-

With the power of blockchain technology, African financial services have significantly improved.

-

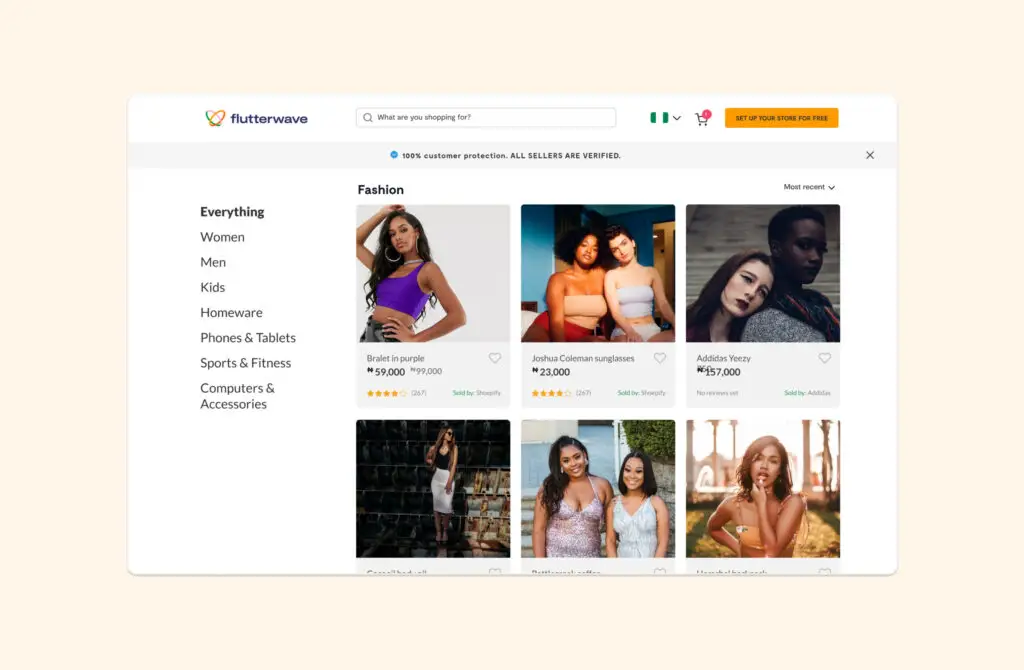

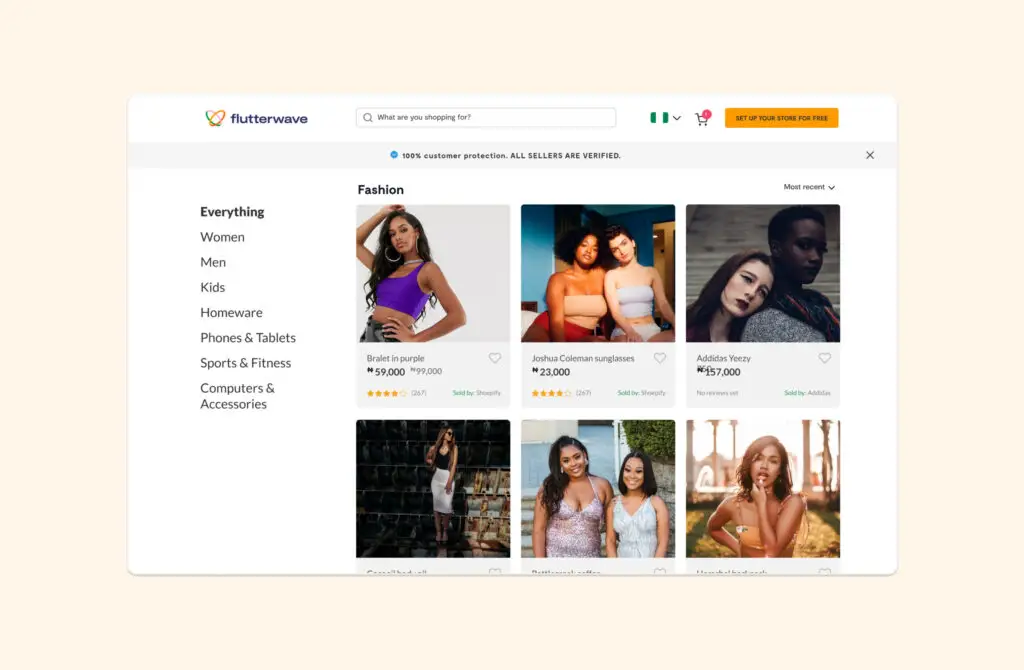

For instance, Bitpesa, Yellow Card, and Fluttewave operate across several African countries.

