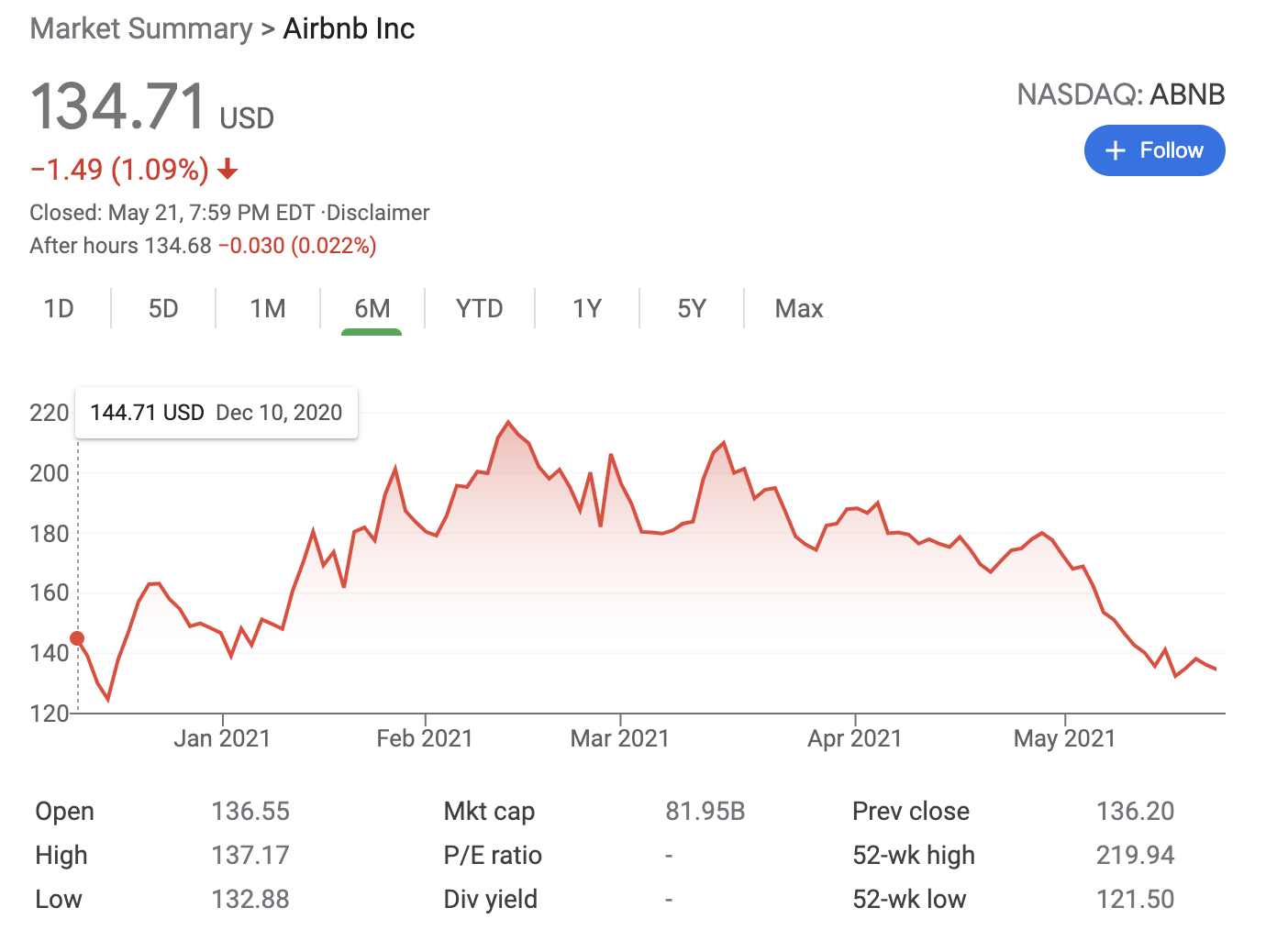

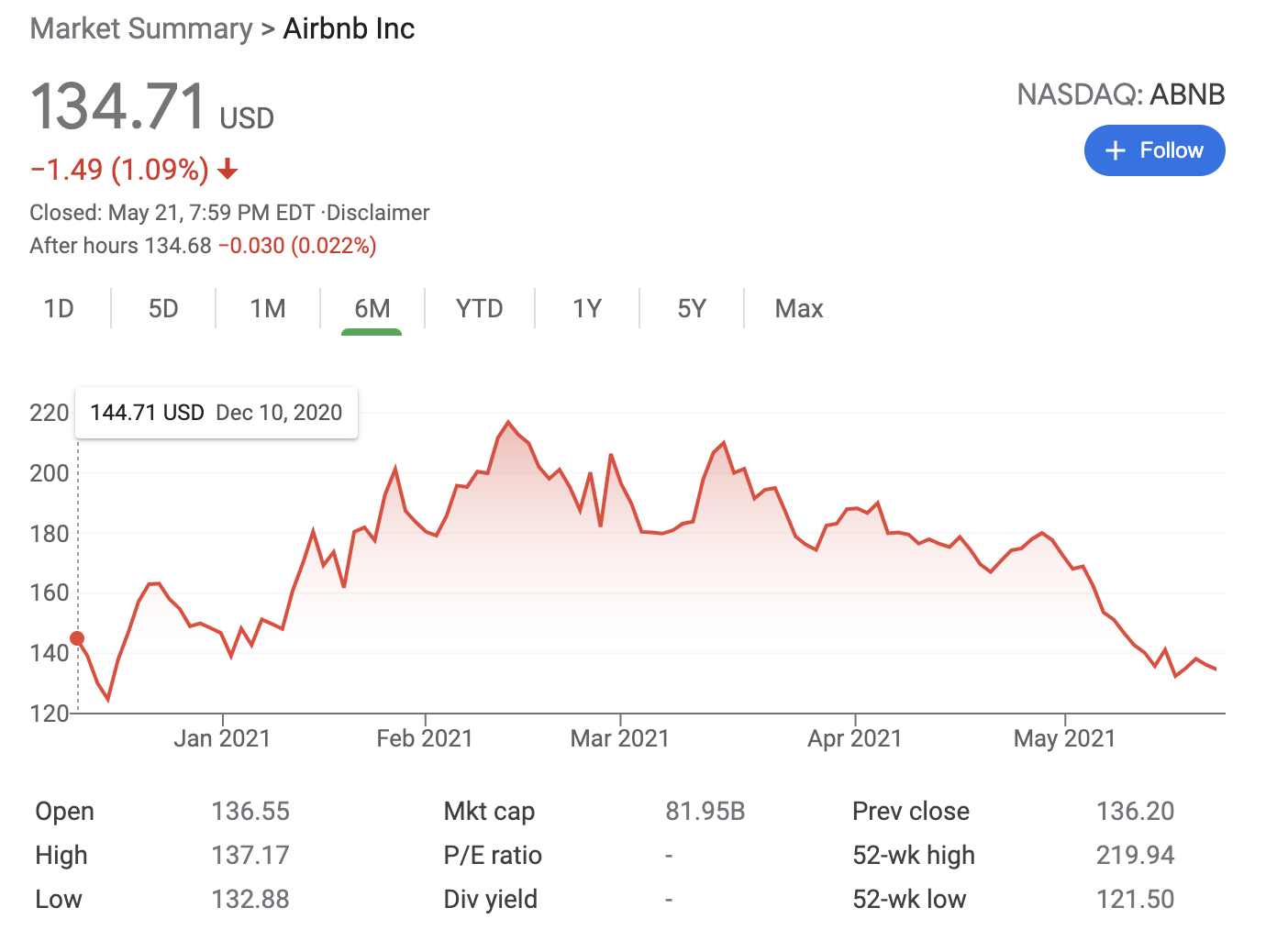

The company set its IPO price at $68 and almost immediately after its IPO debut, the shares of the company soared by 120% to over $150, which took its valuation to over $100 billion.

The company’s stock price rose to over $200 in mid-February, however, challenges in the industry because of the current pandemic, caused it descend significantly.

Airbnb was a great stock to invest in its IPO because the tourism industry is bound to grow significantly and vastly recover when the world recovers from the pandemic within the next year. Also, the company has a great team, increasing revenue sources, and a great reputation.

Coinbase’s IPO was a big success for the initial traders. The cryptocurrency-exchange stock opened 52% above its reference price of $250. And Coinbase’s public debut became the seventh-biggest U.S. IPO ever, based on market cap at the close of the first day of trading.

Because of the volatility and descend in the crypto market in the last month, Coinbase seems to have lost some momentum and the current price is at $224, however, it should recover as more and more people and institutions invest in cryptocurrency.

Affirm, as a company, brought with it a great concept: the ability to pay in parts if the customer is credible. Its IPO price was set at $49 and only on its first day, the stock gained almost 100% value and closed the first day at $97.24.

Even though the peak price reached $134, currently, the price is at $52. However, since the fundamentals of the company are really good and the market size immense, we have reason to believe that the stock will bounce back in the coming months to its high levels.

There are basically hundreds of terms that you can learn about an IPO specifically, which you can see here.

However, there are a few terms that create the key difference.

A lock-up period is a window of time when investors are not allowed to redeem or sell shares of a particular investment.

Lock periods help show that company leadership remains intact and that the business model remains on solid footing. It also allows the IPO issuer to retain more cash for continuing growth.

