The SOL price eyes $150 after a recent 25% surge over the week but it seems that the Solana-based products saw a huge capital outflow as we can see more today in our latest cryptocurrency news.

The price of Solana could increase by over 45% in the upcoming weeks as the crypto intends to complete a double-bottom chart pattern against the USD. Double-bottoms appear at an end of a downtrend when the price drops a low and rebounds to levels near the previous low. With the bears unable to push the price to a new low, the sentiment became exhausted and led to a sharp upside retracement and a breakout move afterward.

SOL has been painting a similar pattern after extending its rebound move by increasing 25% week to date and hitting about $100. The visible bullish divergence between the price and the RSI shows a high probability of the double-bottom breakout. The bullish confirmation could come if the SOL price breaks above the double bottom neckline near the $120 level with a rise in the trading volume so it happens that the SOL upside target can be at length equal to the distance between the double-bottom pattern’s lowest point to the neckline.

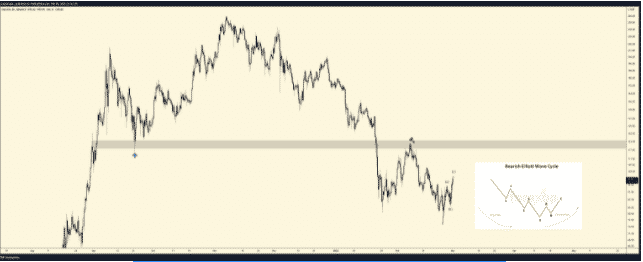

This will put SOL en route to $150 with a chance of continuing the bullish move towards $170 that was marked in the red. The double-bottom envisioned SOL at $150 as a popular market analyst Capo warned the potential bull trap on the market and noted that altcoins will resume their downtrends. The analyst also presented $120 as a double-bottom neckline as a solid resistance level that can limit the SOL upside retracement and he also applied the popular Elliott Wave Theory to show a start of a new bearish wave cycle:

“It’s impossible to me to be bullish here, after the break of all the bullish MS + correctives moves to the upside. You can enjoy the LTF pumps while they last, but don’t get too comfy.”

The bearish outlook lined with the Coinshares report published last week showed the most altcoins investment vehicles seeing a negative investor sentiment like BNB, DOT, XRP, ADA, and LTC. Solana also suffered as the week ended in february and saw SOL investment products losing $2.6 million in capital outflows. All of the digital asset investments products combined gathered $36 million in the same period.

- About

- ADA

- All

- Altcoins

- analysis

- analyst

- asset

- bearish

- Bears

- bnb

- breakout

- Bullish

- capital

- CoinShares

- could

- crypto

- cryptocurrency

- Cryptocurrency News

- digital

- Digital Asset

- distance

- double

- here

- High

- HTTPS

- huge

- impossible

- Increase

- investment

- Investments

- investor

- IT

- jump

- Led

- Level

- LTC

- Market

- million

- most

- move

- MS

- Near

- news

- Outlook

- Pattern

- Popular

- price

- Price Analysis

- Products

- pumps

- report

- resume

- Route

- sentiment

- similar

- So

- Solana

- start

- surge

- Target

- today

- Trading

- USD

- Vehicles

- visible

- volume

- Wave

- week

- xrp