-

VBS Mutual Bank in South Africa shut down due to its massive internal corruption, which led to several fraud scandals.

Web3 and its numerous applications are redefining tech and various industries in real-time. Decentralized applications have become more mainstream today, creating new opportunities for developers, investors, and the entire Web3 community.

Web3’s revolutionary changes are significantly impacting African financial services. The power of decentralization has led innovators and visionaries to bypass traditional banking systems, introduce new services, and transform the continent’s financial inclusion rate.

Moreover, as governments explore the integration of digital assets into their economies, adopting DeFi systems is further accelerated, painting a hopeful future for African financial services.

Let’s delve into a real-world use case that vividly illustrates how blockchain technology transforms archaic forms of banking systems, providing a glimpse into the future of financial services.

Blockchain technology overhauling Financial services

Digital assets have become a trend among organizations, startups, and governments. With Bitcoin’s steady success as a financial entity, many have opted to apply its underlying tech improvements to their own systems.

This trend eventually led to the resurgence of DeFi systems and DApps. Web3 has solidified its place as the next iteration of the internet by ushering in a new industrial revolution. It’s common to find decentralized platforms running more efficiently than standard Web2 applications.

As a result, we have Blockchain in health care, real estate, agriculture, entertainment, and industry. Its unprecedented adoption has further sparked ingenuity within Africa, empowering many entrepreneurs, developers, and even artists to dive into the world of Web3 and profit from it. Soon, it became clear that Africa had vast untapped potential within Web3.

Also, Read Layer-1 Blockchain WAX Signs Deal With Amazon Web Services for Worldwide Asset Exchange.

Despite the technology’s apparent success and flexibility, what makes Web3 stand out is its immense accomplishments within the financial sector.

The first application of Web3, Bitcoin, initially strived to provide a better and alternative financial service without the unnecessary control and supervision of centralized systems. This blossomed to inspire many successful African financial services.

The likes of Bitsiksa. Pezesha, Yellow Card and Flutterwace have dominated the market, overhauling the continent’s financial inclusion and digital asset adoption rates and eradicating financial exclusion in Africa.

Although this begs the question: How did Blockchain technology evolve Africa’s financial industry in less than a decade?

Blockchain overhauling African Financial services

Bitcoin’s decentralized, immutable, and available nature inspired many to test the boundaries of its capabilities. This led to several new iterations of digital assets, such as Altcoins, CBDCs, and stablecoins. However, the development of DeFi systems truly made a mark, ushering in a new era of Fintech startups designed to cater to Africa’s low financial inclusion rate.

Below are several key ways in which Blockchain supersedes and evolves traditional financial systems:

Transparency, Availability and Security

One of the first vital elements DeFi systems emulate is their ability to safeguard user information, funds, and transactions from your mobile phone. With Africa still developing, most of its population is clustered and scattered throughout the region.

This brought about several issues, including inaccessibility to the banking system. Many banking systems were initially developed in major African urban areas, which are almost countable. This leaves behind a good majority residing in rural regions, forcing many to make long trips to banks only to be met with long queues.

This discouraged many citizens from opening bank accounts, opting for a tin can or a small cut on the bed to store their money. In addition, long processing hours hindered many who tried to receive or send money abroad. Fortunately, with blockchain technology, these issues are a thing of the past.

The automatization Blockchain offers is a crucial element behind most fintech startups. Its fast processing power ensures constant updates of one’s balance, and since many digital assets are accessible via phones, many have opted for DeFi systems.

Furthermore, its immutable nature reassures clients of real-time information regarding their balances, and some have additional financial perks such as low-fee loans.

Lower Transaction Cost

The age of digital money swept across Africa before transversing throughout the globe. Mpesa quickly became a popular option among East Africans due to its accessibility. Traditional banks offered broader services, but with each came additional transaction costs.

Mpesa offered a better alternative but also faced several issues regarding its transaction costs. Due to the automation of smart contracts, Blockchain or DeFi systems cut down complex supply chains by more than half. It creates a direct connection between sender and receiver; hence, it only requires a small gas fee to conduct the transaction.

For instance, Bitpesa, Yellow Card, and Fluttewave operate across several African countries. Each might price its gas feed differently, but compared to non-blockchain payment systems, it leans on the lower side; furthermore, with reduced fees, international rankers have broadened several aspects.

