Financial Risk Analytics, Credit & Risk Solutions, Market Intelligence, S&P Global, 25 Ropemaker St, London, EC2Y 9LY, UK

Find this paper interesting or want to discuss? Scite or leave a comment on SciRate.

Abstract

Monte Carlo (MC) simulations are widely used in financial risk management, from estimating value-at-risk (VaR) to pricing over-the-counter derivatives. However, they come at a significant computational cost due to the number of scenarios required for convergence. If a probability distribution is available, Quantum Amplitude Estimation (QAE) algorithms can provide a quadratic speed-up in measuring its properties as compared to their classical counterparts. Recent studies have explored the calculation of common risk measures and the optimisation of QAE algorithms by initialising the input quantum states with pre-computed probability distributions. If such distributions are not available in closed form, however, they need to be generated numerically, and the associated computational cost may limit the quantum advantage. In this paper, we bypass this challenge by incorporating scenario generation – i.e. simulation of the risk factor evolution over time to generate probability distributions – into the quantum computation; we refer to this process as Quantum MC (QMC) simulations. Specifically, we assemble quantum circuits that implement stochastic models for equity (geometric Brownian motion), interest rate (mean-reversion models), and credit (structural, reduced-form, and rating migration credit models) risk factors. We then integrate these models with QAE to provide end-to-end examples for both market and credit risk use cases.

