1. Market Movements

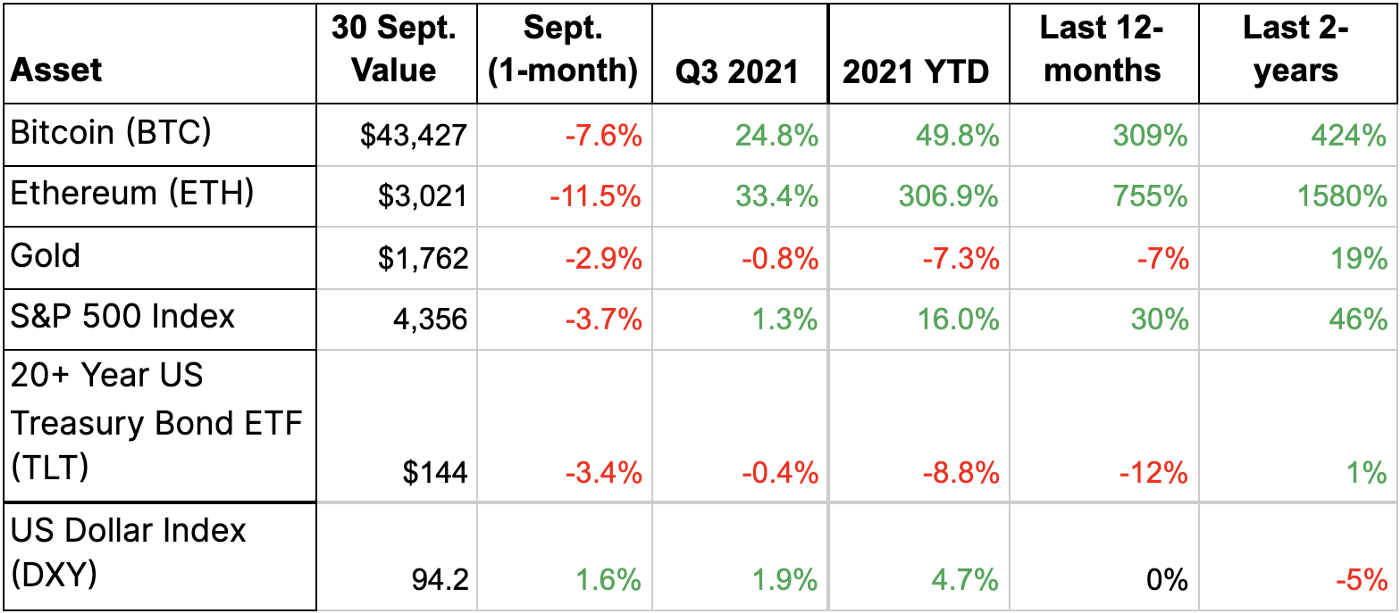

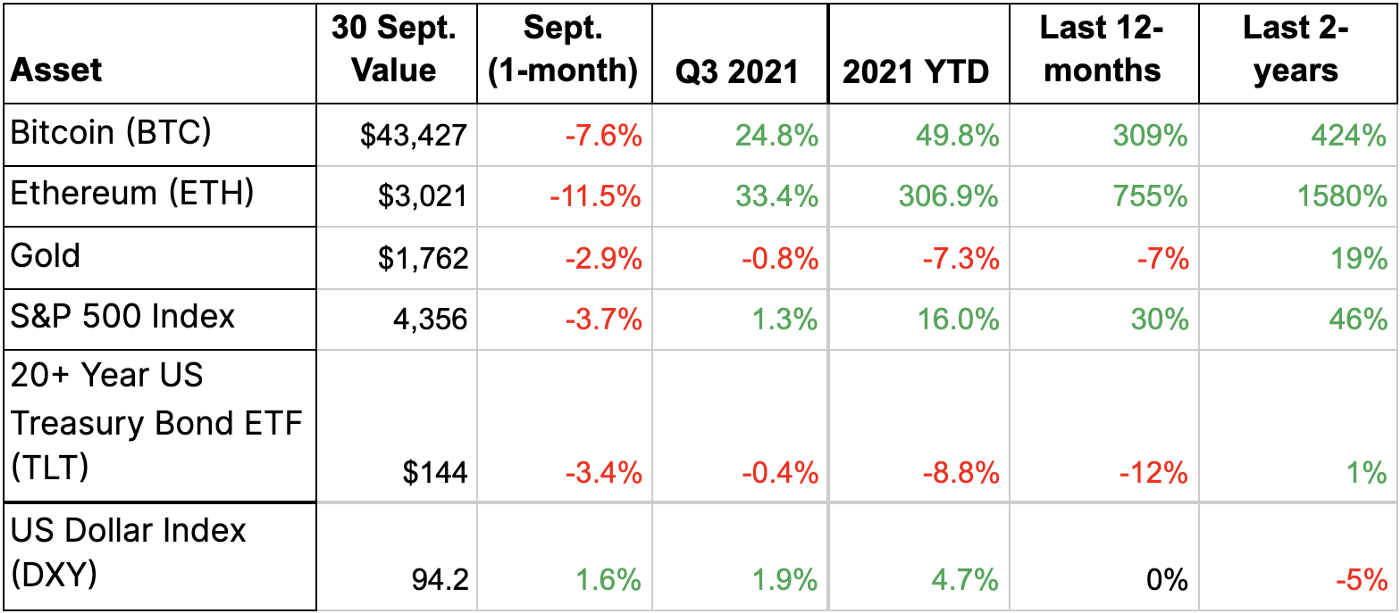

For the third quarter cryptoasset markets outperformed and showed remarkable resilience. Despite crypto running a challenging regulatory gauntlet in markets like China and the US, Bitcoin (BTC) and Ethereum (ETH) were up 25% and 33% in Q3, respectively (Table 1).

Table 1: Price Performance: Bitcoin, Ethereum, Gold, US Equities, USD, Long-dated US Treasuries

Sources: Blockchain.com, Google Finance

However, for the month of September crypto prices dropped alongside declines in equities and many other traditional asset classes.

As we discuss in our market framework below, continued uncertainty around regulation, the impact of Federal Reserve tightening, and when new adoption catalysts may arrive cloud the Q4 picture for crypto.

2. Our Market Framework

We are watching a host of factors that appear likely to influence crypto market pricing over the coming months.

At a high level, the single most important theme we see is the interplay between the growing institutional interest in the crypto space and the increasing regulatory headwinds facing the market.

While it may seem contradictory and ill-advised for The Street to be allocating capital to the industry in the face of increasingly aggressive official sector pushback, we believe both these trends stem from the same root cause, namely that the disruptive potential of the technology has become apparent and too important for anyone to ignore.

While we anticipate more volatility as crypto participants and the authorities work out new regulatory frameworks, we view this tension as part of a necessary process of maturation that will ultimately generate long-term integrity for the asset class.

The level of activity through our client franchise suggests that there remains a considerable backlog of interest in the space, with substantial additional inquiry and new allocation flows yet to come.

