Many in the crypto-space consider Cardano to be one of the market’s top altcoins. Some even call it the ‘Ethereum killer,’ but no one has ever compared it to Bitcoin.

While the difference between BTC and ADA’s price action is colossal, profitability is another aspect of comparison. And, it would seem that Cardano is currently shining in that respect, making ADA holders more profitable than BTC’s.

These metrics will help us understand which asset will be more profitable going forward.

Is Cardano more profitable than Bitcoin?

Seemingly, yes. This inference comes from the on-chain data which shows the average balance on every address of both these coins. At the moment, Cardano is enjoying a higher balance per address than Bitcoin. The average balance for addresses of ADA holders comes up to $22,854, whereas for BTC holders it is $19,570.

This $3k difference implies that Cardano is significantly profitable than the king coin right now.

Cardano’s Average Balance | Source: Intotheblock – AMBCrypto

Bitcoin’s Average Balance | Source: Intotheblock – AMBCrypto

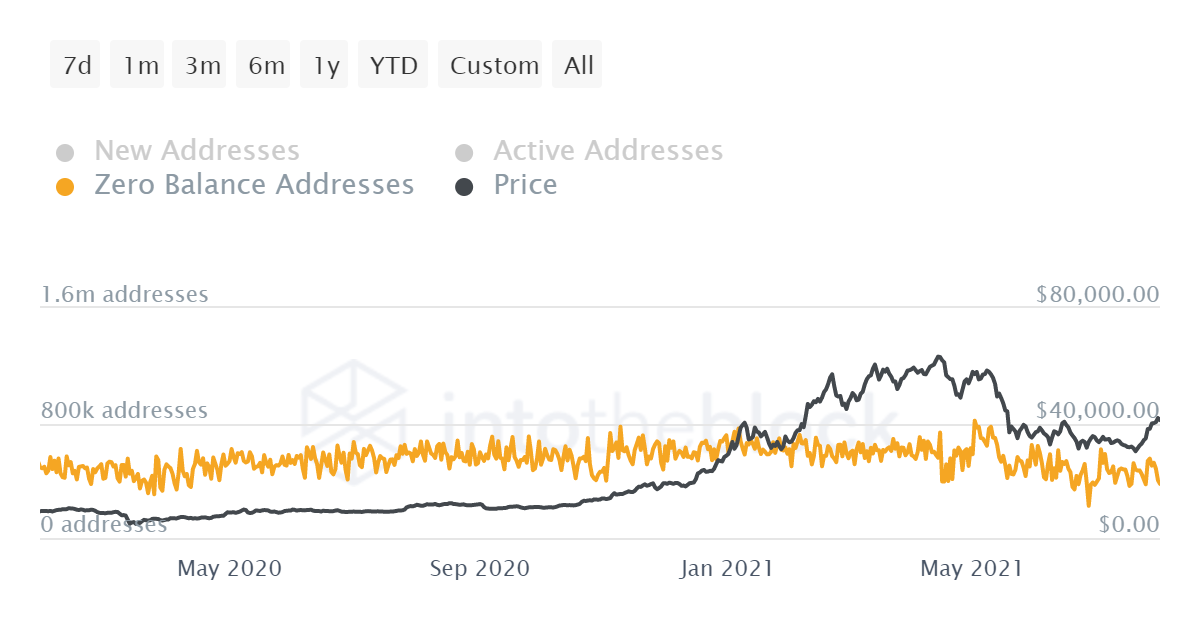

The behavior of investors plays a part too though. When it comes to addresses, BTC has much higher active addresses than ADA. But, it also has a higher number of addresses with a Zero (0) balance than ADA.

In fact, over the last 48 hours, Cardano’s zero balance addresses were at an absolute zero. Bitcoin, on the other hand, has over 400k to 500k zero balance addresses on a daily basis. This goes to show that ADA investors are much more sincere and serious about the altcoin’s potential than BTC investors.

This, despite the fact that 16% more Bitcoin addresses are in profit in comparison to Cardano, primarily due to BTC’s high prices.