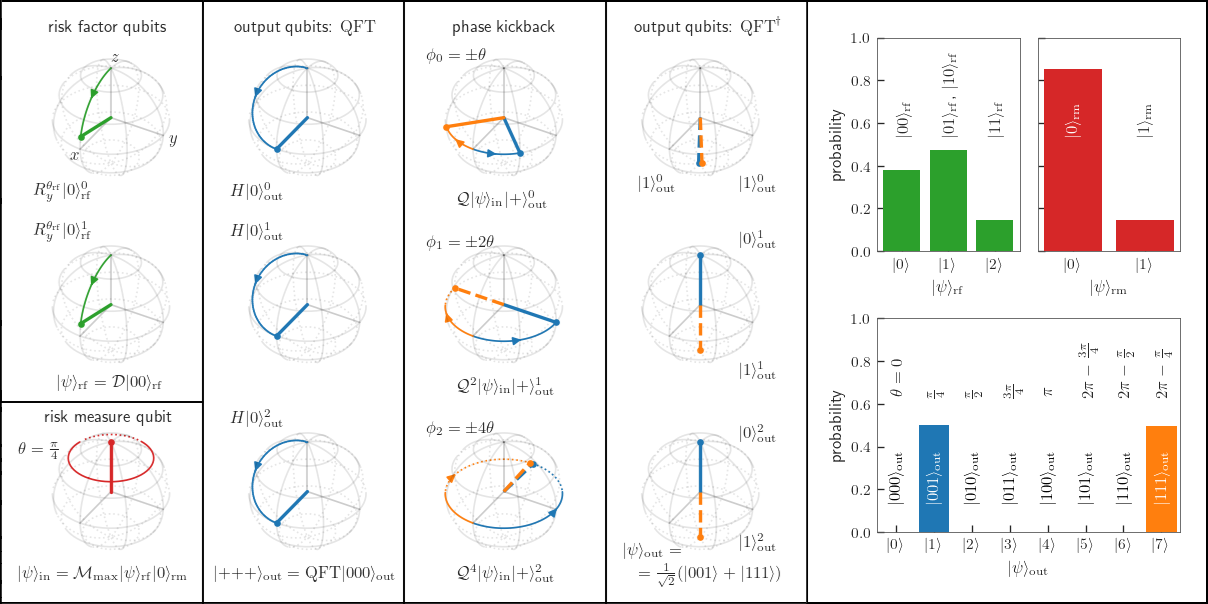

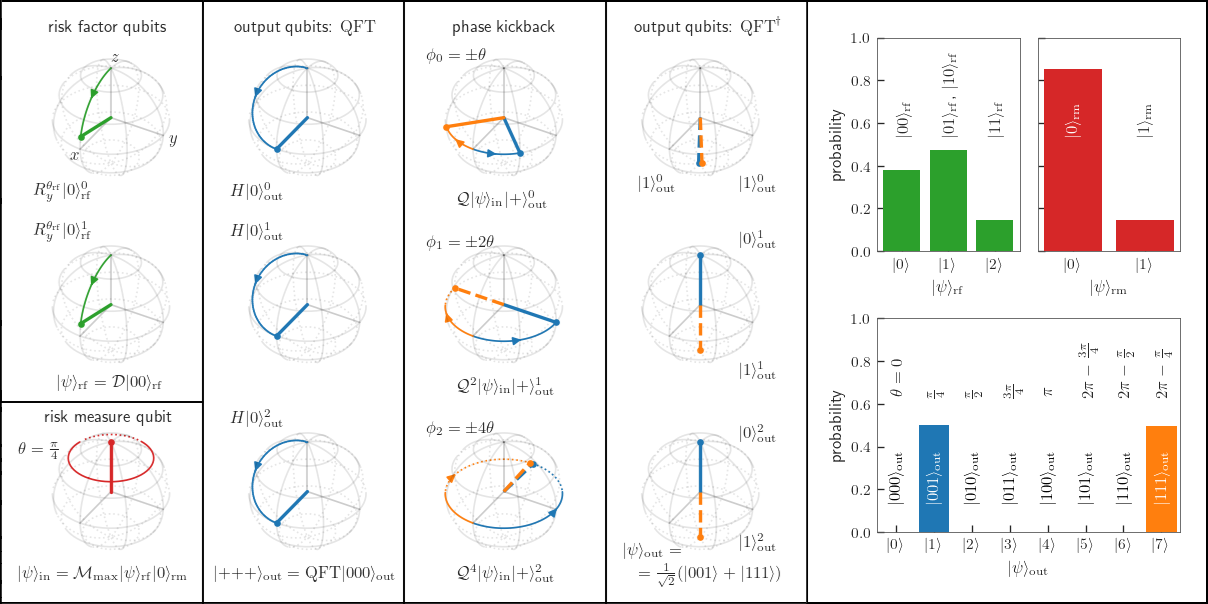

Featured image: Quantum states of a 6-qubit circuit that implements a Quantum Monte Carlo simulation for a stochastic 2-period equity model together with Quantum Amplitude Estimation to measure the probability of the equity price to go up twice. With the help of rotation gates, each of the two risk factor qubits (green) encode the probability of the equity price to go up at the first and second periods, respectively. Taken together, the two qubits represent the probability (green bar chart) of the equity price to be down (left bar), remain unchanged (middle), or be up (right) at the end of the second period. The risk measure qubit state (red) is prepared with a Toffoli gate that encodes the probability (red bar chart) of two upward price moves (right bar) in the angle $theta$. The 3 output qubits (blue/orange with superscripts 0, 1, and 2) go through a Quantum Fourier Transform gate (second column), a phase kickback process to imprint a multiple of $theta$ onto their phases $phi$ (third column), and an Inverse Quantum Fourier Transform gate (fourth column) that leverages quantum interference allowing to directly read off the value of $theta$, see blue/orange bar chart.

Popular summary

► BibTeX data

► References

[1] Román Orús, Samuel Mugel, and Enrique Lizaso. “Quantum computing for finance: Overview and prospects”. Reviews in Physics 4, 100028 (2019).

https://doi.org/10.1016/j.revip.2019.100028

[2] Daniel J. Egger, Claudio Gambella, Jakub Marecek, Scott McFaddin, Martin Mevissen, Rudy Raymond, Andrea Simonetto, Stefan Woerner, and Elena Yndurain. “Quantum computing for finance: State-of-the-art and future prospects”. IEEE Transactions on Quantum Engineering 1, 1–24 (2020).

