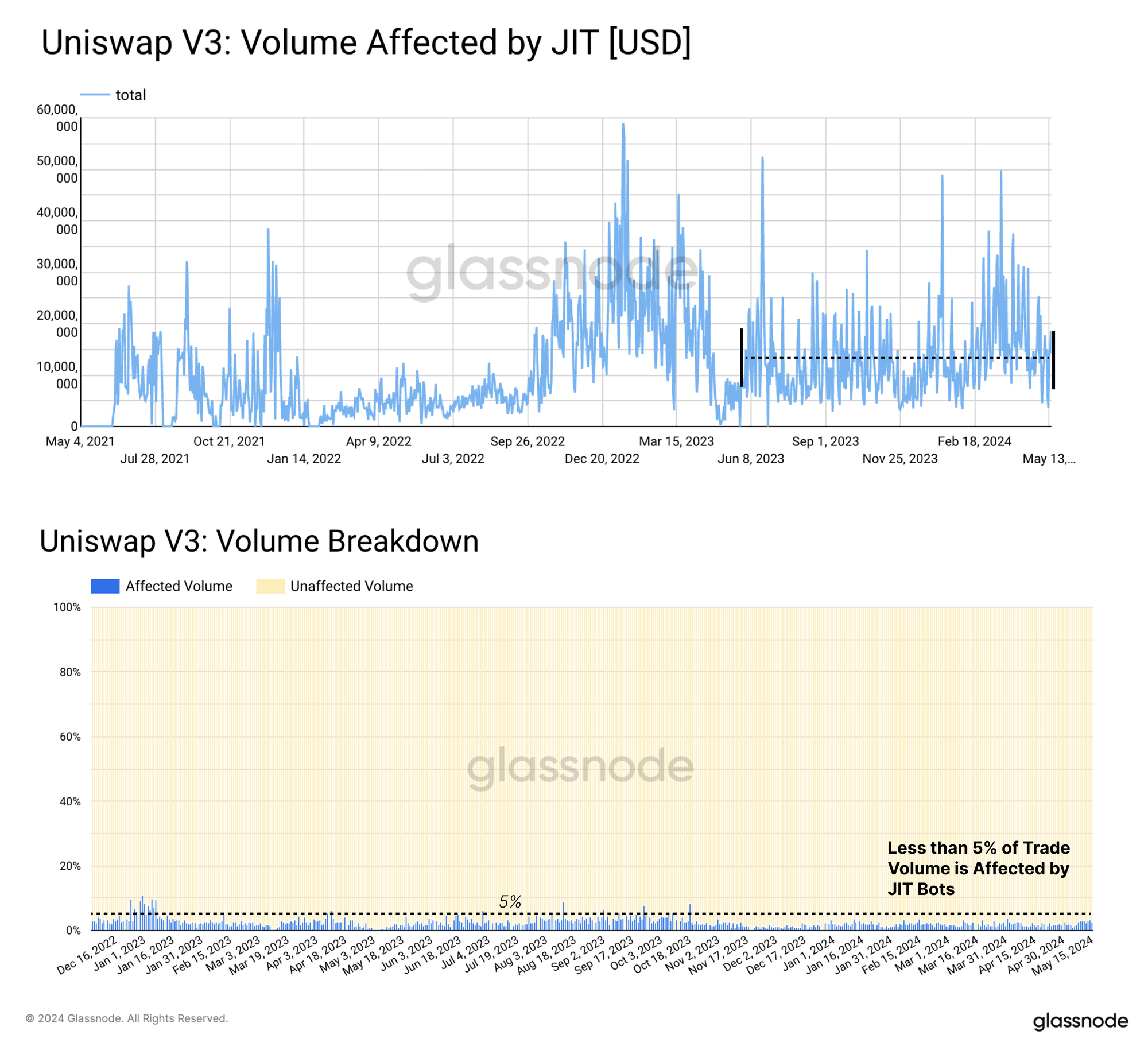

When looking at the volume affected by JIT bots, we see a slightly different picture. JIT bots facilitate $13.6M of the daily trade volume, which is a little than 5% of the total trade volume on Uniswap V3. (Note: For this metric, we only consider mature pools to eliminate noise). The relatively larger impact of JIT bots on trading volume compared to swaps is indicative of how these bots target larger-sized trades for their attacks.

It’s worth remembering that JIT liquidity does not negatively impact traders. Instead, these MEV strategies improve liquidity depth for the trades. However, this metric provides an indication of the fee amount diverted from organic Market Making activities.

JIT Bots’ Impact on Market Making

JIT bots’ seizure of volume simulteanouesly results in the removal of fees from Market Makers. Between its most profitable periods from September to April 2022, and from February 2024 to today, JIT bots have averaged revenue of $34.7k per day.

