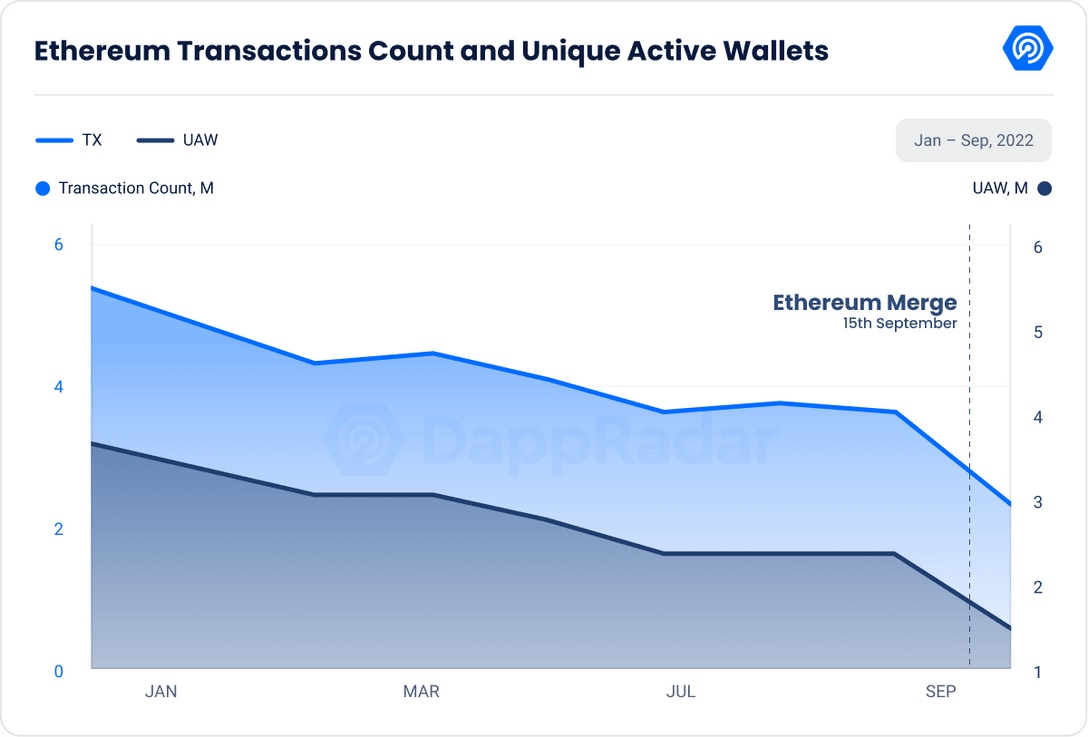

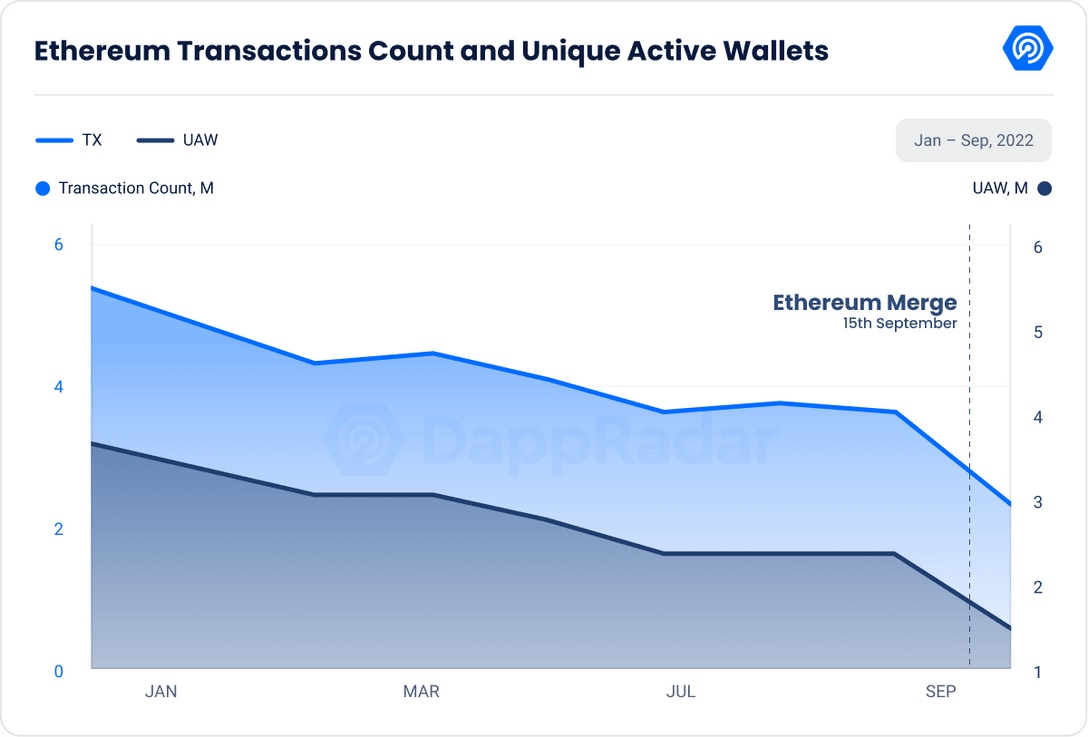

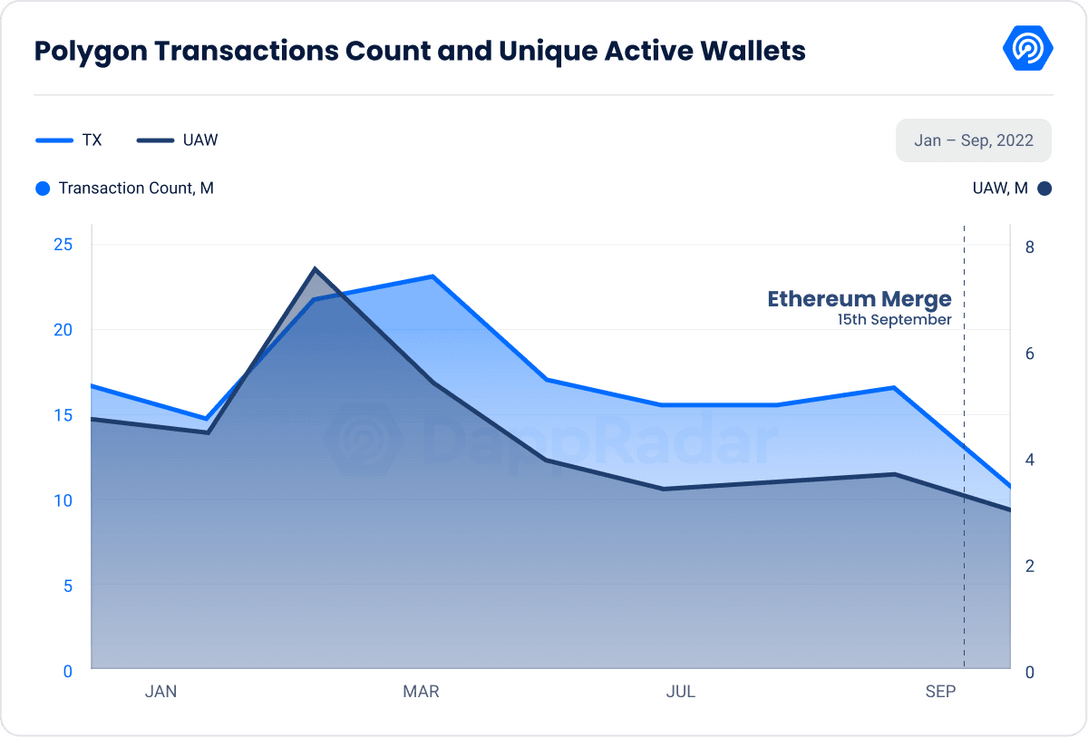

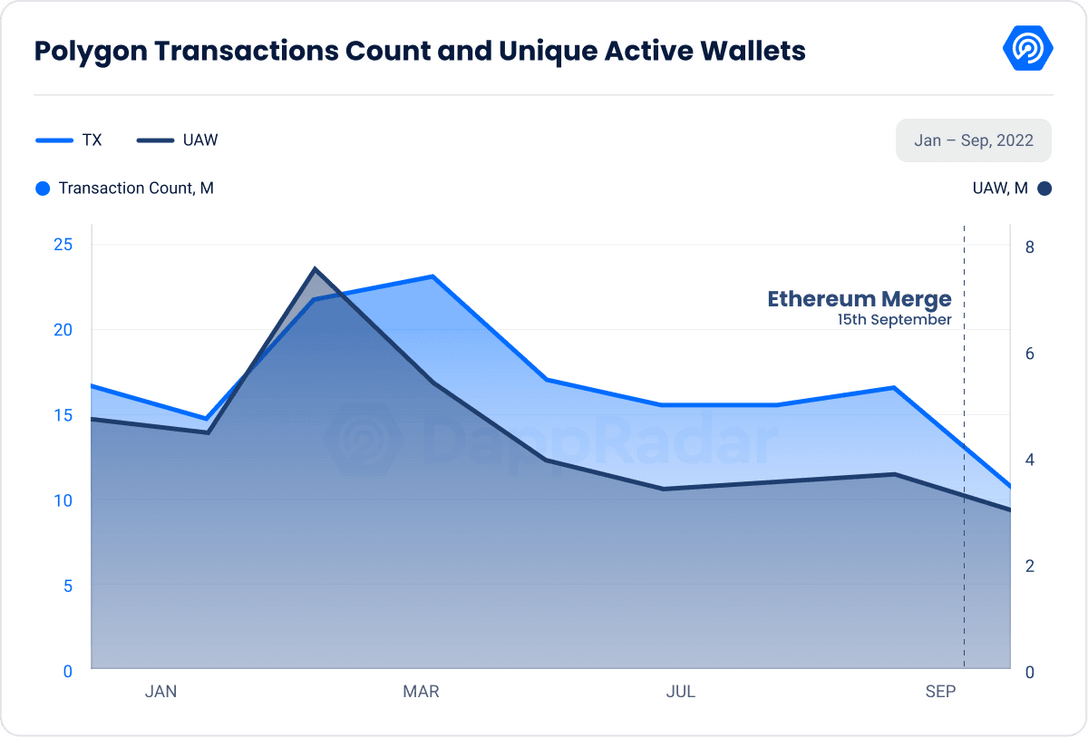

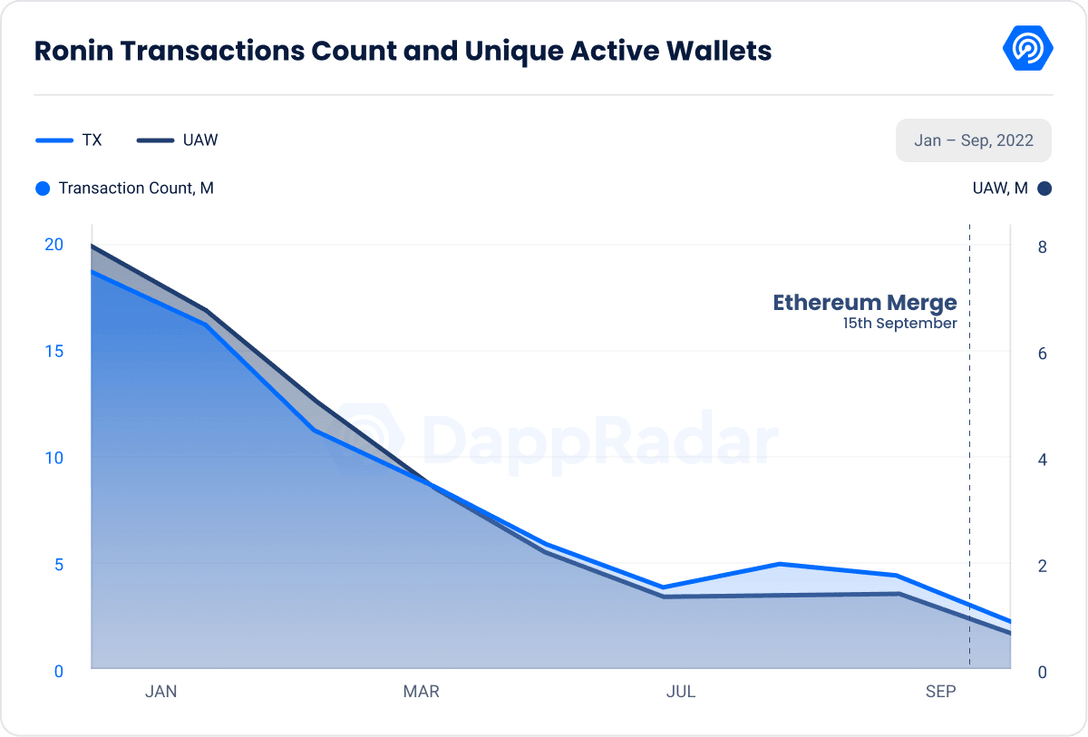

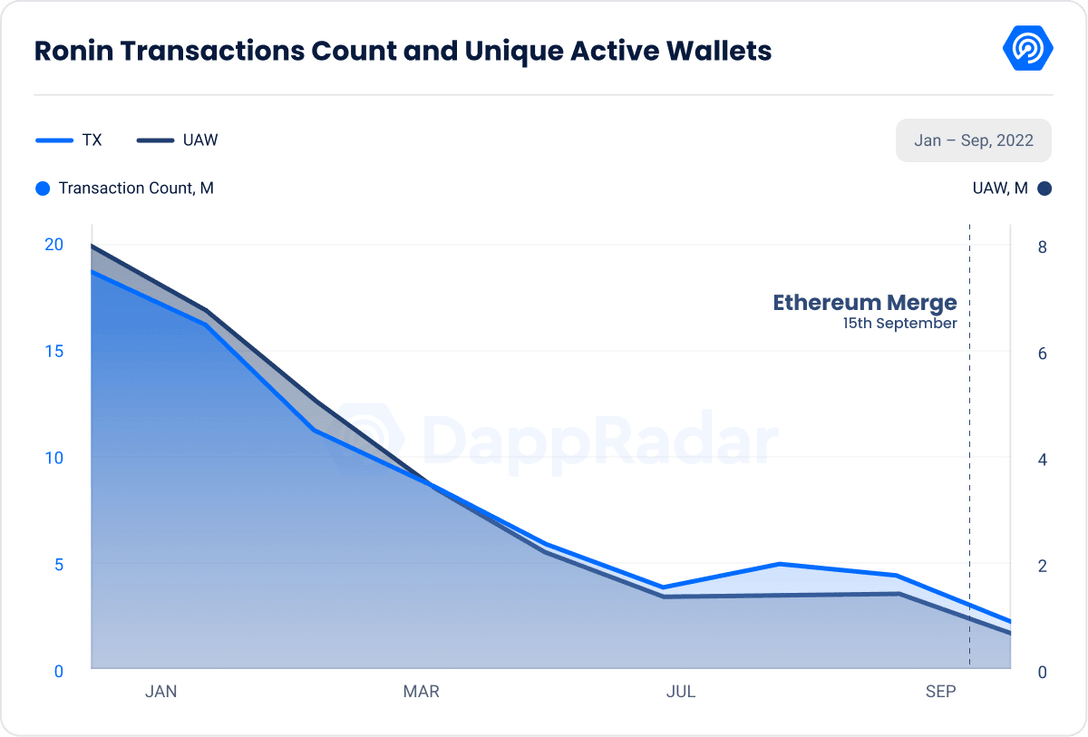

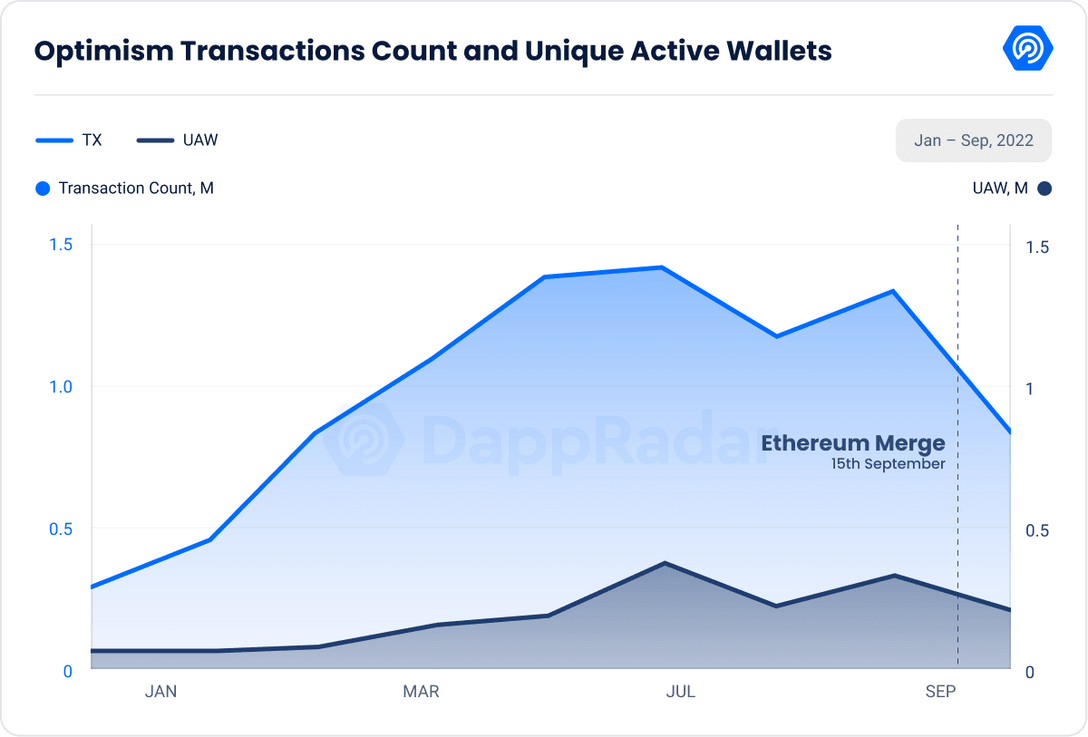

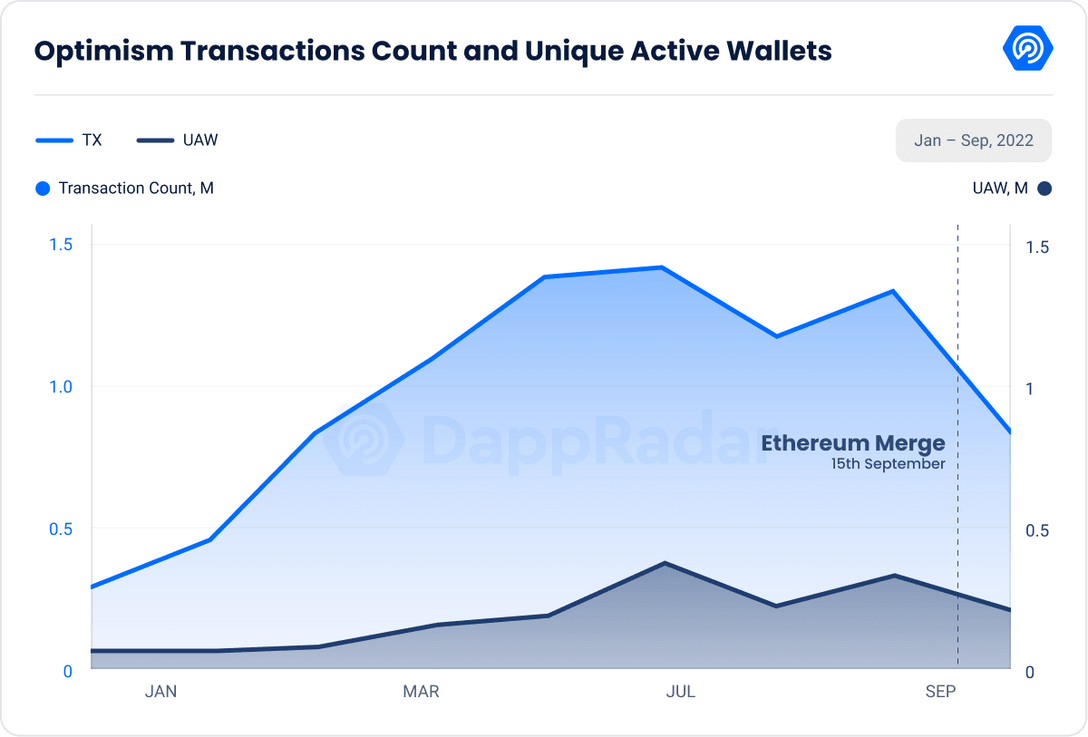

Activity on layer 2 was greater before the Merge; however, the number of transactions dropped by 36% following the merge, and the number of unique active wallets dropped by 27%.

Ethereum, the second-largest cryptocurrency behind bitcoin and the gateway to hundreds of DeFi initiatives, has a safe environment. As it is programmable and scalable, anybody may use it to create dapps and other blockchain products. However, hefty gas prices, power consumption, and network congestion topped the list of Ethereum’s shortcomings.

High gas prices impeded traders, gamers, and artists from transacting on the Ethereum network. Consequently, several layer-2 solutions are addressing common Ethereum difficulties by offering safe and rapid network confirmation without or lower gas price.