https://doi.org/10.1109/tqe.2020.3030314

[3] Andrés Gómez, Alvaro Leitao Rodriguez, Alberto Manzano, Maria Nogueiras, Gustavo Ordóñez, and Carlos Vázquez. “A survey on quantum computational finance for derivatives pricing and var”. Archives of Computational Methods in Engineering 29, 4137–4163 (2022).

https://doi.org/10.1007/s11831-022-09732-9

[4] Dylan Herman, Cody Googin, Xiaoyuan Liu, Alexey Galda, Ilya Safro, Yue Sun, Marco Pistoia, and Yuri Alexeev. “A Survey of Quantum Computing for Finance” (2022). arXiv:2201.02773.

arXiv:2201.02773

[5] Sascha Wilkens and Joe Moorhouse. “Quantum computing for financial risk measurement”. Quantum Information Processing 22 (2023).

https://doi.org/10.1007/s11128-022-03777-2

[6] Philip Intallura, Georgios Korpas, Sudeepto Chakraborty, Vyacheslav Kungurtsev, and Jakub Marecek. “A Survey of Quantum Alternatives to Randomized Algorithms: Monte Carlo Integration and Beyond” (2023). arXiv:2303.04945.

arXiv:2303.04945

[7] Alexander M. Dalzell, Sam McArdle, Mario Berta, Przemyslaw Bienias, Chi-Fang Chen, András Gilyén, Connor T. Hann, Michael J. Kastoryano, Emil T. Khabiboulline, Aleksander Kubica, Grant Salton, Samson Wang, and Fernando G. S. L. Brandão. “Quantum algorithms: A survey of applications and end-to-end complexities” (2023). arXiv:2310.03011.

arXiv:2310.03011

[8] Stefan Woerner and Daniel J. Egger. “Quantum risk analysis”. npj Quantum Information 5, 15 (2019).

https://doi.org/10.1038/s41534-019-0130-6

[9] D. J. Egger, R. Garcia Gutierrez, J. Cahue Mestre, and S. Woerner. “Credit risk analysis using quantum computers”. IEEE Transactions on ComputersPages 1–1 (5555).

https://doi.org/10.1109/TC.2020.3038063

[10] Kazuya Kaneko, Koichi Miyamoto, Naoyuki Takeda, and Kazuyoshi Yoshino. “Quantum speedup of Monte Carlo integration with respect to the number of dimensions and its application to finance”. Quantum Information Processing 20, 185 (2021).

https://doi.org/10.1007/s11128-021-03127-8

[11] Patrick Rebentrost, Brajesh Gupt, and Thomas R. Bromley. “Quantum computational finance: Monte carlo pricing of financial derivatives”. Phys. Rev. A 98, 022321 (2018).

https://doi.org/10.1103/PhysRevA.98.022321

[12] Nikitas Stamatopoulos, Daniel J. Egger, Yue Sun, Christa Zoufal, Raban Iten, Ning Shen, and Stefan Woerner. “Option Pricing using Quantum Computers”. Quantum 4, 291 (2020).

https://doi.org/10.22331/q-2020-07-06-291

[13] Almudena Carrera Vazquez and Stefan Woerner. “Efficient state preparation for quantum amplitude estimation”. Phys. Rev. Appl. 15, 034027 (2021).

https://doi.org/10.1103/PhysRevApplied.15.034027

[14] Shouvanik Chakrabarti, Rajiv Krishnakumar, Guglielmo Mazzola, Nikitas Stamatopoulos, Stefan Woerner, and William J. Zeng. “A Threshold for Quantum Advantage in Derivative Pricing”. Quantum 5, 463 (2021).

https://doi.org/10.22331/q-2021-06-01-463

[15] João F. Doriguello, Alessandro Luongo, Jinge Bao, Patrick Rebentrost, and Miklos Santha. “Quantum algorithm for stochastic optimal stopping problems with applications in finance” (2021). arXiv:2111.15332.

https://doi.org/10.4230/LIPIcs.TQC.2022.2

arXiv:2111.15332

[16] Hao Tang, Anurag Pal, Lu-Feng Qiao, Tian-Yu Wang, Jun Gao, and Xian-Min Jin. “Quantum Computation for Pricing the Collateralized Debt Obligations” (2020). arXiv:2008.04110.