The most profitable pools for JIT bots turned out to be those with WETH combinations. In the USDC/WETH 0.05% pool, JIT bots secured a total of over $7.4M in fees. However, this accounts for only 2% of the total fees generated in that pool. The smaller pools, listed in the lower left of the chart, have a higher JIT fee share, putting Market Makers at a relatively greater disadvantage. However, even in these pools, with one exception, the effect is marginal, with JIT bots capturing less than 7% of the fees. High profits for JIT bots do not necessarily equate to significant damage for organic Market Makers, as JIT bots take a relatively small portion of the total fees in these pools. This makes their impact quite unnoticeable from the perspective of LP profitability. Moreover, greater liquidity due to JITbots improves the trading experience.

Different Market Making Strategies for Bots

In this section we move on to compare the different market making strategies, for JIT Bots vs organic Market Making. Using the range size of the liquidity position, we classify liquidity positions by their degree of liquidity concentration:

-

Atomic Liqudity: Position covers 1 single price tick

-

Highly Concentrated Liquidity: Position spreads over 1-10 price ticks

-

Less Concentrated Liqiudity: Positions spreads over +10 price ticks

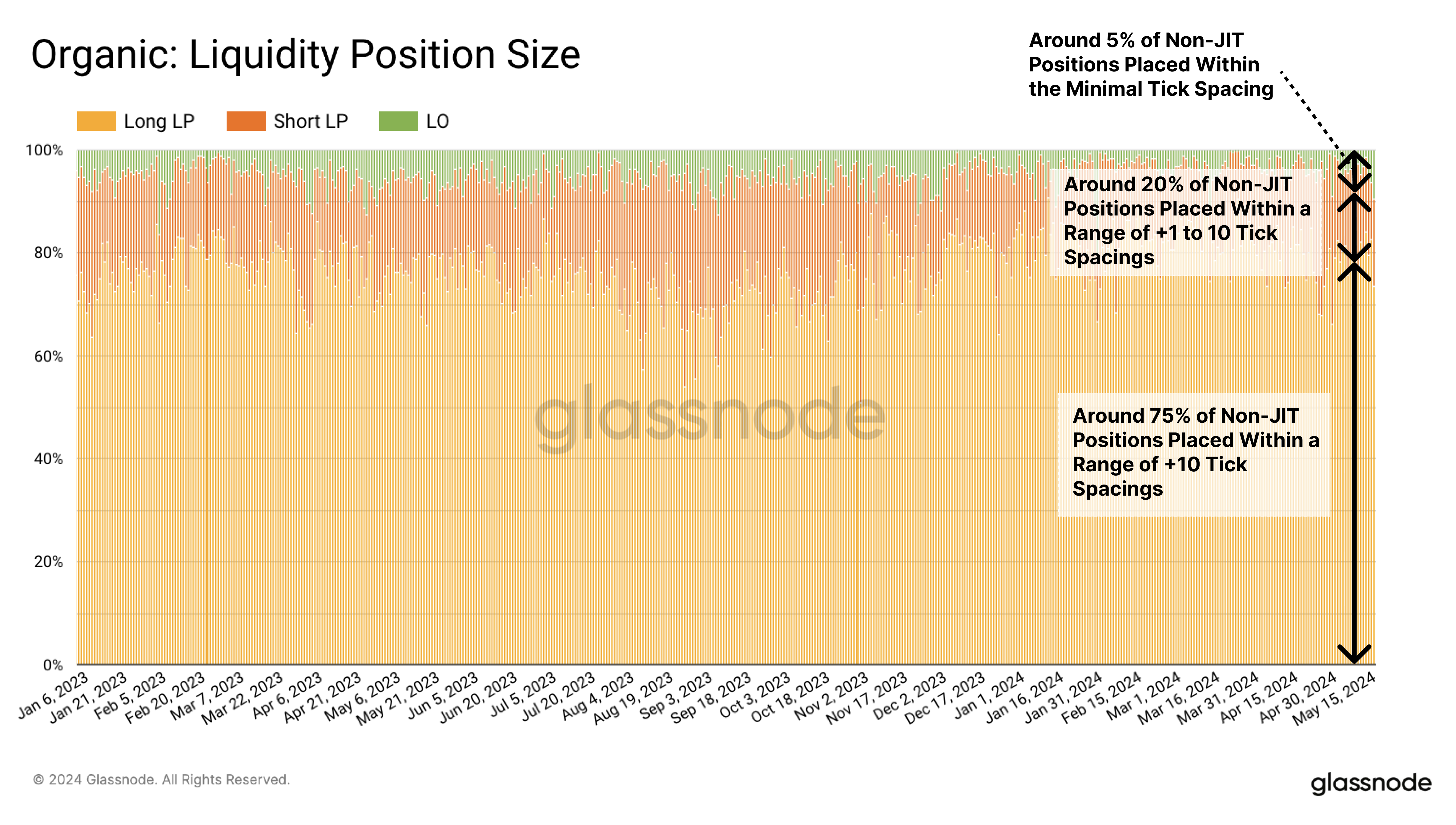

Only 5% of organic liquidity positions are placed within the minimal tick spacing. We interpret these less as market-making activities, but more as Limit Orders. As Uniswap does not offer conditional orders, traders provide liquidity in within the lowest tick spacing and their trade is automatically executed when the market crosses that price. (Ticks serve as measurement units used to delineate precise price ranges, representing the smallest increments where liquidity can be allocated. Read more here) Approximately 20% of the organic liquidity position are what we define as highly concentrated liquidity positions. Meanwhile, around 75% are less concentrated positions, which are likely managed less actively.

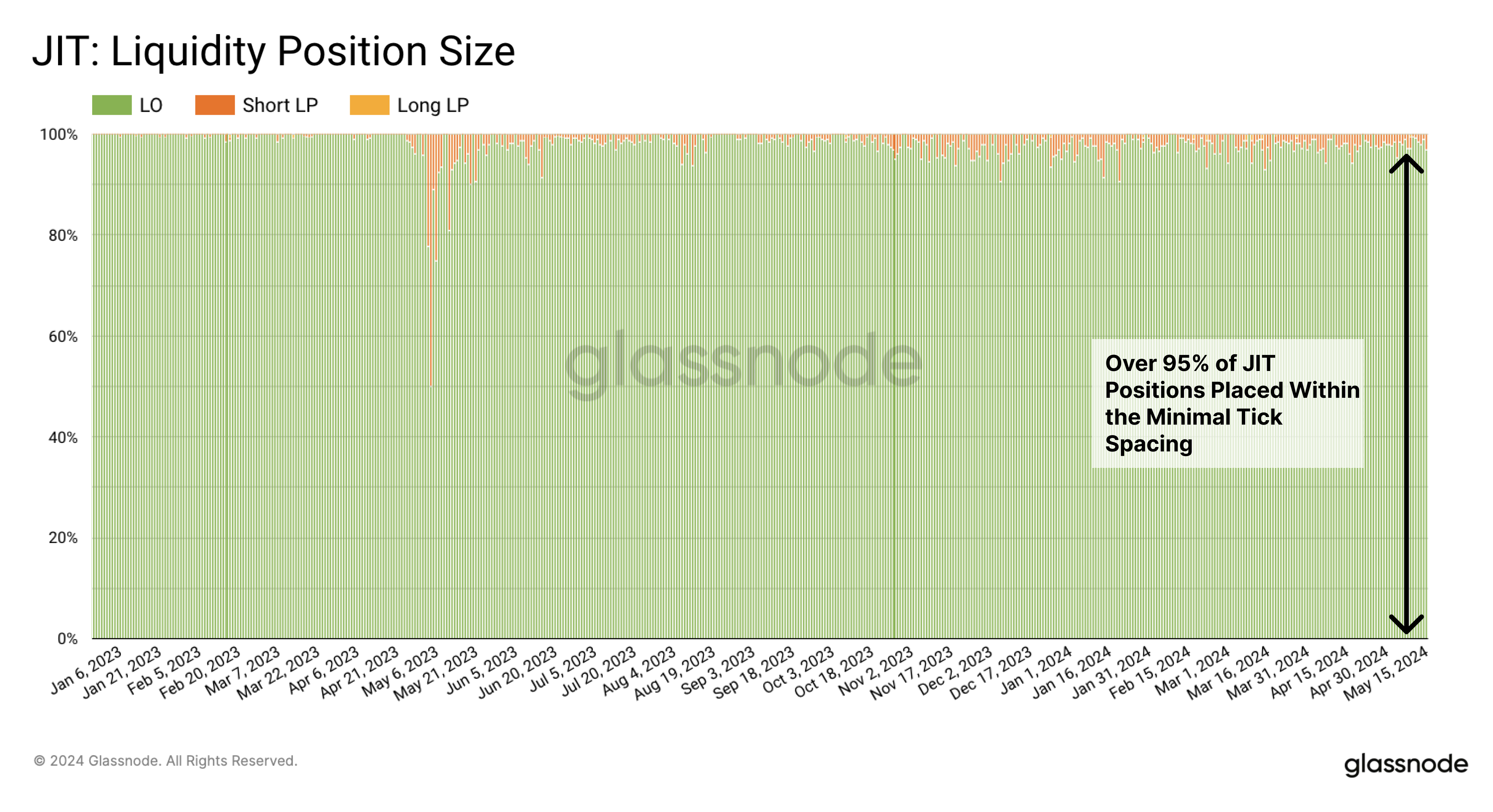

For JIT bots, we observe a different scenario. Over 95% of the Liquidity Positions fall within within the minimal tick spacing. This is expected as these bots can predict price movements based on public transactions awaiting inclusion in the blockchain. The JIT bot then aims to provide highly concentrated liquidity in one price tick to maximize fee extraction from that predicted profitable trade.

