On-chain data allows for a remarkable level of transparency about the performance of digital assets, often to a degree that is uncommon for traditional financial assets. A benefit of this transparency is that it allows for analysts and investors to monitor market trends and momentum through a very wide range of metrics and indicators.

In this article, we will explore how on-chain data can be used to identify inflection points, and sustained periods of positive market momentum for Bitcoin. We will explore this concept through the lens of four on-chain analysis categories:

- 🟢 On-chain Activity: Using network activity and adoption to identify periods of growth and user-base expansion.

- 🔵 Market Profitability: Identifying periods where the unrealized profit held by investors is improving.

- 🔴 Spending Behavior: Spotting periods when there is a sufficient inflow of demand to absorb profit taking by existing holders.

- 🟠 Wealth Distribution: Considering the balance and transfer of wealth between old and new holders.

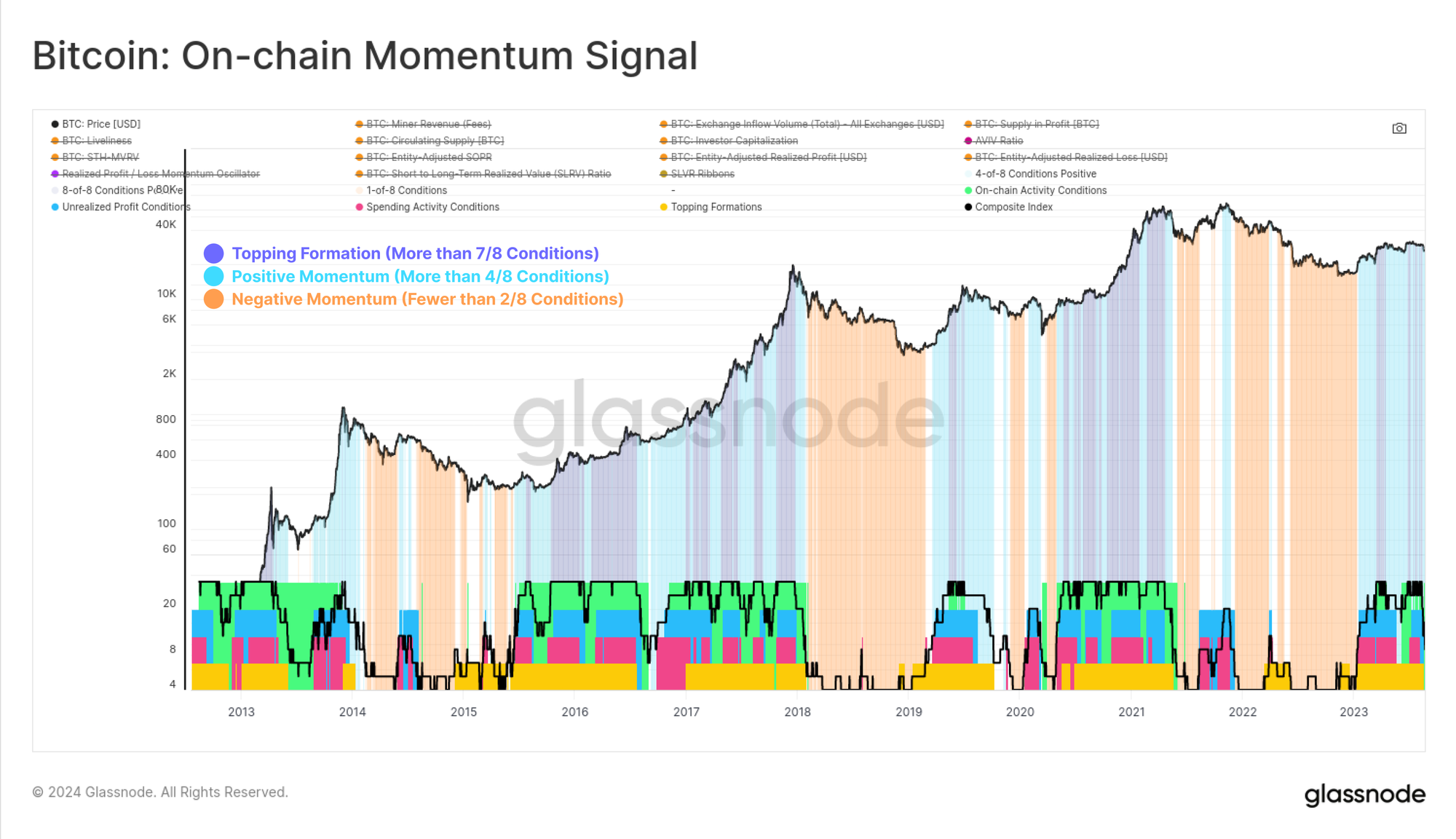

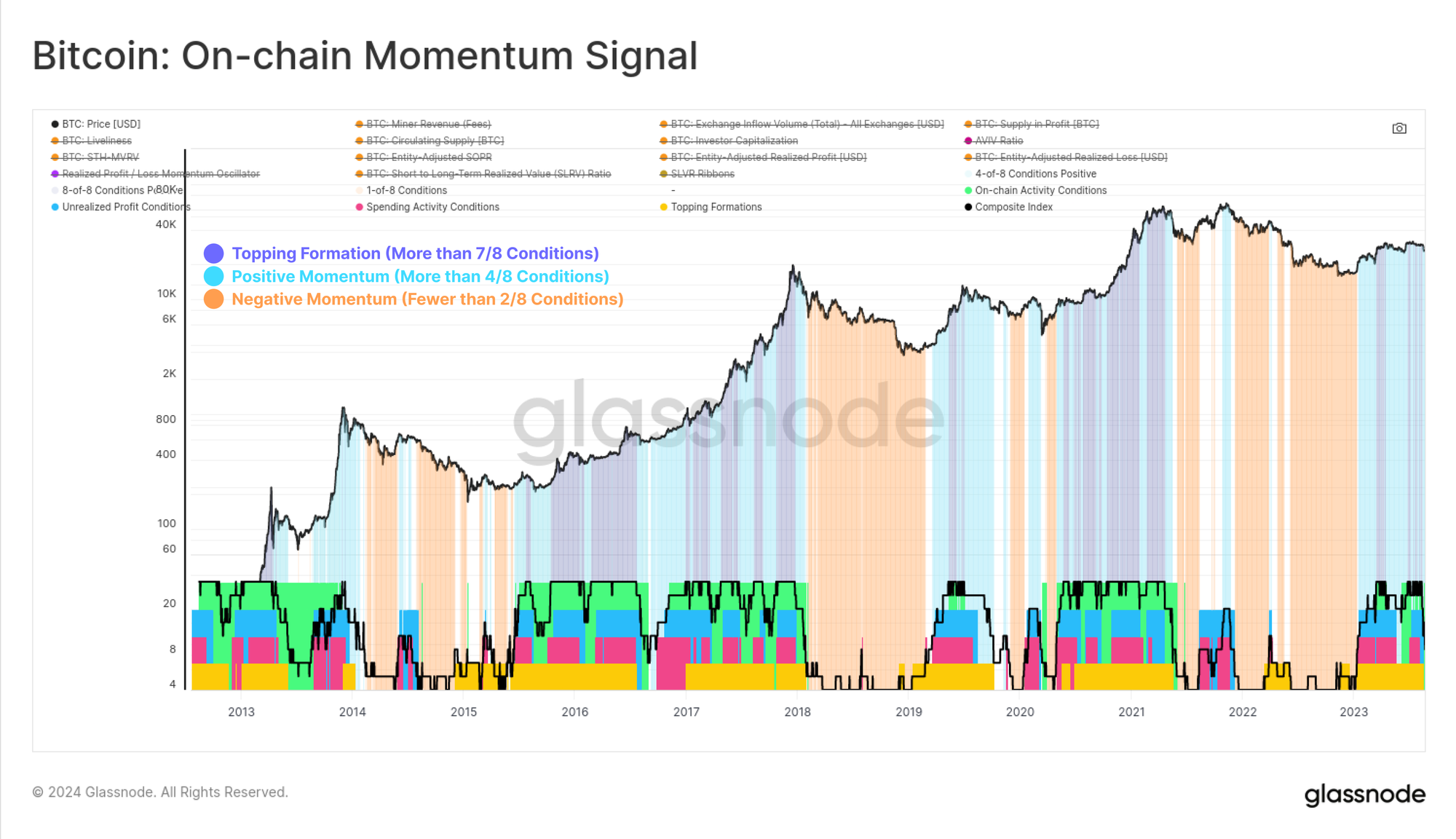

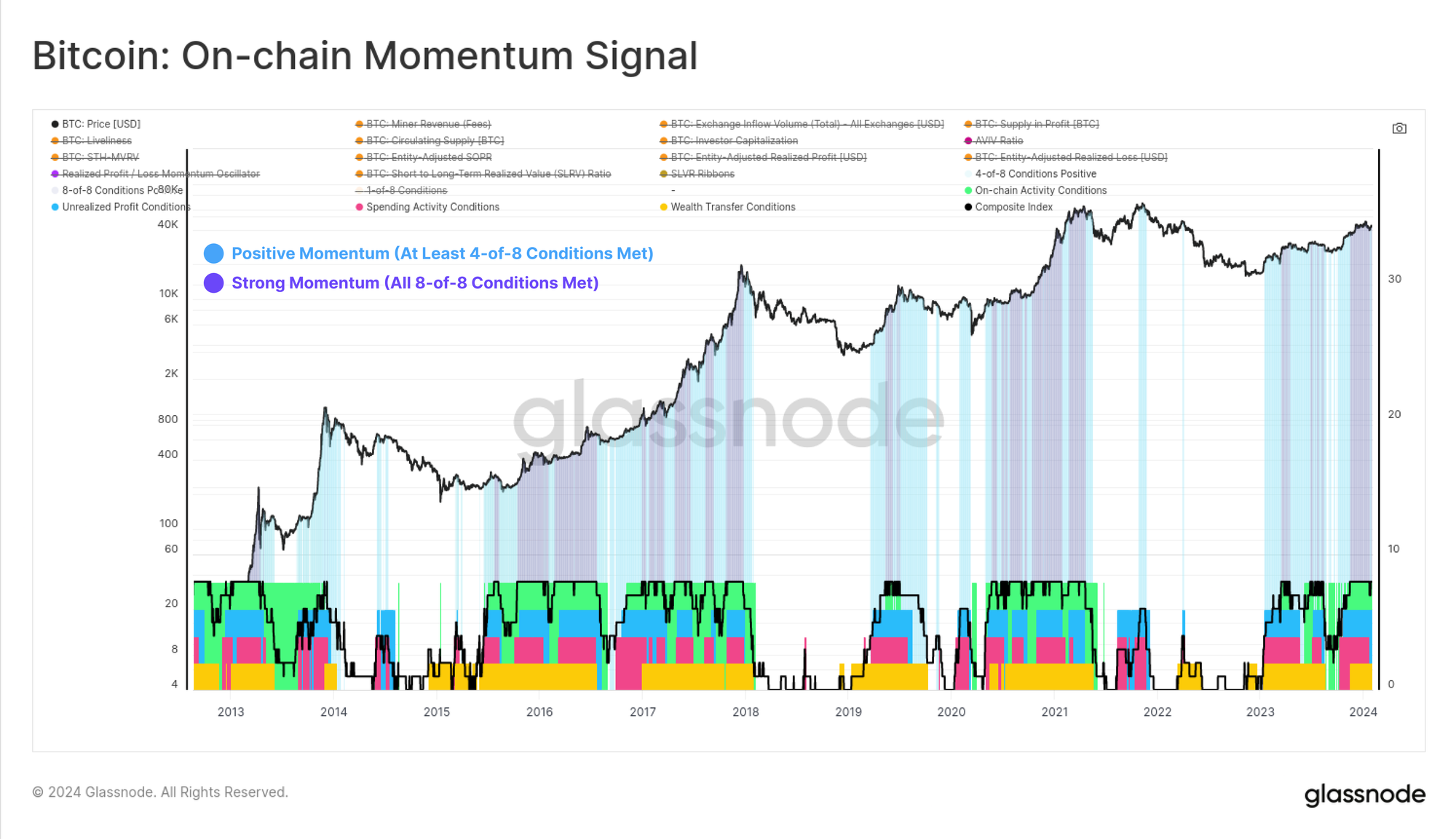

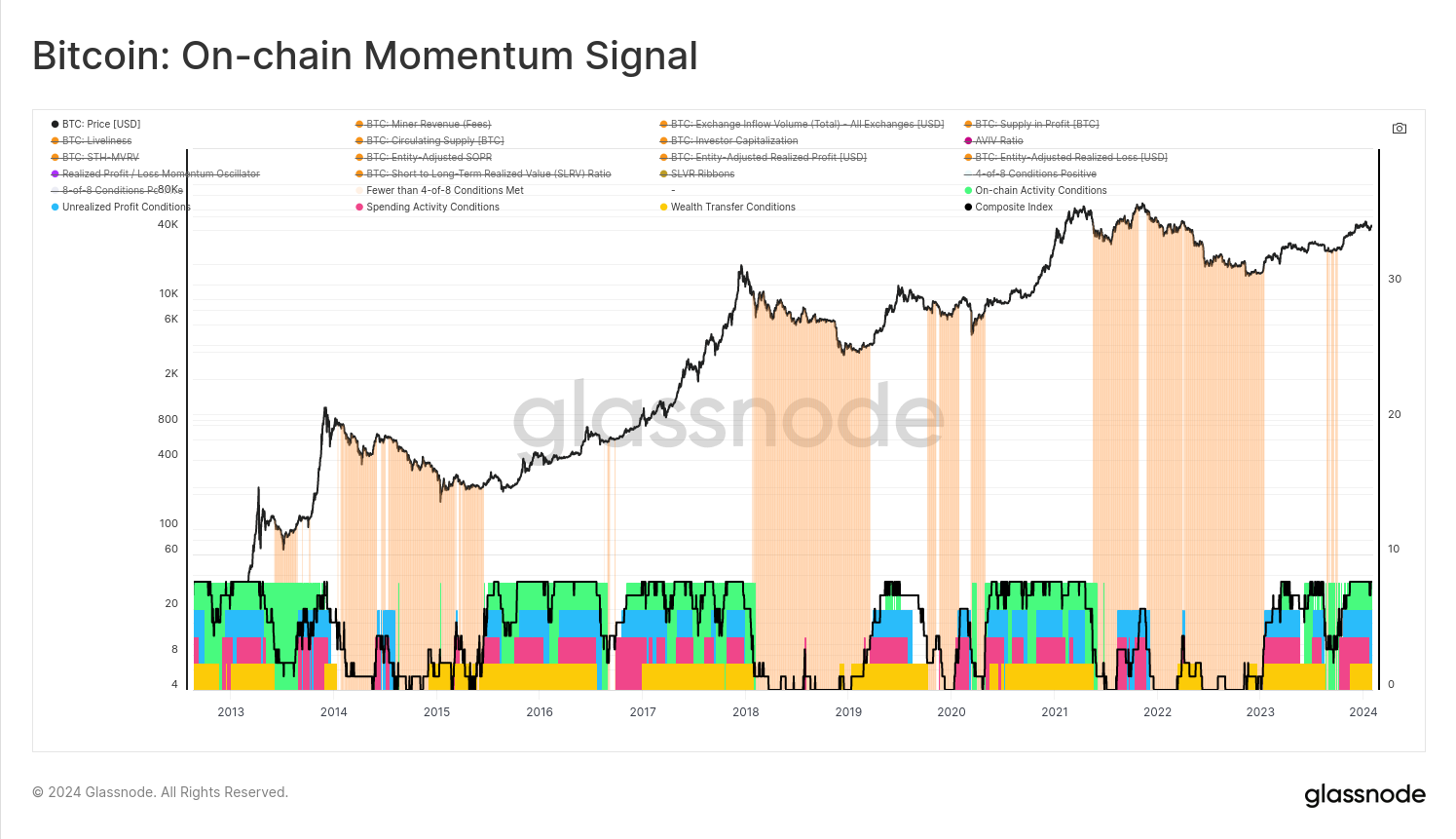

Whilst each indicator can be considered individually, we will also construct a composite index as shown below to assess the strength and direction of market momentum.

