Published 41 mins ago

Polygon (MATIC) price analysis turns positive today. The price opened lower but managed to trade in green over the past few hours. The price finds reliable support at around $0.75, resulting in intraday gains.

advertisement

It is interesting to watch if MATIC could sustain the gains.

- Polygon price edges higher on Saturday.

- The price hovers near the critical support-turned-resistance $0.80 level.

- If the price closes above this level would it would be a turnaround for MATIC.

Polygon price trades in green

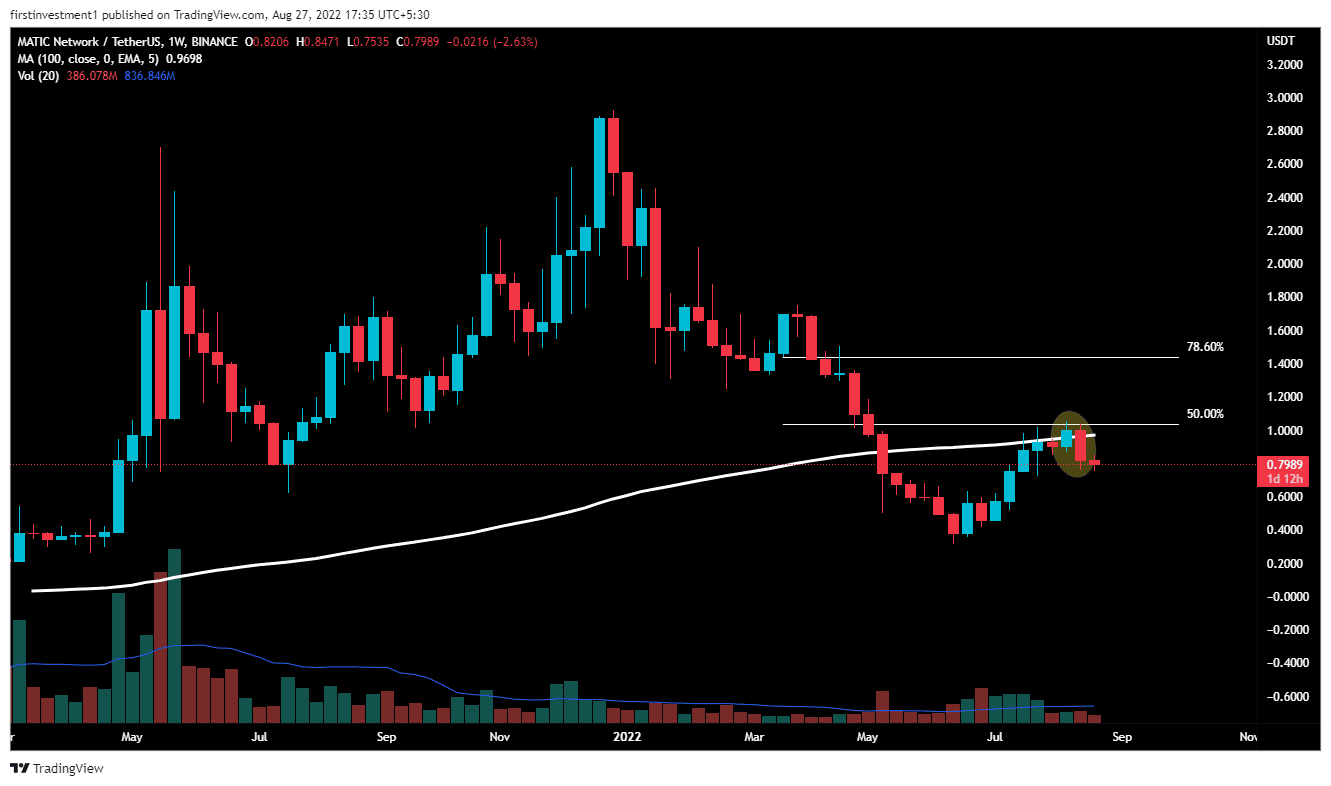

On the weekly chart, MATIC is forming lower lows and lower highs. Further, the price is trading below the 100-day exponential moving average.

Earlier MATIC gave a bearish impulse move from March 28 ($1.76) to June 13 ($0.380), with a more than 80% fall within just three months. However, the price makes a pullback from its lows of up to $(1.0440), where MATIC finds a strong resistance hurdle at the 100-day exponential moving average

Trending Stories

Combined with the 50% Fibonacci retracement level, it makes a higher probability of sizeable downside momentum. If the price closes below 0.75 on a daily chart, then we can expect a fall of up to $0.70 followed by $0.65.

In addition to that, the formation of a bearish engulfing pattern confined the dominance of the sellers.

However, the formation of the Doji candlestick suggests the sellers might be losing out of steam. Still, it needs confirmation to make a trading decision.

On the daily chart time frame, the price is taking reliable support at $0.7500, which earlier acted as a resistance. MATIC forms a “Head & Shoulder” pattern.

A double bottom structure near $0.7500 would result in a discount buying opportunity for the sidelined investors. The momentum oscillators could turn in the favor of bulls.

The RSI(14) is trading below 50. When the relative strength index is below 50, it generally means that the losses are greater than the gains. Any uptick in the indicator could strengthen the positive outlook.

Whereas, the MACD line crosses below the signal line below zero, indicating a bearish trend. However, the decreasing histogram suggests receding bearish momentum.

An acceptance above the session’s high would bring more gains with additional buying interest. On Moving higher, the first upside target could be found at $0.85.

Also read: http://Elon Musk And Now Sarath Ratanavadi – Billionaires To Invest In Cryptocurrencies

On the other hand, if the price break below the Head $ Shoulder pattern’s neckline support, with rising volumes, then we can expect a good fall. If the price sustains below $0.75, then there is a higher chance of MATIC dropping toward $0.65.

The nearest support is $0.75, whereas the nearest resistance is $0.8500. There is a higher probability of the price to breaks its resistance level. The “Buy on the dip” opportunity is the best course of plan we can go with.

advertisement

MATIC is sideways to mildly bullish on different time frames. Above $0.85 closing on the hourly time frame, we can put a trade on the buy side.

Share this article on:

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

- Bitcoin

- blockchain

- blockchain compliance

- blockchain conference

- coinbase

- Coingape

- coingenius

- Consensus

- crypto conference

- crypto mining

- cryptocurrency

- decentralized

- DeFi

- Digital Assets

- ethereum

- machine learning

- non fungible token

- plato

- plato ai

- Plato Data Intelligence

- Platoblockchain

- PlatoData

- platogaming

- Polygon

- Polygon price analysis

- Price Analysis

- proof of stake

- W3

- zephyrnet