- Momentum and micro factors are likely the key drivers of Nasdaq 100 performance at this juncture.

- The current year-to-date (YTD) performance of AI giant Nvidia’s share price of 98% has contributed to a significant 47% to 49% of Nasdaq 100 and S&P 500 YTD gains.

- 2 of 5 prior earnings results releases of Nvidia since February 2023 have led to ex-post negative returns of -4.5% (12 trading days) and -8.2% (45 trading days).

- Before these 2 episodes of negative returns, the Nasdaq 100 had been trading below its 20-day moving average before the release of Nvidia’s earnings result.

- Right now, ahead of today’s Q1 Nvidia earnings release, the Nasdaq 100 has traded above its 20-day moving average since 3 May.

This is a follow-up analysis of our prior report, “Nasdaq 100: Sandwiched, watch the US 10-year Treasury yield next” on 3 May 2024. Click here for a recap.

Since our last publication, the Nasdaq 100 has managed to stage a rally of 4.6% in the past two weeks and printed a fresh all-time high of 18,714 yesterday, 21 May considering a push down seen earlier on the US 10-year Treasury yield below the 4.58% level on 3 May (bullish bias trigger level for Nasdaq 100).

Thereafter, the US 10-year Treasury yield continued to slide by 20 basis points to print an intraday low of 4.31% last Thursday,16 May reinforced by the “softened” US CPI print release on Wednesday, 15 May.

Interestingly, the past three days of up move seen in the Nasdaq 100 that rallied to another fresh all-time yesterday has broken its inverse correlation with the US 10-year Treasury yield (in the context of the sensitivity on technology stocks being impacted by long-duration risk) as the US 10-year Treasury yield rebounded in the past three days to trade higher at 4.45% that recouped all its losses inflicted on last Wednesday, ex-post US CPI.

So, what is driving the movement of the Nasdaq 100 at this juncture?

Micro (earnings growth potential) is taking a front seat over adverse macro factors

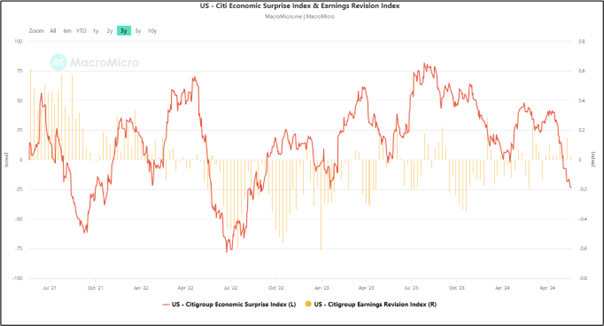

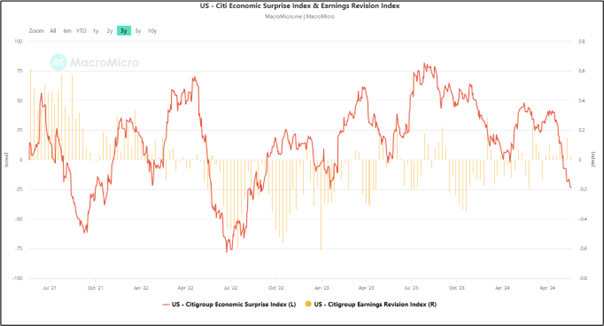

Fig 1: Citigroup US Economic Surprise Index & Earnings Revision Index as of 20 May 2024 (Source: MacroMicro, click to enlarge chart)

Recent key leading US economic data have pointed to a likely slowdown in economic growth such as the preliminary University of Michigan Consumer Sentiment Index for May that dropped to a six-month low coupled with a contraction in the services activities that contribute to almost two-thirds of US economic growth as indicated by April’s ISM Services PMI that decelerated to 49.2, its first contraction reading since December 2022.

These not-so-rosy macro factors can also be expressed in aggregate by the Citigroup US Economic Surprise Index which continued to plummet since late April 2024; as of 20 May, it continued to inch lower to -23.20, its lowest level in almost one and a half years (see Fig 1).

In contrast, the sell-side analysts are still optimistic about the future earnings growth of US corporations where the Citigroup US Earnings Revision Index has stayed above its zero level for eight consecutive weeks as of the week ending 17 May 2024, an indication that implied more analysts on the aggregate have upgraded their earnings estimates versus earnings downgrades.