After determining the liquidity concentration degree for each cohort, we proceed to compare various strategies for both. We again consult the most active pool, USDC/ETH 0.05% as an example.

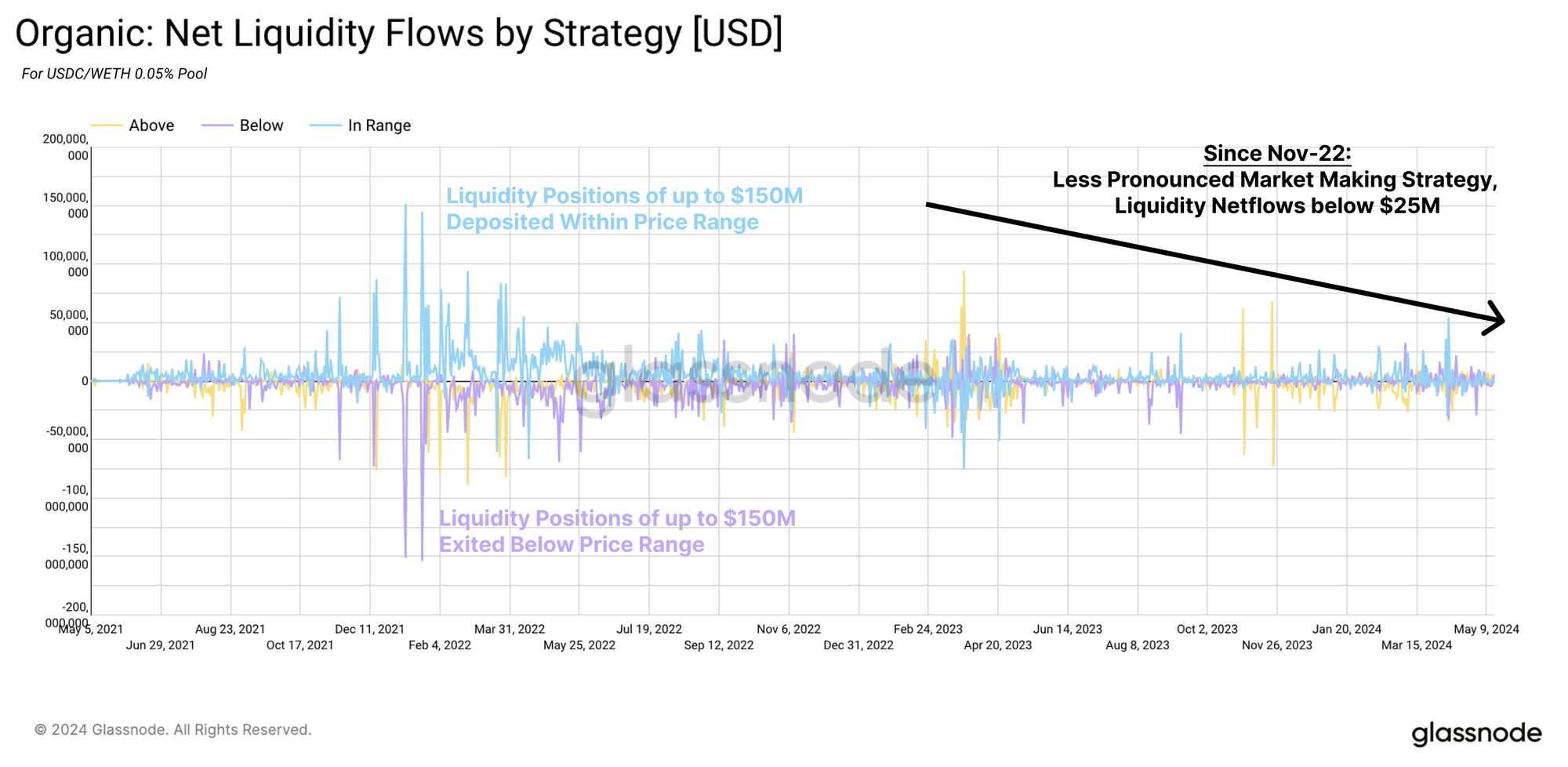

Organic liquidity positions reached up to $150M per day in this pool. Liquidity was generally provided within a certain price range, but exited below that range during this period. Meaning organic Market Makers provided active liquidity and removed it once it left the price range and turned inactive. Since November, there has been a less pronounced strategy among organic Market Making.

