At least from the outside, it appears Microsoft isn’t actively competing for a seat at the XR table, which is fairly odd coming from a company that pioneered enterprise AR while simultaneously wrangling some of its top OEM partners to make a fleet of PC VR headsets for consumers in 2017. Microsoft gained a great early start, but now the Redmond-based tech giant is positioned to play catchup, which historically hasn’t worked out that well. Could we be in for another ‘Zune moment’? If Microsoft goes in half-cocked, maybe.

Microsoft released the first-gen Zune in 2006, an MP3 player that looked to compete with Apple’s largely dominant line of iPods. By “largely dominant,” I mean Apple not only had majority market share of the product category, making it synonymous with portable music at the time, but had already produced numerous generations of iPod Classic, iPod Mini, iPod Nano and iPod Shuffle. Apple wasn’t the first to make a portable MP3 player, although it was the first to make one everyone wanted.

Now, I can hear the Zune defenders in my head, and I sympathize. Zune wasn’t terrible, and it came at a time when full-color screens in MP3 players were just becoming a thing. It had a compelling reason to exist, which is why Microsoft directly competed against iPod Touch over the course of three device generations before eventually giving up the goat in 2011 and discontinuing the third-gen Zune. Many chalk it up to poor marketing, lack of brand cache, and not enough music to choose from. Zooming out, Zune’s ultimate defeat belies a larger pattern of behavior.

Zune didn’t generate the sort of loyal customer base that Apple had in spades because entering rapidly evolving product categories isn’t easy. By the time platforms solidify, companies that come too late are usually tasked with flipping what’s left of undecided users or attracting users away from other ecosystems with unique selling points. Even with viable hardware on your side, it’s not an easy thing to do.

To put it into perspective, Zune entered the market one year before Apple announced the first iPhone. From that moment Microsoft was forced to play catchup not only with its MP3 players, but with its widely maligned Windows Phones which came afterwards, of which there are famously few defenders. Needless to say, Apple’s iPhone is still kicking, and that iPod/iPhone success story is why Apple is largest company in the world.

Breaking the Zune Curse?

Don’t get me wrong, Microsoft has success stories. Windows is still the world’s largest PC operating system. Azure Cloud Platform competes alongside AWS and Google Cloud. There’s a reason why we call digital slideshows a PowerPoint no matter which program you use to make them, and that’s thanks to Microsoft’s ongoing dominance in the general computing space. When Microsoft gets in early and sticks it out, you don’t generally get a Zune.

To its credit, the company had the foresight to release HoloLens in 2016, a full two years before unicorn startup Magic Leap could get its first standalone AR headset out the door. Three years later it released HoloLens 2, which directly competes today against Magic Leap Two. When HoloLens 3 will arrive, or whether it’s even in the works, still isn’t clear. We’re hoping they stick it out and it doesn’t turn into a ‘Zune moment’ down the line.