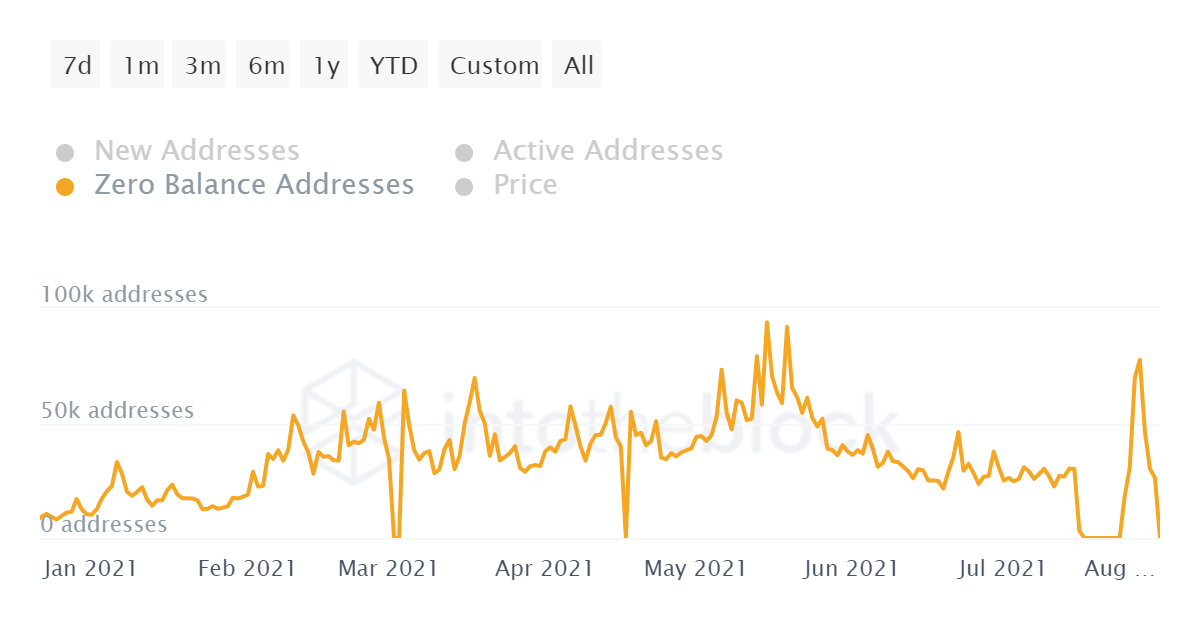

Cardano’s Zero Balance Addresses | Source: Intotheblock – AMBCrypto

Bitcoin’s Zero Balance Addresses | Source: Intotheblock – AMBCrypto

Here, it’s worth underlining that as the world’s biggest cryptocurrency, BTC is the target of popular trends. This contributes to a hike in participation, but not necessarily an increase in investment.

Going forward – Cardano or Bitcoin?

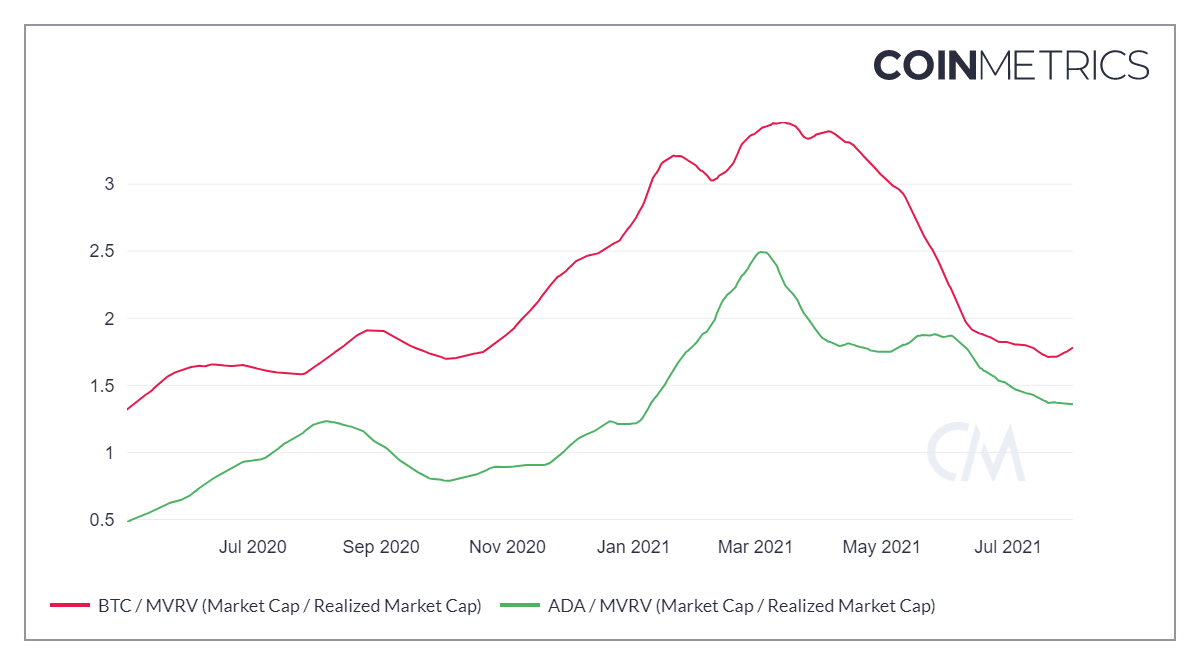

With the latest rally pushing both cryptos north and keeping other metrics in mind, it becomes difficult to declare either one of them to be better than the other.

Since the beginning of the rally, Cardano has risen by about 25% whereas Bitcoin was up by 32%, at press time. Even on the MVRV chart, BTC was slightly higher than ADA, but as far as their values are concerned, both seem to be pretty profitable right now.

Cardano and Bitcoin MVRV | Source: Coinmetrics – AMBCrypto

However, with smart contracts coming to the Cardano network soon, things could change. When that happens, Cardano’s prospects might become more favorable.

Where to Invest?

Subscribe to our newsletter

Source: https://ambcrypto.com/should-traders-finally-look-at-cardano-from-the-lens-of-profitability/

- 7

- Absolute

- Action

- active

- ADA

- Altcoins

- asset

- Biggest

- Bitcoin

- BTC

- call

- Cardano

- change

- Coin

- CoinMetrics

- Coins

- coming

- Container

- contracts

- cryptocurrency

- data

- Finally

- Forward

- High

- HTTPS

- Increase

- intotheblock

- investment

- Investors

- IT

- keeping

- King

- latest

- Making

- Metrics

- network

- North

- Other

- Popular

- press

- price

- Profit

- profitability

- rally

- smart

- Smart Contracts

- Target

- time

- top

- Traders

- Trends

- us

- worth

- zero