- National Australia Bank (NAB) will block payments to certain cryptocurrency platforms due to high scam risk

- Other major Australian banks have also blocked payments to some exchanges, possibly including Binance

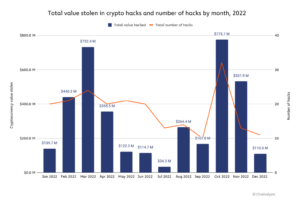

- Cryptocurrency scams are a growing security threat, with Australians losing over $221 million last year

On July 17, National Australia Bank (NAB) revealed a series of measures to protect its customers from fraud under its “bank-wide scam strategy.” These measures involve blocking payments to certain cryptocurrency platforms due to perceived high levels of scam risk in the industry. However, NAB did not disclose the names of the specific platforms facing blocks, referring to them only as “high-risk” platforms where scams are more prevalent.

NAB’s decision aligns with actions taken by other major Australian banks, such as Westpac and the Commonwealth Bank, who have also reportedly blocked payments to certain cryptocurrency exchanges. Although NAB’s executive for group investigations and fraud, Chris Sheehan, did not explicitly name Binance, there are indications that the exchange could be among those affected by the payment blocks.

The concerns raised by NAB and other local banks highlight the alarming statistics related to cryptocurrency scams in Australia. NAB’s statement suggests that nearly 50% of reported scam funds in the country are linked to the crypto industry, and cryptocurrency scams are considered one of the fastest-growing security threats. In the past year alone, Australians have lost over $221 million to fraudulent activities involving cryptocurrencies.

READ: Top ten cryptocurrency tokens running bizarre use cases

NAB’s announcement also touched on public sentiment regarding payment protection. The bank stated that 40% of Australians are willing to tolerate slower payment processes if it enhances their protection against scammers. This indicates a growing awareness and concern among the public about the risks associated with cryptocurrency transactions.

Despite the new measures, NAB did not provide detailed criteria for categorizing platforms as “high-risk” or specific information about the impacted cryptocurrencies. This lack of transparency has raised questions and uncertainty among investors and crypto enthusiasts who rely on these platforms for their digital asset transactions.

The potential block on payments to Binance, one of the largest cryptocurrency exchanges globally, may signal broader scrutiny faced by the platform in the Australian market. The outcome of these decisions could have significant implications for Binance’s operations and reputation in the region.

While NAB’s efforts to protect customers from scams are commendable, they raise discussions about striking a balance between security and innovation in the cryptocurrency sector. As the industry continues to evolve, finding effective methods to combat scams without stifling legitimate and innovative projects remains a considerable challenge.

In conclusion, National Australia Bank’s move to implement measures to counter cryptocurrency scams reflects the growing concern over fraudulent activities in the crypto space. The impact of these actions on platforms like Binance remains uncertain, but they underscore the need for robust security measures within the cryptocurrency industry. Striking the right balance between customer protection and fostering innovation will continue to be a priority for financial institutions and regulatory authorities as the landscape evolves.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://web3africa.news/2023/07/17/news/national-australia-bank-joins-cryptocurrency-boycott/

- :has

- :not

- :where

- 17

- a

- About

- actions

- activities

- against

- Aligns

- alone

- also

- Although

- among

- and

- Announcement

- ARE

- AS

- asset

- associated

- Australia

- Australian

- Authorities

- awareness

- Balance

- Bank

- Banks

- BE

- between

- binance

- Block

- blocked

- blocking

- Blocks

- broader

- but

- by

- categorizing

- certain

- challenge

- Chris

- combat

- commendable

- Concern

- Concerns

- conclusion

- considerable

- considered

- continue

- continues

- could

- Counter

- country

- criteria

- crypto

- Crypto Industry

- crypto space

- cryptocurrencies

- cryptocurrency

- Cryptocurrency Exchanges

- Cryptocurrency Industry

- Cryptocurrency scams

- customer

- Customers

- decision

- decisions

- detailed

- DID

- digital

- Digital Asset

- Disclose

- discussions

- due

- Effective

- efforts

- Enhances

- enthusiasts

- evolve

- evolves

- exchange

- Exchanges

- executive

- faced

- facing

- financial

- Financial institutions

- finding

- For

- fostering

- fraud

- fraudulent

- from

- funds

- Globally

- Group

- Growing

- Have

- High

- Highlight

- However

- HTTPS

- if

- Impact

- impacted

- implement

- implications

- in

- Including

- indicates

- indications

- industry

- information

- Innovation

- innovative

- institutions

- Investigations

- Investors

- involve

- involving

- IT

- ITS

- Joins

- jpg

- July

- July 17

- Lack

- landscape

- largest

- Last

- legitimate

- levels

- like

- linked

- local

- LOCAL BANKS

- losing

- lost

- major

- Market

- May..

- measures

- methods

- million

- more

- move

- NAB

- name

- names

- National

- National Australia Bank

- nearly

- Need

- New

- of

- on

- ONE

- only

- Operations

- or

- Other

- Outcome

- over

- past

- payment

- payments

- perceived

- platform

- Platforms

- plato

- Plato Data Intelligence

- PlatoData

- possibly

- potential

- prevalent

- priority

- processes

- projects

- protect

- protection

- provide

- public

- Questions

- raise

- raised

- reflects

- regarding

- region

- regulatory

- related

- rely

- remains

- Reported

- reputation

- Revealed

- right

- Risk

- risks

- robust

- running

- Scam

- Scammers

- scams

- scrutiny

- sector

- security

- Security Measures

- Security threats

- sentiment

- Series

- Signal

- significant

- some

- Space

- specific

- stated

- Statement

- statistics

- Strategy

- such

- Suggests

- taken

- ten

- that

- The

- The Landscape

- their

- Them

- There.

- These

- they

- this

- those

- threat

- threats

- to

- Tokens

- touched

- Transactions

- Transparency

- Uncertain

- Uncertainty

- under

- use

- Westpac

- WHO

- will

- willing

- with

- within

- without

- year

- zephyrnet