Throughout this article we will also demonstrate a variety of techniques for parsing and normalizing on-chain data which can be instructive for analysts.

📊

On-chain Activity and Adoption

Increasing usage of the Bitcoin network is a typical characteristic during periods of growth, where the user-base expands, network activity increases, and price tends to appreciate. As such, we can identify periods of positive momentum via metrics describing an uptick in on-chain activity.

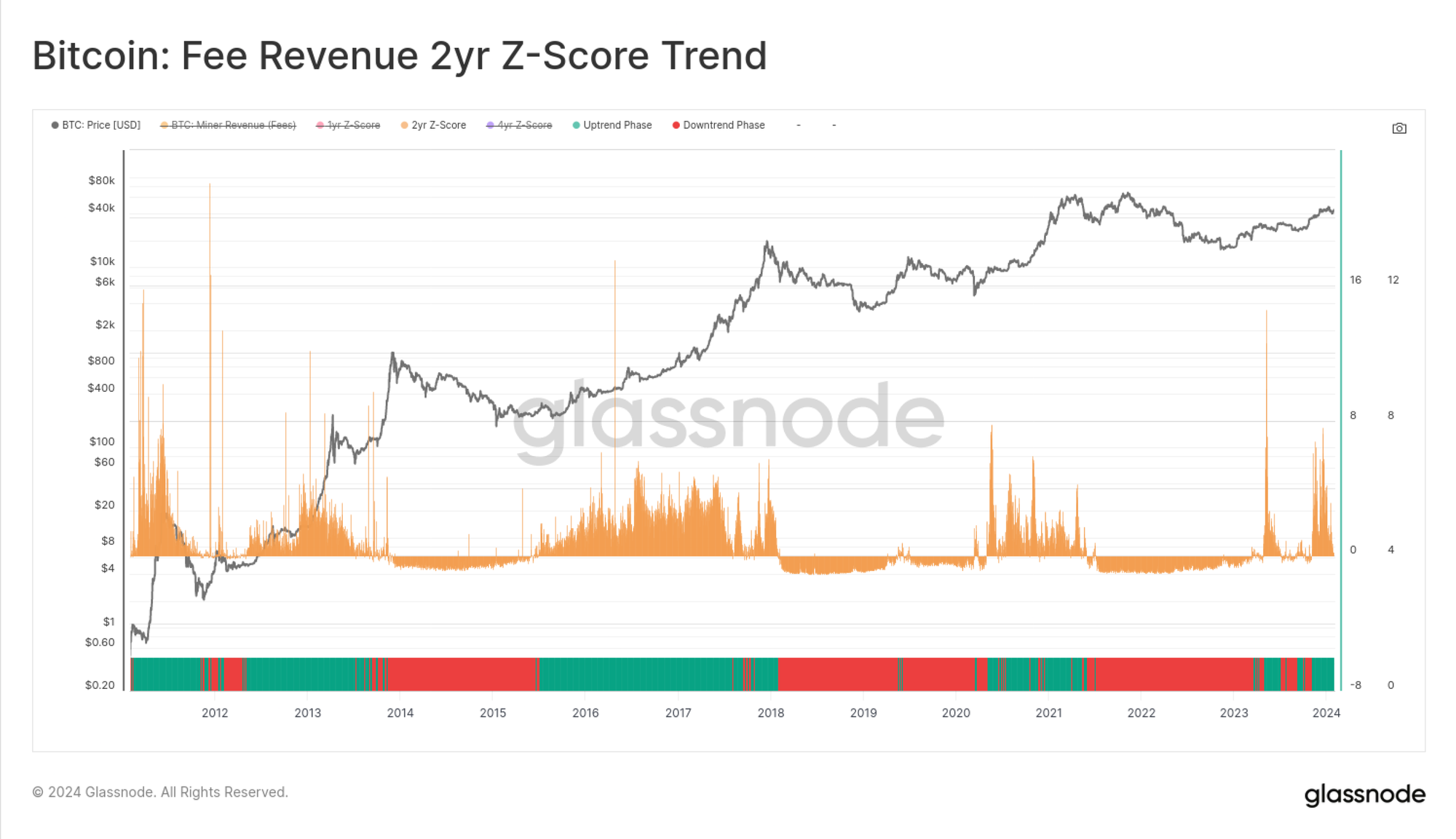

Rising Fee Pressure

The first example utilizes on-chain fee revenue as a proxy for blockspace demand. Fee pressure will increase when users are expressing heightened urgency and a willingness to pay elevated fees for inclusion in the next block.

In this instance, we have applied a 2-Year rolling Z-Score to the proportion of miner revenue earned from fees. This metric selection and Z-score transformation achieves two goals:

- Standardizes the data set across cycles.

- Spots inflection points relative to the last 2yr half-cycle (e.g. an uptick in fees relative to a waning bear market, or a decline in fees after a cycle peak).

💡

– Base Metric: Miner Revenue From Fees

– Transformation: 2yr Rolling Z-Score

– 🟩 Positive Momentum: Z-Score > 0

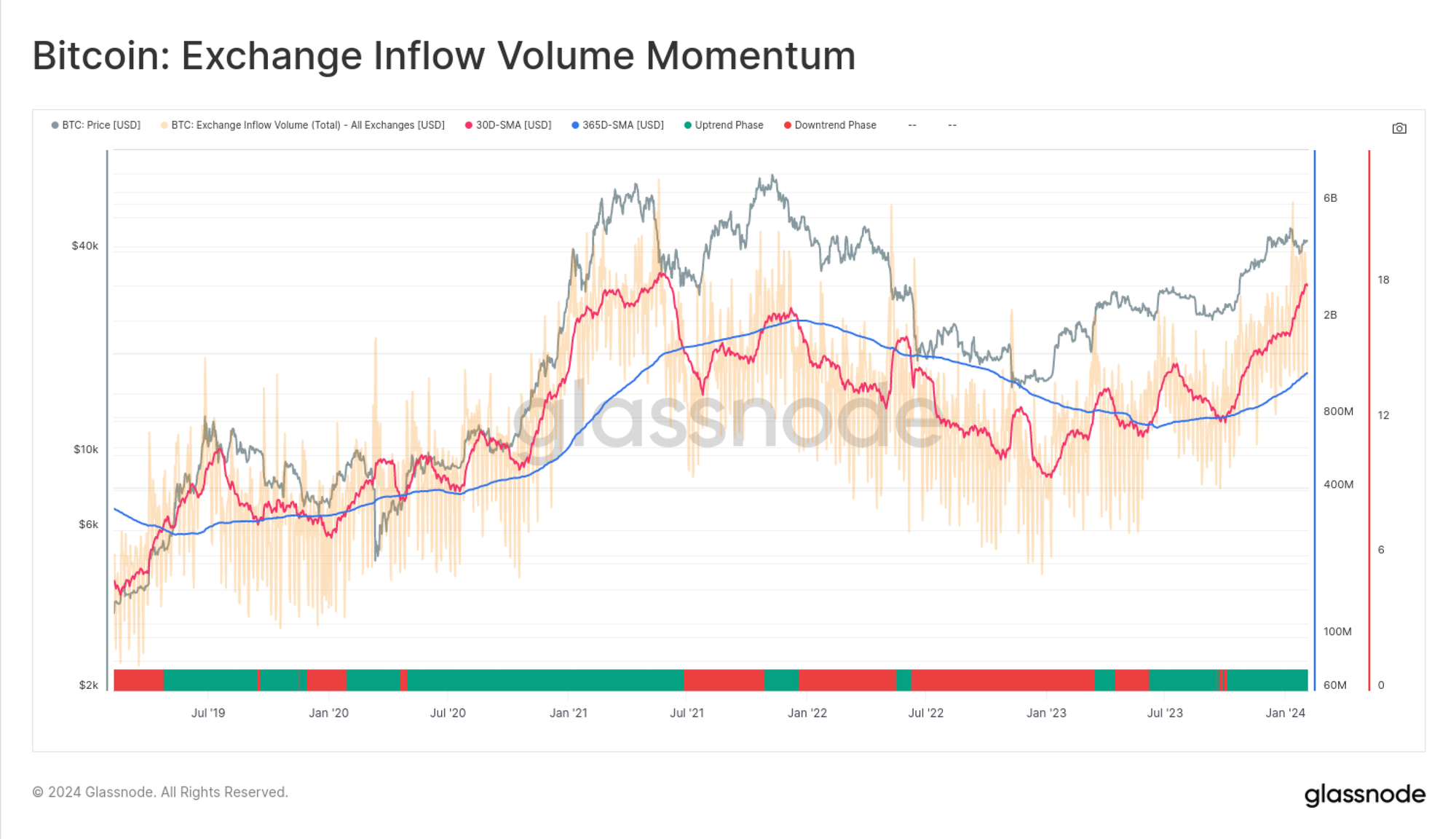

Exchange Inflow Volume Momentum

It is also typical for exchange related volumes and trading activity to climb during periods of network growth. Here we consider Exchange Inflow Volumes as it benefits from Glassnode’s entity-adjustment heuristics, and is a more direct proxy for spot trading activity.