In line with this theme, the recent uptrend in alternative Layer 1 (L1) networks (i.e., blockchain networks beyond Bitcoin (BTC) and Ethereum (ETH), such as Algorand (ALGO), Solana (SOL), etc.) appears to us as yet another validating datapoint around institutional inflows. Given that it is still early days in crypto, the “alt L1 trade” appears to be a case of allocators attempting to back a broad basket of all credible horses in the race. This is a sound strategy for crossover investors that lack the bandwidth to pick favored single assets.

Against this core dynamic, technological developments within the ecosystem are accelerating. Given the recent easy availability of venture and growth equity capital for crypto projects and infrastructure (eg bitcoin mining), we see no reduction in this trend for the foreseeable future. In particular, we are watching the growth of Layer 2 scaling solutions for BTC (eg Stacks (STX)) and ETH (eg Polygon (MATIC)) as a potential theme to capture the market’s attention over the coming months. As one product manager here at Blockchain.com recently put it to us, “Things actually work now. We can build features and apps that we couldn’t do even three months ago… It’s great to feel young in crypto again!”

Put differently, new technical capabilities should form a powerful tailwind for activity and innovation. We see a material possibility that this theme sets off a bull run into the close of 2021, led by ETH, or possibly even BTC itself depending on whether the recent explosive growth on the Lightning network persists through the coming weeks. A rally led by BTC would certainly be a surprise to the market given recent attention on NFTs, DeFi, and other smart contracting use cases. To us, however, it seems quite possible given the recent on-chain accumulation of the float into strong hands and the declining exchange balances we are observing. Note also that with BTC trading at a key support area around $42k USD, and BTC market cap dominance at historical lows of ~40%, the technical setup may be poised for a reversal higher into year end.

