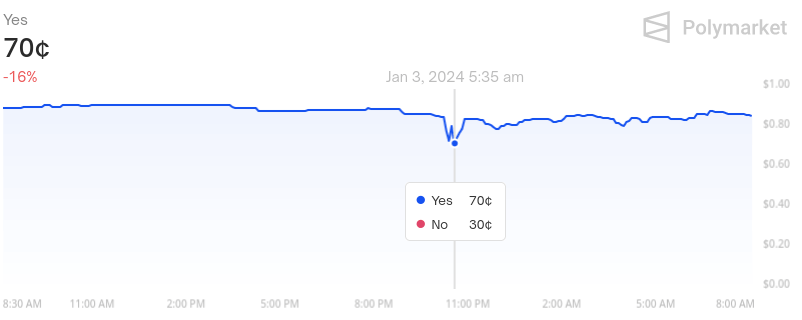

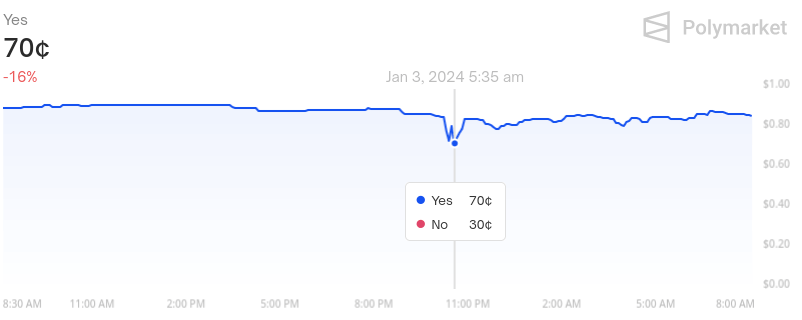

Betting odds on Polymarket concerning the approval of pending spot Bitcoin exchange-traded funds (ETFs) briefly fell to 70% on Jan. 3.

On whether a spot Bitcoin ETF will be approved by Jan. 15, Polymarket displayed a “yes” outcome as priced at $0.70 at 1:30 p.m. UTC on Jan. 3. Polymarket data and various other reports suggested that a “yes” outcome was priced at $0.89 on Jan. 2. Current Polymarket data indicates that “yes” is currently priced at $0.84.

So far, Polymarket users have bet $912,569 on this market, though it is unclear how many individuals have placed bets in total.

Contrarian report may be responsible for drop

The decline in Polymarket’s “yes” odds may be related to a contrarian report from Matrixport analyst Markus Thielen published on Jan. 3.

Thielen argued that the U.S. Securities and Exchange Commission (SEC) may reject all pending spot ETFs for political reasons. He noted that many SEC Commissioners are members of the Democratic party (which is often considered anti-cryptocurrency) and highlighted SEC chair Gary Gensler’s hostility to crypto. Thielen also asserted that pending applications do not currently meet a critical requirement but did not identify the requirement in question.

Polymarket’s odds nevertheless represent an overwhelming chance of approval. Its current 84% odds are roughly in line with a prediction from Bloomberg ETF analysts, who say there is a 90% chance that the SEC approves at least one ETF when it decides on Ark Invest’s application by a Jan. 10 deadline.

Incidentally, Bloomberg ETF analyst Eric Balchunas responded to Thielen’s report. As evidence of approval, he noted that the SEC has worked extensively with applicants and that at least three commissioners are in favor of approval.

Polymarket may represent a more balanced view than either source. Because Polymarket’s odds are determined based on user positions, they represent the opinion of several individuals rather than a single person.

Bitcoin also saw 8% flash crash

Declining Polymarket odds came alongside an 7.9% flash crash that saw the price of Bitcoin (BTC) fall from $45,421 to $41,804 in a matter of hours.

Once again, Thielen’s comments may have contributed to that price crash. However, some have also pointed to CNBC personality Jim Cramer’s positive comments about Bitcoin as a possibly harming prices. Cramer has developed a reputation for frequently being incorrect, leading some investors to act contrary to his opinions according to the “Inverse Cramer effect.”

Bitcoin has since partially recovered to $42,967 as of 10:00 p.m. UTC. Any more significant news around a spot Bitcoin ETF will likely see further fluctuations.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://cryptoslate.com/polymarket-etf-odds-fell-to-70-btc-saw-8-flash-crash-amidst-matrixport-prediction/

- :has

- :is

- :not

- ][p

- 1

- 10

- 15%

- 30

- 320

- 7

- 70

- 804

- 84

- a

- About

- According

- Act

- again

- All

- alongside

- also

- amidst

- an

- analyst

- Analysts

- and

- any

- applicants

- Application

- applications

- approval

- approved

- ARE

- argued

- around

- AS

- At

- balanced

- based

- BE

- because

- being

- Bet

- Bets

- Bitcoin

- Bitcoin ETF

- Bloomberg

- briefly

- BTC

- but

- by

- came

- Chair

- Chance

- CNBC

- CoinGecko

- comments

- commission

- concerning

- considered

- contrary

- contributed

- Crash

- critical

- crypto

- Current

- Currently

- Dark

- data

- deadline

- Decline

- democratic

- democratic party

- determined

- developed

- DID

- displayed

- do

- effect

- either

- eric

- Eric Balchunas

- ETF

- ETFs

- evidence

- exchange

- exchange-traded

- exchange-traded funds

- extensively

- Fall

- far

- favor

- Flash

- fluctuations

- For

- frequently

- from

- funds

- further

- harming

- Have

- he

- High

- Highlighted

- his

- HOURS

- How

- However

- http

- HTTPS

- identify

- in

- indicates

- individuals

- Investors

- IT

- ITS

- Jan

- Jim

- leading

- least

- likely

- Line

- many

- Market

- Matrixport

- Matter

- max-width

- May..

- Meet

- Members

- more

- Nevertheless

- news

- noted

- Odds

- of

- often

- on

- ONE

- Opinion

- Opinions

- Other

- Outcome

- overwhelming

- party

- pending

- person

- Personality

- plato

- Plato Data Intelligence

- PlatoData

- political

- positions

- possibly

- prediction

- price

- Price Crash

- Prices

- published

- question

- rather

- reasons

- related

- report

- Reports

- represent

- reputation

- requirement

- responsible

- roughly

- s

- saw

- say

- SEC

- sec chair

- Securities

- Securities and Exchange Commission

- see

- several

- significant

- since

- single

- some

- Source

- Spot

- Spot Bitcoin Etf

- than

- that

- The

- There.

- they

- this

- though?

- three

- to

- Total

- u.s.

- U.S. Securities

- U.S. Securities and Exchange Commission

- User

- users

- UTC

- various

- View

- was

- when

- whether

- which

- WHO

- will

- with

- worked

- zephyrnet