GBTC Discount Shrinks To 39%

Crypto prices are rising along with stock markets after the latest report from the US Bureau of Labor Statistics showed that consumer prices fell in December.

The year-on-year Consumer Price Index (CPI), a measure of annualized inflation, dropped to 6.5% from 7.1% in November.

Bitcoin, already having a good week, is turning it into a great one with an 8.4% jump in the last 24 hours, according to The Defiant Terminal. ETH, BNB, and XRP, the top non-pegged digital assets after Bitcoin, are also rallying, though not as much as the world’s oldest cryptocurrency — ETH is up 7.1%, BNB is up 3.2%, and XRP 1.5%.

ETH Price + BTC Price + BNB Price + XRP Price, Source: The Defiant Terminal

GBTC Discount Shrinks

Despite the ongoing battle between crypto exchange Gemini and Digital Currency Group (DCG), GBTC has curiously surged even more than Bitcoin — the beleaguered security, which represents a share in an underlying pool of Bitcoin, jumped almost 12% on the day.

GBTC is a publicly-traded investment fund issued by Grayscale, a subsidiary of DCG. Because of the structure of the investment vehicle, the security doesn’t trade one-to-one with the underlying Bitcoin it represents.

Instead, GTBC floats at a premium or discount relative to the underlying BTC based on market demand for its shares — GBTC’s discount to its Net Asset Value (NAV) hit an all-time high of nearly 50% in December.

Notably, traditional stock markets are also up on the CPI news, indicating that crypto continues to be just another risk-on trade in the current macro environment and is not meaningfully differentiated from equities.

Annualized inflation in the United States hit a high of 9.1% in June 2022 and has been edging lower since.

Lido Leads DeFi Higher

The DeFi tokens of the top protocols in terms of total value locked (TVL) have also taken a leg up. Leading the charge is Lido, one of a red hot set of liquid staking protocols — LDO is up a whopping 19.4% on the day, according to The Defiant Terminal.

MKR Price + LDO Price + UNI Price + AAVE Price + CRV Price, Source: The Defiant Terminal

Next Fed Meeting

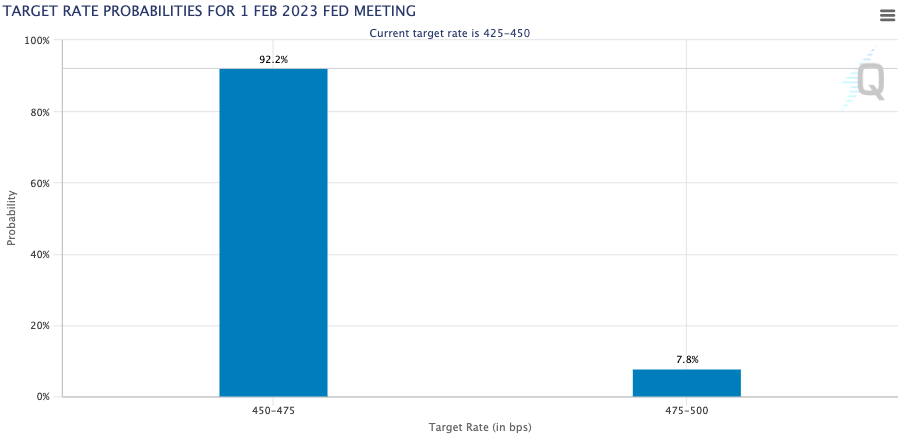

The Fed’s next meeting will take place on Feb. 1, and the CME Group’s FedWatch tool indicates a 92.2% chance of a 25 basis point hike.

The Bureau of Labor statistics’ next release of CPI data, which will reference January prices, will come out on Feb. 14.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://thedefiant.io/markets-surge-as-us-inflation-cools/

- 1

- 2%

- 2022

- 7

- 9

- a

- aave

- AAVE Price

- According

- After

- already

- amp

- and

- annualized

- Another

- asset

- Assets

- based

- basis

- Battle

- because

- between

- Bitcoin

- bnb

- BNB Price

- BTC

- btc price

- Bureau

- bureau of labor statistics

- Chance

- charge

- CME

- come

- consumer

- consumer price index

- continues

- CPI

- CPI data

- CRV

- crypto

- crypto exchange

- Crypto Exchange Gemini

- cryptocurrency

- Currency

- Current

- data

- day

- DCG

- December

- DeFi

- defi tokens

- Demand

- digital

- Digital Assets

- digital currency

- digital currency group

- Digital Currency Group (DCG)

- Discount

- Doesn’t

- dropped

- Environment

- Equities

- ETH

- Even

- exchange

- Fed

- from

- fund

- GBTC

- Gemini

- Grayscale

- great

- Group

- Group’s

- having

- High

- Hike

- Hit

- HOT

- HOURS

- HTTPS

- in

- index

- indicates

- inflation

- investment

- Investment vehicle

- Issued

- IT

- January

- jump

- Jumped

- labor

- Last

- latest

- LDO

- LDO price

- leading

- Leads

- LIDO

- Liquid

- liquid staking

- locked

- Macro

- macro environment

- Market

- Markets

- measure

- meeting

- more

- nav

- nearly

- net

- net asset value

- net asset value (NAV)

- news

- next

- November

- oldest

- ONE

- Place

- plato

- Plato Data Intelligence

- PlatoData

- Point

- pool

- Premium

- price

- Prices

- protocols

- release

- represents

- rising

- security

- Share

- Shares

- Shows

- since

- Source

- Staking

- States

- statistics

- stock

- Stock markets

- structure

- subsidiary

- surge

- Surged

- Take

- Terminal

- terms

- The

- The Defiant

- to

- Tokens

- tool

- top

- Total

- total value locked

- trade

- traditional

- Turning

- TVL

- underlying

- UNI

- UNI price

- United

- United States

- us

- us inflation

- value

- vehicle

- which

- will

- world’s

- xrp

- zephyrnet