We will use a simple fast/slow moving average cross-over transformation for this metric, seeking periods where the 30D-SMA is above the 365D-SMA. This indicates that near term activity is higher than the slower long-term baseline.

Analysts may also consider the magnitude of the deviation between these moving averages, as well as their gradient for identifying more advanced indications and divergences.

💡

– Base Metric: Exchange Inflow Volume [USD]

– Transformation: 30D-SMA and 365D-SMA cross-over

– 🟩 Positive Momentum: 30D-SMA > 365D-SMA

Unrealized Profit and Pricing

A primary advantage of on-chain analysis is the ability to monitor the cost basis of each coin considering the pricestamp at which it last transacted. We can use this toolkit of Unrealized Profit/Loss to identify price zones where a large volume of the supply has changed hands.

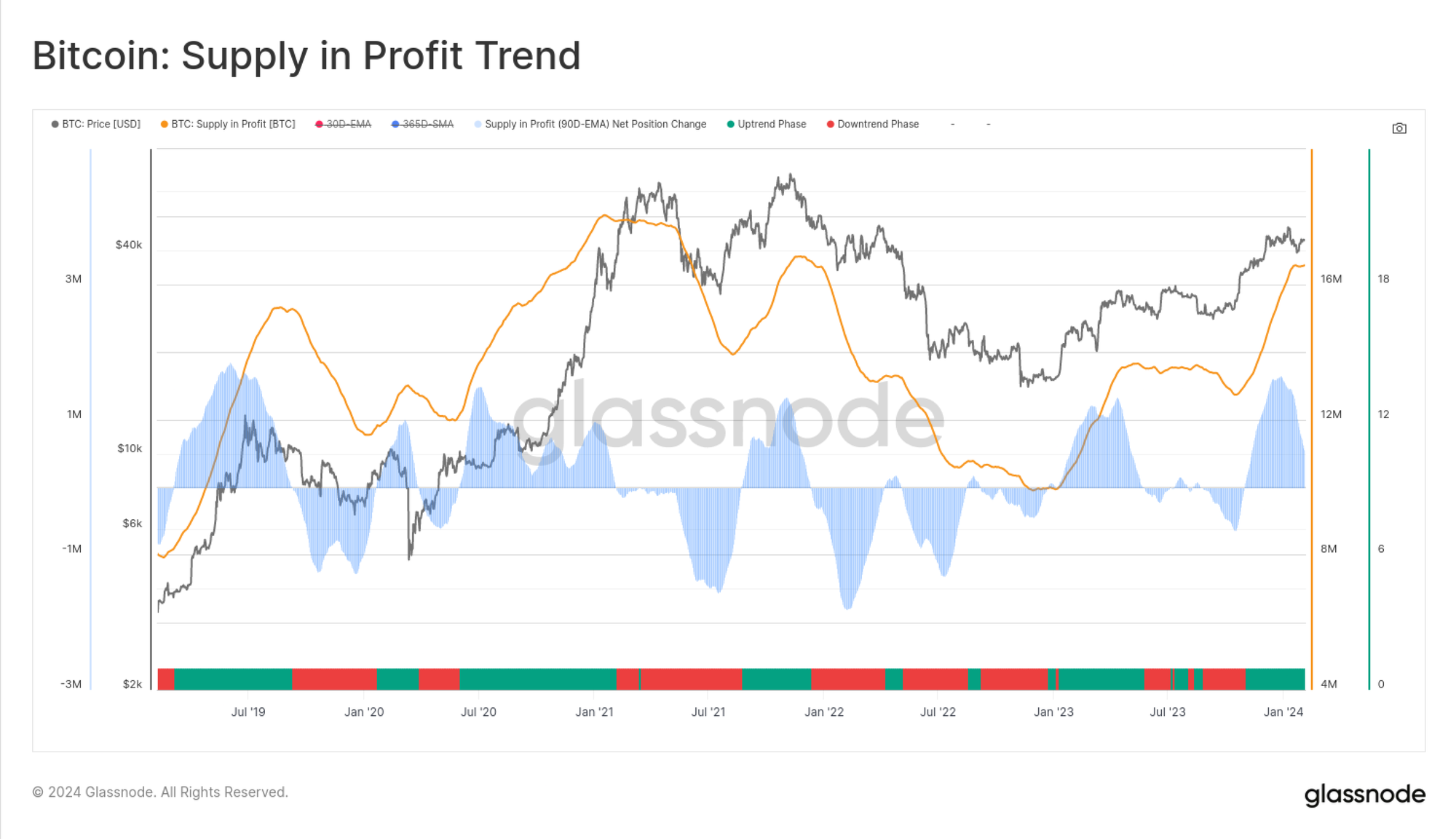

Supply in Profit Trend

During sustained market uptrends, the spot price continues to climb above the cost basis of increasing volumes of the coin supply (putting that supply ‘in-profit’). To smooth out daily fluctuations, we have applied a 90D-EMA to the total Supply in Profit [BTC] metric.

We can then identify periods of positive momentum as those where the 90D-EMA of Supply in Profit is increasing. Here we use a 30-day difference function and display it as a 🔵 oscillator. Positive values signify that the total supply in profit has increased over the last 30-days.

More advanced analysis can consider the magnitude and divergences of this oscillator, especially as it relates to cycle extremes (100% of supply in profit at ATHs, and when large volumes change hands near cycle lows).

💡

– Base Metric: Supply in Profit [BTC]

– Transformation: 30-day Difference of Supply in Profit (90D-EMA)

– 🟩 Positive Momentum: Supply In Profit (90D-EMA) increases over last 30-days.