Lesser themes we see that also bear close observation:

- Entry into crypto of more sophisticated arbitrage traders. It’s clear now that volatility arbitrage, basis trading, and other relative value strategies in crypto appear very attractive vs comparative returns on offer in traditional markets. These strategies are continuing to attract new entrants and should serve to lower the cost of capital for the ecosystem as a whole while also reducing trading volatility. Conversely, if we were to observe unreasonably attractive pricing in the well known opportunities such as futures basis, that would be a strong indicator that the institutional inflows have either reversed or been undermined by some other extraordinary market dynamic.

- Correlation with traditional markets. We expect to see the recent increase in correlation between crypto and equities persist. This is a natural consequence of the increasing cross allocations by investors with co-mingled risks in both buckets.

- Pipeline of Bitcoin ETF applications up for decisions in October and November. Some of them are purely futures based, which could increase their likelihood of approval. At this point we doubt it will have much fundamental impact on inflows, but the market may still appreciate the headline. Moreover, if a futures backed ETF is approved and gains market inflows, then we may see an impact on the cash/futures basis to wider rates once again, thereby creating additional incentive for yield seeking crossover investors to accelerate their pace of onboarding into the crypto market.

- US rates markets and monetary policy outlook. The recent taper announcement has had a dramatic impact on the rates curve, fuelling a bear steepener. While the technical drivers of the rates selloff seem straightforward (taper is the opposite of yield curve control), the underlying economic signal in the price action seems less clear. If we have finally arrived at the end of the easing cycle, with core economic strength that justifies policy tightening, then real yields should continue to increase. Increasing real yields could fuel a rotation out of tech assets into cyclicals, and would likely pose an initial drag on the crypto market. That said, given growth risks arising from global energy and supply chain issues and the onshore Chinese real estate slowdown, a reversal of the recent hawkish Fed pivot strikes us as a potential upside catalyst for crypto pricing as well.

- China crypto crackdown. Continued enforcement against crypto by the Chinese authorities may still cause some market disruption. However, it appears as though there is now significantly less remaining crypto involvement by Chinese domestic citizens, thereby lessening the effects of any future further crackdowns.

- Near-term US dollar strength. This appears increasingly likely over the next few months based on rate differentials and a huge reduction in YoY global liquidity. Forward looking macroeconomic indicators all point to a rapid slowdown in global growth, originating in China. These factors are all supportive of a bullish USD view, and the DXY is currently attempting a major price breakout on the charts, which points to a 5–10% increase in the near future if successful. This is not necessarily bearish for crypto specifically, but dollar strength has a tendency to cause overall market volatility (sometimes in both directions) and could hold back pricing across all asset classes.

3. On-Chain Analysis

Each month we dive into on-chain data to explore interesting trends or movements on the Bitcoin network.

On a monthly basis, overall bitcoin on-chain activity increased in the month of September (Table 2).

Table 2: September vs August bitcoin network activity

On a quarterly basis, bitcoin’s market cap increased by 22.5%. Despite that, we’ve seen a slowdown in on-chain activity over the quarter with our average daily payments down by 14.7%. We have however, seen an increase of 6.3% in Blockchain.com payments overall (Figure 1).

Figure 1: Bitcoin payments utilizing Blockchain.com wallets and platform vs. bitcoin payments made via non-Blockchain.com wallets and platforms

As a result of reduced on-chain activity, average transaction fees have fallen from $17.50/transaction to $3.01/transaction — a dramatic 82% drop. Towards the end of Q2, we (Blockchain.com) implemented the Segregated Witness (SegWit) scalability upgrade, an eagerly awaited advance. This rollout resulted in an 80% SegWit adoption by the end of Q3 which benefited users by reducing fees.

The large drop in the size of the “Mempool”, which can be thought of as a “holding tank” for unconfirmed bitcoin transactions, also illustrates the significant reduction in bitcoin network activity. Historically, periods of lower relative bitcoin network activity have proven attractive entry points for medium to longer-term bitcoin accumulation by investors.

Figure 2: The size of the bitcoin mempool (a “holding tank” for unspent bitcoin transactions) remains low despite the Q3 rebound in bitcoin’s price

4. Regulatory Overview

In the United States, cryptocurrency has benefitted from a generally accepting regulatory regime over the last decade. Decentralized cryptocurrencies have been neatly folded into the existing licensing regime for money transmitter licenses.

