One advantage of decentralized exchanges over centralized exchanges is that they are more secure and less exposed to potential fraud and hacking accidents.

A Solana-based DEX then existed, allowing users to trade perpetual futures, spot tokens, borrow and lend, and provide liquidity on the blockchain while prioritizing security.

(Read more: Ultimate Guide to Solana Airdrops 2023 – 2024 and 10 Potential Crypto Airdrops to Watch Out For in 2024)

Table of Contents

Drift Protocol Introduction

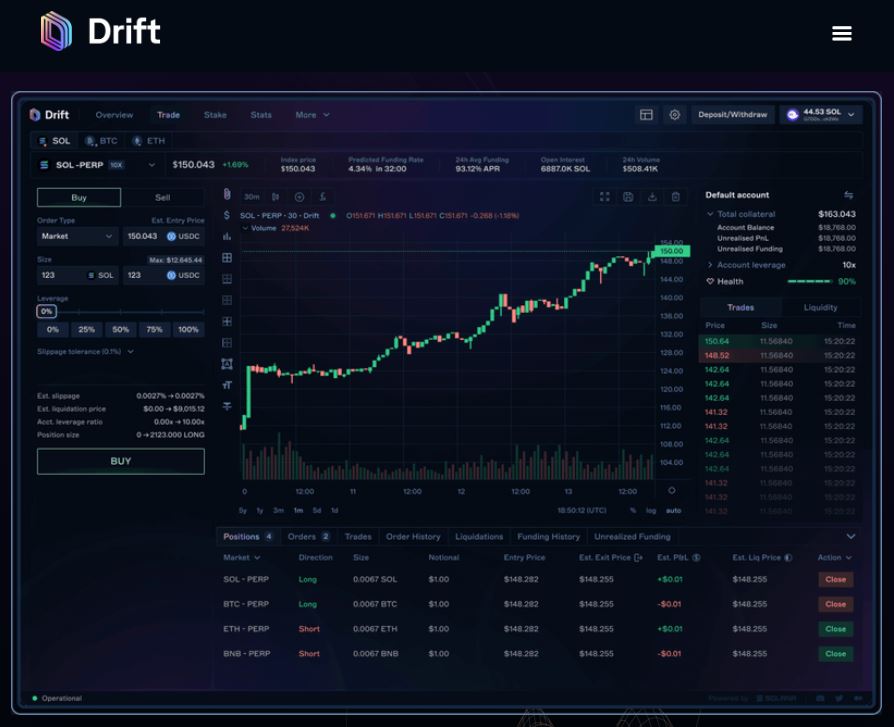

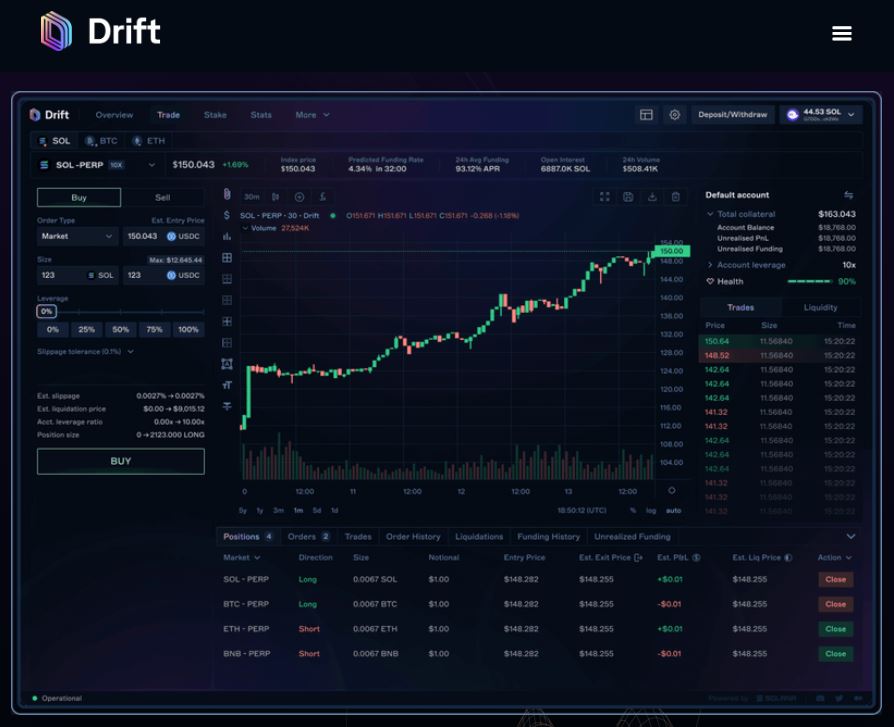

The Drift Protocol is a DEX that supports low slippage, low fees, and minimal price impact on all trades. It offers features such as spot trading, perpetuals trading, lending, and passive liquidity provision.

Drift also uses a cross-margined risk engine, a keeper network, and multiple liquidity mechanisms to offer low fees, low slippage, and high performance.

According to the team, on-chain exchanges suffer from limitations associated with blockchains—namely, speed and limited computational capacity on-chain.

Thus, Drift was designed as an exchange that is “robust, computationally efficient, and incentivizes market maker participation, as well as liquidity provision.”