People are wondering how L2 ecosystems will fit into the scenario ‘after the Merge’, considering that Ethereum is constructing its infrastructure via the Merge. However, due to the Merge, the Ethereum environment was strengthened and opened the road to a more efficient layer-2.

In this report, we will analyze the immediate impact on the most known layer-2.

Key Takeaways

- The Merge seems to be a minor milestone on the Ethereum roadmap, rather than a significant scaling event.

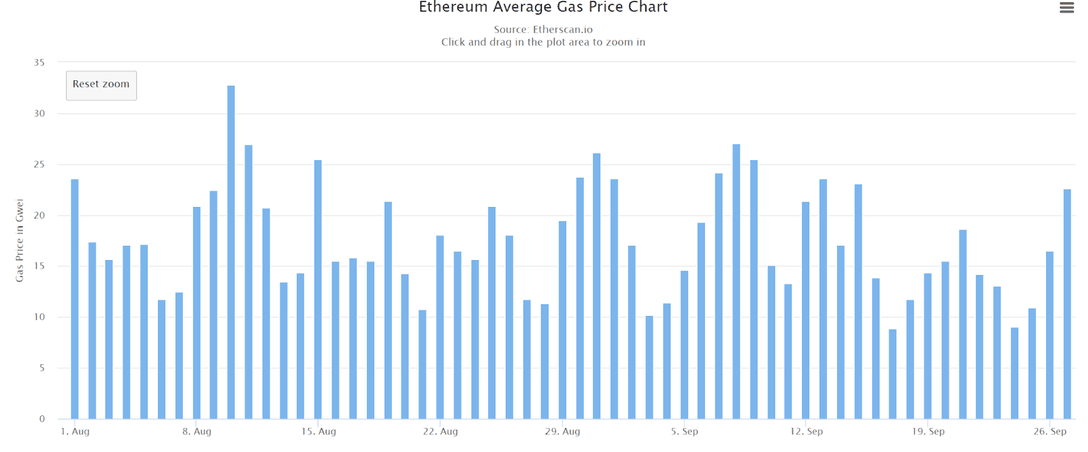

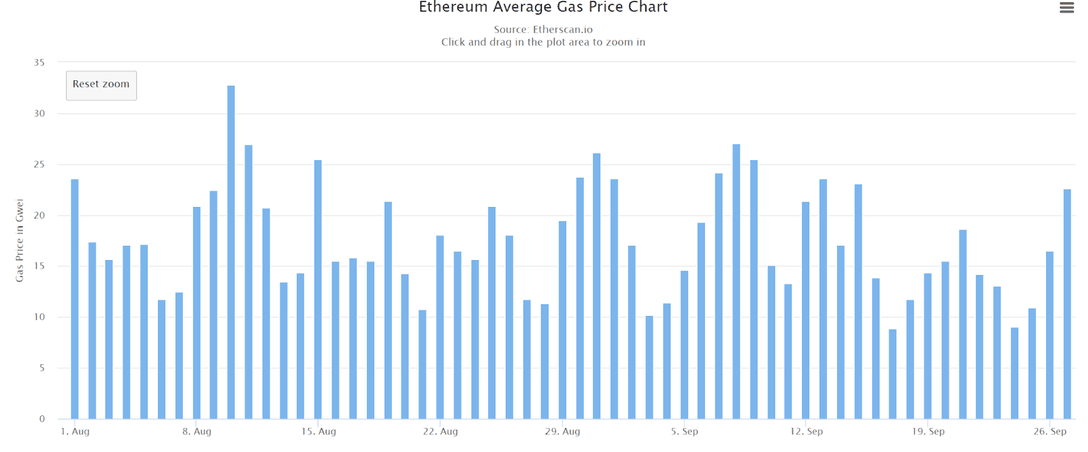

- The average gas price of Ethereum dropped 61% from September 15th to 17th but then resumed rising and is now virtually at pre-merge levels.

- Post-merge activity on layer-2 dropped; the number of transactions fell by 36% and unique active wallets by 27%.

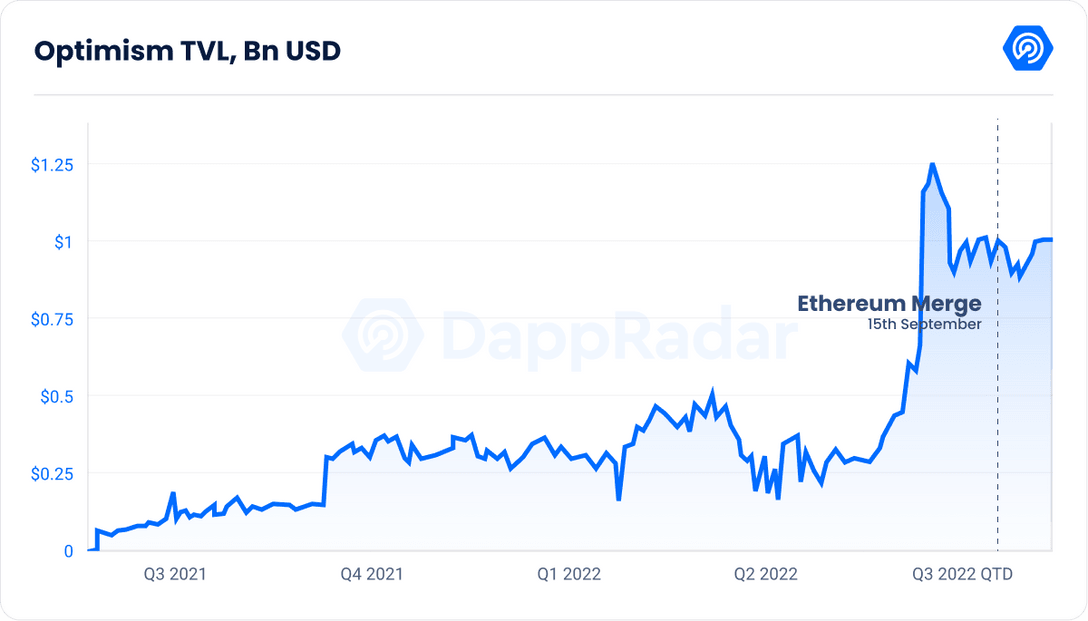

- Optimism witnessed a 228% rise in TVL from $274.46 million on July 1 to $902.74 million on August 31. After the hype of July and August, TVL dropped just 2% ($884.6M) in September, making it one of the best-performing protocols.

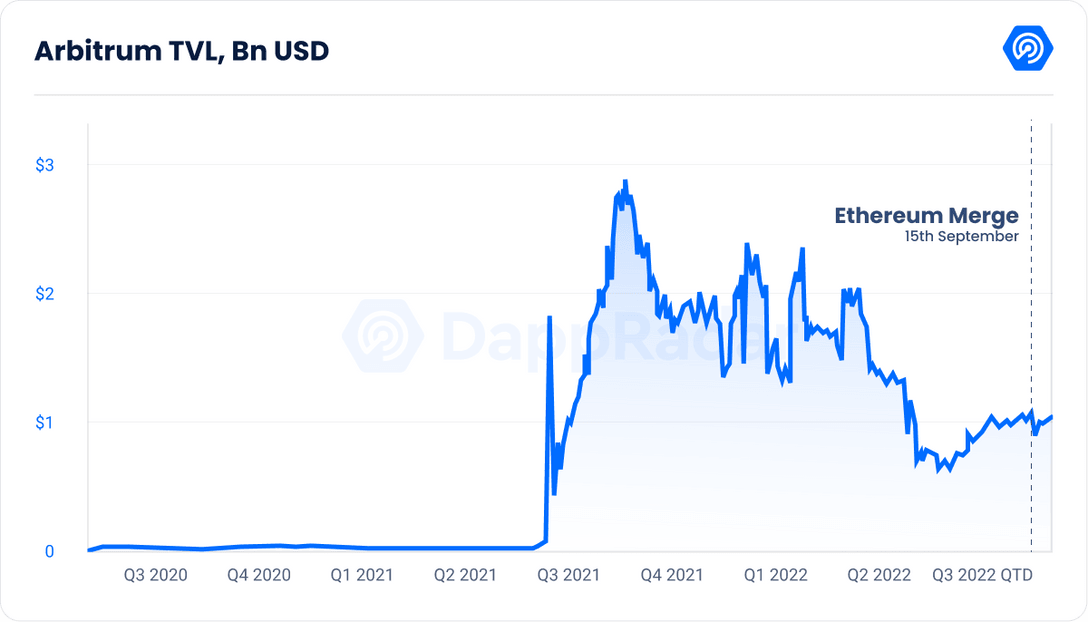

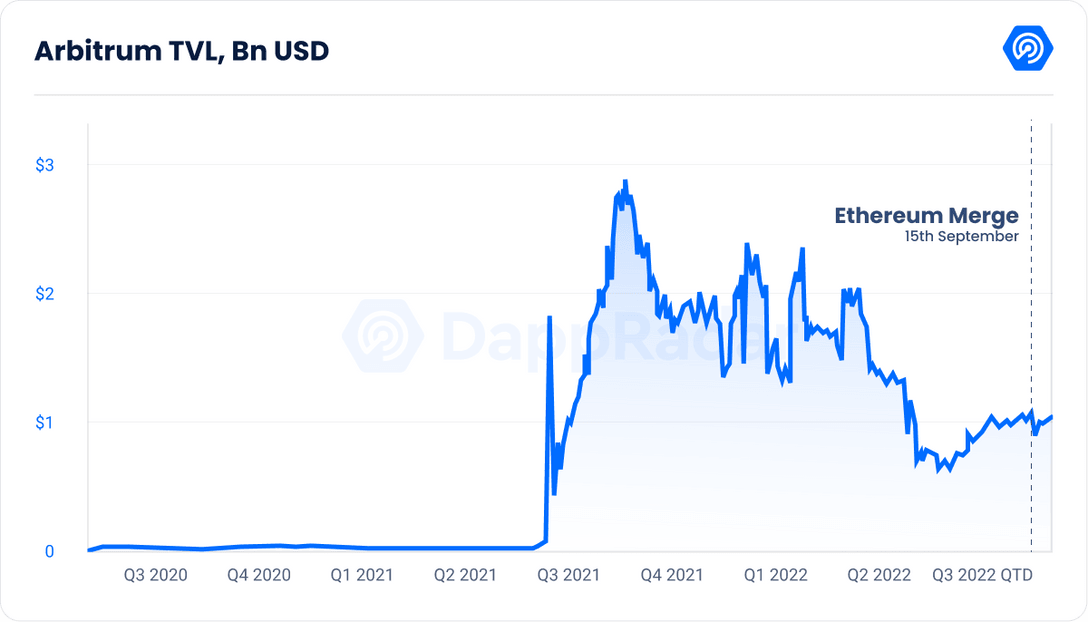

- Transaction volume at Arbitrum has increased by 54.7% month-over-month, while TVL has increased by 2% ($979 million).