Western law enforcement appears to have grown more comfortable with the level of visibility into major cryptocurrency networks. In a recent discussion of sanctions related to ransomware, the Treasury Department was clear that it knows much established cryptocurrency activity is legitimate but is nonetheless placing extra focus on “a subset of smaller nascent exchanges”, which it believes are disproportionately responsible for criminal activity.

Developments in the application of United States securities laws to cryptoassets are not as clear cut. The SEC has made it plain that it believes some cryptoassets are securities and under the ambit of the SEC. Chairman Gensler has made a number of statements that indicate a fuller application of United States securities laws to crypto assets markets if his views on the nature of such assets persuade lawmakers.

In addition, the SEC, the Treasury Department and various state regulators have begun inquiries into cryptocurrency interest programs. If the SEC makes its case successfully, there could be a shock to liquidity in the market and perhaps a shift to more Decentralized Finance lending programs.

Finally, on the subject of DeFi, the SEC has also indicated interest in pursuing the operators of decentralized exchanges, most of which have no permissions on what is listed and therefore almost certainly do trade securities. These present a tricky problem for regulators as most decentralized exchange smart contracts would continue to exist and operate under all but the most extreme circumstances. We are watching closely to see how any such regulation might end up being calibrated.

5. What we’re reading, hearing, and watching

Crypto

Beyond Crypto

Important note

The research provided herein is for your general information and use and is not intended to address your particular requirements.

In particular, the information does not constitute any form of advice or recommendation by Blockchain.com and is not intended to be relied upon by users in making (or refraining from making) any investment decisions.

Appropriate independent advice should be obtained before making any such decision.

- Action

- Additional

- Adoption

- advice

- ALGO

- Algorand

- All

- allocation

- Announcement

- Application

- applications

- apps

- arbitrage

- AREA

- around

- asset

- Assets

- AUGUST

- availability

- bearish

- Bitcoin

- Bitcoin ETF

- Bitcoin mining

- Bitcoin Payments

- bitcoin transactions

- blockchain

- Blockchain.com

- breakout

- BTC

- btc trading

- build

- Bull Run

- Bullish

- capital

- cases

- Cause

- chairman

- Charts

- China

- chinese

- Cloud

- coming

- continue

- contracts

- Creating

- Criminal

- crypto

- Crypto Market

- cryptocurrencies

- cryptocurrency

- curve

- data

- decentralized

- Decentralized Exchange

- Decentralized Finance

- DeFi

- Disruption

- Dollar

- Drop

- dropped

- DX

- Early

- easing

- Economic

- ecosystem

- energy

- equity

- estate

- ETF

- ETH

- ethereum

- ethereum (ETH)

- exchange

- Exchanges

- Face

- facing

- Features

- Fed

- Federal

- federal reserve

- Fees

- Figure

- Finally

- finance

- Focus

- form

- Forward

- Framework

- Fuel

- future

- Futures

- General

- Global

- Gold

- great

- Growing

- Growth

- here

- High

- hold

- How

- hr

- HTTPS

- huge

- ia

- Impact

- Increase

- industry

- influence

- information

- Infrastructure

- Innovation

- Institutional

- interest

- investment

- Investors

- IP

- issues

- IT

- Key

- large

- Law

- law enforcement

- lawmakers

- Laws

- Led

- lending

- Level

- licenses

- Licensing

- lightning

- Lightning Network

- Line

- Liquidity

- major

- Making

- Market

- Market Cap

- Markets

- Matic

- medium

- Mempool

- Mining

- money

- months

- namely

- Near

- network

- networks

- NFTs

- offer

- official

- Onboarding

- opportunities

- Other

- Outlook

- payments

- performance

- picture

- Pivot

- platform

- policy

- present

- price

- pricing

- Product

- Programs

- projects

- Race

- rally

- ransomware

- Rates

- Reading

- real estate

- Regulation

- Regulators

- regulatory

- Requirements

- research

- returns

- Run

- running

- Sanctions

- Scalability

- scaling

- SEC

- Securities

- Securities Laws

- SegWit

- shift

- Size

- smart

- Smart Contracts

- Solana

- Solutions

- Space

- State

- States

- Stem

- Strategy

- street

- Strikes

- successful

- supply

- supply chain

- support

- surprise

- tech

- Technical

- Technology

- theme

- trade

- Traders

- Trading

- transaction

- Transactions

- Treasury Department

- Trends

- United

- United States

- us

- US Dollar

- USD

- users

- value

- venture

- View

- visibility

- Volatility

- Wallets

- What is

- within

- Work

- work out

- year

- Yield