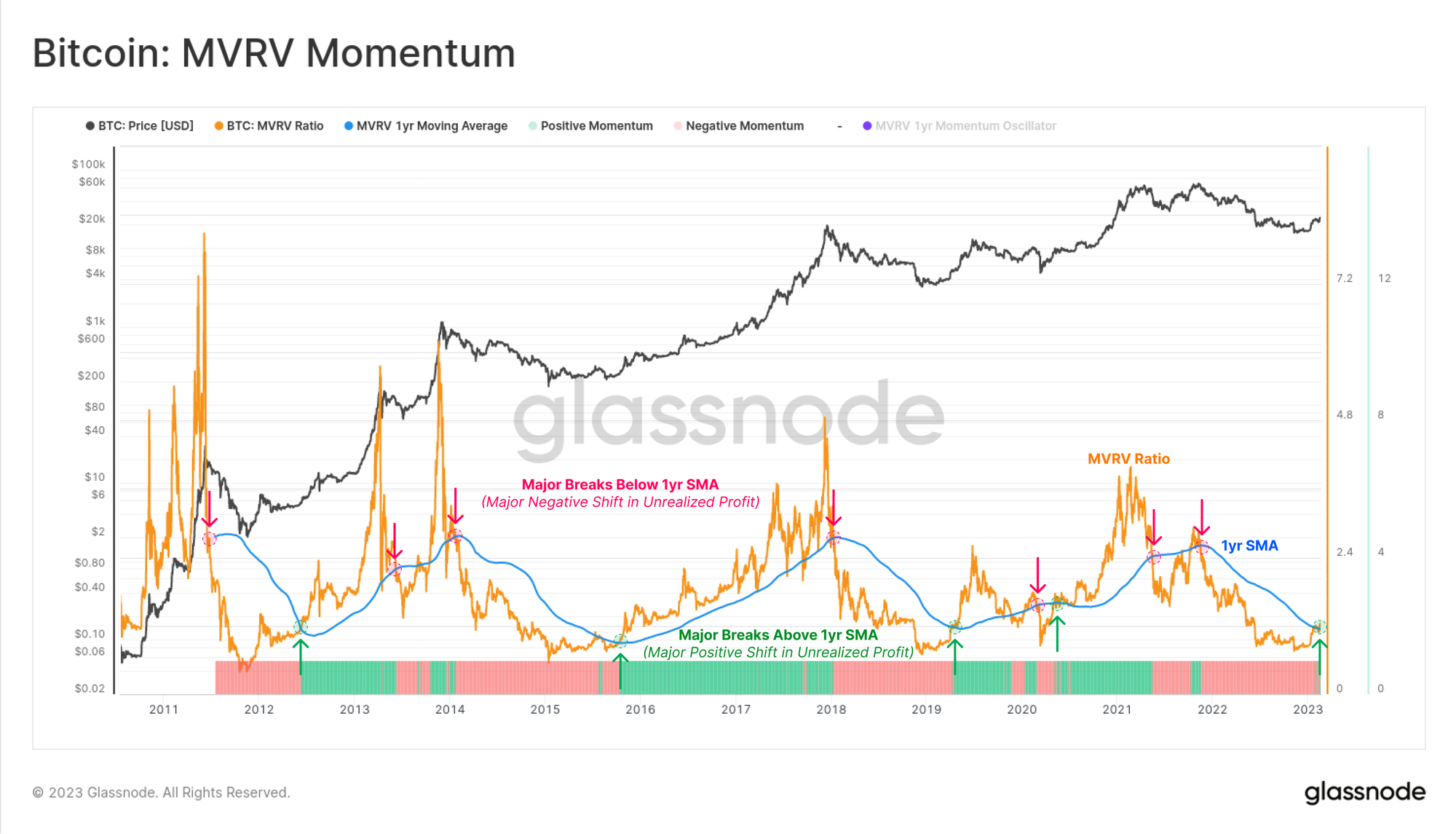

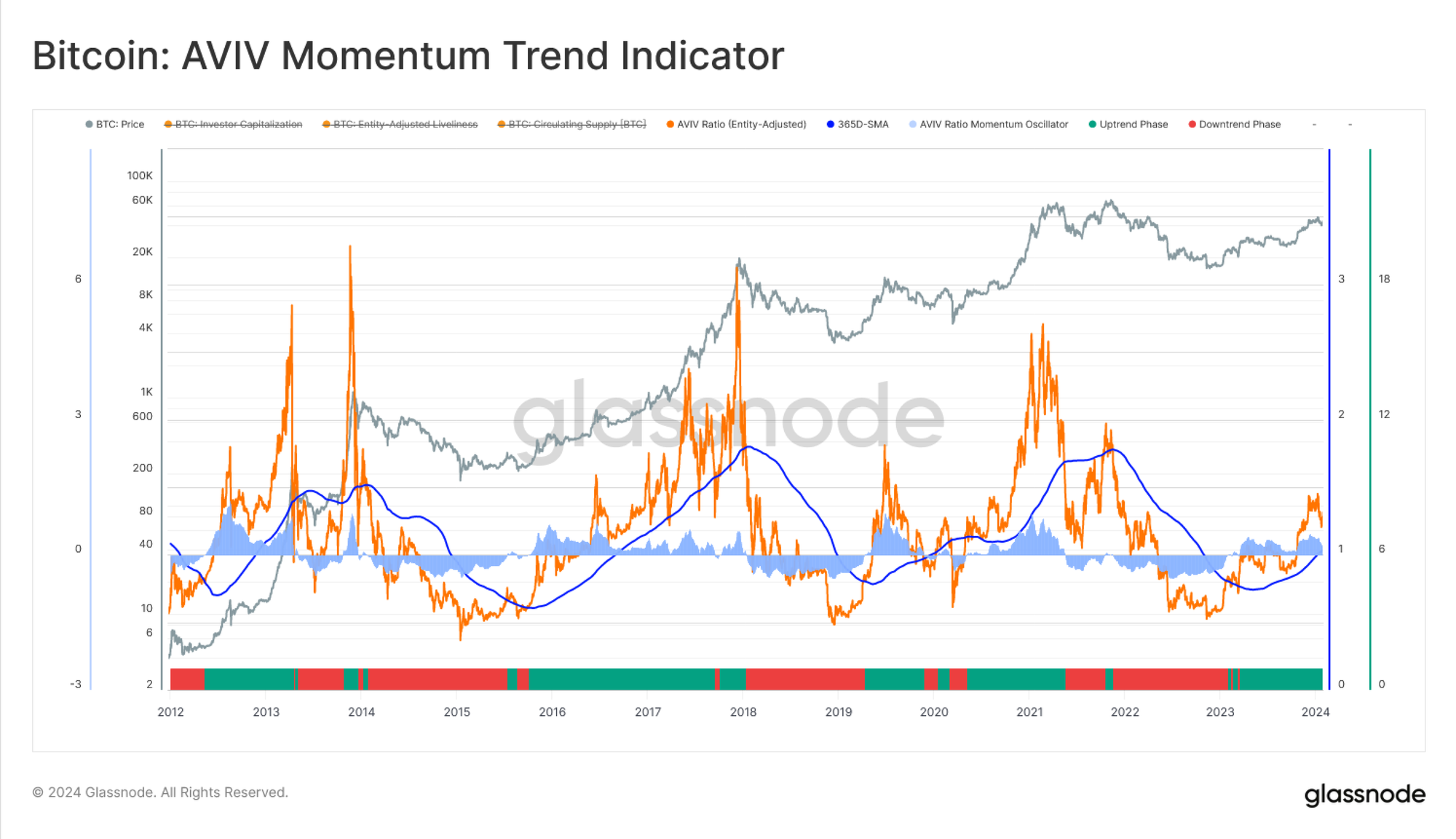

MVRV and AVIV Inflection Points

Another powerful tool to monitor inflection points in investor profitability is the MVRV Ratio. In our prior report, Mastering the MVRV Ratio, we established an indicator for tracking market momentum based on a 365D-SMA cross-over methodology.

More recently, we developed the AVIV Ratio alongside ARK Invest as part of the Cointime Economics framework. We consider AVIV to be a more representative unrealized profit/loss oscillator for active investors. From this, we can identify market inflection points:

- Positive Momentum: AVIV crosses above its 365D-SMA as investor profitability improves, often indicating many investors hold coins with a now favourable cost basis.

- Negative Momentum: AVIV crosses below its 365D-SMA as investor profitability worsens, often indicating many investors are trapped with an elevated and underwater cost basis.