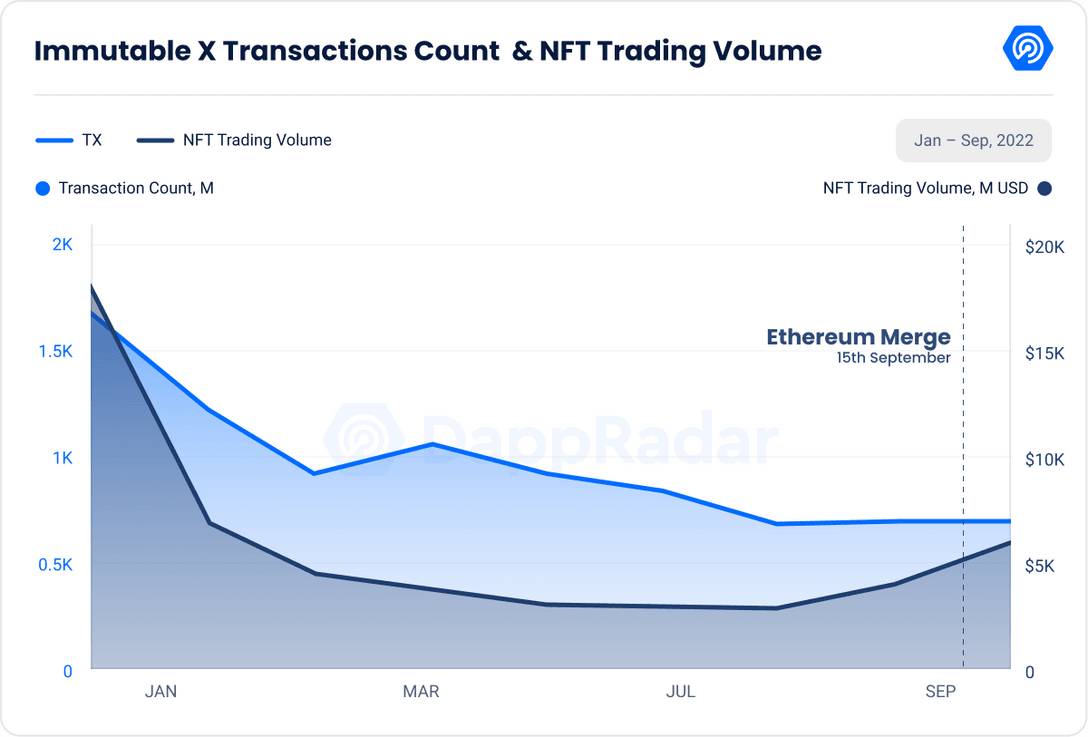

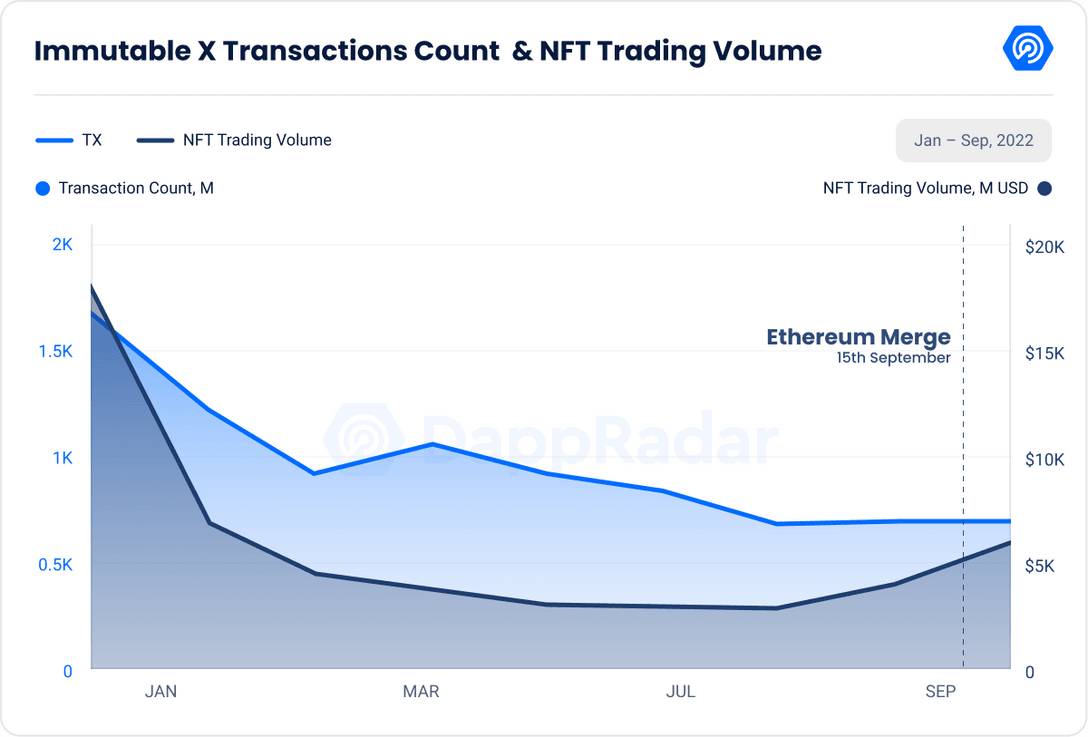

- Although the number of ImmutableX transactions decreased by 1.1%, the amount of NFT trading volume grew by 101% ($4.3M).

Contents

Gas costs in Ethereum have remained unchanged post-merge

Ethereum is a decentralized blockchain-based application that supports smart contracts. Ethereum is an open-source platform mainly used to support Ether, the second-largest cryptocurrency in the world. Ethereum allows smart contracts and apps created on its blockchain to operate without fraud, downtime, third-party intervention, or control.

Ethereum is also a programming language that facilitates developers´ creation of distributed apps. Microsoft’s collaboration with ConsenSys to provide Ethereum Blockchain as a Service on Microsoft Azure enables developers and corporate customers to access a cloud-based blockchain development environment with a single click.

For further details about Ethereum, read this guide.

The Merge upgrade was Ethereum’s long-awaited migration from the “Proof-of-Work” consensus mechanism to a “Proof-of-Stake” system.

Due to its potential material and philosophical ramifications, The Merge, which took six years to develop, was seen by many as a watershed moment in the history of cryptocurrencies. After months of market instability owing, among other things, to inflation and increasing interest rates, this achievement could’ve helped strengthen market confidence and infuse some much-needed optimism.

For more information regarding the Ethereum merge, check this article.

Looking at the unique active wallets and transactions during the whole 2022, we could see a descending trend, and comparing August data with September, both transactions and UAW had a decrease of 35% month-to-month.

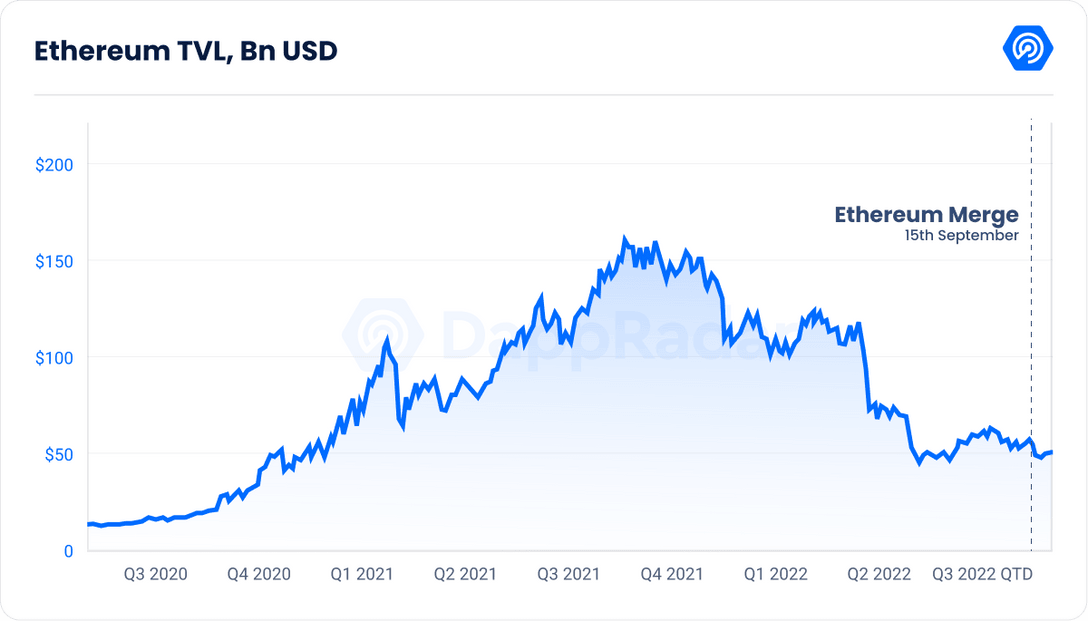

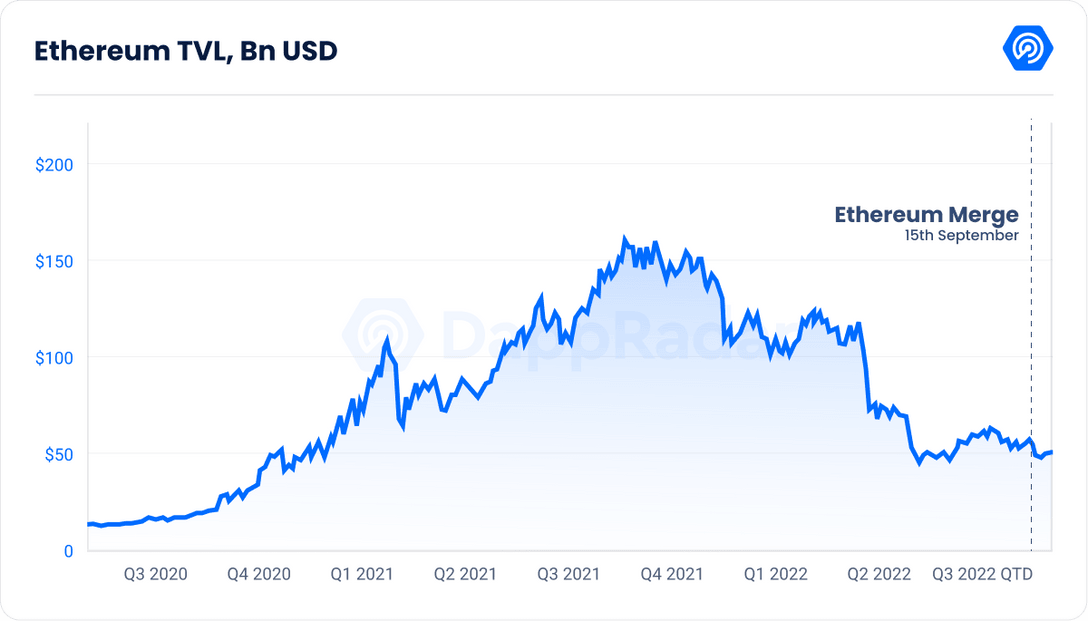

On the same trend as Ethereum transactions and unique active wallets, Ethereum’s TVL is also on a descending trend since the beginning of the year, and comparing it to August, it had a decrease of 5.6% ($31.41B) month-to-month.