Drift Protocol Features

As a DEX, a Solana wallet is needed and should be connected to use Drift’s products and services. Its utility token is also $SOL, which means transaction fees are paid through $SOL tokens.

- To trade spot tokens, go to the spots trading section, choose the token or pair to be traded, type in the desired amount, and choose the “buy” or “sell” buttons. The order book, the chart, and the recent trades can also be accessed on the platform.

- To trade perpetual futures, go to the perpetual futures section, choose the token or pair to be traded, type in the desired amount, choose the leverage percentage, and choose the “buy” or “sell” buttons. The funding rate, the liquidation price, and the PnL can also be accessed on the feature.

- To borrow or lend, go to the lending section, choose the token to be borrowed or lent, type in the desired amount, and choose the “borrow” or “lend” buttons. The interest rate, the collateral ratio, and the available balance can also be accessed on the section.

- To provide liquidity, go to the liquidity section, choose the desired pool, type in the desired amount, and choose the “deposit” button. The pool size, the fee rate, and the APY can be accessed on the feature.

- To stake, go to the staking section, choose the token to be staked, type in the desired amount, and choose the “stake” button. The staking rewards, the lockup period, and the unstake fee can also be accessed in the same section.

Drift Protocol Airdrop Guide

Like the Phantom Wallet, the information about the airdrop of the wallet is just speculation.

Allegedly, once the DEX launches its own utility token, a grand airdrop will happen.

To secure potential rewards, users must consistently use the features of the exchange. The features are mentioned in the Drift Protocol section of this article.

This article is published on BitPinas: Potential Drift Protocol Airdrop Guide | Solana-based DEX

Disclaimer:

- Before investing in any cryptocurrency, it is essential that you carry out your own due diligence and seek appropriate professional advice about your specific position before making any financial decisions.

- BitPinas provides content for informational purposes only and does not constitute investment advice. Your actions are solely your own responsibility. This website is not responsible for any losses you may incur, nor will it claim attribution for your gains.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://bitpinas.com/learn-how-to-guides/drift-protocol-airdrop-guide/

- :is

- :not

- 2023

- 8

- a

- About

- accessed

- accidents

- actions

- ADvantage

- advice

- airdrop

- Airdrops

- All

- Allowing

- also

- amount

- an

- and

- any

- appropriate

- APY

- ARE

- article

- AS

- associated

- available

- Balance

- BE

- before

- BitPinas

- blockchain

- book

- borrow

- BORROWED

- button

- CAN

- Capacity

- carry

- centralized

- Centralized Exchanges

- Chart

- Choose

- claim

- Collateral

- computational

- connected

- consistently

- constitute

- content

- crypto

- cryptocurrency

- decentralized

- decentralized-exchanges

- decisions

- designed

- desired

- Dex

- diligence

- does

- due

- efficient

- Engine

- essential

- exchange

- Exchanges

- exposed

- Feature

- Features

- fee

- Fees

- financial

- For

- fraud

- from

- funding

- Futures

- Gains

- Go

- grand

- guide

- hacking

- happen

- High

- HTTPS

- Impact

- in

- incentivizes

- information

- Informational

- interest

- INTEREST RATE

- investing

- investment

- IT

- ITS

- jpg

- just

- launches

- lend

- lending

- less

- Leverage

- limitations

- Limited

- Liquidation

- Liquidity

- liquidity provision

- Lockup

- losses

- Low

- low fees

- maker

- Making

- Market

- market maker

- max-width

- May..

- means

- mechanisms

- mentioned

- minimal

- more

- multiple

- must

- needed

- network

- of

- offer

- Offers

- on

- On-Chain

- once

- only

- or

- order

- out

- over

- own

- paid

- pair

- participation

- passive

- percentage

- performance

- period

- Perpetual

- Perpetuals

- phantom

- Phantom Wallet

- photo

- platform

- plato

- Plato Data Intelligence

- PlatoData

- pool

- position

- potential

- price

- prioritizing

- Products

- professional

- protocol

- provide

- provides

- provision

- published

- purposes

- Rate

- ratio

- Read

- recent

- responsibility

- responsible

- Rewards

- Risk

- same

- Section

- secure

- security

- Seek

- Services

- should

- Size

- slippage

- Solana

- Solana wallet

- solely

- specific

- speculation

- speed

- Spot

- Spot Trading

- spots

- Staked

- Staking

- Staking Rewards

- such

- Supports

- team

- that

- The

- the information

- then

- they

- this

- Through

- to

- token

- Tokens

- trade

- traded

- trades

- Trading

- transaction

- Transaction Fees

- type

- use

- users

- uses

- utility

- Utility Token

- Wallet

- was

- Watch

- Website

- WELL

- which

- while

- will

- with

- You

- Your

- zephyrnet

![[Recap] AxiePH Meetup: Axie Infinity Plans to Spend Its Second Bear Market Building Alongside its Fans [Recap] AxiePH Meetup: Axie Infinity Plans to Spend Its Second Bear Market Building Alongside its Fans PlatoBlockchain Data Intelligence. Vertical Search. Ai.](http://platoblockchain.com/wp-content/uploads/2022/06/recap-axieph-meetup-axie-infinity-plans-to-spend-its-second-bear-market-building-alongside-its-fans-300x225.jpg)