💡

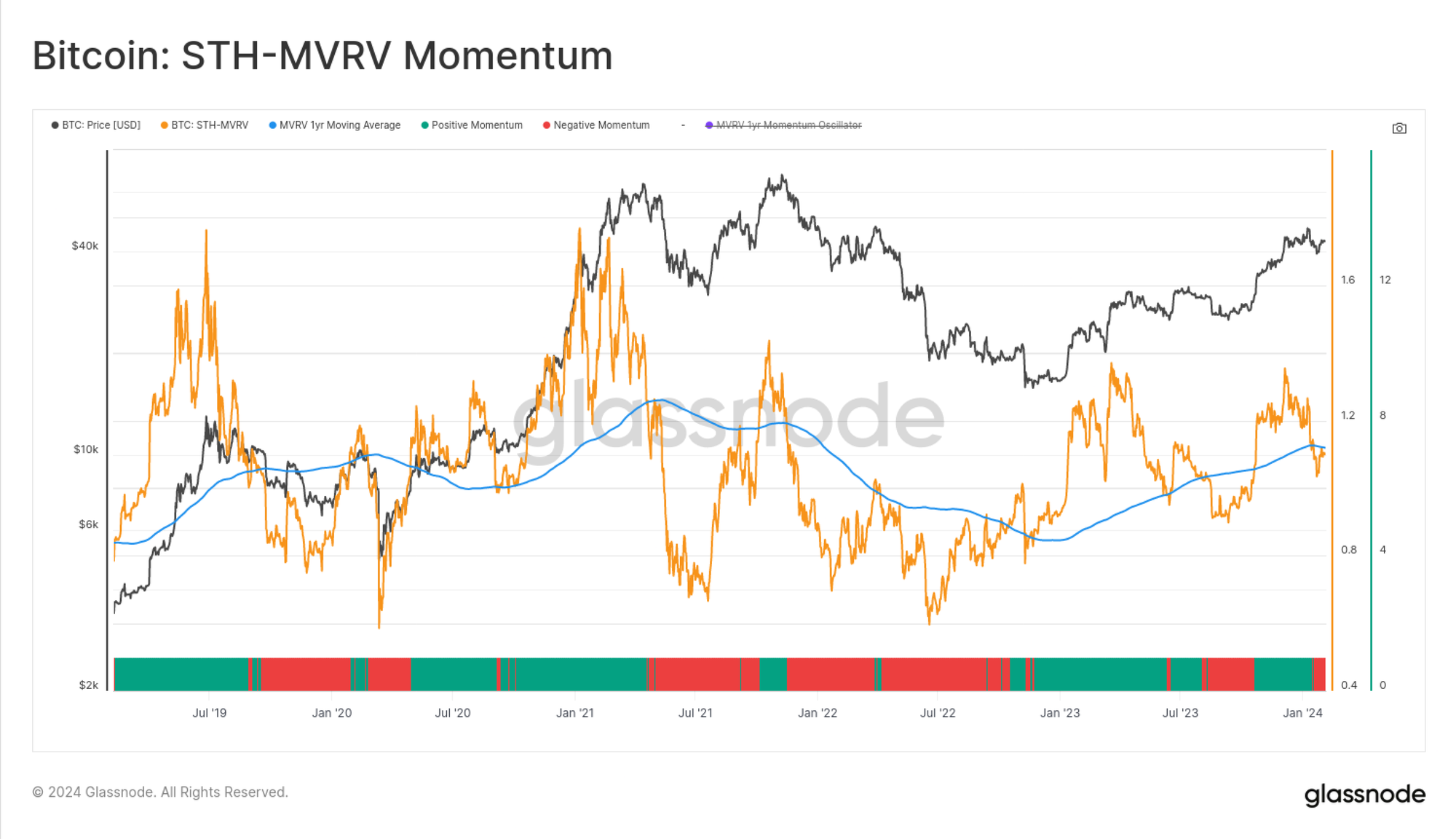

Short-Term Holders In Profit

We can also leverage the Short-Term Holder MVRV to specifically track the unrealized profit or loss of new demand entering the market. Comparing the STH cost-basis to the spot price provides insight into the degree of pressure new market participants are experiencing to either capitulate at a loss, or to take profit.

A very simple momentum indicator can be achieved by tracking periods where STH-MVRV trades above or below 1.0.

This particular variant will be quite responsive (relative to MVRV and AVIV) as it only considers coins moved within the last 155-days. As such, it is quite sensitive to periods when lots of coins have recently changed hands within a specific price range. As price trades away from that cluster, it dramatically changes the unrealized profit/loss position of STHs.

Realized Profit/Loss and Spending Activity

In the previous section, we assessed the unrealized profit/loss incentives which drive market participants to make decisions. These observations are well paired with metrics that describe whether investors actually take action in response to these incentives.

Thus, the next logical step is to evaluate the realized market response to these pressures.

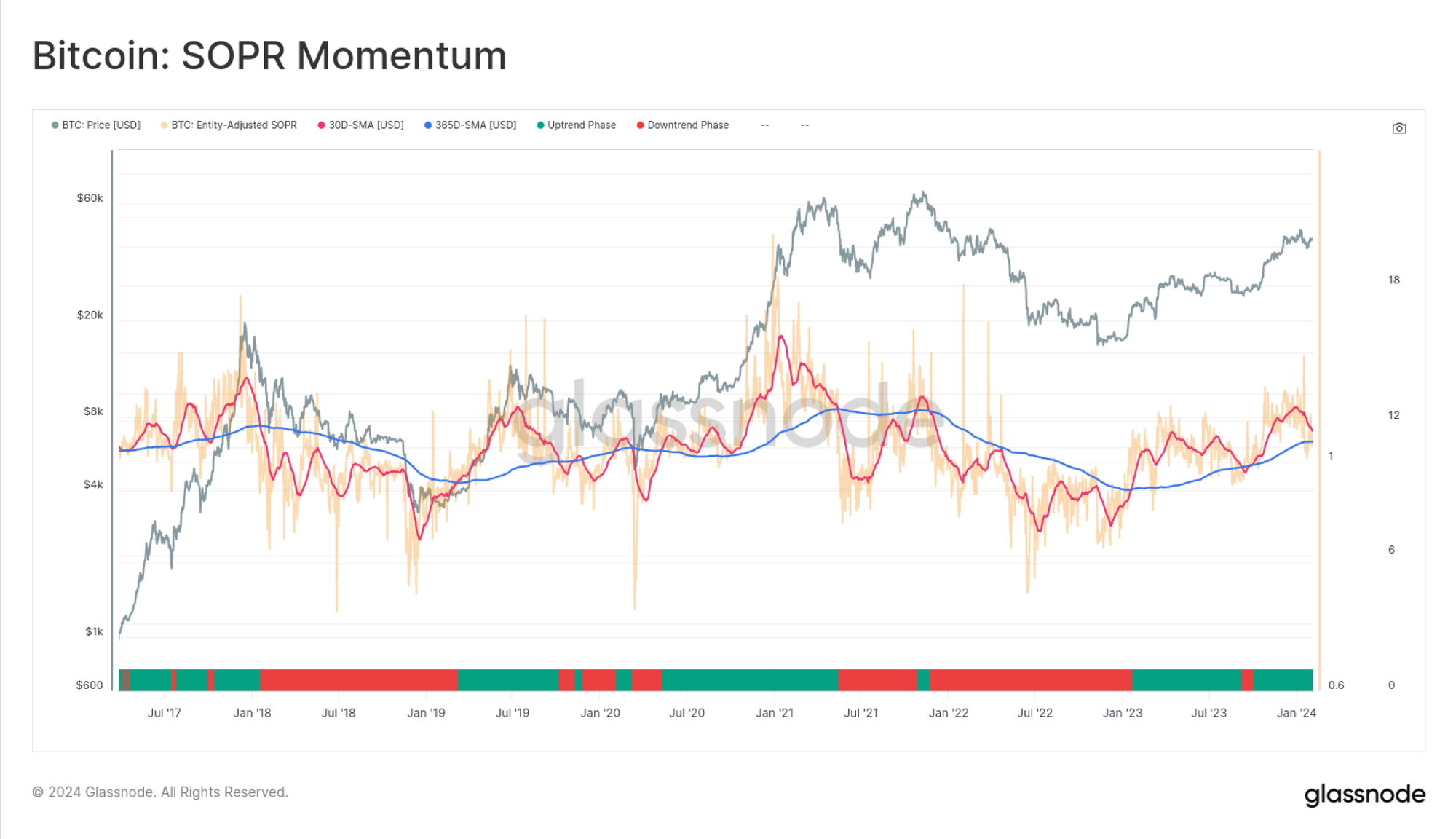

SOPR Momentum

The first metric we consider is the SOPR indicator, which assesses the average magnitude of participant profit and loss taking events on any given day. The objective is to identify periods when profit taking is increasing relative to a longer term baseline.

To achieve this, we again utilize a fast/slow momentum cross-over strategy applied to the SOPR metric. We will also employ our Entity-Adjusted SOPR variant to ensure we capture only economically meaningful transactions, and exclude internal transactions and self-spends.