The Merge did not immediately reduce gas prices. In fact, looking at the average gas price chart, we could see how the average gas fee decreased from 15th to 17th of September by 61%, but then it started increasing and currently is almost at the same value pre-merge.

There is nothing incorporated into The Merge’s technological advancements that is intended to reduce costs. However, it will provide the required technological infrastructure for future gas optimizations.

Due to the high economic uncertainty and current macroeconomic landscape, and taking in consideration that the merge wasn’t a huge scaling event but only a tiny step in the Ethereum roadmap, the indicators are showing us that the Merge hadn’t had this huge impact people expected.

Polygon’s transactions and unique active wallets dropped by 33% and 17%

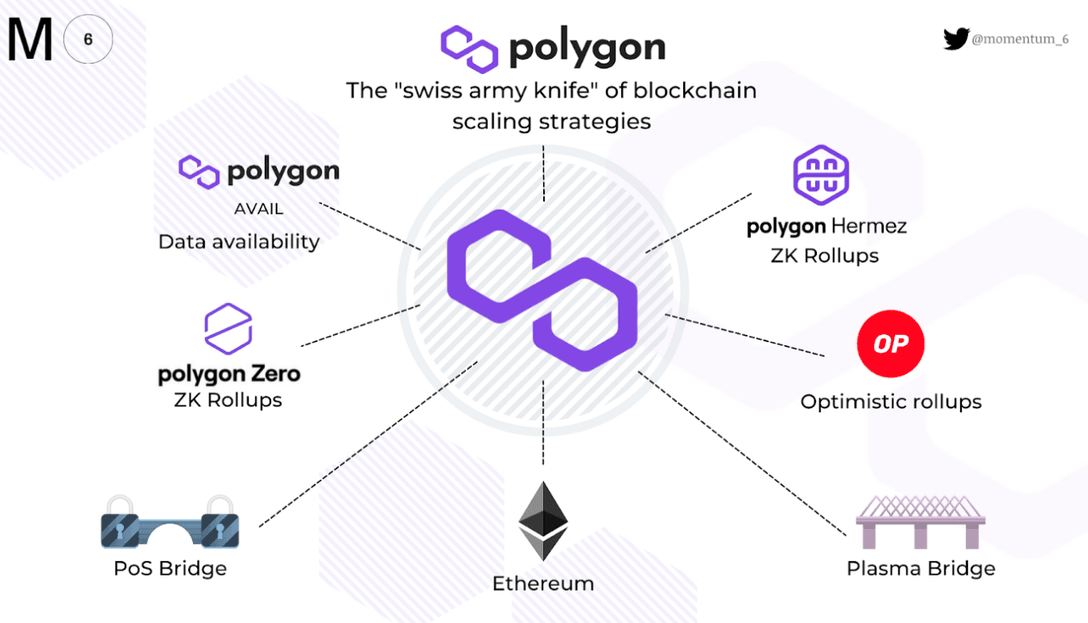

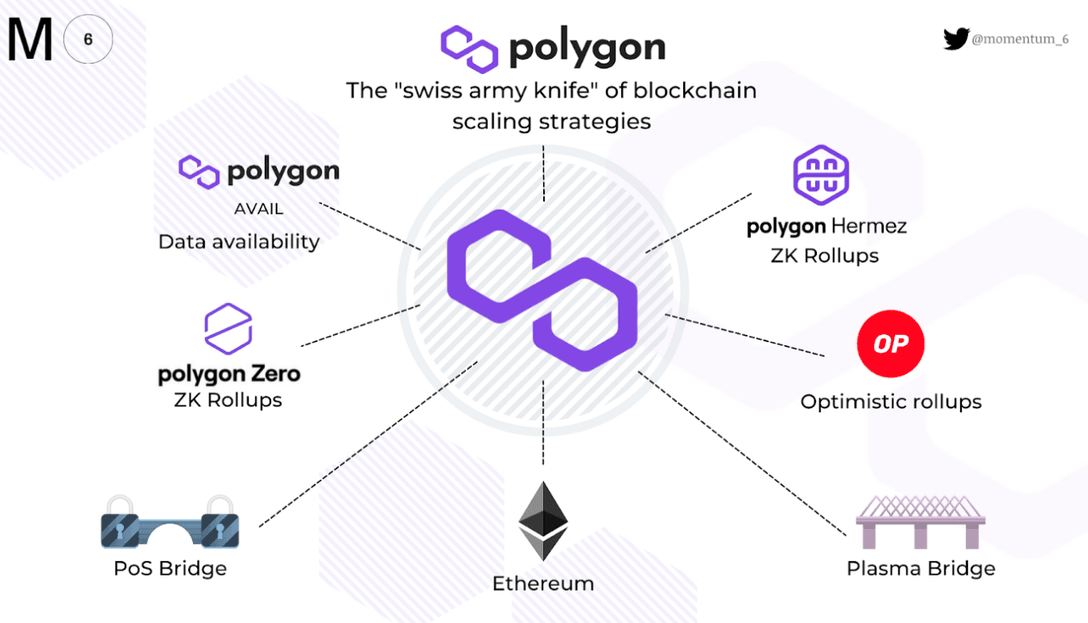

Polygon, formerly known as Matic, is a sidechain created for the building of Ethereum-compatible blockchains and as a layer-2 solution on the Ethereum network. Matic, the network’s native token, is utilized for utility services like gas charge payments, a governance tool, and staking incentives.

As a sidechain protocol, Polygon has benefits like cheaper fees and much faster transaction rates, which are disadvantages of mainstream blockchains.

The notion of a sidechain entails operating a second blockchain simultaneously with a “main” blockchain. Then, these two blockchains might communicate with one another in a manner that permits assets to transfer between them.

For further information in regards to Polygon, read this guide.

Polygon transactions and unique active wallets have the same descending trend as Ethereum. Looking at the chart, we can observe an increase of 6.4% in transactions, and 4% in UAW from June to August 2022, mostly driven by the enthusiasm for pre-merge and the multitude of news. This increase was followed by a sharp decrease in September, and compared to the previous month we have a 33% decrease in transactions and a 17% drop in unique active wallets.

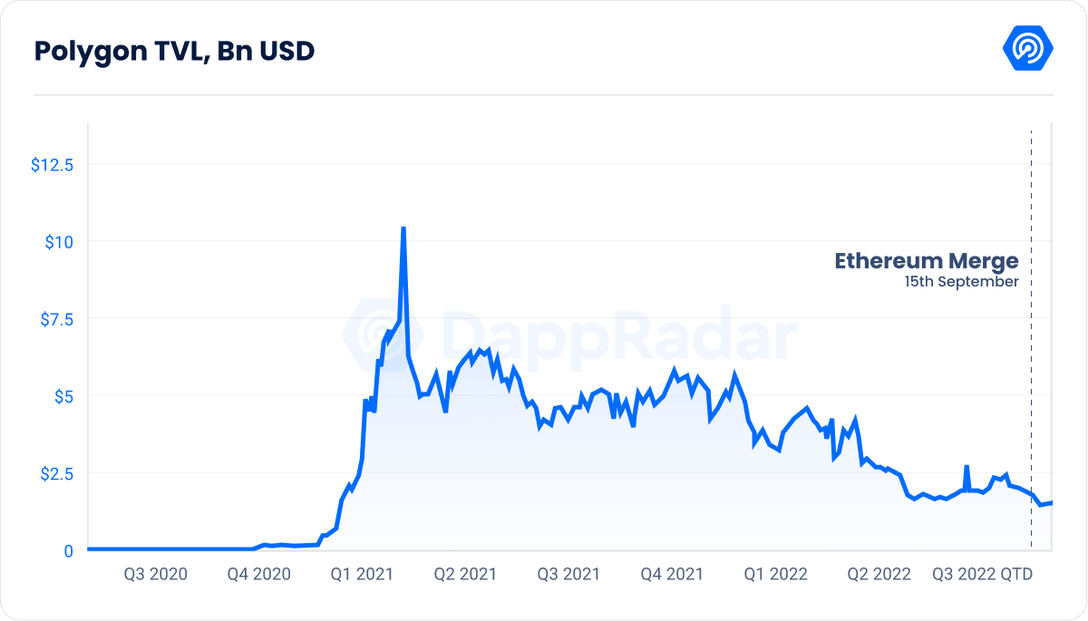

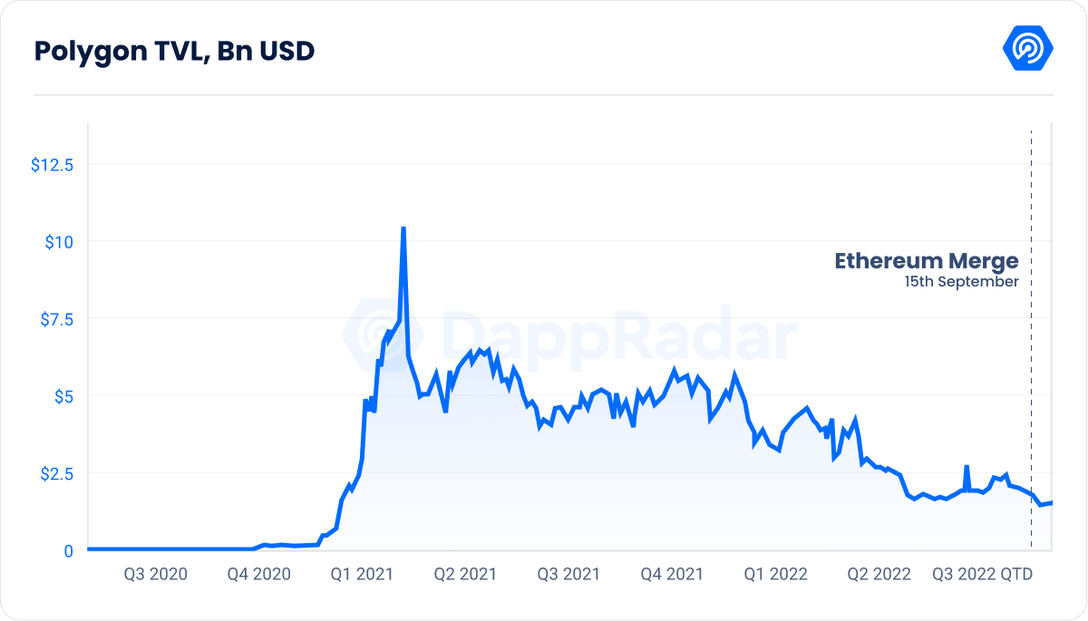

Following the same trend as the indicators analyzed before, Polygon’s is in a continuous decrease, and this month had a decrease of 28% ($1.33B) compared to the previous one.