For instance, it allows African-based organizations to access a broader market without fearin’ of excess charges in fees. Thus making it cheaper for Africans worldwide to access international markets.

Also, Read Ripple Empowers Onafriq Fintech: Unleashing Cross-Border Payment Capabilities Across Africa.

Improved Remittance Services:

For the unaware, remittance services involve transferring money by foreign workers back to their home countries. Africa is a standard service since most countries export their human resources to developed nations.

Unfortunately, the fee charges, long processing, and long transaction time when dealing with traditional banks often discourage many from sending them back to their families. Fortunately, with the power of blockchain technology, African financial services have significantly improved.

The technology reduces cost while increasing speed enhances security and provides easy accessibility via the internet or smartphone. For example, SureRemit offers a non-cash remittance service that allows users to send crypto vouchers that can be used directly to pay bills, school fees, and medical services in several African countries.

This reduces the cost of sending money across borders and ensures that the money is used for the intended purpose.

Battling Fraud and Corruption

One of the major issues contributing to Africa’s slow development phase is the amount of corruption most nations face. This vice has eaten away at most African countries, leading to an economic, political and even, in some cases, social decline.

For instance, VBS Mutual Bank in South Africa shut down due to its massive internal corruption, which led to several fraud scandals. According to Daily Maverick, several bank officials and directors indulged in fraudulent activities, siphoning several billion from municipal investments.

In addition, Kroll’s 2023 Fraud and Financial Crime Report highlighted how financial crime risk only rises as technology improves. African fintech startups have recently adopted the use of smart contracts within most financial services. This automates digital asset lending, receiving and transacting, removing the likelihood of “missing funds.”

Pezesha, a Kenyan DeFi platform, utilizes this feature to automate lending services. The contract automatically handles the disbursement and repayment of loans based on predefined terms, reducing the risk to management.

Bitsika implemented blockchain services to provide a decentralized money transfer service across Africa. This diminishes the control of any single individual or group over the system, curbing any corruption attempts.

These use cases demonstrate how Blockchain is not just a technological innovation but a transformative tool for improving the financial landscape in Africa, making it more inclusive, secure, and efficient.

These initiatives pave the way for broader adoption of Blockchain globally, potentially revolutionizing how financial transactions and agreements are managed in various sectors.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://web3africa.news/2024/04/23/news/african-financial-services-web3/