The current YTD gain of Nvidia share price is a significant contributor to the performance of Nasdaq 100

Fig 2: Nvidia major and medium-term trends as of 21 May 2024 (Source: Trading View, click to enlarge chart)

Let’s focus now on Nvidia where the current year-to-date return of its share price as of yesterday, 21 May has skyrocketed to 98%%, surpassing the gains of the S&P 500, Nasdaq 100, and the iShares Semiconductor ETF by a wide margin over the same period.

Nvidia is at the forefront of the ongoing optimism on AI technology, its current bull run on its share price has contributed to almost 47% to 49% of the gains seen in the S&P 500 and Nasdaq 100 so far in 2024 as it is the third biggest market-cap component stock in the S&P 500 and Nasdaq 100 with a weightage of 5.2% and 6.4% respectively.

The bar has been set high again for Nvidia’s Q1 earnings as analysts expect an increase in earnings per share (EPS) to $5.60; that’s an implied increase of +8.5% q/q and +414% y/y, and so far, Nvidia has managed to beat earnings expectations in the past four quarters of earnings results reporting.

In the lens of technical analysis, the major uptrend phase of Nvidia in place since the 28 December 2022 low remains intact and continues to exhibit positive medium-term technical elements.

Price actions surpassed its 50-day moving average on 3 May 2024, and traded above it so far with a positive momentum reading displayed by its daily RSI momentum indicator. If it manages to hold above the 746.10 key medium-term pivotal support, the bullish tone remains likely intact with the next medium-term resistances coming in at 1,014.25/1,070.15 and 1,269.40/1,326.40 (see Fig 2).

2 of 5 prior Nvidia earnings results led to negative reactions in Nasdaq 100

Fig 3: US Nas 100 major and medium-term trends as of 22 May 2024 (Source: Trading View, click to enlarge chart)

Using the start of the current major uptrend phase of the Nasdaq 100 in place since January 2023 as the reference point, we looked back at the prior five quarters’ earnings releases of Nvidia and assessed the respective performance of Nasdaq 100 ex-post Nvidia earnings.

Only two of the earnings releases of Nvidia led to a negative performance on the Nasdaq 100; firstly, the 22 February 2023 earnings release saw an ex-post loss (open to low) of -4.5% that lasted for 12 trading days. Secondly, the 23 August 2023 earnings release led to an ex-post loss of -8.2% on the Nasdaq 100 over 45 trading days (see Fig 3).

Interestingly before the release of these two (22 February 2023 and 23 August 2023) negative ex-posts earnings dates of Nvidia, the price actions of Nasdaq 100 had traded below its 20-day moving average which already suggests some form of inherent short-term price actions weakness before the release of Nvidia’s earnings results.

Right now, ahead of today’s Q1 Nvidia earnings results release, the price actions of Nasdaq 100 have traded above its 20-day moving average since 3 May which suggests that the short-term uptrend phase of Nasdaq 100 remains intact, and odds may be skewed towards a potential positive performance on Nasdaq 100 ex-post Nvidia earnings.

Watch the 18,370 key short-term support on the Nasdaq 100

Fig 4: US Nas 100 short-term trend as of 22 May 2024 (Source: Trading View, click to enlarge chart)

As seen on the 1-hour chart, the price action of the US Nas 100 Index (a proxy of the Nasdaq 100 futures) is still oscillating within a steeper minor ascending channel in place since 1 May 2024 (see Fig 4).

In addition, the hourly RSI momentum indicator has just rebounded after a retest on a key parallel ascending support at around the 50 level which suggests short-term upside momentum remains intact.

If the 18,370 short-term pivotal support holds, the Index may see its next near-term resistances coming in at 18,850 and 18,990/19,055.

On the flip side, a break below 18,370 negates the bullish tone for a slide to expose the next near-term supports at 18,100 and 17,970 (also the 20-day and 50-day moving averages).

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.marketpulse.com/indices/nasdaq-100-pay-close-attention-to-nvidia-price-actions-ex-post-earnings-release/kwong