Ronin transactions and unique active wallets dropped 51% and 54%, respectively

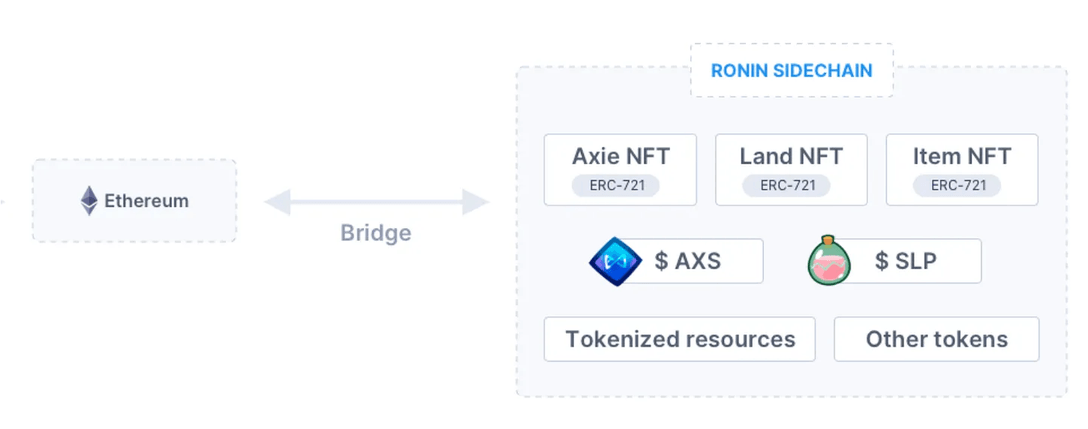

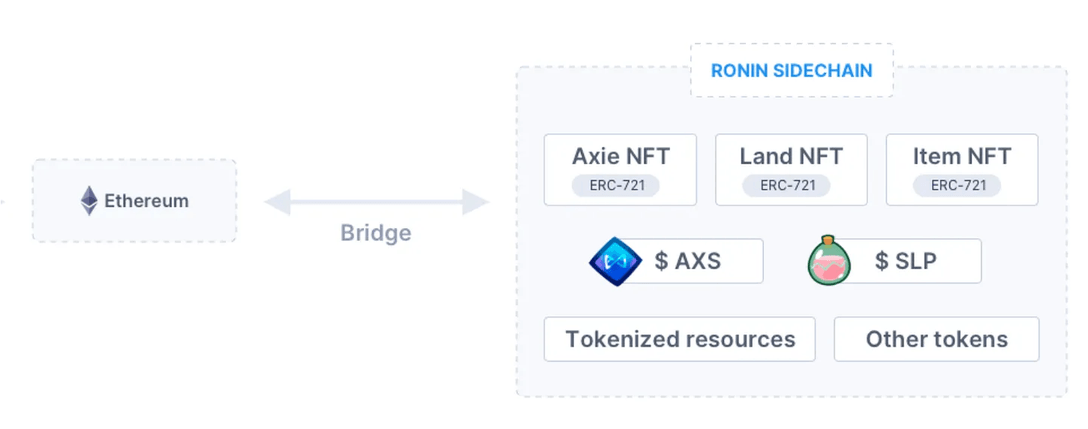

Ronin is an Ethereum sidechain that was developed specifically for the Axie ecosystem. It is geared for near-instant transactions and modest costs, enabling millions of microtransactions inside video games.

The network is the backbone of Axie Infinity, facilitating all transactions and keeping its assets – Axies, Land, SLP, AXS, and Wrapped ETH (WETH). Currently, the network employs a consensus approach based on proof of authority. This indicates that there are fewer validators (7), but transaction confirmation times are much quicker. Currently, the network’s validators include Binance, Ubisoft, and Animoca brands.

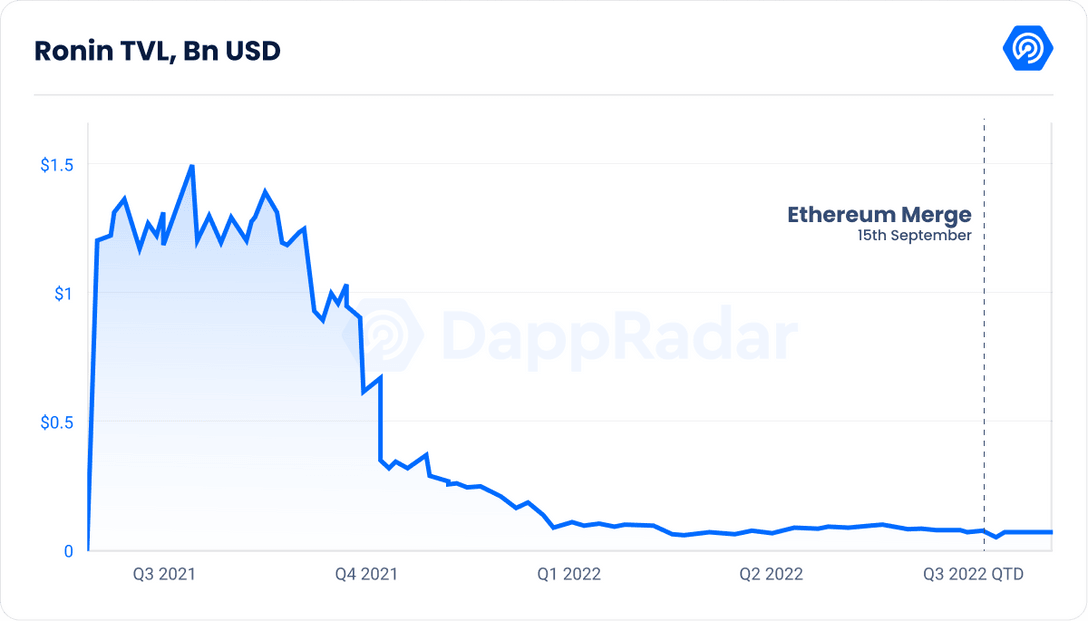

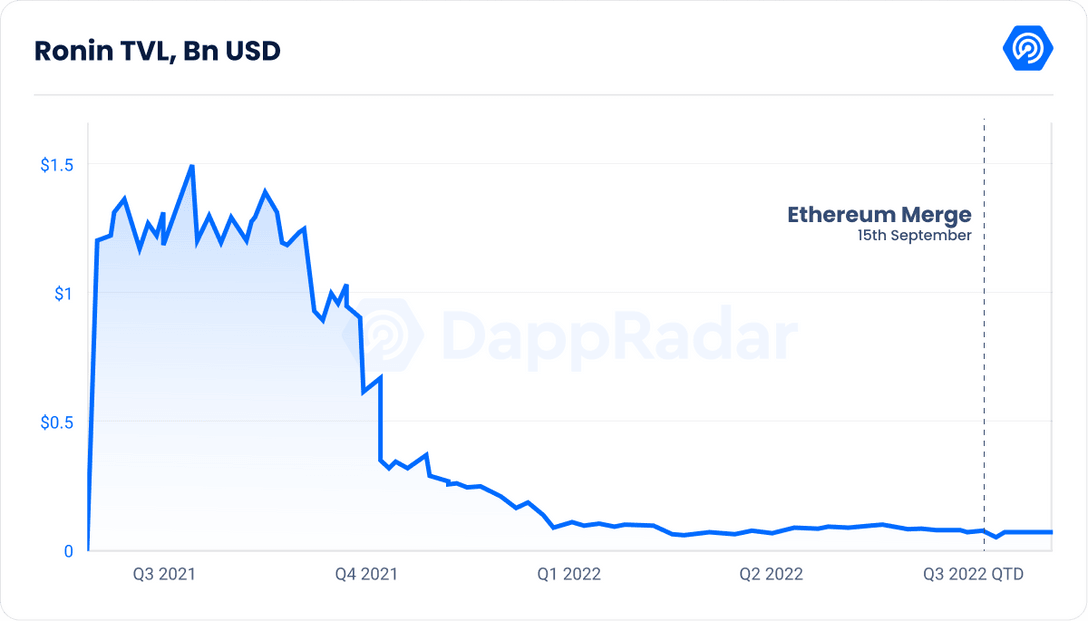

Ronin’s transactions count and unique active wallets have the same descending trend as Polygon and Ethereum, and they decrease respectively by 51% and 54% from August 2022.

Ronin’s TVL follows the same trend and has a 15% ($58.44M) decrease from the previous month. It is worth mentioning that from the 12th till the 15th of September it decreased by 30% ($46.28M), and then started increasing reaching the current value,

Optimism, a top crypto winter performer

Optimism Layer-2 is an efficient scaling solution for Ethereum that reduces transaction fees on the Ethereum blockchain.

Optimism is a unique technique in which optimistic roll-ups are used to consolidate many crypto transactions into one and then send that transaction to another blockchain for further processing.

Utilizing the concept of data compression, it subsequently issues the transaction receipts back to Ethereum, hence reducing the cost of doing Ethereum transactions.

For more information in regards to Optimism, read this guide.

Optimism, since the beginning of the year 2022 is still in an ascendent trend, even if the transactions count and unique active wallets both fell by 37% compared to the previous month. But, from January 2022, it had an increase of 194% in transactions count and 275% in unique active wallets. It is one of the best-performing protocols during this crypto winter.

Optimism was one of the best-performing protocols in July and August and saw a 228% increase in TVL from around $274.46 million on July 1 to approximately $902.74 million on August 31.

This increase was fueled by the belief that Optimism may gain from the Merge as a result of Ethereum’s “Rollup-Centric Roadmap,” which transforms its main chain into a settlement and data availability layer and delegates scalability to layer-2 rollups through “danksharding.”

After the hype of July and August, in September the TVL had a decrease of only 2% ($884.6M), once again, one of the best performing protocols in September too.

Arbitrum, like Optimism, a top performer during this bear market

Arbitrum is a layer-2 solution project that aims to improve the scalability of Ethereum smart contracts and provide extra privacy features.

The platform is intended to make it simple for developers to execute Ethereum Virtual Machine (EVM) contracts and Ethereum transactions at layer-2 while retaining Ethereum’s superior layer-1 security.

Arbitrum was developed to overcome some of the deficiencies of Ethereum-based smart contracts. As for the disadvantages, such as lengthy transactions and expensive execution fees:

Arbitrum logs batches of transactions submitted to the Ethereum main chain and executes them on affordable, scalable layer-2 sidechains using a process known as transaction rollup. This technique alleviates the majority of Ethereum’s computing and storage overhead while allowing a new class of resilient layer-2-based dapps.