💡

SOPR Momentum:

– Base Metric: Entity-Adjusted SOPR

– Transformation: 30D-SMA and 365D-SMA

– 🟩 Positive Momentum: 30D-SMA > 365D-SMA

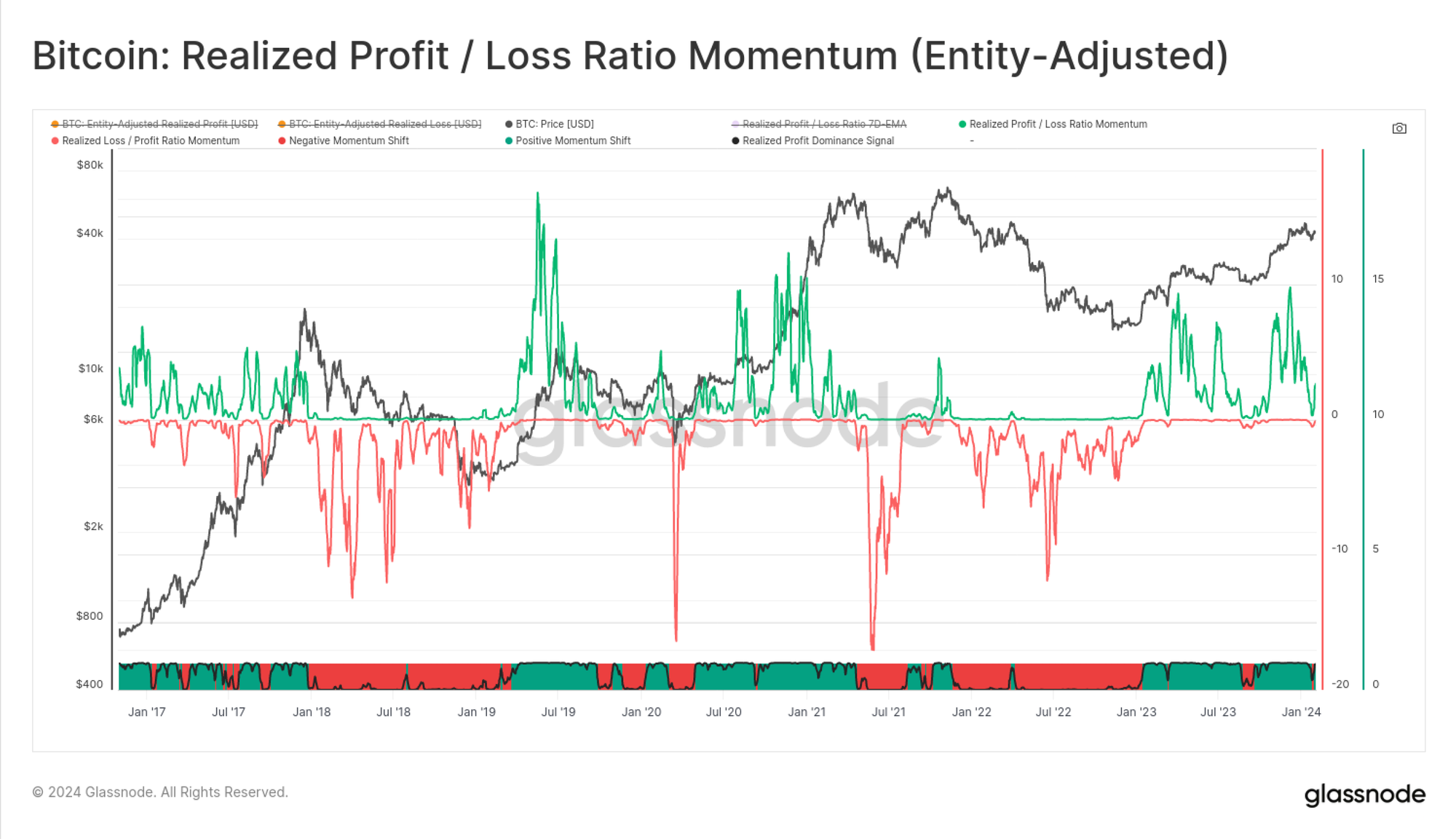

The second metric to consider is the ratio between Realized Profit and Realized Loss. This tools is particularly sensitive during regime shifts such as:

- During strong uptrends there are relatively few coins in loss. However this changes rapidly during corrections, as recent buyers panic and spend previously profitable coins in loss.

- Near bear cycle lows, many investors capitulate at steep losses, and there are relatively few coins in profit. As the market starts to recover, there is a dramatic uptick in realized profit relative to the preceding bearish trend.

We will again employ a momentum cross-over methodology to highlight periods where the Profit/Loss Ratio is experiencing rapid acceleration in either direction. This aides in identification of trend inflection points.

💡

– Base Metrics: Ratio between Realized Profit and Realized Loss (Entity-Adjusted)

– Transformation: 30D-SMA and 365D-SMA

– 🟩 Positive Momentum: 30D-SMA > 365D-SMA

Wealth Transfer

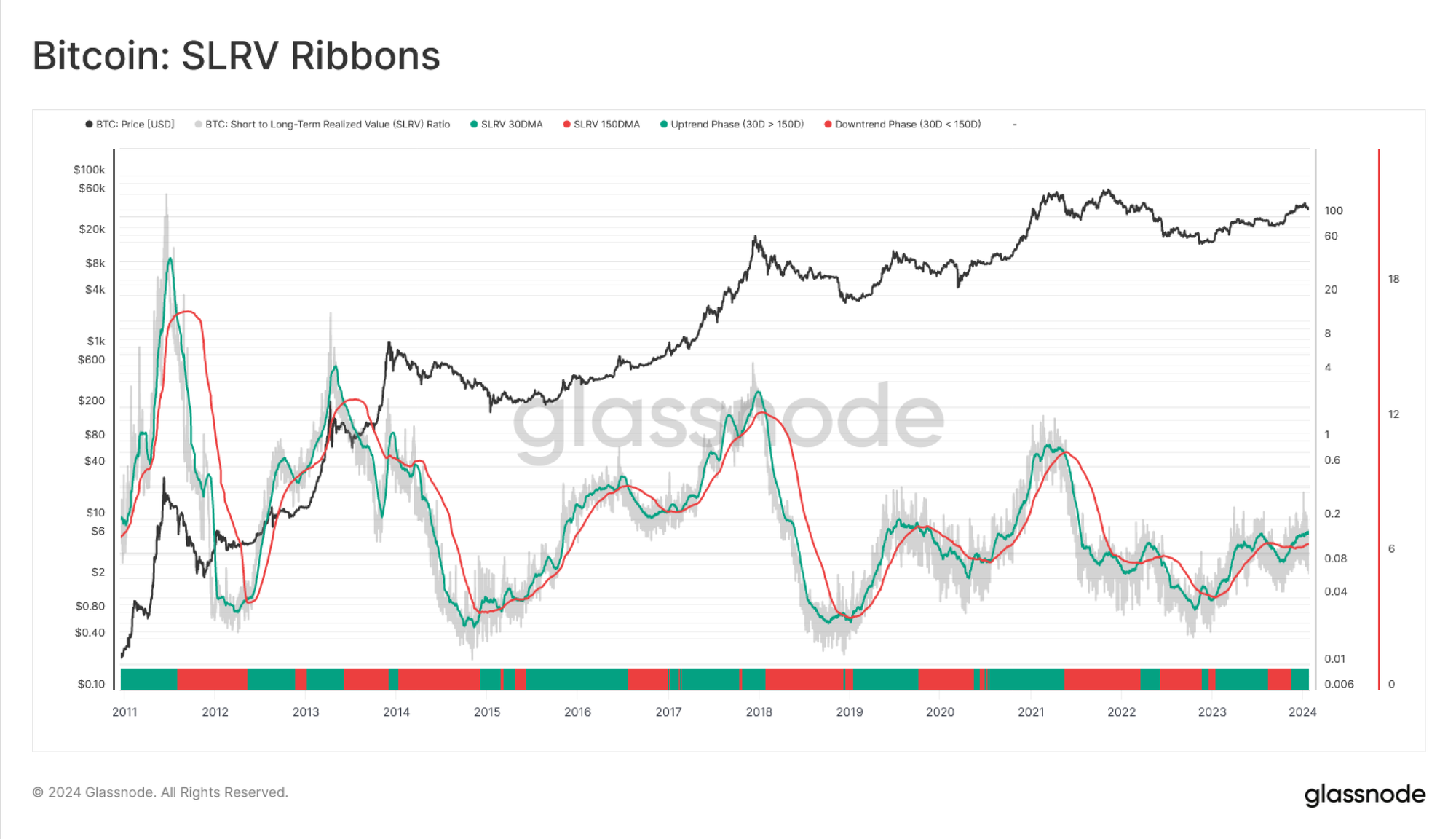

SLRV Ribbon Momentum

The final charactestric we shall discuss is the transfer of wealth from longer-term investors, to newer and often less experienced investors. Typically, cycle bottoms are distinguished by a disproportionate amount of wealth held by Long-Term Holders. Conversely, cycle tops are often punctuated by a significant saturation by Short-Term Holders.