arXiv:2008.04110

[17] Javier Alcazar, Andrea Cadarso, Amara Katabarwa, Marta Mauri, Borja Peropadre, Guoming Wang, and Yudong Cao. “Quantum algorithm for credit valuation adjustments”. New Journal of Physics 24, 023036 (2022).

https://doi.org/10.1088/1367-2630/ac5003

[18] Jeong Yu Han and Patrick Rebentrost. “Quantum advantage for multi-option portfolio pricing and valuation adjustments” (2022). arXiv:2203.04924.

arXiv:2203.04924

[19] Nikitas Stamatopoulos, Guglielmo Mazzola, Stefan Woerner, and William J. Zeng. “Towards Quantum Advantage in Financial Market Risk using Quantum Gradient Algorithms”. Quantum 6, 770 (2022).

https://doi.org/10.22331/q-2022-07-20-770

[20] John Preskill. “Quantum Computing in the NISQ era and beyond”. Quantum 2, 79 (2018).

https://doi.org/10.22331/q-2018-08-06-79

[21] Gilles Brassard, Peter Høyer, Michele Mosca, and Alain Tapp. “Quantum amplitude amplification and estimation”. Quantum Computation and InformationPages 53–74 (2002).

https://doi.org/10.1090/conm/305/05215

[22] Lov Grover and Terry Rudolph. “Creating superpositions that correspond to efficiently integrable probability distributions” (2002). arXiv:quant-ph/0208112.

arXiv:quant-ph/0208112

[23] Steven Herbert. “No quantum speedup with grover-rudolph state preparation for quantum monte carlo integration”. Phys. Rev. E 103, 063302 (2021).

https://doi.org/10.1103/PhysRevE.103.063302

[24] Christa Zoufal, Aurélien Lucchi, and Stefan Woerner. “Quantum generative adversarial networks for learning and loading random distributions”. npj Quantum Information 1, 103 (2019).

https://doi.org/10.1038/s41534-019-0223-2

[25] Junxu Li and Sabre Kais. “A universal quantum circuit design for periodical functions”. New Journal of Physics 23, 103022 (2021).

https://doi.org/10.1088/1367-2630/ac2cb4

[26] Nikitas Stamatopoulos and William J. Zeng. “Derivative Pricing using Quantum Signal Processing” (2023). arXiv:2307.14310.

arXiv:2307.14310

[27] Sam McArdle, András Gilyén, and Mario Berta. “Quantum state preparation without coherent arithmetic” (2022). arXiv:2210.14892.

arXiv:2210.14892

[28] Ashley Montanaro. “Quantum speedup of monte carlo methods”. Proceedings of the Royal Society A: Mathematical, Physical and Engineering Sciences 471, 20150301 (2015).

https://doi.org/10.1098/rspa.2015.0301

[29] Michael B. Giles. “Multilevel monte carlo methods”. Acta Numerica 24, 259–328 (2015).

https://doi.org/10.1017/S096249291500001X

[30] Dong An, Noah Linden, Jin-Peng Liu, Ashley Montanaro, Changpeng Shao, and Jiasu Wang. “Quantum-accelerated multilevel Monte Carlo methods for stochastic differential equations in mathematical finance”. Quantum 5, 481 (2021).

https://doi.org/10.22331/q-2021-06-24-481

[31] John C. Hull. “Options, futures, and other derivatives”. Pearson. (2021). 11th ed., pearson global ed. edition.