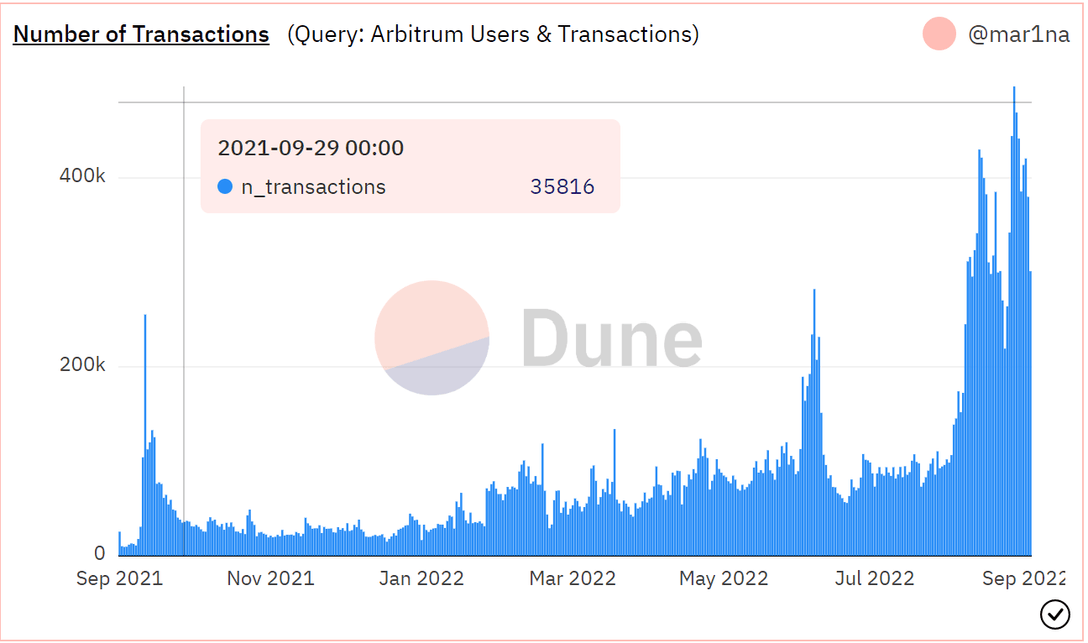

Arbitrum, along with Optimism, is another protocol that is performing well during this bear market. When we look at the transactions count, we can see that it has been in an ascendent trend since the beginning of the year, and it has increased 54.7% from August to September.

The Arbitrum’s TVL is not following the same trend as the transactions count, but starting from the beginning of August 2022, we see a formation of a new and smaller ascending trend. Looking at September data, the TVL actually increased by 2% ($979M) from the previous month.

Loopring, the native blockchain of GameStop NFT marketplace

Loopring is a Layer-2 scaling protocol based on the Ethereum blockchain for decentralized exchanges (DEXs) that can resolve thousands of deals per second. While Loopring technology is applicable across DEXs as a protocol layer, the platform also provides Loopring Exchange, a non-custodial trading platform with safe, high-speed transactions and no gas costs. Loopring utilizes Zero-Knowledge Proofs (ZKPs), a blockchain breakthrough that bundles transactions for efficiency, to let anybody create a high-throughput, non-custodial DEX. Loopring also rewards Zero-Knowledge Rollup (zk-Rollup) operators and liquidity providers with its own LCR coin.

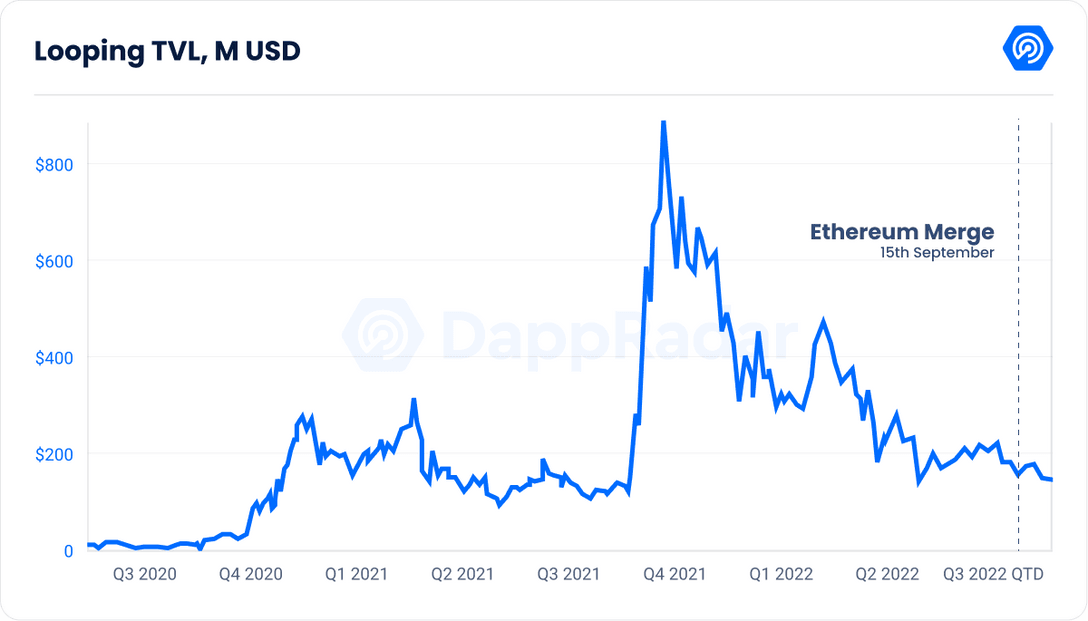

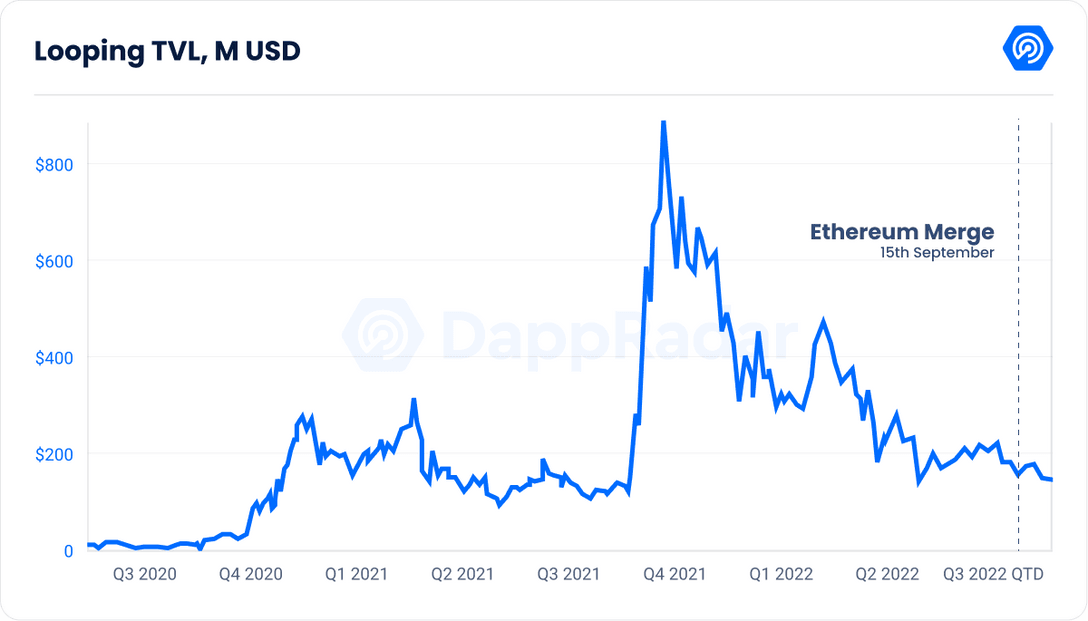

Loopring’s TVL is in a descending trend too, and it decreased by 15.8% ($138.64M) from the previous month.

It is worth mentioning that the GameStop marketplace runs natively on Loopring, and they’ve just announced an additional project, the creation of a GameStop wallet on Loopring’s protocol.

GameStop entered the scene of NFTs late. Nobody saw this approach coming. It joined the ranks of rivals aiming to undermine OpenSea’s dominating position. As of September 2022, it ranks as the 10th most-traded marketplace.

For further details on the GameStop marketplace, read our latest report.

Immutable X transactions declined 1.1%, whereas NFT volume rose 101%

Immutable X is a layer-2 blockchain that addresses the scalability problem for Ethereum-based NFTs. It lets users construct and administer NFT projects on a secure platform for free. It also provides rapid transaction confirmation, no gas costs, and scalability without sacrificing security for games, apps, and markets.

Using zero-knowledge rollup technology, the network is able to perform more than 9000 transactions and mints every second. This exceeds the size requirements for conventional NFT projects. Immutable X also aims to simplify the trading, minting, and mailing of NFTs and ERC-20s.

For further information regarding ImmutableX, read our guide.

In addition to developing a layer-2 solution for NFTs on the Ethereum Blockchain, Immutable X provides a comprehensive carbon-neutral NFT marketplace that compensates for carbon emissions. In other words, the L2 approach ensures that no energy is wasted during the creation and trading of NFTs. Immutable X does this by forming a relationship with climate-aware firms Trace and Cool Effect.

Immutable X is another top performer in this bear market, especially since the NFT trading volume increased by 101% ($4.3M) from the previous month, and the transactions count had only a 1.1% decrease month-to-month.

