The British pound is almost unchanged today, as GBP/USD trades at the 1.2000 line.

UK inflation hits new 40-year high

UK inflation rose in June to its highest level since 1982, as the cost-of-living crisis has moved from bad to worse. Headline CPI hit 9.4% YoY, up from 9.1% in May and a notch above the consensus forecast of 9.3%. Core CPI dipped from 5.9% to 5.8%, matching the forecast.

The UK employment report yesterday was stronger than expected, and together with the sizzling inflation numbers, there is strong pressure on the BoE to accelerate rate hikes. A strong labor market means that the economy should be able to withstand higher rate increases – the BoE has been ultra-cautious, raising rates a mere 0.25% five consecutive times. Clearly, that extent of rate tightening won’t be enough to make a dent in inflation, which is approaching 10%. BoE Governor Bailey hinted in a speech yesterday that a 0.50% salvo was on the table at the August meeting.

The BoE has essentially thrown in the towel in the fight against inflation, hoping that the elusive inflation peak will appear sometime later this year. The Bank expects inflation to hit 11% before easing lower. Wage growth declined sharply in the three months to May to 6.2%, down from 6.8%. With inflation rising and wage growth falling, consumers are getting hammered and the risk of a recession is high. Still, as far as the BoE is concerned, inflation remains enemy number one, and a recession is a price the central bank is willing to pay in order to reel in runaway inflation. The BoE has weathered a lot of criticism over its handling of inflation, and a 0.50% increase at the August meeting would help restore some credibility and show that the Bank is determined to stamp out inflation.

.

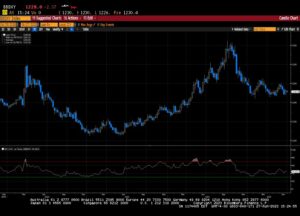

GBP/USD Technical

- GBP/USD continues to test resistance at 1.2018. Above, there is resistance at 1.2167

- There is support at 1.1889 and 1.1740

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

- Bitcoin

- blockchain

- blockchain compliance

- blockchain conference

- BoE Governor Bailey

- BoE rate meeting

- Central Banks

- coinbase

- coingenius

- Consensus

- crypto conference

- crypto mining

- cryptocurrency

- decentralized

- DeFi

- Digital Assets

- ethereum

- FX

- GBP/USD

- machine learning

- MarketPulse

- News events

- Newsfeed

- non fungible token

- plato

- plato ai

- Plato Data Intelligence

- Platoblockchain

- PlatoData

- platogaming

- Polygon

- proof of stake

- Technical Analysis

- TradingView

- UK inflation UK wage growth

- W3

- zephyrnet