- :has

- :is

- :not

- 1

- 20

- 2019

- 2023

- 455

- 7

- a

- ability

- About

- abroad

- accelerated

- access

- accessibility

- accessible

- accomplishments

- According

- Accounts

- across

- activities

- addition

- Additional

- adopted

- Adopting

- Adoption

- africa

- African

- africans

- age

- agreements

- agriculture

- allows

- almost

- also

- Altcoins

- alternative

- Amazon

- Amazon Web Services

- among

- amount

- an

- and

- any

- apparent

- Application

- applications

- Apply

- archaic

- ARE

- areas

- Artists

- AS

- aspects

- asset

- Assets

- At

- Attempts

- automate

- automates

- automatically

- Automation

- availability

- available

- away

- back

- Balance

- balances

- Bank

- bank accounts

- Banking

- banking system

- Banks

- based

- BE

- became

- become

- before

- behind

- Better

- between

- Billion

- Bills

- Bitcoin

- blockchain

- blockchain technology

- borders

- boundaries

- broader

- brought

- but

- buy

- by

- bypass

- came

- CAN

- capabilities

- card

- care

- case

- cases

- cater

- CBDCs

- centralized

- centralized systems

- chains

- Changes

- charges

- cheaper

- Citizens

- clear

- clients

- Common

- community

- company

- compared

- complex

- Conduct

- connection

- constant

- contract

- contracts

- contributing

- control

- Corruption

- Cost

- cost-effective

- Costs

- countries

- creates

- Creating

- Crime

- cross-border

- crucial

- crypto

- curbing

- Currency

- Cut

- daily

- DApps

- deal

- dealing

- decade

- Decentralization

- decentralized

- Decentralized Applications

- Decline

- DeFi

- DeFi platform

- delve

- demonstrate

- designed

- developed

- developers

- developing

- Development

- DID

- differently

- digital

- Digital Asset

- Digital Assets

- Digital Money

- direct

- directly

- Directors

- disbursement

- discouraged

- dive

- dominated

- down

- due

- each

- East

- easy

- Economic

- efficient

- efficiently

- element

- elements

- empowering

- empowers

- Enhances

- ensures

- Entertainment

- Entire

- entity

- entrepreneurs

- Era

- estate

- Even

- eventually

- evolve

- evolves

- example

- excess

- explore

- export

- Face

- faced

- families

- FAST

- Feature

- fee

- Fees

- financial

- financial inclusion

- Financial sector

- financial service

- financial services

- financial systems

- financial-crime

- Find

- fintech

- fintech startups

- First

- Flexibility

- For

- forcing

- foreign

- forms

- Fortunately

- Founded

- fraud

- fraudulent

- from

- funds

- further

- Furthermore

- future

- GAS

- Glimpse

- Globally

- globe

- good

- Governments

- Group

- had

- Half

- Handles

- Have

- Health

- Health Care

- hence

- Highlighted

- hindered

- Home

- hopeful

- HOURS

- How

- However

- HTTPS

- human

- Human Resources

- illustrates

- immense

- immutable

- Impact

- impacting

- implemented

- improved

- improvements

- improves

- improving

- in

- Including

- inclusion

- Inclusive

- increasing

- individual

- indulged

- industrial

- Industrial Revolution

- industries

- industry

- information

- ingenuity

- initially

- initiatives

- Innovation

- innovators

- inspire

- inspired

- instance

- integration

- intended

- internal

- International

- Internet

- into

- introduce

- Investments

- Investors

- involve

- issues

- IT

- iteration

- iterations

- ITS

- jpeg

- just

- Key

- landscape

- leading

- Led

- lending

- less

- likelihood

- likes

- Loans

- local

- Long

- Low

- lower

- made

- Mainstream

- major

- major issues

- Majority

- make

- MAKES

- Making

- managed

- management

- many

- mark

- Market

- Markets

- massive

- maverick

- max-width

- medical

- met

- might

- Mobile

- mobile phone

- money

- more

- most

- municipal

- mutual

- Nations

- Nature

- New

- next

- numerous

- of

- offered

- Offers

- officials

- often

- on

- only

- opening

- operate

- operates

- opportunities

- Option

- or

- organizations

- out

- over

- own

- painting

- past

- pave

- Pay

- payment

- Payment Systems

- perks

- phase

- phone

- phones

- Place

- platform

- Platforms

- plato

- Plato Data Intelligence

- PlatoData

- political

- Popular

- population

- potential

- potentially

- power

- predefined

- price

- processing

- Processing Power

- Profit

- provide

- provides

- providing

- purpose

- question

- quickly

- Rate

- Rates

- real

- real estate

- real world

- real-time

- reassures

- receive

- receiving

- recently

- Redefining

- Reduced

- reduces

- reducing

- regarding

- region

- regions

- Remittance

- removing

- repayment

- report

- requires

- Resources

- result

- Revolution

- revolutionary

- revolutionizes

- Revolutionizing

- Rises

- Risk

- running

- Rural

- s

- safeguard

- scandals

- scattered

- School

- sector

- Sectors

- secure

- security

- sell

- send

- sender

- sending

- service

- Services

- several

- shut

- Shut down

- side

- significantly

- Signs

- since

- single

- slow

- small

- smart

- Smart Contracts

- smartphone

- Social

- some

- soon

- South

- South Africa

- sparked

- speed

- Stablecoins

- stand

- standard

- Startups

- steady

- Still

- store

- success

- successful

- such

- supervision

- supply

- Supply chains

- system

- Systems

- tech

- technological

- Technology

- terms

- test

- than

- that

- The

- The Future

- the world

- their

- Them

- These

- thing

- this

- throughout

- Thus

- time

- to

- today

- tool

- traditional

- traditional banking

- transacting

- transaction

- transaction costs

- Transactions

- transfer

- Transferring

- Transform

- transformative

- transforms

- Trend

- tried

- true

- truly

- unaware

- underlying

- unleashing

- unnecessary

- unprecedented

- untapped

- Updates

- urban

- USDC

- USDT

- use

- use case

- used

- User

- users

- ushering

- utilizes

- various

- Vast

- via

- vice

- visionaries

- vital

- was

- WAX

- Way..

- ways

- we

- web

- web services

- Web2

- Web3

- Web3 community

- were

- What

- when

- which

- while

- WHO

- with

- within

- without

- workers

- world

- worldwide

- Yellow Card

- Your

- zephyrnet