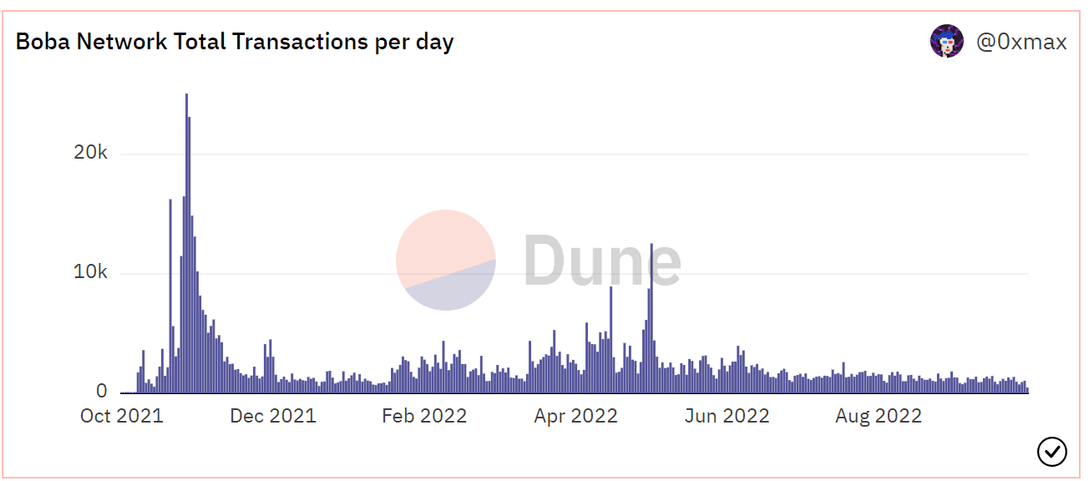

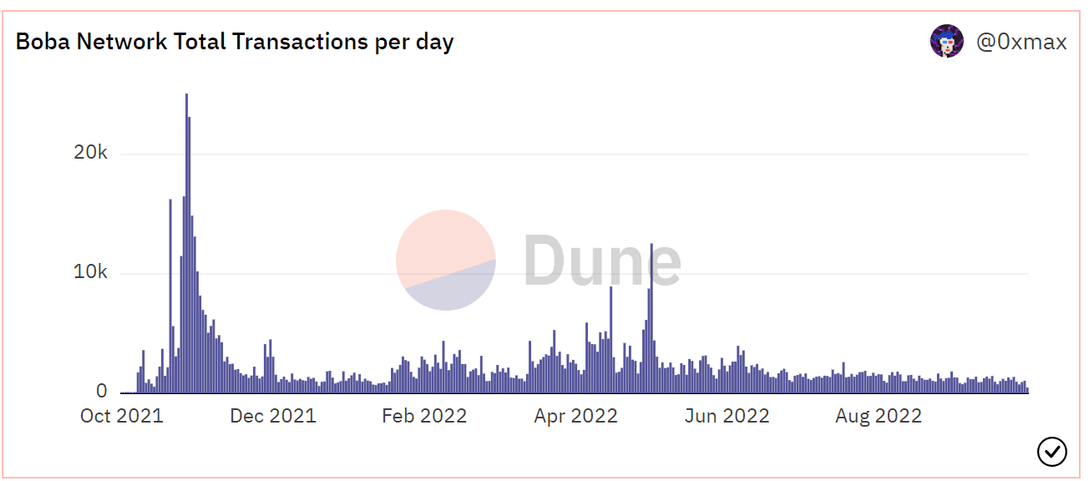

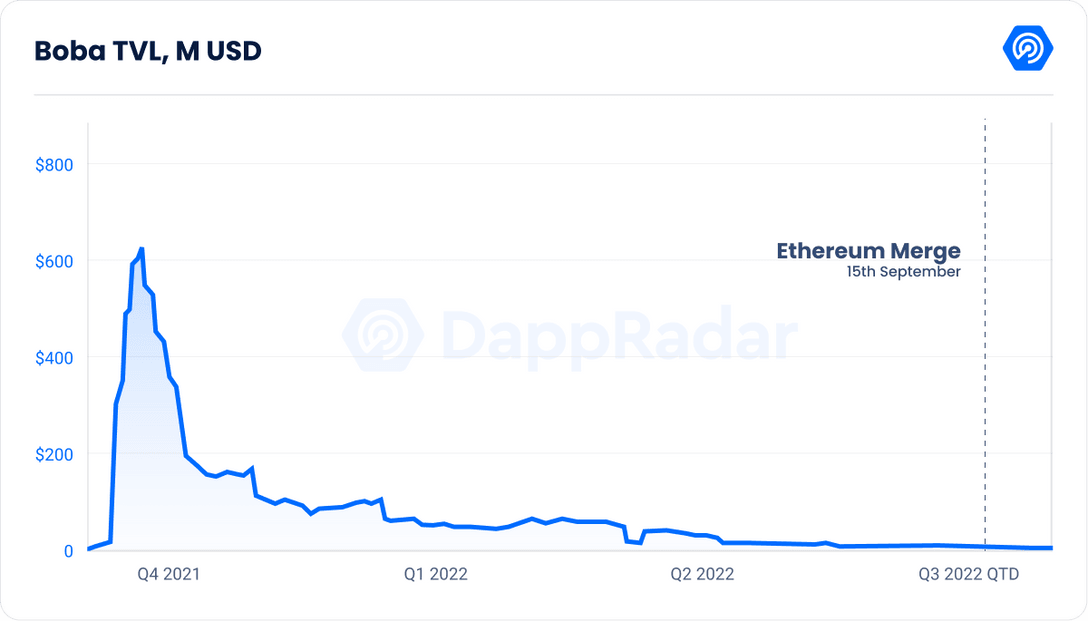

Boba’s transactions count and TVL decreased by 42% and 35%

Boba Network (previously OMGX) is a scaling solution for Ethereum that released its mainnet beta in August 2021. On the Ethereum network, Boba Network promises to cut transaction and computation costs, enhance throughput, and extend the capabilities of smart contracts. Boba Network employs Optimistic Rollups (ORs), a Layer-2 scaling mechanism that presume transactions are genuine until they are disputed, to accomplish this. The transaction may be examined and validated using computation if it is contested.

Enya, a blockchain and artificial intelligence (AI) infrastructure business, and the OMG Foundation both promote Boba Network (formerly OMG Network and OmiseGo). Enya is a blockchain infrastructure business that contributes significantly to OMG, one of the initial Layer-2 solutions for Ethereum. BOBA was created by Enya and the OMG Foundation in order to offer a scalable platform for application development that is entirely compatible with the Ethereum network. Ultimately, BOBA will assist developers in rapidly creating powerful and diverse apps.

In the decentralized finance (DeFi) ecosystem, Boba Network employs the boba token (BOBA) to support governance and reward network expansion and user adoption. In addition to being used by non-fungible token (NFT) projects, Boba Network also powers Web3-enabled apps.

Analyzing the transactions count of Boba, we can observe that for the past 3 months the transactions count remained in the same range, and in September decreased by 42% in comparison with the previous month.

The TVL is in a descending trend too, and it decreased by 35% ($4.2MIL) in comparison with the previous month.

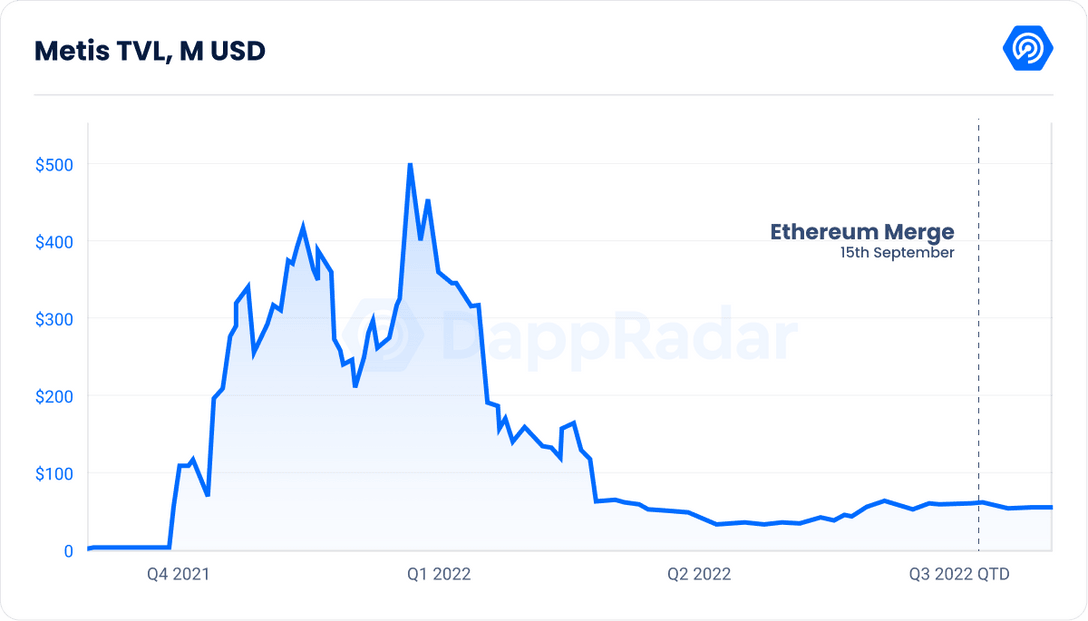

Metis’s TVL shows signs of recovery

Metis is a layer-2 blockchain based on the Ethereum blockchain with an emphasis on fostering the growth of decentralized communities (DAOs). With blockchain technology comes the promise of decentralization — DAO is the decentralized form of a firm, institution, or organization without a CEO, Chairman, or President, for example. All the rules of an organization or community are outlined in a DAO’s smart contract, and all users have the ability to vote or suggest amendments, which are all recorded on the blockchain.

As a layer-2 solution, the Metis blockchain handles transactions off-chain before syncing them in huge batches to the Ethereum mainnet. It is comparable to Abitrum and Optimism in this regard. However, the primary distinction between Metis and other layer-2 systems is that it processes transactions using Optimistic rollups rather than zK rollups.

Optimistic rollups are the most recent generation of layer-2 scaling solutions, and they provide a number of benefits over zK rollups. zK rollups necessitate a higher level of security due to the sequencing layers for validators; these layers are in place to prevent fraudulent transactions on the blockchain, but they use a single sequencer that clogs the network during high transaction volumes, resulting in the same problems as the original mainnet.

The Metis TVL has begun to rise, and in August it climbed from $39.59 million to $56.53 million, a 42.7% increase. This rise was consistent with the pre-merge anticipation. After the gain in August, the TVL declined by 9.7% ($51.01M) in September, but was still up 29% from the beginning of August.

Conclusion

After the Merge, Ethereum is still a long way from becoming the final product that Buterin envisioned it to be. The user experience is negatively impacted by the lengthy withdrawal periods associated with optimistic rollups, while sharding scaling solutions are still many years away from being implemented.

With new L1s immediately delivering high transaction capabilities, but still lacking Ethereum’s desirable level of security, the world’s leading Web3 network needs to deliver speed and cost-efficiencies for dApp developers and users immediately. This is because new L1s deliver high transaction capabilities right off the bat.

Even though the cryptocurrency market is in a bear market, the non-fungible token (NFT) and blockchain gaming markets are still growing rapidly. Because of this, Ethereum needs to be prepared to handle fresh surges in demand, which, in the world of cryptocurrency, could occur at any time, without clogging up and sending gas fees into orbit. Because this can only be done via L2s, it is safe to assume that L2s will continue to exist for a considerable amount of time in the future.

- Bitcoin

- blockchain

- blockchain compliance

- blockchain conference

- coinbase

- coingenius

- Consensus

- crypto conference

- crypto mining

- cryptocurrency

- DappRadar

- decentralized

- DeFi

- Digital Assets

- ethereum

- machine learning

- non fungible token

- plato

- plato ai

- Plato Data Intelligence

- PlatoData

- platogaming

- Polygon

- proof of stake

- W3

- zephyrnet