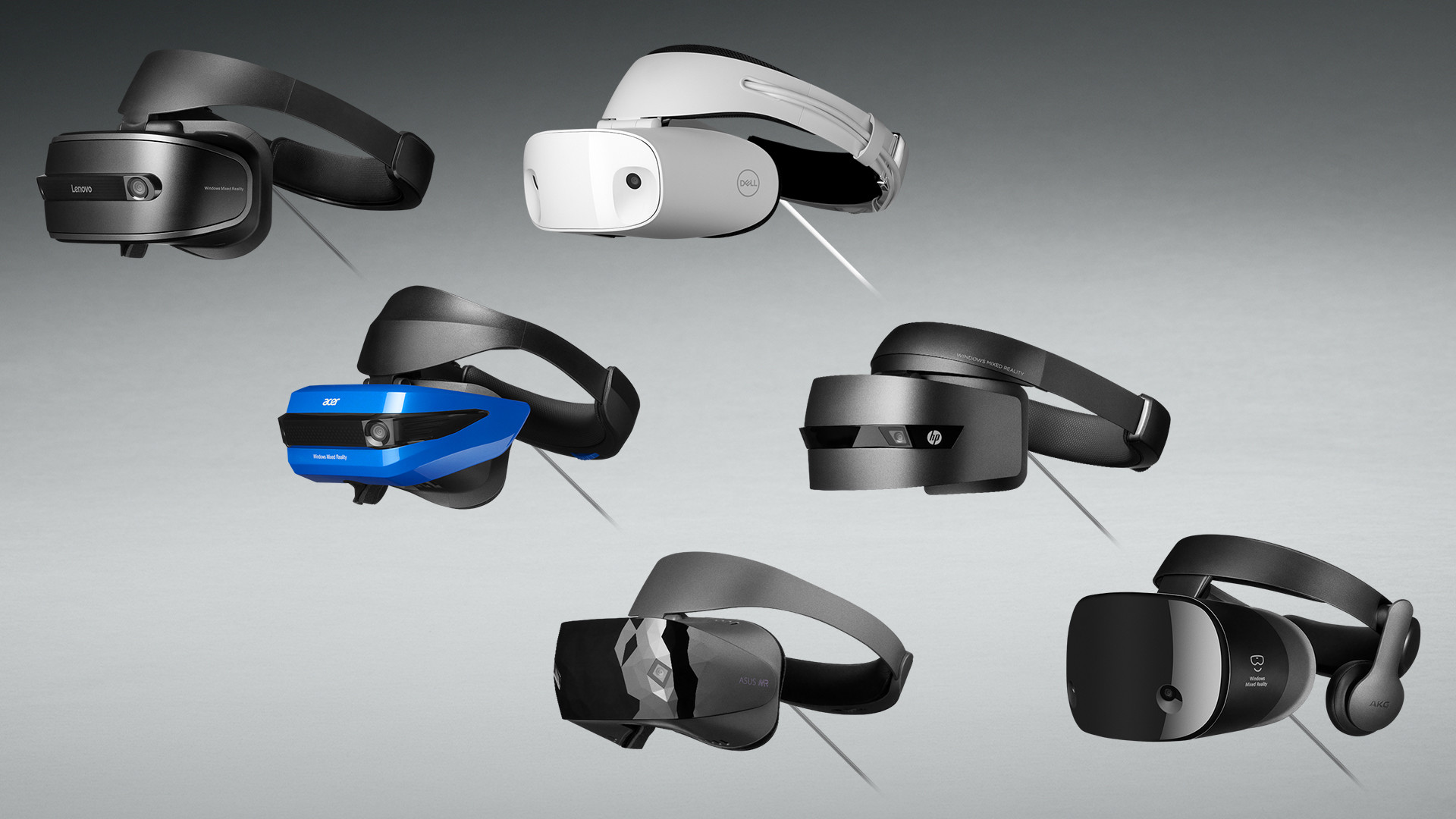

In 2017, Microsoft also managed to assemble a host of major OEMs to create what would be the first Windows VR headsets, which included PC VR headsets from Dell, Lenovo, Acer, HP, Samsung, and Asus. It was a good opening gambit to break up the Oculus/HTC Vive PC VR binary that had developed a year prior, although those Windows VR headsets weren’t just new hardware destined to hook into Steam content. Microsoft made its own Windows Mixed Reality Store which ultimately failed to compete with Steam for developers, which was kind of like a Zune owner somehow getting all their music from iTunes and not Zune Marketplace.

And we’re still early, although that may not be the case for long. Compared to smartphones today, the current XR landscape is toddling out of its infancy. You’d be surprised how much competition there is already, not only across multiple hardware platforms, but entire content ecosystems—something you can’t just grow over night. Currently major contenders are Meta, Sony, HTC, Valve, Pico, Pimax, and Apple starting next year. The future leaders are shaping up to be Sony, Meta and Apple, the last two moving into mixed reality (Meta Quest Pro, Meta Quest 3, Apple Vision Pro) which feature VR displays and color passthrough cameras for AR tasks, while Sony is already in their second-gen PlayStation VR. Things are changing, and Apple jumping into XR could see a host of other companies deciding they want a piece of the pie fairly soon.

Whatever the time frame, eventually the amount of money Microsoft leaves on the table is going to pile up until it can’t be ignored. That’s essentially the strategy the company has decided to take with Xbox at least, with Xbox Game Studio head Matt Booty saying in a recent Hollywood Reporter interview that VR just isn’t big enough yet.

“We have 10 games that have achieved over 10 million players life-to-date, which is a pretty big accomplishment, but that’s the kind of scale that we need to see success for the game and it’s just, it’s not quite there yet with AR, VR,” Booty told the Hollywood Reporter.

So, while we’re no closer to knowing when Microsoft will decide it’s the right time to enter into VR (or MR for that matter), the company is well equipped and funded to break the Zune curse. Whenever Microsoft chooses to compete in consumer XR, any potential failure can’t be blamed on the lack of resources. The company now boasts a vast collection of game studios it can weaponize, which includes the entire Zenimax family of studios, including Bethesda, Arkane Studios, id Software, MachineGames, Tango Gameworks, and ZeniMax Online Studios. Provided the contentious Activision Blizzard acquisition goes through, Microsoft will also own World of Warcraft, Call of Duty, and Diablo franchises. That untapped library of IP and developer talents could make whatever Microsoft decides to bring to the XR table a serious contender.