The balance of wealth held between these two cohorts can then be used to provide insight into the position of the current cycle.

To model this phenomena, we shall utilize the SLVR metric, which compares the wealth held by coins aged 24hrs to coins aged 6m-1y. A momentum cross-over of 30days to 150days is used, as originally proposed by the metric author Capriole Investments.

Constructing a Composite Momentum Indicator

Finally, a composite index of several of the aforementioned conditions can be constructed to produce a holistic model. The goal is to assess confluence across various categories; Profitability, Spending Behavior, On-chain Activity and the Transfer of Wealth.

Here we have weighted each individual component evenly, and applied a simple condition to flag when 4-of-8 conditions are met in blue. This has historically identified periods when the Bitcoin market is in a sustainable uptrend. We can also flag when all eight conditions are met in purple, indicating periods with extremely strong positive momentum across all categories.

Conversely, a composite index value of less than 4 denotes that on net, the majority of these momentum conditions are negative. This suggests the market is experiencing overall negative momentum, and is typically experienced throughout bear markets, including the initial inflection points.

Summary and Conclusions

On-chain data provides analysts and investors with a remarkable degree of transparency into the performance, adoption, and investor positioning within digital assets. In this piece, we highlighted several approaches and frameworks for assessing market momentum across various data categories.

Disclaimer: This report does not provide any investment advice. All data is provided for information and educational purposes only. No investment decision shall be based on the information provided here and you are solely responsible for your own investment decisions.

Exchange balances presented are derived from Glassnode’s comprehensive database of address labels, which are amassed through both officially published exchange information and proprietary clustering algorithms. While we strive to ensure the utmost accuracy in representing exchange balances, it is important to note that these figures might not always encapsulate the entirety of an exchange’s reserves, particularly when exchanges refrain from disclosing their official addresses. We urge users to exercise caution and discretion when utilizing these metrics. Glassnode shall not be held responsible for any discrepancies or potential inaccuracies. Please read our Transparency Notice when using exchange data.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://insights.glassnode.com/the-week-onchain-week-06-2024/

- :has

- :is

- :not

- :where

- 1

- 2000

- 26%

- 29

- 30

- 30-days

- 8

- a

- ability

- About

- above

- acceleration

- accuracy

- Achieve

- achieved

- Achieves

- across

- Action

- active

- activity

- actually

- address

- addresses

- Adoption

- advanced

- ADvantage

- advice

- After

- again

- aged

- algorithms

- All

- allows

- alongside

- also

- always

- amassed

- amount

- an

- analysis

- analyst

- Analysts

- and

- any

- applied

- appreciate

- approaches

- ARE

- Ark

- ark invest

- article

- AS

- assess

- assessed

- assesses

- Assessing

- Assets

- At

- author

- available

- average

- aviv

- away

- Balance

- balances

- base

- based

- Baseline

- basis

- BE

- Bear

- Bear Market

- bear markets

- bearish

- behavior

- below

- benefit

- benefits

- between

- Bitcoin

- Bitcoin market

- Bitcoin Network

- Block

- Blue

- both

- BTC

- buyers

- by

- CAN

- capture

- categories

- caution

- change

- changed

- Changes

- characteristic

- climb

- Cluster

- clustering

- Coin

- Coins

- comparing

- component

- comprehensive

- concept

- condition

- conditions

- confluence

- Consider

- considered

- considering

- considers

- construct

- constructed

- continues

- conversely

- Corrections

- Cost

- cost basis

- Current

- cycle

- cycles

- daily

- dashboard

- data

- data set

- Database

- day

- decision

- decisions

- Decline

- Degree

- Demand

- demonstrate

- denotes

- Derived

- describe

- describing

- developed

- deviation

- difference

- digital

- Digital Assets

- direct

- direction

- Disclosing

- discretion

- discuss

- Display

- disproportionate

- Distinguished

- distribution

- does

- dramatic

- dramatically

- drive

- during

- e

- each

- earned

- Economics

- educational

- eight

- either

- elevated

- ensure

- entering

- entirety

- especially

- established

- evaluate

- evenly

- events

- example

- exchange

- Exchanges

- Exercise

- existing

- expands

- expansion

- experienced

- experiencing

- explore

- expressing

- extremely

- extremes

- fee

- Fees

- few

- Figures

- final

- financial

- First

- fluctuations

- For

- four

- frameworks

- from

- function

- given

- Glassnode

- goal

- Goals

- Growth

- Hands

- Have

- heightened

- Held

- here

- higher

- Highlight

- Highlighted

- historically

- hold

- holder

- holders

- holistic

- How

- However

- HTTPS

- Identification

- identified

- identify

- identifying

- important

- improves

- improving

- in

- Incentives

- Including

- inclusion

- Increase

- increased

- Increases

- increasing

- index

- indicates

- indications

- Indicator

- Indicators

- individual

- Individually

- Inflection

- information

- initial

- insight

- instance

- internal

- into

- Invest

- investment

- investor

- Investors

- IT

- ITS

- Labels

- large

- Last

- lens

- less

- Level

- Leverage

- logical

- long-term

- long-term holders

- longer

- loss

- losses

- lots

- Lows

- Majority

- make

- many

- Market

- Market Trends

- Markets

- May..

- meaningful

- met

- methodologies

- Methodology

- metric

- Metrics

- might

- miner

- model

- Momentum

- Monitor

- more

- moved

- moving

- moving average

- moving averages

- MVRV

- MVRV ratio

- Near

- negative

- net

- network

- New

- New Market

- newer

- next

- Next Block

- no

- note

- Notice..

- now

- objective

- of

- official

- Officially

- often

- Old

- on

- On-Chain

- on-chain activity

- On-chain analysis

- on-chain data

- only

- or

- originally

- our

- out

- over

- overall

- own

- paired

- Panic

- part

- participant

- participants

- particular

- particularly

- Pay

- Peak

- performance

- periods

- piece

- plato

- Plato Data Intelligence

- PlatoData

- points

- position

- positioning

- positive

- potential

- powerful

- preceding

- presented

- pressure

- pressures

- previous

- previously

- price

- primary

- Prior

- produce

- Profit

- profitability

- profitable

- proportion

- proposed

- proprietary

- provide

- provided

- provides

- proxy

- published

- punctuated

- purposes

- Putting

- quite

- range

- rapid

- rapidly

- ratio

- Read

- realized

- recent

- recently

- Recover

- regime

- regularly

- related

- relates

- relative

- relatively

- remarkable

- report

- representative

- representing

- reserves

- response

- responsible

- responsive

- revenue

- Ribbon

- Rolling

- Second

- Section

- seeking

- selection

- sensitive

- set

- several

- Shifts

- short-term

- Short-term holder

- shown

- significant

- signify

- Simple

- smooth

- solely

- SOPR

- specific

- specifically

- spend

- Spending

- Spot

- Spot Trading

- spotting

- starts

- Step

- Strategy

- strength

- strive

- strong

- such

- sufficient

- Suggests

- supply

- supply in profit

- sustainable

- Take

- taking

- team

- techniques

- tends

- term

- than

- that

- The

- the information

- their

- then

- There.

- These

- this

- those

- Through

- throughout

- to

- tool

- toolkit

- tools

- Tops

- Total

- track

- Tracking

- trades

- Trading

- traditional

- Transactions

- transfer

- Transformation

- Transparency

- trapped

- Trend

- Trends

- two

- typical

- typically

- Uncommon

- underwater

- uptrend

- urgency

- Usage

- USD

- use

- used

- users

- using

- utilize

- utilizes

- Utilizing

- utmost

- value

- Values

- Variant

- variety

- various

- very

- via

- volume

- volumes

- we

- Wealth

- WELL

- when

- whether

- which

- while

- wide

- Wide range

- will

- Willingness

- with

- within

- You

- Your

- zephyrnet

- zones