[32] Lov K. Grover. “A fast quantum mechanical algorithm for database search”. In Gary L. Miller, editor, Proceedings of the Twenty-Eighth Annual ACM Symposium on the Theory of Computing, Philadelphia, Pennsylvania, USA, May 22-24, 1996. Pages 212–219. ACM (1996).

https://doi.org/10.1145/237814.237866

[33] Yohichi Suzuki, Shumpei Uno, Rudy Raymond, Tomoki Tanaka, Tamiya Onodera, and Naoki Yamamoto. “Amplitude estimation without phase estimation”. Quantum Information Processing 19 (2020).

https://doi.org/10.1007/s11128-019-2565-2

[34] Dmitry Grinko, Julien Gacon, Christa Zoufal, and Stefan Woerner. “Iterative quantum amplitude estimation”. npj Quantum Information 7 (2021).

https://doi.org/10.1038/s41534-021-00379-1

[35] Kirill Plekhanov, Matthias Rosenkranz, Mattia Fiorentini, and Michael Lubasch. “Variational quantum amplitude estimation”. Quantum 6, 670 (2022).

https://doi.org/10.22331/q-2022-03-17-670

[36] John C. Cox, Stephen A. Ross, and Mark Rubinstein. “Option pricing: A simplified approach”. Journal of Financial Economics 7, 229–263 (1979).

https://doi.org/10.1016/0304-405X(79)90015-1

[37] Vlatko Vedral, Adriano Barenco, and Artur Ekert. “Quantum networks for elementary arithmetic operations”. Phys. Rev. A 54, 147–153 (1996).

https://doi.org/10.1103/PhysRevA.54.147

[38] David Oliveira and Rubens Ramos. “Quantum bit string comparator: Circuits and applications”. Quantum Computers and Computing 7 (2007).

[39] Various authors. “Qiskit textbook”. Github. (2023). url: github.com/Qiskit/textbook.

http://github.com/Qiskit/textbook

[40] Oldrich Vasicek. “An equilibrium characterization of the term structure”. Journal of Financial Economics 5, 177–188 (1977).

https://doi.org/10.1016/0304-405X(77)90016-2

[41] Robert C. Merton. “On the pricing of corporate debt: the risk structure of interest rates”. The Journal of Finance 29, 449–470 (1974).

https://doi.org/10.1111/j.1540-6261.1974.tb03058.x

[42] “Qiskit: An open-source framework for quantum computing” (2021).

[43] John C Hull and Alan D White. “Numerical procedures for implementing term structure models i”. The Journal of Derivatives 2, 7–16 (1994).

https://doi.org/10.3905/jod.1994.407902

Cited by

[1] Javier Gonzalez-Conde, Ángel Rodríguez-Rozas, Enrique Solano, and Mikel Sanz, “Efficient Hamiltonian simulation for solving option price dynamics”, Physical Review Research 5 4, 043220 (2023).

The above citations are from SAO/NASA ADS (last updated successfully 2024-04-05 11:16:46). The list may be incomplete as not all publishers provide suitable and complete citation data.

On Crossref’s cited-by service no data on citing works was found (last attempt 2024-04-05 11:16:44).

This Paper is published in Quantum under the Creative Commons Attribution 4.0 International (CC BY 4.0) license. Copyright remains with the original copyright holders such as the authors or their institutions.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://quantum-journal.org/papers/q-2024-04-04-1306/