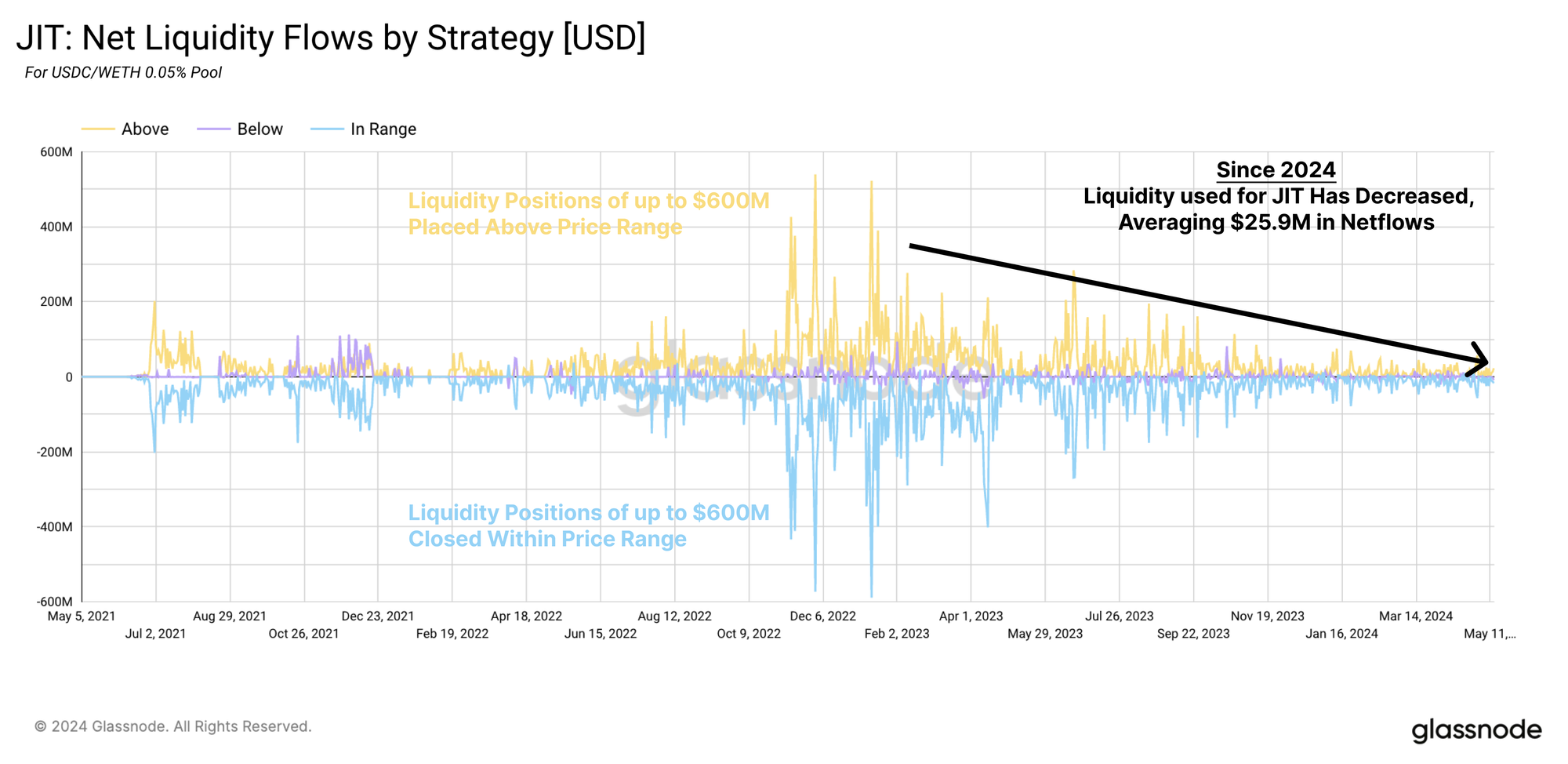

This is quite the opposite for the JIT bots. We can detect a well-defined pattern, where JIT bots opened their position above the price range and then close them when falling in the price range. This implies that they typically aim for trades large-sized trades that aim to sell ETH for USDC and slightly decrease the ETH price. (Please be mindful once more of the USDC/WETH denomination).

JIT liquidity inflows for that pool reached its peak approximately one year later than liquidity inflows of organic Market Making and has since decreased in size. It’s also worth noting the significant difference in deposit sizes, with the liquidity positions for JIT being up to four times higher.