Just the same, if the megalithic Microsoft can’t overcome what must be a massive internal friction to put out something focused, timely and well-supported, whatever it makes might as well be Zune.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://www.roadtovr.com/microsoft-xr-strategy-zune-moment/

- :has

- :is

- :not

- $10 million

- $UP

- 10

- 2006

- 2011

- 2016

- 2017

- 23

- 7

- a

- acer

- achieved

- acquisition

- across

- actively

- Activision Blizzard

- afterwards

- against

- All

- alongside

- already

- also

- Although

- amount

- an

- and

- announced

- Another

- any

- appears

- Apple

- AR

- AR Headset

- ARE

- AS

- At

- attracting

- away

- AWS

- Azure

- Azure Cloud

- base

- BE

- because

- becoming

- before

- Big

- boasts

- brand

- Break

- bring

- but

- by

- Cache

- call

- Call of Duty

- came

- cameras

- CAN

- case

- categories

- Category

- changing

- Choose

- classic

- clear

- closer

- Cloud

- Cloud Platform

- collection

- color

- come

- coming

- Companies

- company

- compared

- compelling

- compete

- competed

- competes

- competing

- competition

- computing

- consumer

- Consumers

- content

- could

- Course

- create

- credit

- Current

- Currently

- curse

- customer

- decide

- decided

- Deciding

- Defenders

- Dell

- destined

- developed

- Developer

- developers

- device

- digital

- directly

- displays

- do

- Doesn’t

- Dominance

- dominant

- Dont

- Door

- down

- Early

- easy

- Ecosystems

- enough

- Enter

- entered

- entering

- Enterprise

- Entire

- equipped

- Even

- eventually

- everyone

- evolving

- exist

- Failed

- Failure

- fairly

- family

- famously

- Feature

- few

- First

- FLEET

- focused

- For

- For Consumers

- FRAME

- friction

- from

- full

- funded

- future

- future leaders

- gained

- Gambit

- game

- Games

- General

- generally

- generate

- generations

- get

- getting

- giant

- Giving

- Goes

- going

- good

- Google Cloud

- great

- Grow

- had

- Hardware

- Have

- head

- Headset

- headsets

- hear

- historically

- HoloLens

- hololens 2

- hololens 3

- hoping

- host

- How

- HTC

- HTTPS

- i

- ID

- if

- image

- in

- included

- includes

- Including

- internal

- Interview

- into

- IP

- iPhone

- iPod

- IT

- ITS

- jpg

- just

- Kind

- Knowing

- Lack

- landscape

- largely

- larger

- largest

- Last

- Late

- later

- launched

- lead

- leaders

- Leap

- least

- left

- Lenovo

- Library

- like

- Line

- Long

- looked

- loyal

- made

- magic

- Magic Leap

- major

- Majority

- make

- MAKES

- Making

- managed

- many

- Market

- Marketing

- marketplace

- massive

- Matter

- max-width

- May..

- me

- mean

- Meta

- Meta Quest

- meta quest 3

- meta quest pro

- Microsoft

- might

- million

- mixed

- mixed reality

- moment

- money

- moving

- MP3 player

- mr

- much

- multiple

- Music

- must

- my

- nano

- Need

- Needless

- net

- New

- new hardware

- next

- night

- no

- now

- numerous

- of

- on

- ONE

- ongoing

- online

- only

- opening

- operating

- operating system

- or

- Other

- out

- outside

- over

- Overcome

- own

- owner

- partners

- passthrough

- Pattern

- PC

- pc vr

- perspective

- phones

- Pico

- piece

- Pimax

- pioneered

- platform

- Platforms

- plato

- Plato Data Intelligence

- PlatoData

- Play

- player

- players

- playstation

- PlayStation VR

- points

- poor

- positioned

- potential

- pretty

- Prior

- Pro

- Produced

- Product

- Program

- provided

- put

- quest

- quest 3

- quest pro

- rapidly

- Reality

- reason

- release

- released

- Resources

- right

- same

- Samsung

- say

- saying

- Scale

- screens

- see

- Selling

- serious

- shaping

- Share

- shuffle

- side

- simultaneously

- smartphones

- Software

- some

- something

- Sony

- soon

- Space

- standalone

- start

- Starting

- startup

- Steam

- Still

- store

- Stories

- Story

- Strategy

- studio

- studios

- success

- Success Stories

- success story

- surprised

- synonymous

- system

- table

- Take

- talents

- tasks

- tech

- tech giant

- Thanks

- that

- The

- The Future

- The LINE

- the world

- their

- Them

- There.

- they

- thing

- things

- those

- three

- Through

- time

- to

- today

- too

- top

- touch

- TURN

- two

- ultimate

- Ultimately

- unicorn

- unique

- untapped

- until

- use

- users

- usually

- valve

- Vast

- version

- viable

- vision

- vive

- vr

- VR headsets

- want

- wanted

- Warcraft

- was

- Wave

- we

- WELL

- were

- What

- whatever

- when

- whenever

- whether

- which

- while

- why

- widely

- will

- windows

- with

- worked

- world

- world’s

- would

- Wrong

- xbox

- XR

- year

- years

- yet

- You

- Your

- zephyrnet

- zooming