- :is

- :not

- ][p

- $UP

- 1

- 10

- 11

- 11th

- 12

- 13

- 14

- 15%

- 16

- 17

- 19

- 1994

- 1996

- 20

- 2008

- 2015

- 2018

- 2019

- 2020

- 2021

- 2022

- 2023

- 22

- 23

- 24

- 25

- 26%

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 35%

- 36

- 39

- 40

- 41

- 43

- 54

- 7

- 77

- 8

- 9

- 98

- a

- above

- ABSTRACT

- access

- ACM

- adjustments

- ADvantage

- adversarial

- affiliations

- Alan

- Alexander

- algorithm

- algorithms

- All

- Allowing

- alternatives

- Amplification

- an

- analysis

- analytics

- and

- angle

- annual

- Application

- applications

- approach

- apr

- archives

- ARE

- AS

- associated

- At

- attempt

- author

- authors

- available

- bar

- BE

- Beyond

- Bit

- both

- Break

- but

- by

- bypass

- calculation

- CAN

- cao

- carlos

- cases

- challenge

- Changpeng

- Chart

- chen

- classes

- closed

- COHERENT

- collateralized

- Column

- come

- comment

- Common

- Commons

- compared

- complete

- complexities

- computation

- computational

- computers

- computing

- Convergence

- copyright

- Corporate

- Cost

- counterparts

- Cox

- credit

- Daniel

- data

- Database

- David

- Debt

- derivative

- Derivatives

- Design

- dimensions

- directly

- discuss

- distribution

- distributions

- dong

- down

- due

- dynamics

- e

- each

- Economics

- ed

- edition

- editor

- efficient

- efficiently

- emil

- end

- end-to-end

- Engineering

- equations

- Equilibrium

- equity

- Era

- evolution

- examples

- Explored

- factor

- factors

- FAST

- finance

- financial

- Financial Derivatives

- Financial Market

- First

- For

- form

- found

- Fourth

- Framework

- from

- functions

- future

- Futures

- GAO

- Gary

- gate

- Gates

- generate

- generated

- generation

- generative

- Gilles

- GitHub

- Global

- Go

- grant

- Green

- Grover

- harvard

- Have

- help

- holders

- However

- http

- HTTPS

- i

- IEEE

- if

- image

- implement

- implementing

- implements

- in

- incorporating

- information

- input

- institutions

- integrate

- integration

- Intelligence

- interest

- INTEREST RATE

- Interest Rates

- interesting

- Interference

- International

- into

- inverse

- ITS

- JavaScript

- JOE

- John

- journal

- Last

- learning

- Leave

- left

- leverages

- Li

- License

- LIMIT

- List

- loading

- London

- management

- Marco

- maria

- mario

- mark

- Market

- Martin

- mathematical

- max-width

- May..

- mc

- measure

- measurement

- measures

- measuring

- mechanical

- methods

- Michael

- Middle

- migration

- Miller

- model

- models

- Month

- motion

- moves

- multiple

- Need

- networks

- New

- no

- Noah

- number

- obligations

- of

- off

- on

- onto

- open

- open source

- Operations

- optimal

- Option

- or

- original

- Other

- output

- over

- over-the-counter

- overview

- pages

- Paper

- particular

- patrick

- pearson

- Pennsylvania

- period

- periods

- Peter

- phase

- phases

- Philadelphia

- physical

- Physics

- plato

- Plato Data Intelligence

- PlatoData

- portfolio

- preparation

- prepared

- previous

- price

- pricing

- problems

- procedures

- Proceedings

- process

- processing

- properties

- prospects

- provide

- published

- publisher

- publishers

- qiskit

- quadratic

- Quantum

- quantum advantage

- quantum algorithms

- quantum computers

- quantum computing

- quantum information

- Qubit

- qubits

- R

- random

- Randomized

- Rate

- Rates

- rating

- Read

- recent

- Red

- refer

- references

- remain

- remains

- represent

- required

- research

- respect

- respectively

- review

- Reviews

- right

- Risk

- Risk Factor

- risk factors

- risk management

- ROBERT

- royal

- s

- S&P

- S&P Global

- Sam

- scenario

- scenarios

- SCIENCES

- scott

- Search

- Second

- see

- shown

- Signal

- significant

- simplified

- simulation

- simulations

- Society

- Solutions

- Solving

- specifically

- Starting

- State

- state-of-the-art

- States

- stefan

- Stephen

- steven

- stopping

- String

- structural

- structure

- studies

- Successfully

- such

- suitable

- Sun

- Survey

- Symposium

- taken

- tang

- term

- textbook

- that

- The

- their

- Them

- then

- theory

- These

- they

- Third

- this

- thomas

- threshold

- Through

- time

- Title

- to

- together

- Transactions

- Transform

- Twice

- two

- unchanged

- under

- Universal

- UNO

- updated

- upward

- URL

- USA

- use

- used

- using

- Valuation

- value

- various

- volume

- wang

- want

- was

- we

- when

- white

- widely

- william

- with

- within

- without

- works

- X

- year

- zephyrnet