JIT Return of Investment

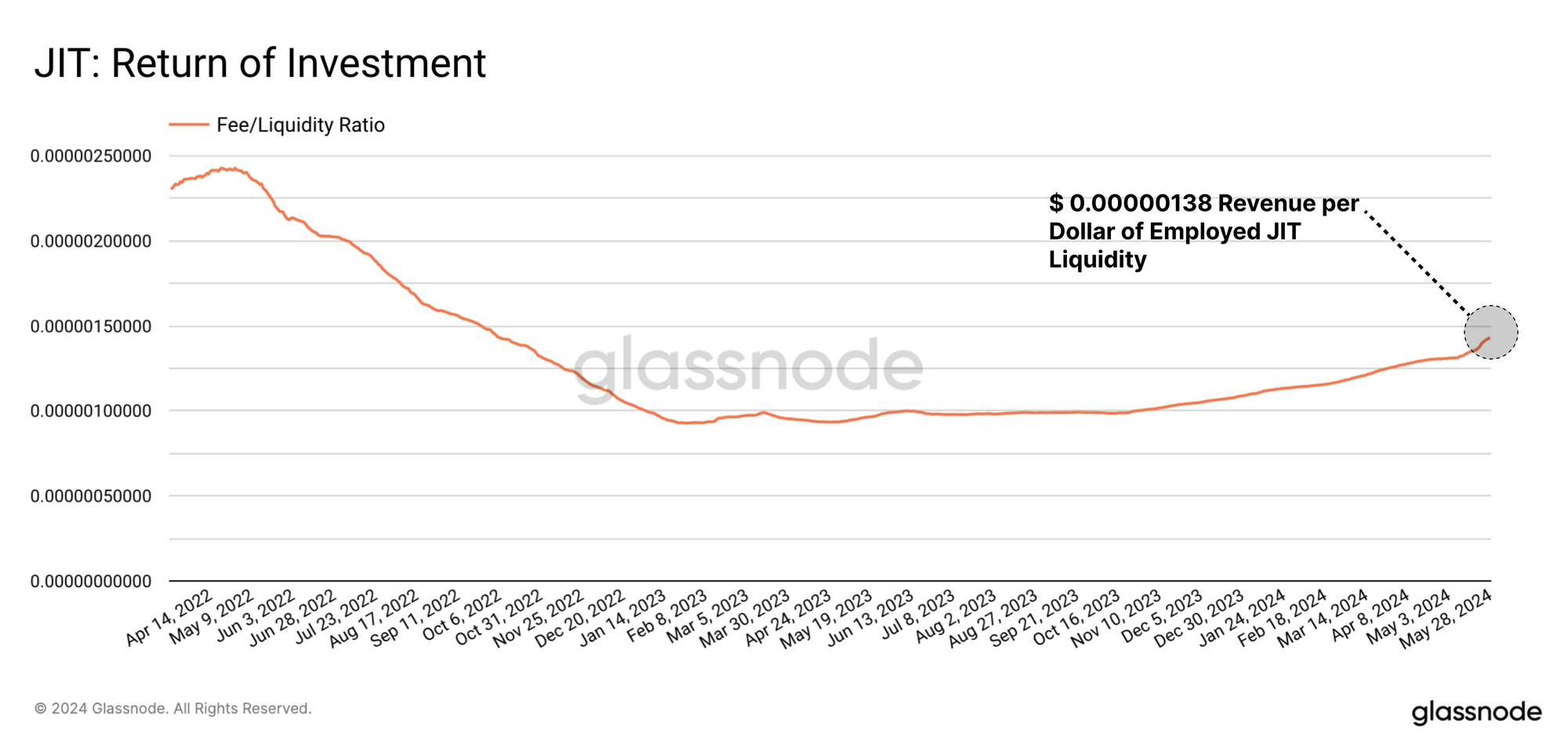

When examining deposit sizes by JIT liquidity positions, it becomes immediately apparent that these are quite large. This is necessary to gain a significant share of the liquidity in a given price tick. This fact is even more noteworthy because a JIT attack needs to be spread over three different transactions. Therefore, it cannot utilize flashloans and must instead rely on the bot owner’s own capital.

However, the significant capital requirements for JIT attacks prompt the question of their effectiveness as MEV strategies. By examining the revenue per dollar of liquidity employed, which amounts to just a fraction of a cent, we find that JIT attacks are highly capital inefficient. Turning it into the MEV strategy with the highest risk to reward ratio.

(Please note that we only consider revenue from swap fees, not the portfolio changes of JIT bots. We also don’t consider costs. For an in-depth analysis of the costs and profits of JIT bots, we recommend reading this paper.)

Summary and Conclusion

The first chapter we establish a decline in unique traders, market makers, and daily fees over recent years. Competition has intesified for Uniswap with new DEXes entering the market as well as users and liquidity dispersing across various Layer-2 solutions. Despite many newly created pools, 70% to 85% of the total liquidity is concentrated in in the Top-10 token pools. During market rallies, trading volumes and liquidity tend to extend into more pools.

