Crypto investors are cheering after Grayscale, an asset manager that holds 3.4% of all the Bitcoin in circulation, notched a legal victory against the SEC on Aug. 29.

A U.S. court ruled that the Securities and Exchange Commission did not adequately explain its denial of Grayscale’s application for an exchange-traded product (ETP).

Grayscale cited the SEC’s approval of twoETPs for Bitcoin futures last year, arguing that its proposed Bitcoin ETP was “materially similar” to the approved products. The court agreed, saying that “the denial of Grayscale’s proposal was arbitrary and capricious because the Commission failed to explain its different treatment of similar products.”

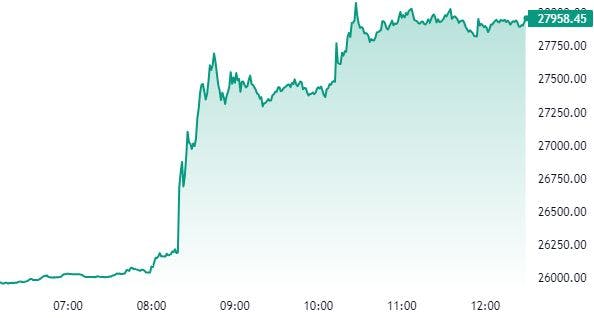

BTC surged nearly 7% on the news and the overall crypto market capitalization gained over $15B in a matter of hours. Almost all top-100 digital assets have posted gains after the ruling became public.

The tenuous relationship between the crypto industry and the SEC has reached a fever pitch this year after the agency filed high-profile lawsuits against major exchanges like Coinbase and Binance.

A win for Grayscale, which has taken heat as its flagship product GBTC has floundered, is welcome news for crypto investors.

GBTC, which has over $16B in assets under management, is up nearly 18% today and has outperformed Bitcoin this year.

Markets have been closely watching the industry’s legal battles with the SEC — a win by Ripple, the company which issues the cross-border payment token XRP, sent markets soaring in July.

To be sure, the Grayscale ruling doesn’t mean that the SEC will approve the firm’s application, noted Jake Chervinsky, one of crypto’s most prominent lawyers. However, Chervinsky did suggest that the ruling would allow the SEC to pivot away from its anti-spot ETP stance.

The SEC says that Grayscale’s product isn’t designed to prevent fraud and manipulation. Chervinsky said the agency has been using this angle for years.

“The SEC has spent a full decade denying spot bitcoin ETF proposals under this reasoning,” he wrote. “That era has now come to an end.”

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://thedefiant.io/markets-soar-on-us-court-ruling-in-grayscale-s-favor

- :has

- :is

- :not

- $UP

- 1

- 100

- 29

- 31

- 7

- 970

- a

- Absolute

- adequately

- After

- against

- agency

- agreed

- All

- allow

- almost

- Alpha

- an

- and

- Application

- approval

- approve

- approved

- ARE

- AS

- asset

- Assets

- Aug

- away

- battles

- BE

- became

- because

- become

- been

- between

- Bitcoin

- Bitcoin ETF

- BITCOIN ETP

- Bitcoin Futures

- Block

- by

- capitalization

- Circulation

- cited

- closely

- come

- commission

- community

- company

- Court

- cross-border

- crypto

- Crypto Industry

- Crypto investors

- Crypto Market

- daily

- data

- decade

- DeFi

- designed

- DID

- different

- digital

- Digital Assets

- disabled

- Doesn’t

- dump

- end

- Era

- ETF

- ETP

- exchange

- exchange-traded

- Exchanges

- Explain

- Failed

- favor

- filed

- flagship

- For

- fraud

- from

- full

- Futures

- gained

- Gains

- GBTC

- Grayscale

- Group

- Have

- he

- Hidden

- high-profile

- holds

- HOURS

- hover

- However

- HTTPS

- in

- industry

- industry’s

- Investors

- issues

- ITS

- Jake Chervinsky

- join

- jpg

- July

- Last

- Last Year

- Lawsuits

- Lawyers

- Legal

- letter

- LG

- like

- major

- manager

- Manipulation

- Market

- Market Capitalization

- Markets

- Matter

- max-width

- mean

- member

- most

- nearly

- news

- now

- of

- on

- ONE

- our

- outperformed

- over

- overall

- payment

- Pitch

- Pivot

- plato

- Plato Data Intelligence

- PlatoData

- podcast

- posted

- Premium

- prevent

- Product

- Products

- prominent

- proposal

- Proposals

- proposed

- public

- reached

- recap

- relationship

- relative

- Ripple

- ruling

- s

- Said

- saying

- says

- SEC

- Securities

- Securities and Exchange Commission

- sent

- similar

- soar

- spent

- Spot

- Spot Bitcoin Etf

- stance

- suggest

- sure

- Surged

- taken

- that

- The

- The Defiant

- this

- this year

- to

- today

- token

- TradingView

- Transcript

- treatment

- u.s.

- under

- us

- using

- victory

- visible

- was

- watching

- welcome

- which

- will

- win

- with

- would

- wrote

- xrp

- year

- years

- zephyrnet