More than half of the BTC addresses are still in profit despite the recent market downturn and the Glassnode reports show that 60% of the transaction volume is what is called “profit dominance” and long-term holders are in the green once again so let’s read more today in our latest Bitcoin news.

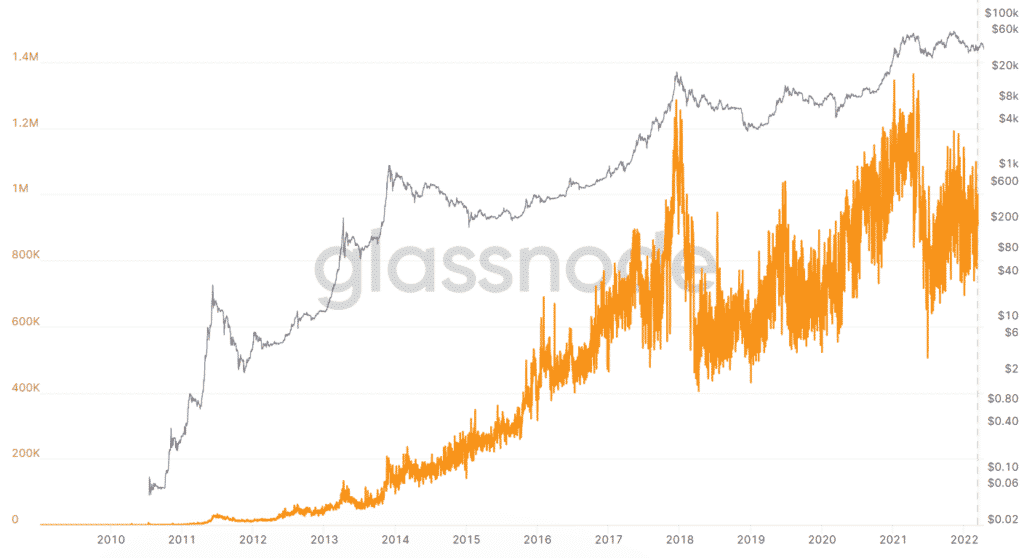

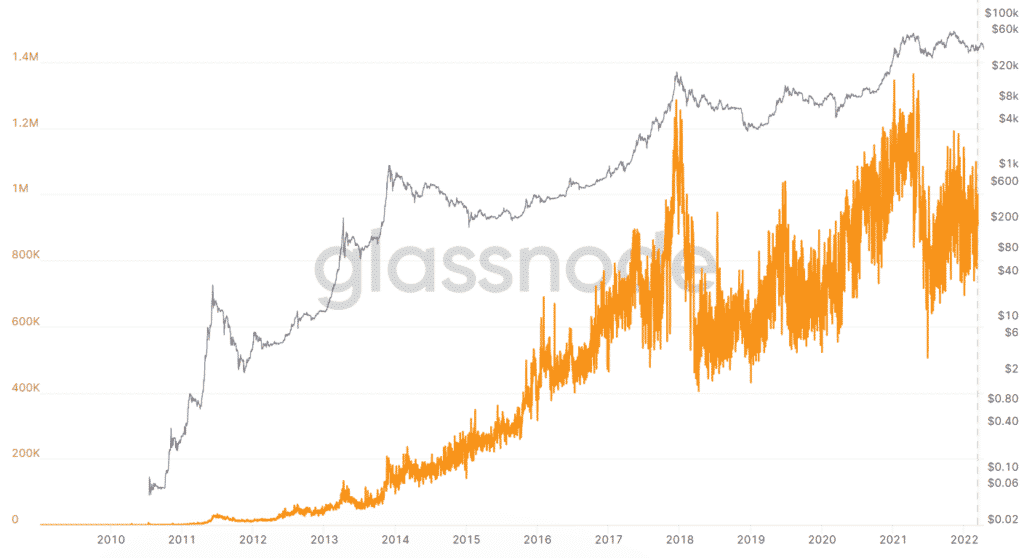

The BTC price has been on the decline lately but the insights from the blockchain analytics company Glassnode show that more than half of BTC addresses or 75% of them are in profit. In the Week-on Chain report, Glassnode analyzed the number of BTC wallets that are in profit and found that about 70% of the addresses are seeing an unrealized profit which is higher than the 45% to the 50% of addresses in the 2018 bear market. The Glassnode analytics added that the bar market is nowhere near as the preivous ones:

“The current bear market is not as severe as the worst phases of all prior cycles, with just 25% to 30% of the market being at an unrealized loss. It remains to be seen if further sell-side pressure will drive the market lower, and thus pull more of the market into an unrealized loss like prior cycles.”

The report revealed that the long-term BTC holders that have held for over 155 days were the least likely to be at loss and more than 67.5% of the long-term holders are at an unrealized profit while the short-term holders that held for less than 155 days have only 7.88% made gains. Right now, the BTC price is below $40,000 and dropped close to $39,000 in the past day which placed the asset back into the bearish market sentiment. The direction in which BTC will head has some speculating a new drop to $30,000 while other data shows traders are trying to push the price to $50,000.

The report detailed that 58% of the volume on the BTC network is in profit dominance which is a metric that has been quite overlooked since December 2021. Glassnode added that the bear markets often see long periods of transaction volume which make a loss and the reversal to profit dominance could be a sign that the sentiment is shifting with the demand for BTC being able to buy the sell-side. However, the reports show that given the prices and their struggle, it suggests that the demand side remains lackluster and that the investors are taking profits into whether market strength can be found.

The analysts added that the market has seen realized profits of 13,300 BTC daily since mid-February while the daily realized losses dropped from 20,000 BTC in January to 8300 BTC last week. While the larger portion of addresses and transactions see a profit, the amount of users on the BTC network and the amount of transactions is still “languish” as per some analysts.

- 000

- 2021

- 67

- 7

- About

- addresses

- All

- amount

- analytics

- asset

- Bear Market

- bearish

- being

- Bitcoin

- Bitcoin News

- blockchain

- BTC

- BTC Addresses

- btc price

- buy

- chain

- company

- could

- Crash

- Current

- data

- day

- Demand

- Despite

- drive

- Drop

- dropped

- found

- further

- Glassnode

- Green

- head

- higher

- holders

- HTTPS

- insights

- Investors

- IT

- January

- larger

- latest

- likely

- Long

- long-term

- made

- Market

- Markets

- more

- Near

- network

- news

- number

- Other

- periods

- pressure

- price

- Profit

- profits

- realized

- report

- Reports

- Revealed

- sentiment

- short-term

- So

- some

- today

- Traders

- transaction

- Transactions

- users

- volume

- Wallets

- week

- What

- What is

- whether

- while