The general deadline for selling shares is 30 to 90 days. If you are not sure about the fundamentals of the company and if you haven’t done due diligence, then, it’s best to wait until the lock-up period is over before investing.

Quiet period is the duration that insiders keep the internal information and analysis confidential so that everyone has an equal chance.

If you aren’t already well informed about the company, then, it’s best if you study the key information before you invest in its IPO.

There may be hundreds of criteria in the checklist, which you can see here.

However, I believe the below would give you a rough idea about the possible success of the IPO:

- Market size

- Company’s market share

- Company’s annual growth

- Company revenue and net profit

- Technology (patent, etc.) it owns

- Company reputation and popularity

- Founders and the team

- Future revenue stream and growth model

You may use the above and add your own criteria to come to a conclusion.

If you are new to investing, it’s best to invest a little at a time checking your results and mistakes while checking results. Then, as in everything else, it makes sense that you would know how to predict the future of the company and its stock value.

Are you going to invest in the RobinHood IPO? Share your comments so that we start a conversation..

- access

- analysis

- BEST

- Billion

- business

- business model

- Cash

- caused

- checking

- closed

- coinbase

- coming

- comments

- company

- Conversation

- crypto

- Crypto Market

- cryptocurrency

- Current

- day

- EU

- First

- Fundamentals

- future

- General

- good

- great

- Grow

- Growth

- here

- High

- How

- How To

- hr

- HTTPS

- Hundreds

- ia

- idea

- industry

- information

- institutions

- investing

- investment

- Investors

- IP

- IPO

- IT

- Key

- Leadership

- LEARN

- LG

- Market

- Market Cap

- medium

- model

- Momentum

- months

- net

- pandemic

- patent

- Pay

- People

- price

- public

- Recover

- Results

- revenue

- Robinhood

- sell

- sense

- set

- Share

- Shares

- Size

- So

- start

- stock

- stock market

- Study

- success

- time

- Tourism

- Traders

- Trading

- u.s.

- Valuation

- value

- Volatility

- wait

- within

- world

- year