The second part of the report delves into the various factors influencing market makers on Uniswap and their decision-making processes. Traders typically gravitate towards the middle fee tiers of 0.3% and 0.05% when choosing a pool. Liquidity tends to follow volume rather than the other way around, moving at a slower pace as market makers react to changes in available fees more than to changes in trading volume. Notably, liquidity providers adjust their liquidity concentration within a pool in response to profitability changes, rather than shifting liquidity between different pools.

In the third chapter, we dissected Market Makers into bots and organic market makers and analyzed their respective strategies. Active market makers are observed to move their concentrated liquidity in anticipation of price trends. JIT bots employ more sophisticated strategies to predict and capitalize on immediate price changes. Outmaneuvering organic market makers and seizing a portion of their potential revenues comes at very high capital costs, making JIT a very risky MEV strategy. Contrary to the general view, JIT bots have a remarkably little effect on individual Market Makers. On the contrary, one could argue a net positive effect as increasing liquidity provides a better trading experience.

Disclaimer: This report does not provide any investment advice. All data is provided for information and educational purposes only. No investment decision shall be based on the information provided here and you are solely responsible for your own investment decisions.

Exchange balances presented are derived from Glassnode’s comprehensive database of address labels, which are amassed through both officially published exchange information and proprietary clustering algorithms. While we strive to ensure the utmost accuracy in representing exchange balances, it is important to note that these figures might not always encapsulate the entirety of an exchange’s reserves, particularly when exchanges refrain from disclosing their official addresses. We urge users to exercise caution and discretion when utilizing these metrics. Glassnode shall not be held responsible for any discrepancies or potential inaccuracies. Please read our Transparency Notice when using exchange data.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://insights.glassnode.com/market-making-on-uniswap-an-analytical-approach-part-iii/