- :has

- :is

- :not

- :where

- ][p

- $UP

- 070

- 1

- 10

- 100

- 12

- 15 years

- 15%

- 16

- 17

- 2%

- 20

- 2022

- 2023

- 2024

- 22

- 23

- 28

- 40

- 49

- 50

- 500

- 60

- 7

- 700

- 970

- a

- About

- above

- access

- Action

- actions

- activities

- addition

- adverse

- advice

- affiliates

- After

- again

- aggregate

- ahead

- AI

- All

- almost

- already

- also

- an

- Analyses

- analysis

- Analysts

- and

- Another

- any

- April

- April 2024

- ARE

- around

- AS

- assessed

- At

- attention

- AUGUST

- author

- authors

- avatar

- average

- award

- back

- bar

- basis

- BE

- beat

- been

- before

- being

- below

- bias

- Biggest

- Box

- Break

- Broken

- bull

- Bull Run

- Bullish

- business

- buy

- by

- CAN

- Channel

- Chart

- Citigroup

- click

- Close

- COM

- combination

- coming

- Commodities

- component

- conducted

- Connecting

- consecutive

- considering

- consumer

- contact

- content

- context

- continued

- continues

- contraction

- contrast

- contribute

- contributed

- contributor

- Corporations

- Correlation

- coupled

- courses

- CPI

- Current

- daily

- data

- Dates

- Days

- December

- Directors

- displayed

- down

- drivers

- driving

- dropped

- Earlier

- Earnings

- Economic

- Economic growth

- eight

- elements

- Elliott

- ending

- enlarge

- estimates

- ETF

- exchange

- exhibit

- expect

- expectations

- experience

- expert

- expressed

- factors

- far

- February

- fig

- financial

- Find

- First

- five

- Flip

- flow

- Focus

- For

- forefront

- foreign

- foreign exchange

- forex

- form

- found

- four

- fresh

- front

- fund

- fundamental

- future

- Futures

- Gain

- Gains

- General

- giant

- Global

- global markets

- Growth

- growth potential

- had

- Half

- Have

- High

- higher

- hold

- holds

- HTTPS

- if

- impacted

- implied

- in

- Inc.

- Increase

- index

- indicated

- indication

- Indicator

- Indices

- information

- inherent

- inverse

- investment

- iShares

- IT

- ITS

- January

- juncture

- just

- Kelvin

- Key

- Last

- Late

- leading

- Led

- lens

- Level

- levels

- like

- likely

- looked

- loss

- losses

- Low

- lower

- lowest

- lowest level

- Macro

- major

- managed

- manages

- Margin

- Market

- market outlook

- market research

- MarketPulse

- Markets

- max-width

- May 2024

- May..

- Michigan

- micro

- minor

- Momentum

- more

- move

- movement

- moving

- moving average

- moving averages

- nas

- Nasdaq

- Nasdaq 100

- necessarily

- negative

- news

- next

- now

- numerous

- Nvidia

- Odds

- of

- officers

- on

- ONE

- ongoing

- only

- open

- Opinions

- Optimism

- Optimistic

- or

- our

- out

- Outlook

- over

- Parallel

- passionate

- past

- Pay

- per

- performance

- period

- perspectives

- phase

- photo

- pivotal

- Place

- plato

- Plato Data Intelligence

- PlatoData

- please

- Plummet

- pmi

- Point

- points

- positioning

- positive

- Posts

- potential

- preliminary

- price

- PRICE ACTION

- Prior

- Produced

- providing

- proxy

- Publication

- purposes

- Push

- Q1

- rally

- reactions

- Reading

- recap

- reference

- release

- Releases

- remains

- report

- Reporting

- research

- respective

- respectively

- result

- Results

- retail

- return

- returns

- Reversal

- Risk

- rsi

- rss

- Run

- S&P

- S&P 500

- same

- saw

- Securities

- see

- seen

- sell

- semiconductor

- senior

- Sensitivity

- sentiment

- service

- Services

- set

- Share

- sharing

- short-term

- side

- significant

- since

- Singapore

- site

- Slide

- Slowdown

- So

- so Far

- solution

- some

- Source

- specializing

- Stage

- start

- stayed

- Still

- stock

- Stock markets

- Stocks

- Strategist

- subsidiaries

- such

- Suggests

- support

- Supports

- surpassed

- surpassing

- surprise

- taking

- Technical

- Technical Analysis

- Technology

- ten

- that

- The

- The Future

- their

- These

- Third

- this

- thousands

- three

- thursday

- to

- today’s

- TONE

- towards

- trade

- traded

- Traders

- Trading

- Training

- treasury

- Trend

- Trends

- trigger

- two

- two-thirds

- unique

- university

- University of Michigan Consumer Sentiment

- upgraded

- Upside

- uptrend

- us

- US CPI

- using

- v1

- Versus

- View

- Visit

- Watch

- Wave

- we

- weakness

- Wednesday

- week

- Weeks

- WELL

- What

- What is

- which

- wide

- winning

- with

- within

- wong

- would

- years

- yesterday

- Yield

- You

- zephyrnet

- zero