- :has

- :is

- :not

- :where

- $UP

- 1

- 150

- 16

- 2%

- 2000

- 2022

- 2023

- 2024

- 225

- 29

- 50

- 95%

- a

- ability

- Able

- About

- above

- Accounts

- accuracy

- across

- Action

- active

- actively

- activities

- activity

- add

- Additionally

- address

- addresses

- adjust

- adjusting

- adopt

- advice

- affected

- After

- again

- aim

- aimed

- Aiming

- aims

- algorithmic

- algorithms

- All

- allocate

- allocated

- allocation

- allow

- also

- alt

- always

- amassed

- among

- amount

- amounts

- an

- analysis

- Analytical

- analyzed

- and

- Anticipated

- anticipating

- anticipation

- any

- apparent

- applied

- approach

- approximately

- April

- ARE

- argue

- around

- AS

- assess

- assist

- assisting

- At

- attack

- Attacks

- automatically

- available

- average

- awaiting

- aware

- away

- balances

- based

- BE

- because

- becomes

- been

- before

- began

- being

- believe

- below

- Better

- between

- Beyond

- blockchain

- Blocks

- Bot

- both

- bots

- Breakdown

- but

- by

- CAN

- cannot

- capital

- capital requirements

- capitalize

- Capturing

- case

- caution

- cent

- certain

- Changes

- Chapter

- Chart

- choosing

- Classify

- Close

- clustering

- Cohort

- coincided

- collect

- Collecting

- combinations

- comes

- compare

- compared

- comparison

- compete

- competition

- competitive

- comprehensive

- concentrate

- Concentrated

- Concentrates

- concentration

- Consequently

- Consider

- consult

- context

- contrary

- Costs

- could

- cover

- Covers

- created

- critical

- Current

- Currently

- daily

- damage

- dashboard

- data

- Database

- day

- December

- decentralized

- decentralized-exchanges

- decision

- Decision Making

- decisions

- Decline

- decrease

- decreased

- deeper

- define

- Degree

- deliver

- delves

- Demand

- demonstrate

- Denominated

- deposit

- depth

- derive

- Derived

- Design

- Despite

- detect

- determined

- determining

- Dex

- DEXes

- difference

- different

- direction

- Disadvantage

- Disclosing

- discover

- discretion

- do

- does

- Dollar

- don

- due

- during

- dynamics

- each

- earn

- earned

- educational

- effect

- effectively

- effectiveness

- eliminate

- employed

- engaged

- ensure

- entering

- entirety

- establish

- ETH

- eth price

- ethereum

- ethereum network

- evaluate

- Even

- evident

- examine

- Examining

- example

- exception

- exchange

- Exchanges

- excluding

- executed

- Exercise

- existing

- expected

- expecting

- experience

- extend

- extended

- extensive

- extract

- extraction

- facilitate

- fact

- factors

- Fall

- Falling

- featured

- Features

- February

- fee

- Fees

- Figures

- Find

- finding

- First

- Flexibility

- fluctuated

- focuses

- follow

- followed

- For

- four

- fraction

- frameworks

- from

- full

- future

- Future Price

- Gain

- General

- generally

- generated

- get

- Ghost

- given

- Glassnode

- goal

- granted

- greater

- Group

- harm

- Have

- Held

- help

- here

- High

- higher

- highest

- highly

- How

- However

- HTTPS

- if

- iii

- immediate

- immediately

- Impact

- implies

- important

- improve

- improves

- in

- in-depth

- inactive

- includes

- Including

- inclusion

- Income

- Increase

- increased

- increasing

- indicate

- indicated

- indication

- indicative

- individual

- inefficient

- inflows

- influence

- influencing

- information

- instead

- interactions

- interpret

- into

- introduce

- Introduction

- investment

- IT

- ITS

- JIT

- just

- known

- Labels

- landscape

- large

- larger

- Late

- later

- leading

- left

- less

- light

- likely

- LIMIT

- limit orders

- Liquidity

- liquidity pool

- liquidity pools

- liquidity provider

- liquidity providers

- Listed

- little

- looking

- lower

- lowest

- LP

- lucrative

- Main

- mainnet

- maker

- Makers

- MAKES

- Making

- manage

- managed

- many

- March

- March 2024

- Margin

- Market

- market maker

- market makers

- market sentiment

- market-making

- Markets

- mature

- Maximize

- May..

- meaning

- Meanwhile

- measurement

- Mempool

- mentioned

- methodologies

- metric

- Metrics

- MEV

- MEV strategies

- Middle

- might

- minimal

- minted

- Monitor

- more

- Moreover

- most

- move

- movements

- moves

- moving

- must

- necessarily

- necessary

- needs

- negatively

- net

- network

- New

- newly

- no

- Noise

- notably

- note

- noteworthy

- Notice..

- noting

- November

- now

- observe

- october

- of

- offer

- official

- Officially

- on

- once

- ONE

- ONE Price

- ongoing

- only

- opened

- opportunities

- Opportunity

- opposite

- opt

- Optimism

- Optimize

- Options

- or

- Orange

- orders

- organic

- Other

- our

- out

- outside

- over

- overall

- overview

- own

- Pace

- pair

- part

- participants

- particular

- particularly

- passive

- Pattern

- Peak

- per

- performance

- period

- periods

- perspective

- picture

- piece

- Place

- placed

- plato

- Plato Data Intelligence

- PlatoData

- please

- points

- pool

- Pools

- portfolio

- portion

- position

- positioning

- positions

- positive

- potential

- potentially

- practices

- precise

- predict

- predicted

- preferences

- preparing

- present

- presented

- previous

- price

- PRICE ACTION

- Prices

- primarily

- Prior

- proceed

- process

- processes

- Profit

- profitability

- profitable

- profits

- pronounced

- proprietary

- protocol

- provide

- provided

- provider

- providers

- provides

- public

- published

- purposes

- Putting

- question

- quite

- rallies

- rally

- range

- ranges

- rather

- ratio

- reached

- React

- Read

- Reading

- recent

- recommend

- Red

- reduce

- refer

- reflects

- relative

- relatively

- rely

- remembering

- removal

- Removed

- report

- Reports

- represented

- representing

- Requirements

- research

- reserves

- respective

- response

- responsible

- result

- Results

- return

- returns

- revenue

- revenues

- Reward

- right

- Rise

- Risk

- Risky

- Run

- s

- same

- Scale

- scenario

- Second

- Section

- Secured

- see

- seizing

- Seizure

- select

- selecting

- sell

- sentiment

- September

- serve

- set

- Share

- shed

- SHIFTING

- Shifts

- Shows

- significant

- since

- single

- Size

- sizes

- slightly different

- small

- smaller

- solely

- Solutions

- some

- sophisticated

- specific

- speculative

- spread

- Spreads

- stands

- started

- Strategically

- strategies

- Strategy

- strive

- such

- Suggests

- summer

- supply

- Supply and Demand

- surge

- swap

- Swaps

- Take

- Target

- tend

- tends

- than

- that

- The

- the information

- their

- Them

- then

- There.

- therefore

- These

- they

- Third

- this

- those

- three

- Through

- throughout

- Thus

- tick

- tiers

- time

- times

- to

- today

- token

- Tokens

- Total

- towards

- trade

- trader

- Traders

- trades

- Trading

- Trading Fees

- trading volume

- trading volumes

- transaction

- Transactions

- transition

- Transparency

- Trends

- Turned

- Turning

- type

- typically

- understand

- understanding

- unfamiliar

- unique

- Uniswap

- units

- USDC

- used

- users

- using

- utilize

- utilized

- Utilizing

- utmost

- value

- Values

- various

- varying

- very

- via

- View

- Volatility

- volume

- volumes

- vs

- was

- Way..

- we

- WELL

- well-defined

- wETH

- What

- when

- whether

- which

- while

- WHO

- will

- with

- within

- worth

- year

- years

- Yield

- You

- Your

- zephyrnet

- zones